Financial Markets and Economy

57% of Americans Say Their Income Taxes Are Too High. Only 55.5% Pay Income Tax. What? (Wall Street Journal)

Americans’ hatred of taxes defies logic.

A recent Gallup poll pegged the percentage of Americans who think their own federal income tax bills are too high at 57%. That’s up from 51% last year and it’s the highest level since 2001, just before the Bush tax cuts became law.

Why Oil Producers Will Be Over a Barrel for a Long Time Yet (Wall Street Journal)

Oil prices may have rallied on a new International Energy Agency forecast for demand to erode the excess supply next year and hopes exporters will soon agree to tighten the spigots, but producers shouldn’t get too excited.

Yellow Water, Dirty Air, Power Outages: Venezuela Hits a New Low (Bloomberg)

The tap in her apartment yields water only every two weeks. It comes out yellow. Her 8-month-old granddaughter is ill. And as Yajaira Espinoza, a 55-year-old hairdresser, made her way down the halls of Caracas university hospital on Friday, Zika cases evident in the rooms around her, a dense ash-filled smog enveloped the city.

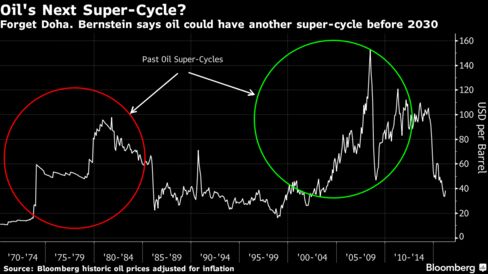

Forget Doha, Oil Demand Could Create Another Super-Cycle by 2030 (Bloomberg)

While talks among major producers to cap oil output in Doha fizzled, investment advisory firm Sanford C. Bernstein & Co. sees a silver lining: growing demand may bring one more super-cycle that allows investors to cash in on rising prices.

Not Yet Impressed By Brazil Impeachment, Fitch Reaffirms Negative Rating (Forbes)

Not Yet Impressed By Brazil Impeachment, Fitch Reaffirms Negative Rating (Forbes)

Not everyone is jumping for joy about the impeachment Sunday evening of Brazilian president Dilma Rousseff.

Fitch Ratings reiterated their negative watch on Brazil’s BB+ junk credit and highlighted concerns over judicial independence with regards to the ongoing Petrobras case in the Supreme Court. All of the top congressmen involved in pushing for impeachment have been implicated in what has become the crime of the century in Brazil.

Low oil prices don't cut into US production by much (CNBC)

It's called the law of supply and demand.

When a commodity costs more to produce than the current market price, producers usually stop producing it. But when it comes to U.S. crude, a global crash in prices hasn't been matched by deep cuts in production.

Disney princesses, Star Wars propel Hasbro results (Reuters)

Hasbro Inc, the No. 2 U.S. toymaker, reported better-than-expected quarterly profit and revenue, driven by strong demand for "Star Wars" action figures and the addition of Disney Princess dolls to its basket of toys.

Shares of the company, which also makes the Monopoly board game and My Little Pony toys, were up 4.6 percent at $86.20 in premarket trading on Monday.

China's Future: Neither Boom Nor Bust (Bloomberg View)

China's Future: Neither Boom Nor Bust (Bloomberg View)

The debate over how China’s economy might evolve over the next decade generally breaks down into two opposing cases. Bulls are confident that Chinese leaders will make the hard reforms needed to clean up local government debt, reform state companies, open more markets to private-sector competition and liberalize the financial sector. This should enable China to achieve another 10-15 years of rapid growth. Bears are equally convinced that the government will fail to enact any real reforms, provoking either a drastic plunge in economic growth or an outright financial crisis.

SP 500 Earnings Update: Big Jump in Forward Estimate – Quite Unusual (Fundamentalis)

Thomson Reuters is re-checking the data, but this past week readers of the Thomson Reuters “This Week in Earnings” report will see another increase in the forward 4-quarter estimate, which is unusual given the historical pattern. Here is the forward 4-quarter estimate for the last 4 weeks

It's All Suddenly Going Wrong in China's $3 Trillion Bond Market (Bloomberg)

The unprecedented boom in China’s $3 trillion corporate bond market is starting to unravel.

Fed's Kashkari favors higher capital requirements, smaller banks (Reuters)

Minneapolis Federal Reserve Bank President Neel Kashkari on Monday doubled down on his call for reforms to the U.S. banking system, saying that failing to make changes could leave taxpayers on the hook for big bank bailouts in any future financial crisis.

It looks like 'helicopter money' isn't headed to Japan anytime soon (Business Insider)

"Helicopter money" isn't coming to Japan anytime soon.

In an interview with The Wall Street Journal, Bank of Japan governor Haruhiko Kuroda ruled out the use of "helicopter drops" of money.

Why One Analyst Believes Gold Prices Could Hit $3,000 An Ounce (Value Walk)

Why One Analyst Believes Gold Prices Could Hit $3,000 An Ounce (Value Walk)

After finishing its best quarter in 30 years, gold extended its gains, rising more than 17.2 percent year-to-date to become the best performing asset class among other commodities, U.S. Treasury bonds and major world currencies and equity indices.

Greenspan Admits The Fed's Plan Was Always To Push Stocks Higher (Zero Hedge)

Former Federal Reserve Chairman Alan Greenspan admitted in an interview with Sara Eisen that quantitative easing did what it was supposed to do, which was to inflate stock prices and drive multiple expansion.

Netflix forecasts Q2 U.S. subscriber additions below estimates (Business Insider)

Video-streaming service Netflix Inc forecast U.S. subscribers additions for the current quarter that fell short of analysts expectation, in part due to price increases for its service.

PepsiCo CFO: ‘The U.S. Consumer Is Actually A Bright Spot’ (The Street)

PepsiCo had some caffeine behind its first-quarter earnings. The beverage and snacks giant Monday reported total revenue fell 3% year over year to $11.9 billion, matching Wall Street forecasts. Excluding the impact of the strong U.S. dollar, which hurt sales by 4.5 percentage points, sales rose 3.5%. Earnings per share, excluding one-time items, came in at 89 cents, topping estimates for 81 cents. Frito-Lay North America saw organic revenue and operating profit increase 4% and 10%, respectively. Meantime, the North America beverage business was able to overcome sluggish soda sales and deliver respective revenue and profit increases of 2% and 7%, respectively, vs. the prior year.

The Lesson of Empires: Once Privilege Limits Social Mobility, Collapse Is Inevitable (Charles Hugh Smith, Of Two Minds)

The next few years will strip away the illusions of "growth" and reveal which dominates our society and economy: privilege or social mobility.

Stocks and bonds are saying completely different things about the economy (Business Insider)

They say the markets are forward-looking, discounting what will happen in the near future rather than what has already happened in the recent past. I believe this is true. However, some markets are better at this than others.

Disney’s Savvy Marketing of ‘The Jungle Book’ (NY Times)

“All of this, honestly, is one big magic trick.”

Those words, spoken by the director Jon Favreau, were meant to sum up the technological wizardry on display in his hyperrealistic remake of “The Jungle Book,” which was largely created with computers. But Mr. Favreau could also have been describing the way Walt Disney Studios used marketing sleight of hand to fill seats on opening weekend. “The Jungle Book” took in an astounding $103.6 million in North America, according to Disney.

Average utilization for natural gas combined-cycle plants exceeded coal plants in 2015 (EIA)

Last year marked the first time on record that the average capacity factor of natural gas combined-cycle plants exceeded that of coal steam plants. The power industry has been running natural gas combined-cycle generating units at much higher rates than just 10 years ago, while the utilization of the capacity at coal steam power plants has declined. The capacity factor of the U.S. natural gas combined-cycle fleet averaged 56% in 2015, compared with 55% for coal steam power plants.

The world's largest investor says negative rates are breeding a disaster for the economy (Business Insider)

BlackRock CEO Larry Fink says negative interest rates are lining up savers and the economy for "potentially dangerous financial and economic consequences."

Debt Grows 3.5x Faster Than GDP – "Big Hole Likely To Cave In Before We Claw Our Way Out" (Zero Hedge)

You often hear me harping on the dangers of too much debt, and I keep my eyes peeled for significant work that backs up my concerns.

Commodity-Exporter Currencies Slump as Oil Falls on Doha Failure (Bloomberg)

The currencies of commodity-exporting nations dropped after oil-producing countries failed to reach an accord to freeze output.

Politics

New Yorkers File Emergency Lawsuit To Give Voting Rights Back To 3.2 Million People (Think Progress)

New Yorkers File Emergency Lawsuit To Give Voting Rights Back To 3.2 Million People (Think Progress)

With less than 24 hours until the presidential primary, a group of New Yorkers who saw their party affiliations mysteriously switched are filing a lawsuit Monday seeking to open the state’s closed primary so that they can cast a ballot.

New York has the earliest change-of-party deadline in the country — registered independent voters who wanted to participate in Tuesday’s presidential primary had to change their party by last October.

Hillary Clinton’s Lead Narrows Among Democratic Primary Voters, Poll Says (Wall Street Journal)

Sen. Bernie Sanders has all but eliminated Hillary Clinton’s polling lead among Democratic voters nationwide, a new Wall Street Journal/NBC News poll has found, offering signs that she continues to struggle with the primary electorate at a time when she wanted to build strength for the general election.

The Socialist Case Against Bernie (The Atlantic)

The Socialist Case Against Bernie (The Atlantic)

I had many questions for Eugene Puryear, the real-life socialist politician seated across the table from me. Did he really want to nationalize the Fortune 500? Why wasn’t he on board with Bernie Sanders? And why had he suggested we meet at a Washington, D.C., fast-casual chain restaurant—the kind of place that practically screams “post-industrial capitalist exploitation”?

Russian Fighter Jet Flies Within 50 Feet Of US Recon Plane Over Baltic Sea (Zero Hedge)

Just days after the US destroyer Donald Cook had a close "buzzing" with two Russian Su-24 fighters which performed several low passes as close as 30 feet away in the Baltic Sea, the US Air Force complained about another close encounter which took place on Thursday.

Technology

Inflatable Module Successfully Attached To International Space Station (Forbes)

Inflatable Module Successfully Attached To International Space Station (Forbes)

Earlier this morning, the Bigelow Exapandable Activity Module (“BEAM”) was successfully attached to the International Space Station. The module is a prototype expandable structure, which is being tested for its performance in space.

According to NASA, the BEAM will be fully expanded with air in late May. Upon full expansion, BEAM will be about the size of a small bedroom – 560 cubic feet. Astronauts will enter BEAM about 2-3 times a year over the course of two years to test the module’s ability to handle radiation, microimpacts, and other hazards of space.

Where Artificial Intelligence Is Now and What’s Just Around the Corner (Singularity Hub)

Unexpected convergent consequences…this is what happens when eight different exponential technologies all explode onto the scene at once.

Computer generates all possible ideas to beat patent trolls (New Scientist)

Computer generates all possible ideas to beat patent trolls (New Scientist)

Alex Reben came up with 2.5 million ideas in just three days. Nearly all of them are terrible – but he doesn’t mind. He thinks he has found a way to thwart patent trolls by putting their speculative ideas in the public domain before they can make a claim.

In his project, called All Prior Art, Reben, an artist and engineer, uses software to rummage through the US patent database, which is freely available online. The software extracts sentences from patent documents and splices them into phrases that describe new inventions.

Health and Life Sciences

Are antihistamines worth it before a big workout? (Futurity)

Are antihistamines worth it before a big workout? (Futurity)

To cope with high pollen levels during vigorous exercise—like running the Boston Marathon—should an athlete pop a couple of antihistamines or no?

There’s no definitive answer yet, but new research finds that 795 (about 27 percent) of 3,000 genes activated after vigorous exercise become blunted in their responses during a three-hour recovery period if exercisers had taken strong doses of antihistamines.

Protein injection hope for Alzheimer's (BBC)

Protein injection hope for Alzheimer's (BBC)

The treatment – IL 33 – appeared to improve memory and help clear and prevent brain deposits similar to those seen in people with Alzheimer's.

Tentative human studies of the treatment will soon begin, but experts say it will take many years to know if it could help patients in real life.

Life on the Home Planet

Astronaut Captures Gorgeous Image Of Volcanic Eruption In Russia (Popular Science)

Astronaut Captures Gorgeous Image Of Volcanic Eruption In Russia (Popular Science)

Astronaut, noted photographer, and current ISS resident Tim Peake took this gorgeous picture of an plume of ash and gas billowing out of an erupting volcano earlier today.

The star of the shot was identified on Twitter as Klyuchevskaya Sopka or Klyuchevskaya volcano, located on Russia's Kamchatka Peninsula. It is one of the tallest active volcanos in the world.

Study Confirms World’s Coastal Cities Unsavable If We Don’t Slash Carbon Pollution (Think Progress)

Study Confirms World’s Coastal Cities Unsavable If We Don’t Slash Carbon Pollution (Think Progress)

A new study confirms what leading climate scientists have warned about for many years now: Only very aggressive climate action can save the world’s coastal cities from inundation by century’s end.

We still could limit sea level rise to two feet this century if we keep total warming below 2°C, according to analysis using these new findings. Otherwise, we should be anticipating five to six feet of sea level rise by 2100 — which would generate hundreds of millions of refugees. That isn’t even the worst-case scenario.

We Might Be Totally Wrong About Why the Dinosaurs Went Extinct (Gizmodo)

We Might Be Totally Wrong About Why the Dinosaurs Went Extinct (Gizmodo)

How the dinosaurs went extinct is a contentious topic of endless scientific debate. Were they killed by a giant asteroid, a rash of volcanic eruptions, or some deadly combination of the two? Or, perhaps, we’ve been thinking about the problem all wrong.

Here’s a different take. It wasn’t just cataclysmic events that did in the dinosaurs—these were the final nail in the coffin. The lineage had already been crumbling for millions of years.