Financial Markets and Economy

Global Stocks Rise Ahead of U.S. Earnings Season (Wall Street Journal)

Global Stocks Rise Ahead of U.S. Earnings Season (Wall Street Journal)

Global stocks were mostly higher Monday as investors waited for the start of the U.S. first-quarter earnings season.

The Stoxx Europe 600 was up 0.8% halfway through the session, led by shares of banks and mining companies.

Fed's Inflation Push Finally Has Bond Traders Wanting to Believe (Bloomberg)

When it comes to inflation, bond traders are finally starting to listen to the Federal Reserve.

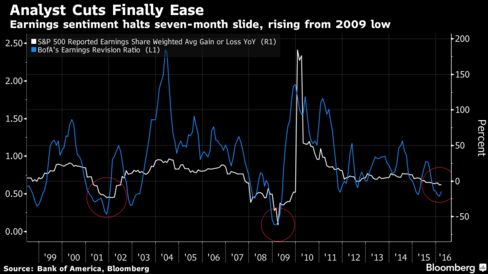

Whipsawed Wall Street Traders Find Bullish Signal in Bad Profits (Bloomberg)

There hasn’t been much good news in U.S. corporate profits since they began sliding a year ago — until now.

U.S. banks' dismal first quarter may spell trouble for 2016 (Reuters)

It is only April, but some on Wall Street are already predicting a rotten 2016 for U.S. banks.

Analysts say it has been the worst start to the year since the financial crisis in 2007-2008 and expect poor first-quarter results when reporting begins this week.

Gold At $10,000? (Forbes)

After being in the doghouse for several quarters, gold rose up to the $1200s in recent weeks, trading places with equities and bonds.

Reports of Oil Rally's Death Premature as Inventories Decline (Bloomberg)

Hedge funds betting that oil’s rally was over missed an 11 percent gain after U.S. crude inventories unexpectedly fell.

Investing Like the 1% (Forbes)

Officials from Japan were out in force talking down the yen on Friday. We’ve talked about the significant role that central banks have played, and continue to play in the global economic recovery. Now that the Fed has begun reversing its emergency policies of the past seven plus years, the Bank of Japan has been thrust into a very critical position.

'The great oil divergence of 2016' could be underway (Business Insider)

'The great oil divergence of 2016' could be underway (Business Insider)

The tail’s wagging the dog again. No matter how hard the market’s tried to escape, stocks have been anchored to oil. A down day for oil has meant a down day for the major averages. And vice versa.

The magnitudes of their fluctuations haven’t matched up. But directionally, stocks and oil have been joined at the hip this year.

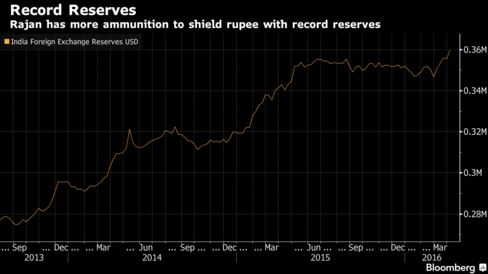

Rajan Builds Record Reserves to Strengthen Asia's Worst Currency (Bloomberg)

Reserve Bank of India Governor Raghuram Rajan is going all out to build up the nation’s foreign-exchange reserves as he seeks to augment the rupee’s defenses.

China's Shrinking Steel Output Will Boost Prices by 2018 (Bloomberg)

China’s steel industry, the world’s biggest, will shrink fast enough to reduce its exports, preventing a repeat of last year’s global price collapse, and paving the way for a stronger comeback in two years, according to a five-decade veteran of global steel markets.

Yuan Forwards Climb as Producer Prices Signal Economic Recovery (Bloomberg)

Forward contracts on the yuan strengthened for a second day as the first monthly increase in China’s factory gate prices since 2013 added to signs of an improving economy.

Bullish Fatigue Sets in On Wall Street (Forbes)

The action on Wall Street is starting to feel top heavy as bullish fatigue begins to set in after a huge rally from the Feb 11th low.

BAML: Everyone is way too bearish (Business Insider)

Economists at Bank of America Merrill Lynch estimate there was no economic growth in the first quarter. And they think the recovery is still on track.

Alcoa Looking to Finally Break Metal Shackles as Earnings Sink (Bloomberg)

Alcoa Inc. has an identity problem, and it’s something Chief Executive Officer Klaus Kleinfeld is hoping to finally fix.

Why Europe's Banks Don't Have Enough Capital (Bloomberg View)

Why Europe's Banks Don't Have Enough Capital (Bloomberg View)

Europe's economic malaise has a lot to do with its crippled banking system. Making that system more fragile seems like the wrong way to address the issue.

With the European Central Bank taking interest rates deeper into negative territory and the euro-area economy languishing, investors have become more concerned about the future profitability — and perhaps the viability — of the region's banks.

Iraq Boosts Oil Production to Record Before Talks to Cap Output (Bloomberg)

Iraq increased crude output to a record level in March, ahead of a meeting in Qatar of OPEC members and other producers on capping production to curb a global glut.

Europe Small Caps Beat Giants as Stock Rally Loses Steam: Chart (Bloomberg)

Even as a recent equity rally has shown signs of fading in the past three weeks, small caps across Europe are holding gains, pushing a gauge tracking them to a two-year high versus larger companies.

In California, Marijuana Is Smelling More Like Big Business (NY Times)

After decades of thriving in legally hazy backyards and basements, California’s most notorious crop, marijuana, is emerging from the underground into a decidedly capitalist era.

China's Banks Need Managers (Bloomberg Gadfly)

Managers needed, private-equity experience preferred, must speak Mandarin and be willing to live in Beijing. The job ad isn't real, but Chinese banks should be hiring along those lines right now.

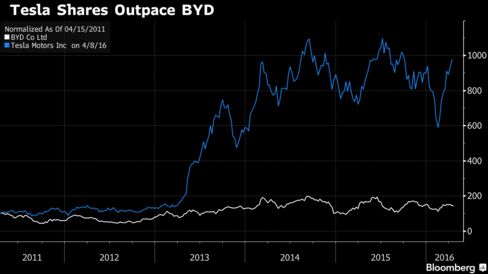

BYD Seeks to Channel Tesla's Model 3 Success With Branding Focus (Bloomberg)

BYD Co. will make improving its brand image the top priority for the Chinese electric car maker, as Tesla Motors Inc.’s success in attracting tens of thousands of reservations for its new Model 3 underscored the importance of star appeal.

The former CFO of Enron warned a group of execs that large US companies are doing the same things he did (Business Insider)

Andrew Fastow, the former Enron CFO, warned a group of business execs that many companies are doing the exact same things he did at the now defunct energy giant.

Moneyball Invades Boston's City Hall, Where Everything Is Graded (Bloomberg)

There is no place sports heroes cast a longer shadow than in Boston, where Red Sox immortal Ted Williams has inspired City Hall to come up with its own batting average.

Unintended Consequences of the Panama Papers (Bloomberg View)

Unintended Consequences of the Panama Papers (Bloomberg View)

The revelations about offshore accounts that came to light in the so-called Panama Papers will reinvigorate government efforts to rein in not just tax evasion, which is illegal, but tax avoidance, too.

They will also add to popular frustration that will challenge the authority of some government officials.

BLANKFEIN: The M&A boom isn't over yet (Business Insider)

Some of the biggest mergers and acquisitions deals on the book have been falling apart recently.

The Long, Agonizing Fall of PacSun (Bloomberg)

Pacific Sunwear of California Inc. filed for bankruptcy protection from creditors on Thursday, hoping a restructuring could help turn around the 36-year-old surf retailer's fortunes. Once a staple merchant of California cool, PacSun wasn't able to adapt as fashion trends left surfwear behind and overexpansion sapped its resources. It amassed crippling debt as it recorded losses each year since 2008. Every effort at reinvention failed. Executives couldn't figure out how to stop the bleeding. The company's shares are down 96 percent over the past 12 months.

Toyota, Ford Lead China Auto Sales Increase After Tax Cut (Bloomberg)

China’s passenger-vehicle sales rose 6.8 percent in the first quarter, led by Toyota Motor Corp. and Ford Motor Co., as consumers took advantage of a government tax cut and discounts from manufacturers.

SolarCity Arranges Financing for $188 Million in Solar Projects (Bloomberg)

SolarCity Corp., the most prolific installer of rooftop panels in the U.S., obtained financing to support about $188 million in solar projects. The investment will cover the costs of equipment and installation.

Politics

Trump Manager Slams 'Gestapo Tactics' After Cruz Colorado Sweep (Bloomberg)

Trump Manager Slams 'Gestapo Tactics' After Cruz Colorado Sweep (Bloomberg)

Republican presidential front-runner Donald Trump’s new convention manager accused Ted Cruz’s campaign of using “Gestapo tactics” after the Texas senator swept the party’s convention-delegate selection process in Colorado.

Sanders Wins Wyoming to Boost Momentum Before New York Duel (Bloomberg)

Democratic presidential candidate Bernie Sanders secured his seventh consecutive nominating-contest victory after voters caucused in Wyoming, to give his campaign a fresh shot of momentum heading into New York’s pivotal primary later this month.

Technology

A New Solar Cell Creates Electricity From Water as Well as Light (Gizmodo)

A New Solar Cell Creates Electricity From Water as Well as Light (Gizmodo)

Rain means clouds and clouds mean less sunlight. That’s bad news for most solar cells, but a new design can actually make use of rain drops that fall on its surface, allowing it to generate electricity even when the weather’s bad.

The new solar cell has been developed by researchers in Qingdao, China.

Electric Fork Tricks Taste Buds Into a Salty Sensation (Scientific American)

Many people need to cut down on the amount of salt in their diet. But if you had this fork you wouldn't need to fork over the flavor.

Japanese scientists developed this prototype electric fork that conveys the sensation of salt on the tongue via the food, but without the health drawbacks associated with too much sodium.

Hitachi’s new customer service robot can tell when you need help shopping in stores (The Next Web)

Hitachi’s new customer service robot can tell when you need help shopping in stores (The Next Web)

It’s only a matter of time before the friendly face behind the counter at your local grocery store is replaced by that of a robot. Last week in Tokyo, Hitachi unveiled a new humanoid robot, the EMIEW3, that’s aimed at automating customer service in stores and public facilities.

Health and Life Sciences

The many forgotten benefits of segmented sleep (Quartz)

The many forgotten benefits of segmented sleep (Quartz)

Sleeping for an uninterrupted eight hours a night is not, in fact, natural human behavior. Last week, writer Jesse Barron described in the New York Times how she accidentally fell into a pattern of “segmented sleep,” a routine that was standard for centuries until the late 19thcentury. The practice—which typically involved going to bed at around 9 to 10pm, sleeping for 3 to 3.5 hours, waking for an hour or so around midnight, and then returning for a second sleep of the same length until around dawn—fell out of fashion with the invention of artificial light, permanently changing our relationship to the natural environment.

Poor New Yorkers Tend to Live Longer Than Other Poor Americans (NY Times)

New York is a city with some of the worst income inequality in the country. But when it comes to inequality of life spans, it’s one of the best.

Chinese scientists genetically modify human embryos for the second time (The Verge)

Chinese scientists genetically modify human embryos for the second time (The Verge)

Scientists in China have reported genetically modifying human embryos in what is only the second published experiment of its kind. Last year, a different team of Chinese researchers edited human embryos in an attempt to remove genes responsible for a dangerous blood disorder. In this new research, scientists from Guangzhou Medical University tried to add a mutation to embryos instead, attempting to make them HIV-resistant. In both cases, the experiments were only partially successful, and were carried out using non-viable human embryos that were incapable of growing into adults.

Life on the Home Planet

TV shows are going way too far to attract viewers (NY Post)

For nearly two decades, we’ve been told that this is the Golden Age of Television: The smartest, deepest storytelling, the most nuanced and morally complex characters, are found here.

Perhaps it’s time for a reconsideration.

Climate Change Is Making Droughts Drier And Deluges Wetter — And Worse Is To Come (Think Progress)

Climate Change Is Making Droughts Drier And Deluges Wetter — And Worse Is To Come (Think Progress)

A deeply flawed new study tries to challenge the basic scientific understanding that “wet areas are likely to get wetter and dry areas drier in a warmer world.” This Nature article has been justifiably criticized for both its methodology and for ignoring a vast literature that contradicts it.

“It is sad for the science,” when “papers like this gets published and get attention,” according to Kevin Trenberth, a leading expert on how climate change impacts the hydrological cycle.

'Longest-ever' captured python dies (BBC)

'Longest-ever' captured python dies (BBC)

A giant python found on a Malaysian building site, that may be the longest ever caught, has died, officials say.