Financial Markets and Economy

Futures are slightly lower (Business Insider)

Stock futures were slightly in the red on Wednesday, a quiet day for economic data. Safe-haven assets rallied.

Treasury Volatility Dips to Lowest Since 2014 on Waning Fed Bets (Bloomberg)

A measure of expected price swings in Treasuries dropped to levels last seen in 2014, signaling a growing conviction among traders the Federal Reserve will maintain a gradual monetary policy path.

U.S. companies are saving $100 billion a year by shifting profits overseas, report says (Washington Post)

U.S. multinational companies are saving $100 billion a year by shifting their profits overseas to lower their tax bills, according to a study released Tuesday that found that corporate tax-dodging is a bigger problem than previously estimated.

Hardcore Bear ETFs Poised to Swell Past Bulls as Inflows Surge (Bloomberg)

The most aggressive traders are joining the growing ranks of those betting against the three-month rally in U.S. stocks.

Merger Advice and Retail Trading (Bloomberg View)

In 2015, the buyers in public-company deals valued at more than $1 billion didn’t use financial advisers in 70 instances, or 26% of the time, according to Dealogic. That is the second-highest total on record and far surpasses the 25 cases, or 13% share, in 2014.

Japan's Warning on Yen Reveals Next Big Trade in Swaps (Bloomberg)

With Japan’s finance minister warning about potential intervention to weaken the yen for the first time since 2011, Bank of America Corp. strategists see a way to profit through interest-rate derivatives.

Port-Trucking Firms Run Into Labor Dispute (Wall Street Journal)

The nation’s busiest ports are emerging as a key battleground in the legal fight over whether truck drivers should be counted as employees or independent contractors.

Stuck with dangerous dollar dominance (Business Insider)

Stuck with dangerous dollar dominance (Business Insider)

The world is getting an object lesson on the problems of having one dominant global currency and even the supposed prime beneficiary, the United States, can see the downside.

Alarming bouts of volatility in world financial markets over the past 12 months have been rooted in a fear of what happens when a world with its highest-ever peacetime debt pile faces even a hint of higher interest rates.

Tumbling Banco Popolare leads Italian bank shares lower (Reuters)

May 11 Shares in Banco Popolare plunged 14 percent on Wednesday after a surprise first-quarter loss driven by loan writedowns — the main focus of investor concerns over Italian banks.

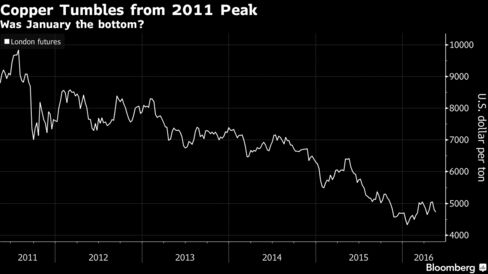

World's Top Copper Miner Sees Prices Rising Toward End 2017 (Bloomberg)

Codelco, the world’s biggest copper producer, sees prices rising toward the end of next year as investment cuts hasten a re-balancing of global supply and demand.

What’s driving Saudi Arabia’s shake-up — and it’s not just oil (Market Watch)

Saudi Arabia’s leaders are fighting to pre-empt their own version of the Arab Spring with a government shake-up over the weekend aimed at creating more jobs, making housing more affordable, reducing the power of the religious police and more.

Crop Prices Rally as Report Points to Easing of Glut (Wall Street Journal)

U.S. crop prices surged Tuesday, extending an unexpected run in agricultural prices that has drawn in big investors like hedge funds.

LendingClub Struggles to Assure Investors as Bond Deals Stall (Bloomberg)

Questions swirling around LendingClub Corp.’s leadership shakeup this week are threatening to compound a concern already weighing on its stock: Will investors keep snapping up its loans?

China's debt is worse than everybody else's … except pre-crisis Ireland (Business Insider)

China's debt is worse than everybody else's … except pre-crisis Ireland (Business Insider)

China's private debt load has grown so large it is now second only to that of Ireland's back in 2008, according to Credit Suisse analyst Andrew Garthwaite and his team.

That was right before the Irish property bubble burst, pushing nearly half of the nation's housing mortgages under water and tripling unemployment.

Disney’s big miss: Investors ‘have been spoiled,’ still ‘significant value’ in films (Market Watch)

Walt Disney Co. whiffed with its quarterly results, and the initial reactions range from sadness to unrepentant optimism.

Mitsubishi Motors says has cash to ride out widening mileage affair (Reuters)

Mitsubishi Motors Corp is confident it has enough cash to weather a damaging fuel efficiency scandal alone, even as it warned incorrect data may have been used for more of its cars.

Shakespeares Need Free Markets, Too (Bloomberg View)

With celebrations underway across the globe to mark the 400th anniversary of William Shakespeare’s death, the arts are as popular as ever. And yet, in an age of government cutbacks, the inevitable grubby question arises: Do the arts provide taxpayers with value for money?

Macy's cut its earnings guidance and shares are tumbling (Business Insider)

Macy's cut its earnings guidance and shares are tumbling (Business Insider)

Macy's lowered its forecast for earnings this year in its quarterly results out Wednesday.

The tech press may be as responsible as Elizabeth Holmes. (Vanity Fair)

Over the past few years, when media outlets reached out to Theranos about whether its wunderkind founder, Elizabeth Holmes, would have time to sit for an interview, her P.R. team generally responded with two questions: What time and where? Holmes was a star.

Paul Singer: "Gold Rally Just Starting" As JPM Predicts A New Gold Bull Market (Zero Hedge)

It was just last week when legendary hedge fund manager Stanley Druckenmiller delivered his latest anti-Fed sermon and once again extolled gold as the asset class to own in these experimental times in which the "bull market in stocks is exhausted", saying "what was the one asset you did not want to own when I started Duquesne in 1981?

Politics

Clinton loss in West Virginia signals trouble in Rust Belt (Reuters)

U.S. Democratic White House candidate Hillary Clinton lost a nominating contest to Bernie Sanders in economically struggling West Virginia on Tuesday, a setback that could signal trouble for her in industrial states in the November general election.

GOP hopefuls struggle with support of Trump (The Hill)

GOP hopefuls struggle with support of Trump (The Hill)

Vulnerable Republican Senate hopefuls are struggling to find the right tone about Donald Trump’s rise to the top of the party’s ticket, weighing how to appeal to moderates without casting aside their base.

They’re choosing their words carefully as Democrats begin trying to tie them to their party’s presumptive presidential nominee in the hopes that doing so will help flip Senate control.

Brazil Impeachment Vote May Spell Rousseff's Last Day on Job (Bloomberg)

Brazil Impeachment Vote May Spell Rousseff's Last Day on Job (Bloomberg)

This Wednesday may be the last day in office for President Dilma Rousseff, as Brazil’s Senate gears up for a vote that would force her out and into an impeachment trial she appears unlikely to survive.

The Senate debate is scheduled to last 10 hours and end with a vote around 7 p.m. local time, the chamber’s speaker Renan Calheiros said.

Technology

London is set for driverless car roll-out – so what comes next? (New Scientist)

London is set for driverless car roll-out – so what comes next? (New Scientist)

The French Riviera is lovely at this time of year. I’m zipping along the coast in an old Honda Civic. The steering wheel spins to take the car round a bend – but my hands stay in my lap. And since there’s no need to keep my eyes on the road, I’m free to enjoy the beachfront view. An oddly pixelated man with a two-dimensional windsurfer under his arm gives me the eye.

This Robot's Teaching Itself to Twirl a Stick (Gizmodo)

This Robot's Teaching Itself to Twirl a Stick (Gizmodo)

If you’ve ever tried to learn how to spin a pencil in your hand, you’ll know it takes some concerted effort—but it’s even harder for a robot. Now, though, researchers have finally built a ‘bot that can learn to do it.

Health and Life Sciences

Does A Common Painkiller Reduce Empathy? (Forbes)

Does A Common Painkiller Reduce Empathy? (Forbes)

Feeling empathetic toward another human being’s pain can strengthen relationships by building trust and showing loyalty. Without the understanding of physical and social aches, connections crumble, destroying carefully constructed societal bonds. One way to potentially avoid this mess: Stay away from certain common painkillers.

Early stress might make brains grow up too fast (Futurity)

Early stress might make brains grow up too fast (Futurity)

Scientists understand that stress in early childhood can create lifelong psychological troubles, but have only begun to explain how they emerge in the brain.

For example, they have observed that stress incurred early in life attenuates neural growth.

Life on the Home Planet

Fight Climate Change, One Bus Ride at a Time (Bloomberg View)

Fight Climate Change, One Bus Ride at a Time (Bloomberg View)

Success in the fight against climate change doesn’t demand dramatic innovations. Houses that heat themselves and jet planes fueled bysunshine and pond goo are good ideas, but there’s no need to wait for them. Power plants that emit only a steady drip of macchiato would be great, too, but they aren’t strictly essential.

Islamic State Claims Baghdad Bombing That Killed at Least 62 (Wall Street Journal)

Islamic State Claims Baghdad Bombing That Killed at Least 62 (Wall Street Journal)

Islamic State claimed responsibility for a car bombing in a densely populated part of Baghdad on Wednesday that killed at least 62 people and wounded 86, in one of the city’s deadliest terror attacks in months.

Super-salty Turkish lakes may hold key to spotting life on Mars (New Scientist)

Super-salty Turkish lakes may hold key to spotting life on Mars (New Scientist)

If you want to visit Mars, visit Turkey. That’s where you’ll find lakes so salty that the only bugs able to live there are species that could probably survive on Mars as well.

For that reason, microbiologists in Turkey have surveyed the array of species that inhabit the Acigol, Salda and Yarisli lakes. They’re hopeful that studying some of them will yield useful insights into the kinds of biology that could help microbes exist on Mars or other potentially habitable planets and moons.