Financial Markets and Economy

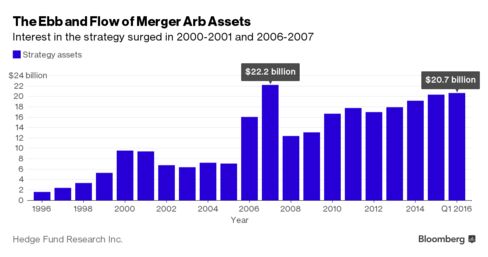

Hedge Fund Investors Have Fallen in Love With Merger Arb (Bloomberg)

With hedge funds losing money and bleeding assets, a handful of firms and clients are pinning their hopes on corporate marriages — just as the best returns might be behind them.

The World Needs More U.S. Government Debt (Bloomberg View)

The World Needs More U.S. Government Debt (Bloomberg View)

Are government-imposed restrictions holding back the U.S. economy? In a way, yes: The federal government is causing great harm by failing to issue enough debt.

The U.S. generates more income than any other country, and will keep doing so for many years to come. The federal government can generate a lot of revenue by taxing this income — a power that puts it in a unique position to issue the kind of extremely safe bonds that are in great demand among the world's investors.

Consumption in China is resilient, despite the economic slowdown (Economist)

If you believe that China’s economy is in trouble and that Chinese consumers are clinging tightly to their yuan, a visit to a local automobile dealership may make you think again.

Uncertainty is a fact of life, so get used to it (Market Watch)

Will the rain hold off until this evening, as the weather forecast suggests? Or should I dash out to mow the lawn now in case it starts to drizzle this afternoon?

Yen Holds Near One-Month Low as Bank of Japan Stimulus Expected (Bloomberg)

The yen held near a four-week low against the dollar before Bank of Japan policy makers decide whether to expand stimulus Thursday.

America Is Finally Putting Home Foreclosure Crisis Behind It (Bloomberg)

It’s taken nine years, but the number of U.S. homes in foreclosure has fallen to a level not seen since before the 2008 housing crisis.

The labor market is still far from ideal for young graduates (EPI)

Young high school and college graduates were hit hard in the Great Recession. While young graduates’ economic prospects have brightened in recent years, they still face elevated unemployment rates and stagnant wages. Many groups—including young graduates of color, as well as young high school graduates entering the workforce—face particularly difficult economic realities.

Picking apart Apple’s Q2 2016 numbers (Six Colors)

So that’s what a bad quarterly result looks like for Apple.

Say goodbye to the golden age of stock and bond returns (Market Watch)

The McKinsey Global Institute has just published a fascinating new research report on the stock and bond markets. Here are 10 things every investor needs to know, according to the report.

The future is the trust economy (Tech Crunch)

As we get into cars with complete strangers, sleep in the beds of people we’ve never met and lend money to others on the other side of the world, a powerful new currency is emerging — and it’s based on trust.

Bonds Have Bear Markets Too, Remember? (ETF)

When looking back to examine what has happened to various investments in the past, we must be careful about the length of the data set used and the bias it can create. Historical bond returns are a classic example.

Hedge Fund Managers? Who Needs 'Em (Bloomberg Gadfly)

Being a hedge fund manager used to be the kind of job you did after a stressful life in banking. Now, not only are there fewer such roles, but they're as taxing as ever. Indeed, the entire money-management world is being turned on its head as investors realize that passive strategies are cheaper, and often perform better.

Facebook is doing everything right (Quartz)

Facebook has proven to be a bright spot amid a series of gloomy earnings from tech companies, including Alphabet, Apple, and Twitter.

Charles Schwab to Cease Selling Load Mutual Funds (Wall Street Journal)

Charles Schwab Corp. plans to stop selling share classes of mutual funds that require investors pay a commission to brokers, the latest hit to the business of paying people to manage money.

NYSE Joins Nasdaq Assailing Plan to Overhaul Trading Fees (Bloomberg)

The head of the New York Stock Exchange said a proposal to overhaul the fee-and-incentive system it uses to get paid for trading would hurt investors and drive trading into the shadows.

Nothing Twitter is doing is working (The Verge)

Twitter reported its first quarter earnings today, and they came in under expectations: the company's haul of $595 million was less than the $607.8 million that analysts expected, and so is the $590 million to $610 million it expects to make in the current quarter. The company added 5 million users, for a total of 310 million — more than Wall Street expected, but well short of the growth that would allow it to siphon significant advertising revenue from Facebook and Google. Twitter's stock fell more than 12 percent after hours as the market confronted reality: nothing Twitter has done to improve the appeal of its core product over the last year has resonated.

The Real Lesson of Valeant's Debacle (Think Advisor)

Bill Ackman is a smart, successful and experienced investor. So are David Poppe, Robert Goldfarb, Glenn Greenberg and Jeffrey Ubben. While known as valueinvestors, they differ meaningfully in style, focus, industry and expertise, leading to different portfolios. Periodically there will be overlap, but these are not the kind of investors who look over their shoulder for guidance. There is no “keeping up with the (Dow) Joneses” problem in this group.

McDonald's CEO Says Better Worker Benefits Boosting U.S. Sales (Fortune)

Turns out paying people a higher wage and giving them more benefits makes them work-motivated.

Politics

Why Carly Fiorina? (The Atlantic)

Why Carly Fiorina? (The Atlantic)

Just like that, Carly Fiorina is back. The former HP executive dropped out of the presidential race months ago after a poor showing in New Hampshire. But now that Ted Cruz has tapped her as his running mate, Fiorina can exert influence over the race once again, and potentially try to make up for qualities Cruz lacks. “We must unite,” the Texas senator said, referring to the Republican Party, “and Carly is a vice-presidential nominee who I believe is supremely skilled, supremely gifted at helping unite this party.”

Bernie's Next Crusade (Bloomberg View)

Bernie's Next Crusade (Bloomberg View)

His hour upon the nation's biggest political stage is almost up. The Democratic nomination is receding from his reach. And a 74-year-old doesn't have a lot of presidential runs in his future. So it's time for Senator Bernie Sanders to take stock: What does he want?

Yes, yes, everyone knows — a revolution. But Sanders is not Lenin and this isn't Russia circa 1917. So what does he really want? He has surprised us all, himself surely included, with the depth and breadth of his support in the Democratic primary.

Technology

Even N00bs Can Rock Out on Magic Instruments’ New Guitar (Wired)

Even N00bs Can Rock Out on Magic Instruments’ New Guitar (Wired)

I gave up trying to play the guitar when I was 12 years old. This was approximately two weeks after I started learning it. Truth be told, I never quite got to the “playing” stage of things; I realized quickly that playing the guitar was hard. The strings hurt your fingers, and the chords don’t come easy. As soon as it dawned on my adolescent self that it was going to take more than a couple days to nail the intro to that one Third Eye Blind song, I decided to call it quits.

A Robot Monk Captivates China, Mixing Spirituality With Artificial Intelligence (NY Times)

Po, the wisdom-seeking hero of the “Kung Fu Panda” films, might recognize this temple in China where the world’s first robot monk dwells. For Po’s Jade Palace, there is Longquan (Dragon Spring) Temple, a place of Buddhist worship in the mountains northwest of Beijing, where gnarled gingko and cypress trees tower over red-walled buildings underneath rocky Phoenix Ridge.

Health and Life Sciences

Sperm-binding beads could work as fertility aid or contraceptive (New Scientist)

Sperm-binding beads could work as fertility aid or contraceptive (New Scientist)

Gotcha. Sticky beads that capture healthy sperm could work as a new form of contraceptive, while also helping fertility doctors select the best sperm for IVF.

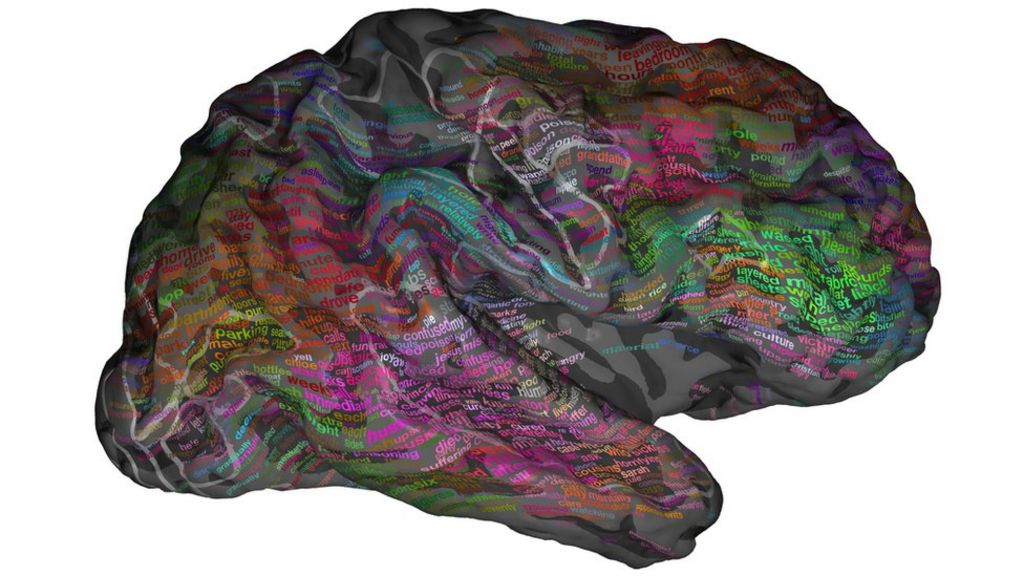

Brain's 'atlas' of words revealed (BBC)

Brain's 'atlas' of words revealed (BBC)

Scientists in the US have mapped out how the brain organises language.

Their "semantic atlas" shows how, for example, one region of the brain activates in response to words about clothing and appearance.

Life on the Home Planet

Noah’s ark island is saving vulnerable species in Australia (New Scientist)

Noah’s ark island is saving vulnerable species in Australia (New Scientist)

It’s a conservationist’s dream. Two endangered Australian mammals are bouncing back from the brink of extinctionafter being relocated to a remote, predator-free island. The once-abundant brush-tailed bettong and black-footedrock-wallaby have been under threat since cats and foxes were introduced to Australia by European settlers.

Organic Pesticides (The Ness)

Organic Pesticides (The Ness)

Have you seen the pro-organic propaganda video with the happy family who switches to organic only food and the pesticides disappear from their urine? It has over 5 million hits as of this writing. This is a core fearmongering strategy of the organic lobby.

Of course, there is no discussion about the absolute level of the pesticides, and the fact that such levels are insignificant and pose no known risk.

Gorillas in Danger of Extinction (NY Times)

The population of the world’s largest primate, the Grauer’s gorilla, has plummeted 77 percent over the last 20 years, with fewer than 3,800 remaining.