Financial Markets and Economy

Stocks Retreat With Commodities as Yen Drops on BOJ Speculation (Bloomberg)

Stocks fell and commodities retreated as investors wound back enthusiasm that had sent gauges of both to this year’s highs earlier in the week. The yen dropped as the Bank of Japan weighed the possibility of offering negative-rate loans to banks.

The oil industry will continue to deteriorate (Business Insider)

The oil industry will continue to deteriorate (Business Insider)

Schlumberger just reported its first-quarter earnings and restated its bearish near-term outlook on the oil industry.

The world's largest oilfield-services company posted adjusted earnings per share (EPS) of $0.40, with a 63% year-on-year drop in net income, excluding charges and credits to $501 million.

Fund manager raises about $100 mln to bet against a single company (Reuters)

Sahm Adrangi's Kerrisdale Capital Management has raised approximately $100 million from investors to bet against a single stock, a person familiar with the situation told Reuters.

Pimco's Oil Outlook Darkens as Doha Failure May Spur Supply (Bloomberg)

Failure by the world’s biggest oil producers to reach an output freeze deal is bearish for prices in the long term as OPEC members may open up fields to foreign investment to shore up balance sheets, according to Pimco.

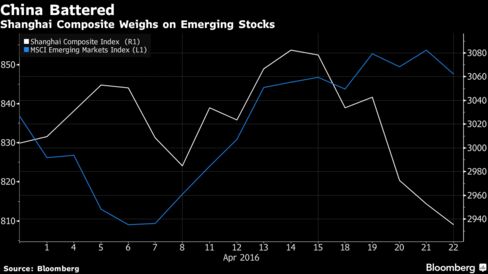

As Global Stocks Rally, China's Markets Send More Ominous Signal (Bloomberg)

As equities climb around the world, Chinese traders aren’t celebrating.

On the U.S. economy, is the glass half full, or half empty? (Market Watch)

“Two roads diverged,” Robert Frost wrote in what is perhaps the most popular poem of all time, “The Road Not Taken.” Frost’s opening words keep playing in my head every time an economic indicator is released, a global macro forecast is revised, or financial markets take a tumble. In all cases, the bulls and the bears find enough ammunition to support their diametrically opposed views on the U.S. economy.

Valeant Finalizing Contract With Perrigo’s Joseph Papa as Next CEO (Wall Street Journal)

Valeant Pharmaceuticals International Inc. is finalizing a contract to name Perrigo Co. Chief Executive Joseph Papa as its next CEO, hoping a fresh face and an experienced pharmaceutical-industry boss will calm nervous investors.

Wall Street's 'witches brew of hockey sticks and financial engineering' (Business Insider)

In a nearby post Jeff Snider makes a clean kill of the sell side hockey stick. Just 22 months ago (June 2014), Wall Street projected GAAP earnings of $144.60 per share for the S&P 500 in 2015.

Russian Economy Ministry forecast sees oil at $40 until 2019 (Reuters)

Russia should use an average oil price of $40 per barrel as the benchmark for its 2017-2019 budgets, the Economy Ministry said on Thursday, giving in to Finance Ministry arguments for fiscal caution.

A slide in oil prices and Western sanctions have pushed Russia into recession, complicating the Finance Ministry's task of keeping the budget deficit manageable.

As Oil Jobs Dry Up, Workers Turn to Solar Sector (Wall Street Journal)

As Oil Jobs Dry Up, Workers Turn to Solar Sector (Wall Street Journal)

A few years ago, Sean and Stormy Fravel were riding the oil and gas boom like so many others in West Texas. But when their jobs disappeared along with $100-a-barrel oil prices, they turned to a new type of energy occupation: solar power.

Instead of driving an 18-wheeler to haul drilling equipment in and out of the oil patch, the Fravels now install solar panel racking systems and perform quality checks on Alamo 6, a solar farm under construction in McCamey, about 300 miles northwest of San Antonio.

GE profit tops estimates but organic revenue falls 1 percent (Reuters)

General Electric Co reported a higher-than-expected first-quarter profit on Friday, but organic revenue fell 1 percent, raising questions about the company's full-year revenue target.

The industrial conglomerate affirmed its forecast of 2 percent to 4 percent growth in annual organic revenue, a figure that excludes foreign exchange and discontinued operations.

China Early Bond Redemptions Spur Investor Concern Over Losses (Bloomberg)

A Chinese local-government financing vehicle’s plan for early bond redemption is raising onshore investor concern that more companies will follow suit, creating the potential for losses if notes are bought back at below-market prices.

China's Great Ball of Money Is Rushing Into Commodities Futures (Bloomberg)

Chinese speculators have a new obsession: the commodities market.

This stock-market rally is running into a wall (Market Watch)

This stock-market rally is running into a wall (Market Watch)

It’s Earth Day, and even stock pundits are talking about our planet and sustainability.

They’re worried.

“Like the weather whose seasonal transgressions occasionally bewilder, but ultimately is beholden by our position from the sun, we expect U.S. equities will again be capped,” writes Erik Swarts over at Market Anthropology.

Singapore Raids Brokers; Exchange Reports Irregularities (Bloomberg)

Singapore authorities raided a number of brokerages in a probe of possible breaches of the securities law, while the stock exchange reported several cases related to alleged insider trading and market manipulation as the city sought to protect its reputation as a financial center.

Europe Stocks Fall for 2nd Day as Daimler Leads Carmakers Lower (Bloomberg)

European stocks slid further away from a three-month high, trimming a second weekly advance, led by declines in carmakers and miners.

Yen Bulls Vulnerable to Kuroda Shock Amid Record Hedge Fund Bets (Bloomberg)

Yen bulls are at risk from Haruhiko Kuroda’s favorite tactic: surprise.

Goldman Says Iron Ore's Going `Back to $35' as Glut Returns (Bloomberg)

Goldman Sachs Group Inc. has one piece of advice after this year’s dramatic iron ore rally: go short.

Google and Facebook Lead Digital Ad Industry to Revenue Record (Bloomberg)

Google and Facebook Inc. claimed the largest share of the booming U.S. digital advertising market in 2015, pulling away from smaller rivals, according to two industry reports Thursday.

Emerging Markets Trim Weekly Gains as Mobius Sees Rally Resuming (Bloomberg)

As emerging-market stocks and currencies reversed the week’s advance amid mixed signals coming out of China over the health of the world’s second-largest economy, Mark Mobius said the rally has further to go.

Germany Stuck in Period of ‘Unspectacular’ Growth, Markit Says (Bloomberg)

Germany’s manufacturing and services sectors cooled slightly in April, leaving the economy in a phase of “unspectacular” growth, according to Markit.

Volvo Profit Beats Estimates on North America Production Cut (Bloomberg)

Volvo AB’s first-quarter operating profit beat analyst estimates as the truckmaker reduced costs by scaling back production in response to slowing North American sales. The stock rose to an eight-month high.

Steel Slumps in China After Exchanges Move to Cool Speculation (Bloomberg)

Steel futures slumped in China as exchanges moved to cool speculation after prices surged to the highest level since 2014 in record volume on Thursday.

Politics

Will Hispanic Millennials Vote? (The Atlantic)

Will Hispanic Millennials Vote? (The Atlantic)

Millennials make up roughly a quarter of Hispanics in the United States, according to a Pew Research Center analysis of U.S. Census Bureau data released on Tuesday. The analysis found that Hispanics between the ages of 18 and 33 comprise 26 percent of the population, while those younger than 18 make up 32 percent. Taken as a whole, the two age groups account for well over half of the Hispanic population in the United States, making it the youngest ethnic group in the country.

Technology

A Microgrid Grows in Brooklyn (Scientific American)

A Microgrid Grows in Brooklyn (Scientific American)

Martha Cameron has gone to great lengths to make her home self-sufficient. The 40-year resident of Brooklyn’s upscale Park Slope neighborhood installed 18 photovoltaic panels on the roof of her three-story brownstone in 2010, and during the warmer months it generates enough electricity to run the first two floors of the building. Cameron does not have batteries to store the energy, so she relies on the power company to absorb electricity from her solar panels and feed it back to her through the existing grid.

The Race to Produce China's Tesla (Bloomberg)

The Race to Produce China's Tesla (Bloomberg)

William Li isn’t your typical, boundlessly optimistic Chinese tech entrepreneur. Yes, the founder of startup NextEV Inc. has big plans to disrupt China’s electric car market, the financial backing of venture capital powerhouses Sequoia Capital and Hillhouse Capital and considers Tesla Motors founder Elon Musk an inspiration.

That said, he rates his chance of succeeding in China’s fast-moving car market at a whopping 5 percent. He also thinks most of the new business models for electric cars being bandied about by tech companies will end up in the junk yard.

Health and Life Sciences

Living Near A Highway Is Terrible For Your Health. 1 In 10 Americans Do It. (Think Progress)

Living Near A Highway Is Terrible For Your Health. 1 In 10 Americans Do It. (Think Progress)

The worst air quality in the United States can be found within about 5 football fields of any highway — where 1 in 10 Americans live. Millions of Americans breathe this air every day. And as a result, they suffer from an increased risk of cardiac disease, according to a new study fromresearchers at Tufts University and Boston University.

Pills That Deliver Injection-Only Drugs (Bloomberg)

Genetically engineered drugs known as biologics typically have to be injected rather than swallowed because their complex proteins break down in the stomach. Rani Therapeutics is developing a pill that will protect those proteins.

Does Turmeric Have Proven Health Benefits? (NY Times)

Curcumin, the plant compound that gives turmeric its bright yellow-orange color, has demonstrated antioxidant, anti-inflammatory, anti-cancer and neuroprotective properties in lab and animal studies. But “claiming that it can be useful for humans is premature, given the current evidence,” said Barbara Delage, a scientist with the Linus Pauling Institute’s Micronutrient Information Center who recently reviewed the published literature on the spice.

Life on the Home Planet

These two changes in the ocean are downright scary (Market Watch)

These two changes in the ocean are downright scary (Market Watch)

The oceans are warmer and more acidic than ever before in recorded history, and likely ever since modern humans evolved. That should worry everyone alive today.

Why? As go the oceans, so goes the health of the globe. Oceans produce more than half the oxygen we breathe, and are critical to regulating the climate. They have absorbed at least 90% of the heat from global warming since 1970, and continue to absorb 2 billion tons of carbon dioxide every year, equal to the weight of all the oil carried by supertankers annually.

U.S. Can Meet Paris Climate Goals (With or Without Supreme Court) (Bloomberg View)

U.S. Can Meet Paris Climate Goals (With or Without Supreme Court) (Bloomberg View)

As world leaders gather in New York on Friday to sign the Paris Agreement on climate change, some have expressed concern that as they implement their commitments, the U.S. Supreme Court has put on hold the Obama administration’s Clean Power Plan. Their concern is understandable, but it’s important to recognize: The federal government is not the primary force in the U.S. fight against climate change, and even if the court ultimately strikes down certain parts of the plan, the U.S. will meet and probably exceed its commitment to reduce emissions by 26 to 28 percent by 2025. Here’s why.

How toxic algae are threatening humans and wildlife across the world (Market Watch)

How toxic algae are threatening humans and wildlife across the world (Market Watch)

If you’ve taken a trip to one of the many coastlines in the U.S. or Caribbean over the past year, there’s a good chance you’ve seen evidence of algal bloom. Murky shores, water with a red tint and beaches blanketed in stinking seaweed are some of the forms that harmful algal bloom can take.

Algal blooms are more than just unsightly and putrid. Harmful algal blooms can kill sea life, hurt businesses and threaten humans.