Financial Markets and Economy

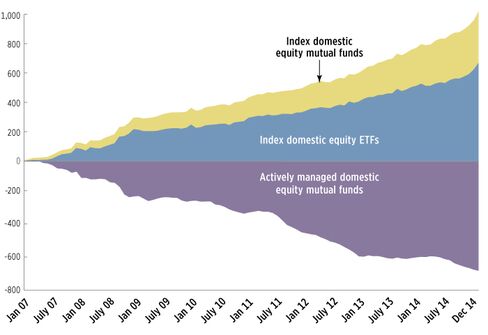

The Financial Industry Is Having Its Napster Moment (Bloomberg)

Has the music stopped for the financial industry?

Monopoly Is Not a Game (Bloomberg View)

Monopoly Is Not a Game (Bloomberg View)

One of the basic lessons of economics is that monopolies are bad news. When there’s only one company in a market, it can jack up prices to above their efficient level. That gives a big boost to profits, but results in too few people being able to afford to buy what the company is selling. Most markets are not monopolies, but a similar principle holds for situations where there are only a few companies, called oligopolies. A lack of players stifles competition, raising profits but lowering overall economic output.

Treasury Should Probe U.S. Banks on Panama Papers, Senators Say (Bloomberg)

A pair of the U.S. banking industry’s biggest Senate critics demanded a Treasury Department investigation into offshore banking revelations contained in leaked documents from a Panama-based law firm.

Strong Dollar Trend Almost at an End, Pimco's Kressin Says (Bloomberg)

The dollar’s three-year advance is coming to an end as central banks recognize a strong U.S. currency is not in the interests of the global economy, according to Thomas Kressin, Munich-based head of European foreign exchange at Pacific Investment Management Co.

The Changing Face Of Sector ETFs (ETF)

Exchange-traded funds that exclude some sectors and funds that use smart-beta factors are part of several new and notable sector-related ETF launches. Unique takes on the sector space are often few and far between—2014 saw only a scattered handful—but over the past year or so, there has been what seems like a burst of such funds.

With short-covering exhausted, a weak dollar may have to save stocks (Market Watch)

With short-covering exhausted, a weak dollar may have to save stocks (Market Watch)

There’s little fire power left for the stock market, say analysts at J.P. Morgan.

Actually, they used quite a few more keystrokes in an aptly titled research note for investors: “Short Covering Exhausted, Investor Positioning Adjusted, Difficult Fundamentals, Limited Upside.”

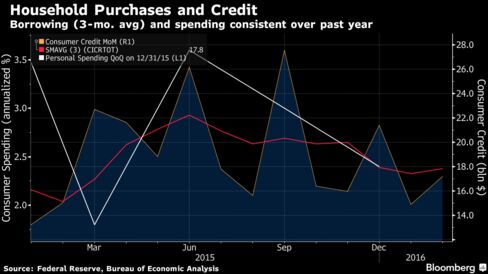

Consumer Borrowing in U.S. Increases on Non-Revolving Credit (Bloomberg)

American household borrowing climbed more than forecast in February from a month earlier, led by financing for automobiles and college education.

Why the old Dow average is what’s new again (Market Watch)

For years, critics have assailed the blue-chip stock average DJIA, -0.98% as being behind the times, and some have called for ditching the index altogether.

Coming to the Dow’s defense is Nicholas Colas, chief market strategists at Convergex, who points out that the selection of companies included in the average seems tailored to the current state of flattening yield curves and a stronger dollar.

Yen Surge Turns 105 Per Dollar Into Next Intervention Flashpoint (Bloomberg)

If there’s one thing yen bulls and bears can agree on, it’s that the threshold for currency intervention is drawing nearer — and could be as close as 105 per dollar.

Low Gas Prices Drove Down Transit Use, So Why Can’t You Find a Seat on the Train (Wall Street Journal)

Transit ridership declined for the first time in five years during 2015, likely due to low gasoline prices, but subways and commuter trains were as crowded as ever.

Markets Flash Warning as Bonds Rise, Yen Strengthens (Wall Street Journal)

Bond yields tumbled and the yen surged to its strongest level against the dollar in a year and a half Thursday, the latest sign that markets are growing cautious following a nearly two-month-long rally in prices of riskier assets.

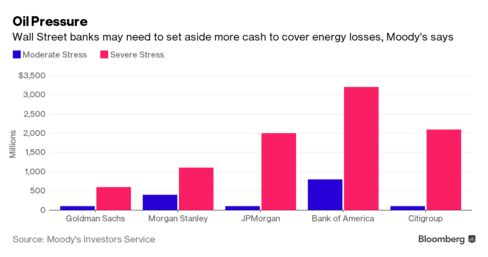

Moody's Sees $9 Billion Hole at U.S. Banks in Worst-Case for Oil (Bloomberg)

Wall Street’s biggest banks need to set aside more cash to cover losses as low oil prices take their toll, according to Moody’s Investors Service.

U.S. Softens New Retirement Rule (Wall Street Journal)

Wall Street breathed a sigh of relief Wednesday when the industry finally got a look at the Obama administration’s new retirement-advice regulation, discovering some onerous requirements floated earlier had been scaled back.

Yellen backs ‘gradual’ rate hikes at panel of Fed chiefs (Market Watch)

Yellen backs ‘gradual’ rate hikes at panel of Fed chiefs (Market Watch)

Federal Reserve Chairwoman Janet Yellen offered an upbeat view of the U.S. economy Thursday and affirmed the central bank’s next step is likely to raise interest rates.

But the central-bank chief didn’t say when she wants the Fed to boost borrowing costs again.

Verizon to Proceed With Yahoo Bid, Google Weighs Offer (Bloomberg)

Verizon Communications Inc. plans to make a first-round bid for Yahoo Inc.’s Web business next week, and is willing to acquire the company’s Yahoo Japan Corp. stake to help sweeten the offer, according to people familiar with the matter.

Here's where JPMorgan is hiring and investing — and why it's doubling down where others shy away (Business Insider)

JPMorgan is not afraid to invest where others won't.

Right now, for example, the firm is hiring senior bankers in "underpenetrated" sectors, including tech, healthcare, and China.

U.S. Bank Earnings, IMF, China GDP, Golf: Week Ahead April 9-16 (Bloomberg)

U.S. banks start reporting first-quarter earnings, led by Bank of America Corp., Citigroup Inc. and JPMorgan Chase & Co. Follow the TOPLive blog for real-time coverage here.

Valeant Shares Have Best Three-Day Run in Almost 20 Years (Bloomberg)

For the first time in a long time, this week was a very good one to own stock in Valeant Pharmaceuticals International Inc.

Argentina Bondholders Say Nation Is Reneging on Settlements (Bloomberg)

A group that holds defaulted Argentine bonds is seeking to block the nation from going forward with more than $6.2 billion in settlements until it gets paid.

Gap Tumbles After Its March Sales Miss Already-Low Expectations (Bloomberg)

Gap Inc. fell as much as 11 percent in late trading after its March results missed analysts’ estimates, a sign the struggling apparel chain has even further to go in its comeback bid.

Pfizer Faces Limited Options After Its Dead Deal With Allergan (NY Times)

Two years ago, the pharmaceutical giant tried — and failed — to take over the British rival AstraZeneca in a bid to become the world’s largest drug company and lower its tax bill in the process. On Wednesday, Pfizer said another big overseas merger had failed, this time a $152 billion merger with Allergan, after the Obama administration introduced rules that would make the deal much less attractive.

Down and Maybe Out, Canada's Oil Producers Mull Recovery Chances (Bloomberg)

Canada’s oil industry, which made deep spending cuts to cope with the worst commodity price slump since the 1980s, will need new export pipelines to profit from a recovery, according to a lobbying group.

Politics

Clinton Is 'Not Qualified'? Sanders Will Regret That Swipe (Bloomberg View)

Clinton Is 'Not Qualified'? Sanders Will Regret That Swipe (Bloomberg View)

A flap has erupted in the Democratic nomination campaign about Bernie Sanders’s claim that Hillary Clinton is not “qualified” to be president because she accepts PAC money, voted for the Iraq War and has done other things Sanders doesn’t like.

1. In fact, Clinton is almost uniquely qualified thanks to her experience in various roles within the U.S. political system.

Donald Trump’s Rivals Home In on New York, Hoping to Bruise Him? (NY Times)

One day after Senator Ted Cruz’s decisive victory in Wisconsin, the Republican presidential race hurtled on Wednesday into conspicuously different terrain — New York City and its suburbs — with Republicans opposed to Donald J. Trump more hopeful than ever that the front-runner can be bruised anew, even in his hometown.

Why Are Voters Angry? It’s the 1099 Economy, Stupid. (New Republic)

Why Are Voters Angry? It’s the 1099 Economy, Stupid. (New Republic)

A favorite parlour game among the D.C. media is to ponder why Americans seem so angry this election season. Reporters drop themselves into primary states like Marlin Perkins in a Mutual of Omaha’s Wild Kingdom episode, trying to decipher these strange creatures who are so frustrated with the U.S. economy that they’d vote for a faux-populist billionaire or an avowed socialist. Why isn’t everybody satisfied with a status quo of slow-yet-steady economic recovery and a record number of consecutive months of private sector job growth?

Technology

This 'Octobot' Has Its Tentacles Around Our Hearts (Popular Science)

This 'Octobot' Has Its Tentacles Around Our Hearts (Popular Science)

Soft and squishy robots are the future as evidenced by the printable hydraulic robot we saw earlier this week. But while walking robots are cool, swimming squishy robots that look like octopuses are so much better.

Are We Living in a Computer Simulation? (Scientific American)

If you, me and every person and thing in the cosmos were actually characters in some giant computer game, we would not necessarily know it. The idea that the universe is a simulation sounds more like the plot of “The Matrix,” but it is also a legitimate scientific hypothesis. Researchers pondered the controversial notion Tuesday at the annual Isaac Asimov Memorial Debate here at the American Museum of Natural History.

Health and Life Sciences

'Key piece of ageing puzzle' identified (BBC)

'Key piece of ageing puzzle' identified (BBC)

A common drug could hold the key to long life, in flies at least, according to research.

At low doses, lithium prolonged the life of fruit flies in lab experiments.

Well: After Physical Therapy, Why Not Cancer Therapy? (NY Times)

My family and I would have given anything for the house calls of a creature we never imagined: an oncological therapist. And it might be less expensive than recurrent emergency room visits.

Life on the Home Planet

Human history tells us we’re an invasive species (Futurity)

Human history tells us we’re an invasive species (Futurity)

Human populations have not always grown unchecked. A new study of South America’s colonization finds that for much of human history on the continent, human populations grew like an invasive species, which is regulated by the environment as it spreads into new places.

Seeing things that aren’t there (Earth Sky)

Seeing things that aren’t there (Earth Sky)

Maybe you’ve seen the proverbial bunny in a patch of clouds, or a clown’s face in a mud splatter on the side of your car? Seeing recognizable objects or patterns in otherwise random or unrelated objects or patterns is called pareidolia. It’s a form of apophenia, which is a more general term for the human tendency to seek patterns in random information. Everyone experiences it from time to time. Seeing the famous man in the moon is a classic example from astronomy. The ability to experience pareidolia is more developed in some people and less in others. Look at the photos below to learn more and test your own ability to see things that aren’t there.