Wheeee, this is fun!

Wheeee, this is fun!

We nailed the top and, unfortunately, that means we're stuck in this nasty downtrend since last Summer with lower lows and lower highs on the bounces. This leg desperately needs to break that pattern or by May it may be far too late to sell as everyone will have gone away already. As noted by Dave Fry this morning – there are plenty of things worrying traders this week:

- A severely overbought market correcting

- Worries about a weak earnings

- Greece crawling its way back to the forefront as the IMF and EU duke it out over another rescue

- The Panama Papers revelations

- Ongoing global economic weakness

- Tuesday’s Trade Deficit indicated a downgrade to GDP ahead (the Atlanta Fed downgraded U.S. growth to only 0.4%)

- Oil prices declined sharply for re-linking previous correlations to stock market declines

- Dip-buying wasn’t seen for the first time in weeks

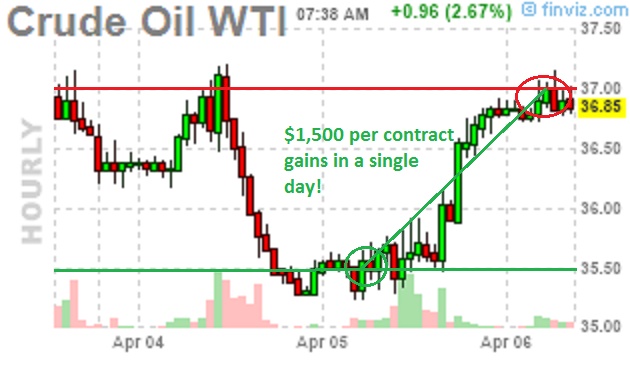

In fact, yesterday's pop in oil prices was the only bright spot that stopped things from getting worse overnight in the global markets and, fortunately, that was our long bet in yesterday's morning post, leading to a very nice $1,500 per contract gain on the /CL futures we picked long at $35.50 – not bad for a day's work!

In fact, yesterday's pop in oil prices was the only bright spot that stopped things from getting worse overnight in the global markets and, fortunately, that was our long bet in yesterday's morning post, leading to a very nice $1,500 per contract gain on the /CL futures we picked long at $35.50 – not bad for a day's work!

Our Silver (/SI) trade was also a home run, going from $15.05 to $15.20, which doesn't sound like much but silver pays $50 per penny for $750 per contract and Gold (/YG) popped off our $1,230 line to just $1,237 but still good for $225 per contract ($33.20 per $1 move). The nice thing about playing Gold Futures is the relatively low margin requirement of just $2,000 per contract vs $5,720 per contract playing /SI Futures.

And, of course, all of our index lines came up winners and we can play them again today, following the same rules and, at the moment, the Russell is lagging the rest, just under 1,095 (our entry was 1,090 and you can see our buys triggering yesterday afternoon on the chart) and we do expect a bullish move into the Fed Minutes at 2pm. We're doing a Live Trading Webinar for our Members this afternoon at 1pm, EST – hopefully we can keep our money-making streak alive as we had a perfect March with our Live Webinar trades.

Speaking of free trade ideas that made a fortune, Lumber Liquidators (LL) came bouncing back off that idiotic attack by Whitney Tilson a few weeks ago. At the time, our FREE trade idea was:

- Sell 5 LL 2018 $13 puts for $5.20 ($2,600)

- Buy 10 LL 2018 $13 calls for $5.20 ($5,200)

- Sell 10 LL 2018 $20 calls for $2.30 ($2,300)

That nets you into the $7,000 spread for just $300 in cash and your worst case is you end up owning 500 share of LL at net $13.60. If LL recovers and gets back over $20 by Jan 2018 expiration (19th), you make $6,700 in profits, which is a return of 2,233% of your cash invested and the ordinary margin on the short puts should be about $2,400 – so it's a very margin-efficient trade as well (248% gain on cash + margin).

With LL popping back over $14 already, the spread is now $1 in the money and already netting back $550, which is up $250 (83%) on our cash outlay but that, of course is nothing as we're well on the path to our full $6,700 gain. As I have been stressing this year – we don't have to take big risks to make very nice short-term profits, sensibly-hedged trades like this one can give you stunning returns when you get them right. Now all we have to do is sit back and watch our pal Whitney capitulate and send the stock back over $15.

No sign of capitulation yet from Tesla (TSLA), as that stock popped to $255 despite my warning yesterday. That's fine with us because, as I said, we hadn't taken our short position yet but we picked up the following in our Live Member Chat Room:

As a short right now on TSLA, I like shorting the June $270 calls for $13.20 and buying the June $275 ($35.70)/250 ($20.70) bear put spread for $15 so net $1.80 on the $25 spread that's 80% in the money to start. The Jan $320 calls are $11.50, so that's the rolling plan and, if you are worried about shorting TSLA at $320 – then this is not a trade for you!

Well, nothing else to do now but wait for the Fed. We went over all the charts and market-moving news earlier this morning and, as I noted above, we're still long off yesterday's Futures lines with very tight stops below. Silver is back down at $14.95 (yes, it's that crazy volatile), so we'll look for another chance to go long there if the Dollar stops rising ($94.50), which is, of course, great for our Nikkei (/NKD) prediction, though we did already hit 15,850 last night – right in the middle of our range and now a good long again at 15,700.

More craziness ahead – have fun!