Reminder: Ilene is available to chat with Members, comments are found below each post.

Update: PRGO may be losing its CEO to Valeant: Valeant’s Latest Acquisition Target: Perrigo’s CEO?. This news is knocking the price down into the low $120s. Paul says he is buying more shares and selling 2018 puts with a strike price of $150. See the screenshot below. Paul sold those three 2018 $150 puts.

Paul writes, "A forced change at the CEO level and PRGO’s depressed share price might induce management to reconsider its refusal to sell at above $200 when Mylan came calling last year. Shareholders are unhappy meaning something is likely being planned to get the stock moving again."

Updated chart:

.png)

As originally posted April 20, 2016.

On June 10, 2015, Paul Price gave us a trade idea on BAX. Baxter Int. (BAX) was trading at around $66/share and scheduled to split off Baxalta (BXLT), its BioScience division, in the ratio of one share of BXLT for each share of BAX. BXLT is now at $40.65 and BAX is at $43.40.

Baxter Int. (BAX) is splitting off its BioSciences division into a new company called Baxalta. Shares of Baxalta will be given as a tax-free dividend, in the ratio of one to one, to BAX holders on record on June 17, 2015.

If you bought BAX, and held both companies after the split, till today, you'd have about a 27% gain. (Both Phil and Paul also suggested selling puts, see the article for more details.)

Now, for about a month, Paul's been suggesting buying and/or selling puts on Perrigo (PRGO, $129) at TheStreet.com's Real Money Pro (paywall) and Guru Focus. PRGO has been languishing around $128 – 130 and he thinks this area makes a good entry point for a longer term trade. Here are several excerpts from Paul's recent article at Real Money Pro with some updated charts.

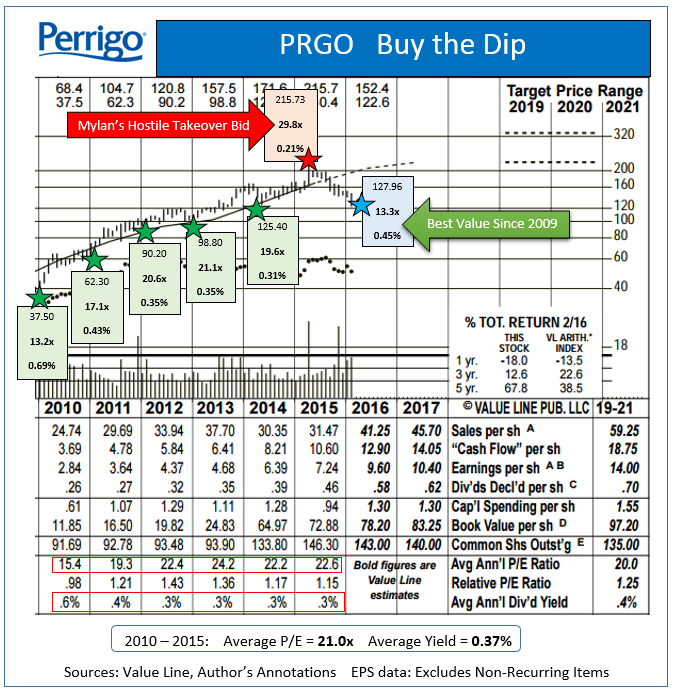

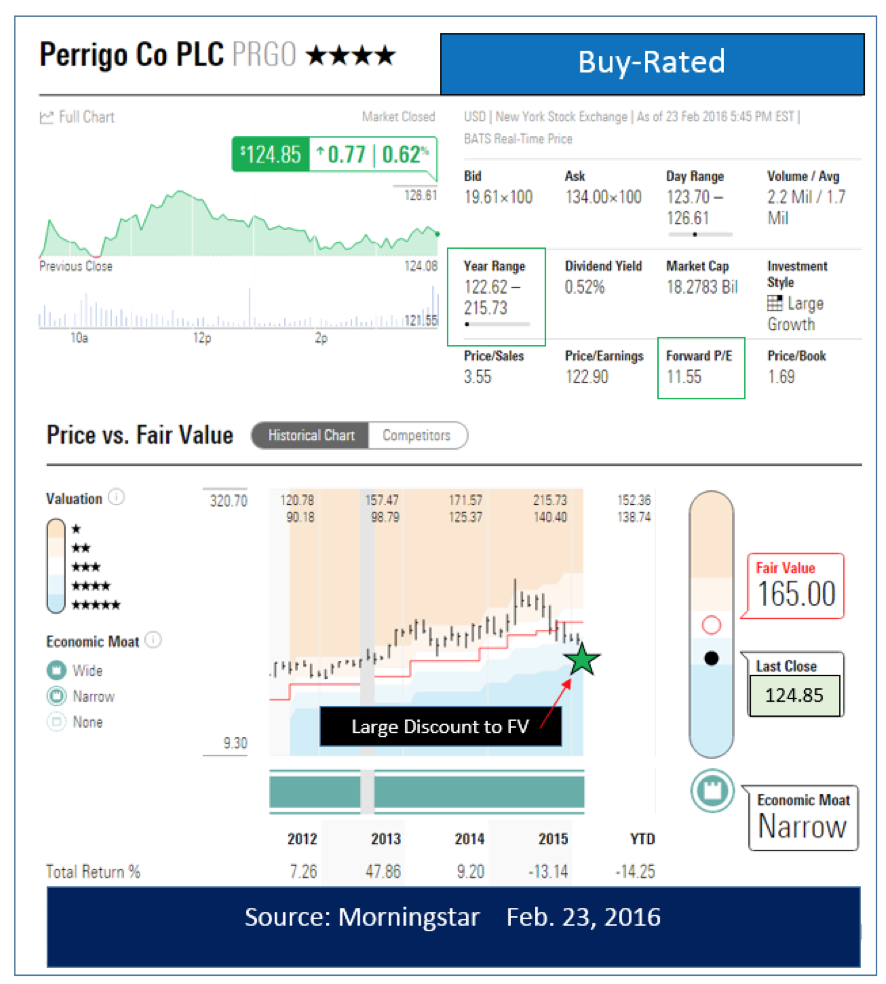

Healthcare products provider Perrigo (PRGO) has a fabulous long-term record. The stock dropped sharply on Feb. 18, 2016, as the firm took a charge in its latest quarter for costs associated with fighting off a hostile takeover attempt from Mylan (MYL).

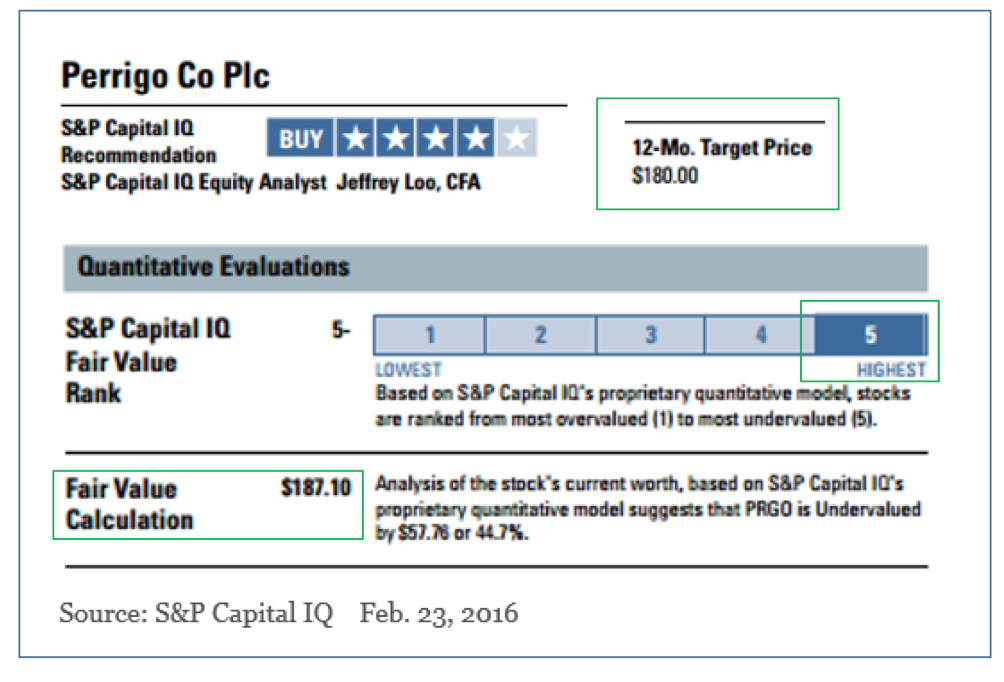

Excluding one-time charges fiscal Q3 EPS were $1.80 versus a $1.82 estimate. Management now expects adjusted FY 2016 earnings to come in around $7.74, up from $7.24. By Feb. 23 PRGO shares have fallen to under $125 from last year’s peak of almost $216…

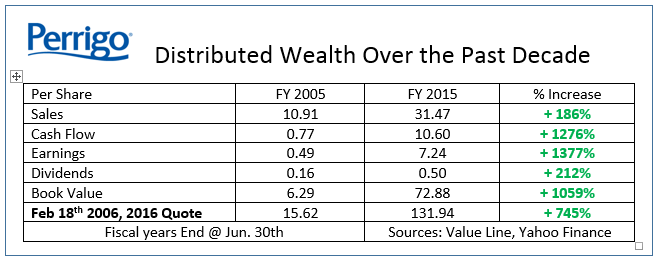

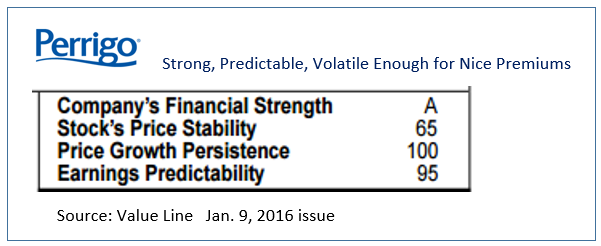

Paul argues that Perrigo’s balance sheet is solid and that its profitability has been strong over time. The following charts illustrate Paul's premise for this long-term trade: Perrigo's business has been growing strongly, the stock's current valuation is at the low end of its historical norm, and its fair value is considerably higher.

Paul continues:

The shares rarely trade cheaply. Unless you caught the exact bottom in 2009, Perrigo’s best entry points of the past nine years (green-starred below) looked very similar to PRGO’s current valuation.

As of Feb. 23, 2016, PRGO’s forward multiple of 16.1x (on FY 2016 estimate) compares favorably with the company’s average P/E of 20.1x. That number was skewed lower by the very depressed 2008 – 2009 period. Its typical multiple has been 22.9x since the end of 2011.

Peak prices of $157.50 to $215.73 were hit during each of the past three years. S&P Research and Morningstar each assigns a 4-star, buy rating on PRGO. S&P sees fair value as more than $188 while targeting $200 over the next 12-months. Morningstar see present day value as $165.

[ValueLine Chart Updated on 4-17-16]

Paul still thinks PRGO is currently undervalued and is both buying the stock and selling puts on it.

Paul's disclosure: Long PRGO shares, short PRGO Jan. 2018, puts.