Financial Markets and Economy

Just How Big Is China's Impact On The World Economy? (Forbes)

Just How Big Is China's Impact On The World Economy? (Forbes)

How big of a deal is China?

Just ask Tata Steel, Vale, Rio Tinto. The list is long of steel makers and iron ore exporters that have been crushed by Chinese oversupply.

State Economic Flu Isn't Catching (Bloomberg View)

Six states lost jobs during the 12 months ended in March. It's a familiar bunch — Alaska, Louisiana, North Dakota, Oklahoma, West Virginia, Wyoming — all hammered by either coal's decline or the collapse in U.S. oil drilling that has followed the collapse of global oil prices. (That price plunge was of course brought on in part by the earlier rise in U.S. oil production enabled by hydraulic fracturing and other new drilling technologies. Ah, the oil business!)

Say Goodbye to the Fed You Once Knew (Bloomberg)

Say Goodbye to the Fed You Once Knew (Bloomberg)

In the panic of 1907, a son of Italian immigrants turned American bank executive highlighted a truism of global finance. Having stockpiled liquid assets ahead of potential financial turmoil, Amadeo Giannini stemmed a run on his bank by displaying his bulked-up gold reserves to a nervous public, offering to convert customers' deposits into the precious metal at a time when other banks were refusing to do the same.

China's GDP Grows 6.7% Thanks to Government Stimulus (Fortune)

China's GDP Grows 6.7% Thanks to Government Stimulus (Fortune)

China’s economy grew 6.7% in the first quarter, more evidence that the country has moved past the economic crisis fears of a few months back.

The government should hope that business confidence—and consumer spending—grow in coming months, as government stimulus is the big reason the economy is so far meeting the government’s target growth range of 6.5% to 7% growth for 2016. Exports are shaky and the service sector slowed down to 7.6% year-over-year growth from 8.2%.

Activists' Bearish Bets Fall Short (Bloomberg Gadfly)

When it comes to shareholder activism, much attention has been paid to the long side of things — well-known folks like Carl Icahn and Nelson Peltz who take stakes in companies and agitate for changes they feel will unlock hidden value. But how are the shorts doing?

Growing wealth inequality 'dangerous' threat to democracy: experts (Reuters)

Growing global wealth inequality is becoming a fundamental risk to democracy and to economies around the world as more people feel government rules "rigged" in favor of the rich leave them with few options, investors and governance experts said Friday.

"It's very dangerous," said Ngaire Woods, dean of the Blavatnik School of Government at the University of Oxford. "If people can't aspire to succeed within the system, they will aspire … outside the system, in ways that break the system."

This is the worst argument about the national debt you’ll ever find (Washington Post)

This is the worst argument about the national debt you’ll ever find (Washington Post)

The United States government has $13.9 trillion in debt, and I feel fine.

You should, too. That's because, despite what Jim Grant tells us on the cover of Time magazine, this doesn't mean that every man, woman, and child has to pay $42,998.12 themselves. All it means is that we have plenty of debt to roll over — which we will. The government, after all, is immortal. It doesn't have to pay back everything it owes like you or I do. It just has to pay back the interest it owes, so that investors will keep lending to it on good terms.

The Best—and Worst—States to Avoid Income Taxes (Bloomberg)

it’s April 18 this year, for you procrastinators—is a bracing annual reminder of how deeply the government reaches into our pockets. One way to reduce your income tax burden? Switch states.

Some of the Most Shorted Stocks Setting Up for Potential Breakouts (Ivan Hoff)

Here’s a list of 12 stocks priced above $10 and trading over 200k shares per day. All of them are heavily shorted – more than 20% of their float is short at this point of time.

The Bank Of Japan Already Owns Over Half Of All ETFs; It Wants To Own More (Zero Hedge)

Less than six months after we pointed out that the BoJ owns 52% of the entire Japanese ETF market, Reuters reports that the Kuroda's Peter Pan fairy tale, aka the Bank of Japan, is thinking about buying even more. The BoJ is said to be currently buying $30 billion of ETF's a year under its current policy, however since the Nikkei is down over 10% this year, that figure is apparently not enough to keep the market propped up.

Apple stock drops suddenly on report of slow iPhone production through June (Business Insider)

Apple is down over 1% to $111 per share on Friday after a Nikkei report claimed that iPhone production will remain slow through June.

Is China recovering? (Marginal Revolution)

The new GDP figure came in at 6.7%. No matter what you believe “the real number” to be.

Politics

Sanders Rages Against the Dying of the Light (Bloomberg View)

Sanders Rages Against the Dying of the Light (Bloomberg View)

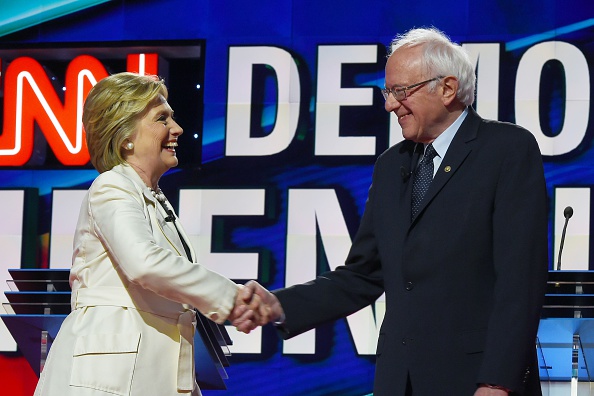

Senator Bernie Sanders could see his flame fading during the debate with Hillary Clinton on Thursday. If he loses the New York primary on Tuesday, he can soldier on, but the gallop that won him eight of the last nine contests is over. You could tie up all the superdelegates in traffic in the Holland Tunnel until the Democratic convention and Sanders still couldn’t win the nomination without New York.

Brooklyn Debate Takeaways: Sarcasm, Snideness and Smackdowns (NY Times)

The Democratic debate on Thursday night played out as a magnified version of the primary race. The personal clashes between Hillary Clinton and Senator Bernie Sanders of Vermont were harsher. Their policy differences gaped wider. And the stakes, for both candidates, were as high as they have ever been.

Sanders’s Not-So-Southern Strategy (The Atlantic)

Sanders’s Not-So-Southern Strategy (The Atlantic)

Just what does the South matter to national politics? Of course, as a Southerner I am not entirely equipped to answer that question without bias, but according to the Census, the South is the largest region in the country, with a population almost equivalent to that of the Northeast and Midwest combined. Depending on definitions, the Deep South has over 100 electoral college votes––a number that swells if other former Confederate states like Florida and Virginia are admitted––and its national electing power is reflected by rich delegate counts in primary races.

Technology

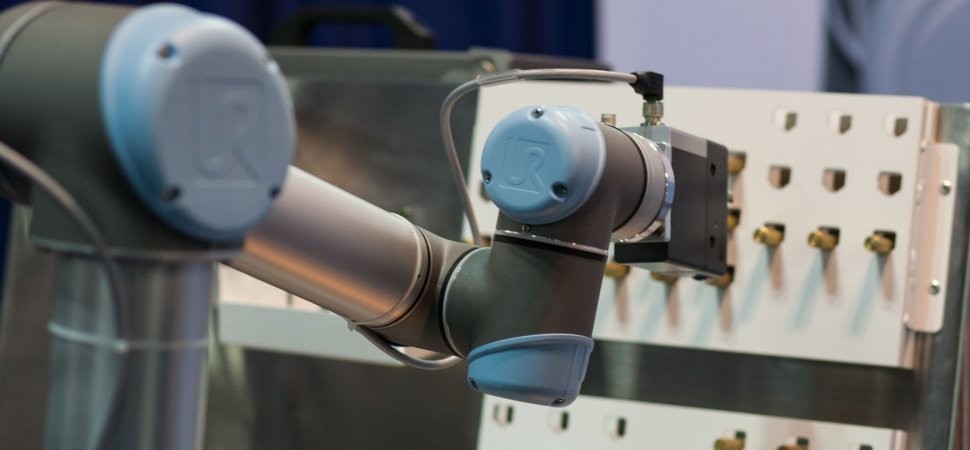

Robots Are Coming for Dirty, Dangerous, and Dull Jobs (Inc.)

Robots Are Coming for Dirty, Dangerous, and Dull Jobs (Inc.)

The debate over how robots could affect employment has been going on for more than a century. Those who rage against the machine say robots will steal our jobs, make us their slaves, and then kill us. Others believe robots are the key to ultimate freedom from work that humans find dull or dangerous.

How Technology Helps Creditors Control Debtors (The Atlantic)

Not everyone can afford to plunk down hundreds, or even thousands, of dollars on a laptop. And not everyone has to: There are rent-to-own computers, offered by rent-to-own outlets alongside refrigerators, televisions, and furniture. But unlike the couch or the mattress or the kitchen appliances, some of these laptops are loaded with remote kill switches that would disable the computer if renters were late with their payments.

Health and Life Sciences

B cells create ‘bone-chewers’ in rheumatoid arthritis (Futurity)

B cells create ‘bone-chewers’ in rheumatoid arthritis (Futurity)

Researchers have uncovered a new mechanism of bone erosion—and a possible biomarker—for rheumatoid arthritis.

The group is the first to demonstrate that immune cells, called B cells, contribute directly to the breakdown of bone in RA by producing a signaling molecule called RANKL.

A Study on Fats That Doesn’t Fit the Story Line (NY Times)

There was a lot of news this week about a study, published in the medical journal BMJ, that looked at how diet affects heart health. The results were unexpected because they challenged the conventional thinking on saturated fats.

Life on the Home Planet

Do Ongoing Global Events Prove The World Is Ready For Revolution? (The Anti-Media)

Do Ongoing Global Events Prove The World Is Ready For Revolution? (The Anti-Media)

Paralleling the increasingly draconian policies marking a worldwide descent into fascism, are massive protests — born in the Arab Spring, but arguably an angrier, more potent extension of the Occupy movement — indicative of an unprecedented tipping point.

We, the people of this planet, now stand together, gazing over the precipice whose murky depths of State repression demand we ask one imperative question: have we finally had enough?

Waking supervolcano makes North Korea and West join forces (New Scientist)

Waking supervolcano makes North Korea and West join forces (New Scientist)

If it blows again, it could make Vesuvius look like a tea party.

Now, in a ground-breaking collaboration between the West and North Korea, vulcanologists are gaining new insights into Mount Paektu, on North Korea’s border with China, and whether it might blow its top any time soon.