Get ready for a quote-fest.

Get ready for a quote-fest.

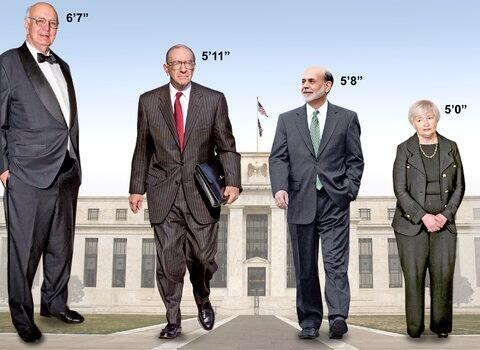

All 4 living Fed Chairs will be speaking tonight in New York, ostensibly "for the kids" but really to have an excuse to spin the Hell out of yesterday's Fed Minutes, which had a nice, fake rally into the close but it's already reversed in the Futures as we're down about 0.5%. For reference, here's each Chairperson organized by the value of the Dollar under their tenure – note the significant shrinkage which leads us to predict Peter Dinklage will die this season in Game of Thrones so he can be tapped to be the next Fed Chairman – you heard it here first!

We reviewed the Fed Minutes live during yesterday's Trading Webinar and we used the volatility to make a quick $480 for our Members trading Oil (/CL) and the Russell (/TF) Futures (replay available here) and, into the close, at 3:31, my note to our Members in our Live Chat Room was:

Dow stopping at 17,600 again. Lined up with 2,055, 4,525 and 1,105 so those are the current shorting lines (same rules but bear now). /NKD at 15,730 so already on the weak side. Dollar 94.45, as expected. Oil $37.68 – as expected. Gold $1,223, silver $15.05 – as usual!

Although the minutes were "doveish", the FUNDAMENTAL reason they were doveish is what concerned us as the economic situation has deteriorated considerably in the 3 weeks since the Fed meeting. This was, of course, a reversal from our morning call to go long but we were already out of the longs ahead of the Fed and looking to short as the minutes only confirmed what we expected to happen.

Although the minutes were "doveish", the FUNDAMENTAL reason they were doveish is what concerned us as the economic situation has deteriorated considerably in the 3 weeks since the Fed meeting. This was, of course, a reversal from our morning call to go long but we were already out of the longs ahead of the Fed and looking to short as the minutes only confirmed what we expected to happen.

That's the nice thing about playing the Futures, you can take advantage of the market gyrations without having to get in and out of your long-term positions. The Russell Futures (/TF) that we focused on yesterday opened below our 1,190 line and topped out at 1,105 for a $1,500 per contract gain, even better than Silver (/SI), which jumped $1,000 per contract or Gold, which is up $350 per contract at the moment.

These were all based on the same premise that the Fed Minutes would weaken the Dollar further and boost the indexes and commodities BUT, as I said, our analysis of the minutes shows a fairly out of touch analysis that completely missed the recent data weakness and that is NOT a bullish thing at all and, as you can see from the quick reversal in the Futures, our interpretation is shared by many overseas.

By the way, on the Russell, that bounce back over to 1,097 means we stop out of the /TF shorts and that's $800 per contract gained on the way down and now we can re-enter the short below the 1,095 line (with tight stops) if yesterday's long lines are breaking down (usual rules) BUT we expect more happy talk from the Central Banksters and no way we bet against the 4 horsemen tonight so, if /TF is over 1,090 and the Dow is over 17,600 and the S&P is over 2,055 and the Nasdaq is over 4,525 and the Nikkei is over 15,600, then we can grab the laggard(s) and go long instead.

See, trading is not hard – you just need a premise and a plan!

The key to good Futures trading (and any kind of short-term trading) is to pick a good line of support/resistance to backstop your play and then make sure you have the discipline to take a quick loss if it breaks. Again, we had live examples of that in the Webinar and all of our March replays, for that matter as we routinely use the Futures to teach good trading techniques, since they move nice and fast for lesson purposes but, of course, the same logic applies whether you are looking at minute or monthly support levels.

Of course, we don't really care about technical voodoo – the reason we're long on /NKD at 15,600 is because it puts pressure on Abe and the BOJ to take action to further weaken the Yen, which is now up 10% since February.

That's very bad for Japan's export-based economy as the same $20,000 Toyota that put 240,000 Yen on TMs books in Feb is now putting 216,000 Yen in their pockets in April. They already made the car and shipped it 3 months ago and they paid their workers and parts suppliers in weaker Yen at the time so this change in currency essentially wipes out all of their profit on the car – that's why this matters so much – especially to a net exporter (and that goes for China too).

Speaking or Toyota (TM), we've been waiting for an opportunity like this to add them back to our Long-Term Portfolio (we took the money and ran at $140 last year). TM is on our Member's Watch List and we're thrilled with $100 but we can give ourselves an even bigger discount with the following trade:

- Sell 5 TM Jan $90 puts for $4.80 ($2,400)

- Buy 5 Jan $100 calls for $7.50 ($3,750)

- Sell 5 Jan $115 calls for $2.25 ($1,125)

That's a net cash outlay of just $225 and the ordinary margin in 5 short puts should be $5,200 and the upside on the trade, if TM is over $115 in January, is $7,275 so pretty margin-efficient (140%) and extremely cash-efficient with the upside potential of 3,233%. The worst case here is we end up owning 500 shares of TM for net $90.45 ($45,225) – 10% off the current price. The great thing about set-ups like that is we don't have to spend much money hedging them – they are already self-hedged! We'll add that to our Long-Term Portfolio and see how it goes – happy to add some more if TM goes lower (possible as the quarter is likely to be bad) and, of course, when 2018 options come out – we can adjust as necessary.

This is what Fundamental investors do, we read the news, track the macro data and, once we feel good about a premise (more easing from Japan) we figure out who benefits (/NKD futures and TM stock) and we construct long or short-term trades to take advantage of it. That's why an "ugly" chart like TM doesn't bother us – we KNOW what the company is worth, even if our fellow investors do not.