Financial Markets and Economy

It’s happening — oil and gas defaults are starting to hurt the rest of the credit market (Market Watch)

The high default rate in the oil and gas sector after a long period of low oil prices is starting to hurt the broader high-yield market, according to a new report from Moody’s.

Big drop in bullishness for U.S. stocks could actually be a good sign (Market Watch)

The U.S. stock market’s recent weakness represents little more than investors taking a breather before they mount another rally.

M&A Breakups Have Cost Wall Street $1.2 Billion in 2016 Alone (Fortune)

M&A Breakups Have Cost Wall Street $1.2 Billion in 2016 Alone (Fortune)

It’s the largest hit since the financial crisis.

After patting themselves on the backs for a record breaking year for dealmaking in 2015, banks are undoubtedly heaving an enormous sigh of dismay at what the new year has brought for mergers and acquisitions.

Bank of Japan: 3 ETFs meet our investment criteria (Market Watch)

The Bank of Japan said Friday that three exchange-traded funds focusing on shares of companies that proactively invest in physical and human capital have met the central bank's criteria for investment.

Why Equity Crowdfunding Could Be Dangerous for Investors and Entrepreneurs (Fortune)

Why Equity Crowdfunding Could Be Dangerous for Investors and Entrepreneurs (Fortune)

In the very near future, equity crowdfunding will no longer be reserved for the ultra-wealthy.

That’s thanks to the Securities and Exchange Commission passage of Title III JOBS Act, which goes into effect May 16. It’s a turning point for entrepreneurs and investors alike. Before that date, only accredited investors — individuals with a net worth of more than $1 million or annual income of more than $200,000 — could take an equity stake in a private company via crowdfunding. After May 16, anyone can participate.

The High Price of ‘Low Volatility’ Funds (Wall Street Journal)

If you buy a “low-volatility” fund, make sure you’re comfortable paying a higher price.

Corporate insiders send a bullish sign (USA Today)

Here’s some welcome news for investors worried about recent market volatility: Corporate insiders on balance are giving stocks the benefit of the doubt. That is a bullish sign for their companies — and for the market in general.

The Longest Downtrend in Crude Oil History is Over (Harvest Exchange)

“Dennis Gartman said Monday that crude oil wouldn’t trade back above $44 ‘in my lifetime.’” – January 25, 2016

Iran Is Back. Is Its Oil Surge Sustainable? (Forbes)

Iran is back. Just months after slipping off the shackles of international sanctions, Iran has boosted its oil exports by more than 700,000 barrels per day to 2 million bpd ,according to Argus Research. Iran’s total production is now up to 3.5 million bpd, nearly back to its levels in 2011, before sanctions were tightened.

Tesla's stock drops as investors question Musk optimism (USA Today)

Tesla stock dropped 5% Thursday as investors expressed skepticism over CEO Elon Musk's plan to accelerate and ramp up deliveries of its electric vehicles, with the downdraft likely exacerbated by short sellers.

Smart Beta Indexes Fall Short of Factor Investing (Chief Investment Officer)

Smart beta indexes may not provide true exposure to factors, according to research from Robeco Asset Management.

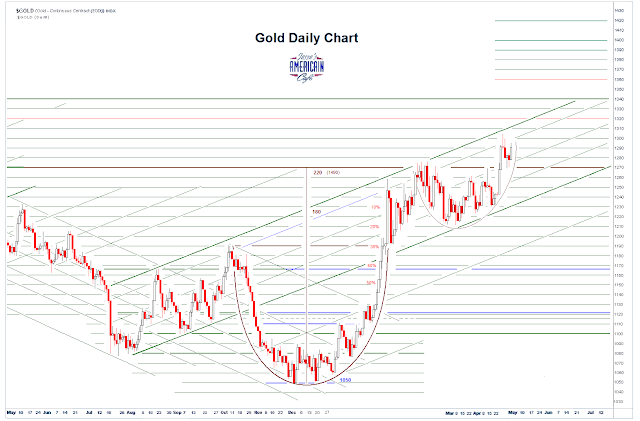

Gold Daily and Silver Weekly Charts – De Nile (Jesse's Cafe Americain)

It must be the rainy season, because today De Nile was overflowing its banks.

June Rate Hike Odds Collapse To Record Lows – Market Prices In No Hikes Through Feb 2017 (Zero Hedge)

The market took one look at today's dismal jobs data and marked down the data-dependent Fed's rate-hike schedule to record lows. June odds are now at 4% – the lowest on record…

The Future of the Hedge Fund Industry (A Wealth of Common Sense)

There was a ton of chatter about the hedge fund industry in the past week from both well-known hedge fund managers and the asset allocators who invest with them.

Equity funds see biggest outflows since 2015 market rout (Reuters)

Investors pulled out of equities at the fastest rate since last summer's market rout and cut cash exposure, opting instead for less risky fixed income and precious metals assets ahead of U.S. jobs data, Bank of America Merrill Lynch (BAML) said on Friday.

Politics

7 ways Trump is about to turn the GOP into a national freakshow? (Salon)

7 ways Trump is about to turn the GOP into a national freakshow? (Salon)

Republicans across the country are swallowing hard and wondering what Donald Trump is going to be like as their presidential candidate—as if the answers are not clear enough.

Some are hoping he will dial down his vulgar mouth and start acting presidential, as if magically transformed by what mainstream media had been calling an “aura of inevitability.”

Why the media will lift Trump up and tear Clinton down (Vox)

Why the media will lift Trump up and tear Clinton down (Vox)

It now seems all but certain that the presidential election will see Donald Trump face off against Hillary Clinton.

We find ourselves at the tail end of a brief period of clarity. For the past few months, virtually everyone outside of the 40 percent of Republican primary voters who carried him to victory has agreed that Trump is not fit to be president.

Technology

Millions of Android devices have been vulnerable for 5 years (but don’t worry too much) (The Next Web)

Millions of Android devices have been vulnerable for 5 years (but don’t worry too much) (The Next Web)

A security researcher has said that hundreds of different models of Android devices are vulnerable to leaking data to seemingly innocuous apps.

Announced by FireEye in a blog post, the vulnerability allows an attacker to potentially do things like view the SMS database and call history, as well as changing system settings.

Japan now has more charging sites than gas stations (Japan Times)

Japan now has more charging sites than gas stations (Japan Times)

There are more electric-car charging points in Japan than there are gas stations.

That surprising discovery comes from Nissan Motor Co., which reported that the number of power points in Japan, including fast-chargers and those in homes, has surged to 40,000, surpassing the nation’s 34,000 gas stations.

Health and Life Sciences

Are older adults more prone to chronic pain? (Futurity)

Are older adults more prone to chronic pain? (Futurity)

When older adults experience pain, inflammation occurs more quickly and at a higher magnitude than when younger adults feel pain. Further, the pain stays around longer, according to a new small study.

The findings suggest that older adults could be at risk for developing chronic pain and may benefit from taking anti-inflammatories soon after an injury or procedure, researchers say.

Global sleeping patterns revealed (BBC)

Global sleeping patterns revealed (BBC)

The world's sleeping patterns have been revealed by scientists analysing data collected from an app.

It showed the Dutch have nearly an hour more in bed every night than people in Singapore or Japan.

Why You Can’t Lose Weight on a Diet (NY Times)

Six years after dropping an average of 129 pounds on the TV program “The Biggest Loser,” a new study reports, the participants were burning about 500 fewer calories a day than other people their age and size. This helps explain why they had regained 70 percent of their lost weight since the show’s finale.

Life on the Home Planet

Did The Paris Climate Accord Start A Low-Carbon Landslide? (Think Progress)

Did The Paris Climate Accord Start A Low-Carbon Landslide? (Think Progress)

Many years from now, the historic international Paris climate agreement could easily be seen as the moment the conversation changed.

“One of the cool things coming out of Paris was the idea of moving from a ‘woe-is-me’ narrative to talking about the possibilities,” said Kathleen Rogers, president of the Earth Day Network. “This change of attitudes is where I think the momentum is. We are in motion.’’

The San Andreas Fault Is ‘Locked and Loaded,’ a Leading Seismologist Warns (Time)

“The springs on the San Andreas system have been wound very, very tight"

A leading earthquake expert has warned that a section of the San Andreas Fault in Southern California may be “ready to go,” and that a major temblor that could shake the Los Angeles metropolitan area is long overdue.

Israel bombs Hamas targets in Gaza in worst violence since war of 2014 (Telegraph)

Israel bombs Hamas targets in Gaza in worst violence since war of 2014 (Telegraph)

Israeli warplanes struck targets inside Gaza and Hamas fired mortars at Israeli troops on Friday in the most intense exchange of fire between the two sides since the 2014 war.

While both Israel and Hamas insisted they were not seeking a fresh conflict, the escalation raised fears of yet another bloody round of fighting in Gaza.