Financial Markets and Economy

Dollar firms, weaker yen boosts Nikkei (Business Insider)

Asian shares got off to a weak start on Tuesday, pressured by weaker crude oil prices, though Japanese shares got a tailwind as the dollar stood tall against the yen.

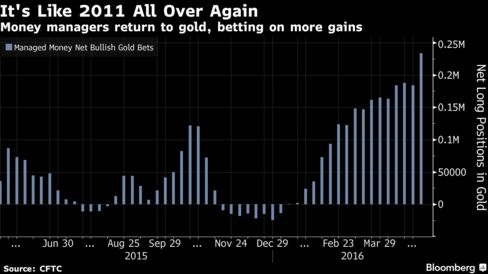

Hedge Funds Take Bullish Gold Bets to Highest Since 2011: Chart (Bloomberg)

For gold bulls, it looks like the good times of five years ago all over again, at least in one respect.

I dissected the S&P 500, and this is what I found? (Market Watch)

Many of us learned the word “dissection” when we examined a frog in grade school. Today, part of my strategic investment process is dissecting the stock market in hopes of gleaning some clues that lead to new opportunities or red flags that help avoid trouble.

NYSE Margin Debt as % of GDP Signaling Ugliness for Equities (Gold Squeeze)

ust one chart for today – it's one that I update every so often because I think it's a worthwhile indicator to follow. The NYSE reports total margin debt each month (with a several week lag) on its website,linked here. Margin debt, as you know, is money borrowed to invest in equities. The higher margin debt goes, the more money is being poured into stocks. The absolute value of margin debt isn't terribly meaningful because you have to take into account inflation, a growing number of investors, etc. What is meaningful, however, is anchoring margin debt to the U.S. Gross Domestic Product. Taking this ratio allows us to follow the level of margin debt relative to the size of our economy.

U.S. companies brighten their earnings outlook? (Reuters)

The profit recession that has weighed on large-cap stocks on Wall Street for the past three quarters may be loosening its grip as U.S. companies allow a hint of blue sky to poke through the gloom.

Bitcoin’s on a bull run again (Quartz)

Bitcoin’s on a bull run again (Quartz)

The price of bitcoin has been climbing all year, even as a “civil war” has divided its community of developers, and an Australian man has claimed to be its creator in a highly orchestrated media spectacle in recent days.

Tesla's Talk Isn't Cheap (Bloomberg Gadfly)

As any Republican will tell you, 2016 is the year of the superlative.

China Stops Trying To Fool The World; World Is Sorry (Dollar Collapse)

Something interesting has happened. China earlier this year responded to falling stock prices by borrowing a trillion dollars and spending it on commodities, boosting the prices of iron ore, oil, copper, etc., and giving the global economy a patina of recovery.

Fed's Kashkari says sees room for improvement in economy (Reuters)

The Federal Reserve's current monetary policy stance is appropriate, a top U.S. central banker said on Monday, because low rates are helping bring workers back to the labor force without putting too much upward pressure on inflation.

The Price Is Right for Sotheby’s (Wall Street Journal)

Spare a thought for the 0.1%.

If You Were Expecting It, It's Not a 'Black Swan' (Bloomberg View)

It's the bread and butter of pundits to speculate what the world might look like after a relatively improbable but potentially disruptive event, like the U.K.'s exit from the European Union or a Donald Trump victory in the U.S. presidential election. The perceived probability of these "black swan" events is pretty high, after all, and contingency plans may be in order.

What Wall Street Is Missing (Value Walk)

“We are better. We are not great. But we are better. And being better feels like great after what we had.”

Wall Street Doesn’t Believe Elon Musk Can Produce 500,000 Cars By 2018 (Huffington Post)

When Elon Musk said last week that Tesla Motors aims to roll out 500,000 vehicles by 2018, plenty of folks on Wall Street immediately voiced their doubts.

Is This What ‘The End Of The Great Debt Cycle’ Looks Like (The Felder Report)

Over the weekend, I sat down with Stig and Preston of The Investors Podcast. One of the questions they asked me was, “what are the three biggest risks you see right now?

The titillating and terrifying collapse of the dollar. Again. (Michael Pettis)

Foreign perceptions about the Chinese economy are far more volatile than the economy itself, and are spread across a fantastic array of forecasts. On one extreme there are still many who hold the view that overwhelmingly dominated the consensus just four of five years ago, with a book by Martin Jacques,When China Rules the World, titillating or terrifying many with a subtitle that promised the end of the Western world and the birth of a new global order.

With Jim Chanos Short, Is SolarCity The Next SunEdison? The Full Bear Case (Zero Hedge)

One year ago, SunEdison was the darling of the hedge fund world. It is now bankrupt. Moments ago, Jim Chanos revealed that (in addition to Tesla) he is also short Elon Musk's SolarCity, sending the stock sliding.

Politics

The man set to lead the Philippines has made a bunch of controversial comments (Business Insider)

The man set to lead the Philippines has made a bunch of controversial comments (Business Insider)

The Philippines is wrapping up its latest election.

Rodrigo Duterte, the mayor of southern Davao city, is leading with over three-quarters of the votes already counted, according to the latest polls cited by BBC. Meanwhile, the AP reports that the unofficial vote count shows he won.

Republicans are losing the argument over Merrick Garland. And it’s only going to get worse. (Washington Post)

Republicans are losing the argument over Merrick Garland. And it’s only going to get worse. (Washington Post)

The nomination of Merrick Garland to fill Antonin Scalia’s seat on the Supreme Court may have slipped from the front page amid all the attention to Donald Trump’s ascension, but the parties are still arguing about it, and something interesting is going on. As Burgess Everett reports, conservative groups are significantly outspending liberal groups in trying to pressure Republican senators to support Garland or at least allow a hearing and vote on his nomination.

95 percent of taxpayers would save money under President Sanders? (Vox)

Bernie Sanders proposes raising taxes on virtually every American, no matter how little money they make. But he has long argued that Americans will get more back in benefits than they pay out in additional taxes — and a new Tax Policy Center analysis suggests that's right.

/cdn0.vox-cdn.com/uploads/chorus_asset/file/6461621/graphic.0.png)

Technology

Why IBM Is Excited About the ‘Special Partnership’ Between Apple, SAP (Fortune)

Why IBM Is Excited About the ‘Special Partnership’ Between Apple, SAP (Fortune)

Get ready for highly personal, consumer-grade business apps.

It just might be the business software world’s biggest love triangle. Two of IBM’s closest partners—Apple and SAP—are getting together with the mutual aim of kick-starting the use of mobile apps in the corporate world.

Solar Power Is Ready to Dominate Energy Thanks to New Tech (Singularity Hub)

In the next 20 years, between 50 percent to 100 percent of the world's energy production could come from solar.

Health and Life Sciences

Gene therapy’s first outright cure for a deadly disease is here — and it could signal a new phase in medicine (Business Insider)

Gene therapy’s first outright cure for a deadly disease is here — and it could signal a new phase in medicine (Business Insider)

A treatment now pending approval in Europe will be the first commercial gene therapy to provide an outright cure for a deadly disease.

The treatment is a landmark for gene-replacement technology, an idea that’s struggled for three decades to prove itself safe and practical.

Nestlé Wants to Sell You Both Sugary Snacks and Diabetes Pills (Bloomberg)

Nestlé Wants to Sell You Both Sugary Snacks and Diabetes Pills (Bloomberg)

Nestlé is by far the largest food company in the world. Its 335,000 employees produce more than 2,000 brands, manufactured in 436 factories across 85 countries. It’s Europe’s most valuable corporation, worth $240 billion, comfortably more than oil giant Royal Dutch Shell. Among the world’s 195 nations, it sells in 189.

Nestlé’s impact on the history of how we eat is almost impossible to overstate.

Life on the Home Planet

After the Pacific Ocean swallows villages and five Solomon Islands, a study blames climate change (Washington Post)

After the Pacific Ocean swallows villages and five Solomon Islands, a study blames climate change (Washington Post)

“The sea has started to come inland, it forced us to move up to the hilltop and rebuild our village there away from the sea,” said Sirilo Sutaroti, 94, a leader of the Paurata tribe, to a group of Australian environmental scientists. The scene of this rising sea is an archipelago of upthrust volcanoes and coral atolls, which dots the Pacific to the northeast of Australia: the Solomon Islands. There, a swollen sea is claiming the shoreline — and even, researchers say, entire masses of land.

Study Confirms World’s Coastal Cities Unsavable If We Don’t Slash Carbon Pollution (Think Progress)

Study Confirms World’s Coastal Cities Unsavable If We Don’t Slash Carbon Pollution (Think Progress)

A new study confirms what leading climate scientists have warned about for many years now: Only very aggressive climate action can save the world’s coastal cities from inundation by century’s end.

We still could limit sea level rise to two feet this century if we keep total warming below 2°C, according to analysis using these new findings. Otherwise, we should be anticipating five to six feet of sea level rise by 2100 — which would generate hundreds of millions of refugees. That isn’t even the worst-case scenario.