Courtesy of Tony Sagami at MauldinEconomics.com

My college-aged kids love him. I’m not talking about Stephen Curry or Justin Bieber (although they love them too); I’m talking about Bernie Sanders.

Whether you support him or not, my guess is that most Americans my age are very surprised about his popularity. However, it shouldn’t be a surprise given the economic stress many Americans face.

The four charts below capture the essence of what I’m talking about…

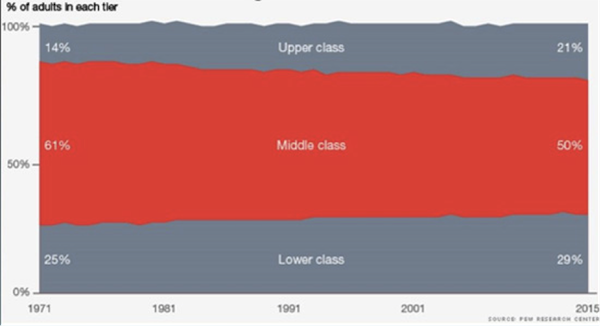

A shrinking middle class and a growing lower class

Sadly, roughly 50 million Americans live below the poverty line—the largest number in our nation’s history—and the poorest 40% of all Americans now spend more than 50% of their incomes just on food and housing.

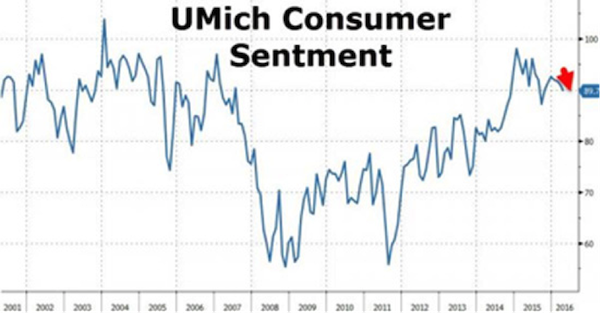

Consumer sentiment is plummeting

No wonder that consumer sentiment has been sinking fast, which is a very troubling sign for our consumer-driven economy.

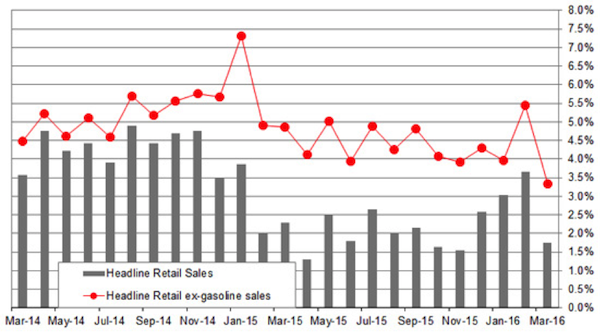

Spending is slowing

That consumer angst translates into a drop in spending. The Commerce Department reported that retail sales dropped by 0.3% in March, well below the +0.1% gain Wall Street was expecting.

The biggest drop was in auto spending, which was down 2.1%. One of the weakest sectors, however, was restaurants.

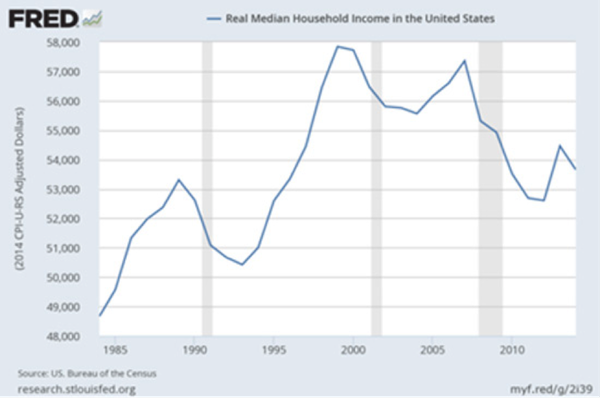

Wages are shrinking

I suspect the root of the issue is wages… or lack thereof. The reality is that inflation-adjusted wages—despite the recent minimum wage increase in several states—have been shrinking.

A recent report concluded, “In real terms, the average wage peaked more than 40 years ago.”

Check out these discouraging numbers:

• 39% of American workers make less than $20,000 a year.

• 52% of American workers make less than $30,000 a year.

• 63% of American workers make less than $40,000 a year.

• 72% of American workers make less than $50,000 a year.

Debt is piling up

And it doesn’t help that Americans continue to rack up debt.

Example: Outstanding auto loans have hit more than a trillion dollars. With an average balance of $12,000 per person, that consumes nearly 8% of the average borrower’s disposable income!

No wonder that an estimated 62% of Americans are living paycheck to paycheck.

And all of us—low, medium, and high income combined—are working longer than ever to pay a growing tax bill. Tax freedom day (the day when the nation as a whole has earned enough to pay the state and federal tax bill for the year) arrived on April 24, according to the nonpartisan Tax Foundation.

That means all the money we made in the first 114 days of 2016 went to taxes.

Actionable investment strategies

So… what do you think all this American angst means for the stock market? Of course, the Wall Street crowd is more concerned about every syllable that comes out of Janet Yellen’s mouth than any economic or corporate statistic.

However, the stock market is butting up against a very serious ceiling of resistance that I believe will limit—if not wipe out—any gains.

Strategy #1: Load up on dividend-paying stocks with a generous yield. In this topsy-turvy world of ZIRP (zero interest rate policy) and NIRP (negative interest rate policy), stocks that pay out decent-size, sustainable dividends will be among the few that will hold their value.

Strategy #2: Raise cash… lots of it. Of course, cash pays almost nothing thanks to our hallucinating central bankers, but zero will be your hero when things turn ugly.

Strategy #3: If you have some capital you can afford to speculate with, you should consider taking out some portfolio insurance with inverse ETFs and/or put options.

You probably need to combine all of the three strategies above because the recent good times won’t last.