Financial Markets and Economy

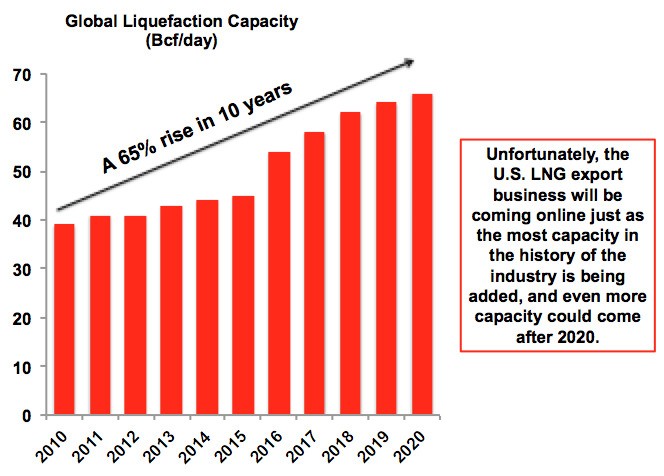

Six Threats for the U.S. Liquefied Natural Gas Business (Forbes)

Combined with lower than expected growth, both oil-linked contract prices and spot prices have plummeted and narrowed the price differentials between the three major markets: the Americas, Europe, and Asia. Per WoodMac, “Up to half of US LNG at risk of shut-in over next 5 years.”

3 Cheap Stocks Set To Double Their Dividends (Forbes)

Plenty of investors judge a stock’s dividend by one thing: the current yield. It’s a key figure, to be sure, but it’s just a starting point. If you’re investing for the long haul, dividend growth is way more important.

Its the Worst Time in 15 Years to Be a First-Time Homebuyer (Fox Business)

Over the last 15 years, the real estate market for first-time homebuyers has been fairly strong. Before the financial crisis, lending standards were such that first-time buyers had little problem obtaining the financing they needed to move into a home of their own. After the crisis, the Obama first-time homebuyer tax credit plus dramatically lower prices put first-time buyers in an enviable position in the market.

Wall Street’s Bond Forecasters Splinter as Fed Credibility Wanes (Bloomberg)

To Thomas Costerg, the big question for bond investors isn’t whether the Federal Reserve will raise U.S. interest rates this year.

Yen weakens on Japan intervention talk before G7 meets (Reuters)

The yen fell on Monday as Japan, readying to host a Group of Seven meeting, again signaled its willingness to intervene in the market, driving the currency to erase early gains made on disappointing Chinese data.

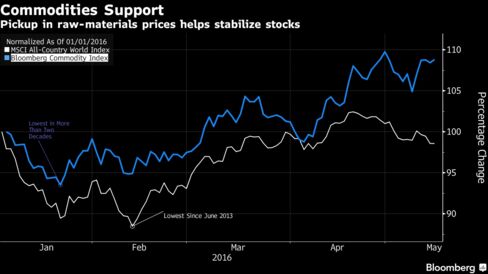

Oil Climbs to Highest Since November as European Shares Retreat (Bloomberg)

Brent crude rose to a six-month high, leading a rebound in commodities and boosting the ruble and mining companies, as supply disruptions in Nigeria added to production woes.

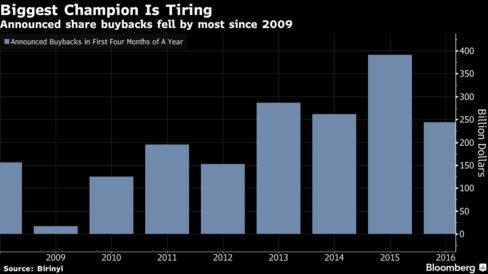

Bull Market Losing Biggest Ally as Buybacks Fall Most Since 2009 (Bloomberg)

Corporate America has its eye on a new target as executives look to tighten their belts amid a slump in profits — and this time shareholders won’t like it.

Moody's downgrades Saudi Arabia: 'The buffers will continue to erode' (Business Insider)

Moody's downgrades Saudi Arabia: 'The buffers will continue to erode' (Business Insider)

Saudi Arabia was downgraded by Moody's, the US credit rating company, as low oil prices and falling economic growth begin to take their toll on the country's finances.

Moody's said "lower oil prices have led to a material deterioration in Saudi Arabia's credit profile," in a statement published on its website.

Asia stocks trade higher despite disappointing China data (BBC)

Asian stock markets rose on Monday, shrugging off disappointing economic data released by China over the weekend.

Central Bankers’ Wisdom Faulted as Gold Holdings Surge 25% (Bloomberg)

The great gold rush of 2016 is gathering pace. Holdings in exchange-traded funds have now surged by a quarter, with investors taking advantage of lower prices over the past two weeks to enlarge stakes on rising concern about central bank policy making worldwide.

Gold rises after weekly drop as equities, dollar retreat (Reuters)

Gold prices rose on Monday as stock markets eased after soft Chinese data, boosting interest in the metal as an alternative asset, and as the dollar weakened against the euro.

Gold edged back above $1,280 an ounce after posting its biggest weekly loss since mid-March last week, with some investors disappointed by its inability to sustain a push to 15-month highs above $1,300 an ounce earlier this month.

European Stocks Fall as Chinese Economic Data Disappoint (Wall Street Journal)

Global stocks struggled for momentum Monday as disappointing Chinese data fueled concerns about the world’s second-largest economy.

Japan steps up yen intervention rhetoric, as it has in the past (Reuters)

Expectations are growing that Japanese currency authorities may intervene in the currency market after they explicitly warned they would do so, worried that the yen's rise to its highest levels in a year and a half will threaten the already sluggish economy.

Here's the story of how a rogue copper trader lost $1.2 billion for the Chinese government (Business Insider)

Here's the story of how a rogue copper trader lost $1.2 billion for the Chinese government (Business Insider)

China couldn’t get enough copper in 2005. Copper is vital for industries ranging from manufacturing to telecommunications and China was the world’s manufacturing hotspot at the time. So it needed a lot of copper. But some in China were willing to bet money that copper prices were about to fall.

Google faces record-breaking fine for web search monopoly abuse (The Telegraph)

Google faces a record-breaking fine for monopoly abuse within weeks, as officials in Brussels put the finishing touches to a seven-year investigation of company’s dominant search engine.

Top Currency Traders Warn White House Race May Echo Brexit Chaos (Bloomberg)

Traders wanting to know what November’s U.S. presidential election will mean for the dollar need look no further than the U.K.

A Battle Brews Over Negative Rates on Mortgages (Wall Street Journal)

As interest rates in Europe fall near or below zero, lawmakers and consumer advocates in Spain and Portugal are attacking an ancient tenet of finance by insisting that lenders can owe money to borrowers.

'Avengers' threaten new insurgency in Nigeria's oil-producing Delta (Reuters)

They call themselves the Niger Delta Avengers. Little is known about the new radical group that has claimed a series of pipeline bombings in Nigeria's oil-producing region this year and evaded gunboats and soldiers trawling swamps and villages.

China Challenged to Keep Yuan Stable as Dollar Rises (Wall Street Journal)

Having had it easy for a few months, the Chinese central bank is now coming under renewed pressure to steady the yuan and prevent money from leaving China’s shores.

China's Credit Growth Grinds To A Screeching Halt: Why This Is Very Important (Zero Hedge)

Last night, when previewing the most important macro event of the day – far more important than US retail sales which predictably tried to refute the gloomy reality reported by actual retailer CEOs – namely China's montly loan creation number, we said that "according to MarketNews, Chinese bank loan growth is expected to slow sharply in April compared with March as the pillar of bank lending, mortgage loans, slowed as the property market cooled."

Berkshire Hathaway is getting hooked up with a $63 billion interest-free loan from the US government (Business Insider)

Berkshire Hathaway held its annual meeting recently and released its first quarter report this past Friday, so there is no better time to examine the factors that have contributed to the uncommon success of Warren Buffett's conglomerate.

Oil prices rise on Nigerian outages, Goldman forecast (Reuters)

Oil prices jumped over 2 percent on Monday to their highest since October 2015 on growing Nigerian oil output disruptions and after long-time bear Goldman Sachs said the market had ended almost two years of oversupply and flipped to a deficit.

"The Global Negative Feedback Loop" – Why Investors Are Fleeing Capital Markets (Zero Hedge)

The following comprehensive analysis of current market risks and concerns, represents one of the better summary assessments by both Brean Capital's Russ Certo as well as Bloomberg's market analysis team, of not only why there seems to be an increasingly more tangible sense of gloom covering global capital markets, but also why investors are increasingly withdrawing from risk, leaving central banks to duke it out among themselves.

These 2 Casinos Are Betting Big on a Vegas Rebound (Fox Business)

Gaming revenues stumbled in March, but Boyd Gaming rolled the dice anyway buying up the Aliante Hotel & Casino in North Las Vegas.

Politics

Hillary Clinton’s Revolutionary Promise To Lift Up The Teaching Profession (Think Progress)

Hillary Clinton’s Revolutionary Promise To Lift Up The Teaching Profession (Think Progress)

During a speech for New York State United Teachers last month, presidential candidate Hillary Clinton did more than offer a few vague platitudes about the selflessness of teachers. She vowed to launch a “national campaign” to improve the teaching profession.

“One of my main goals as president will be to launch a national campaign to modernize and elevate the profession of teaching. To reach out to encourage more talented young people to become teachers. To reach out and encourage more talented mid-career professionals to do the same,” Clinton said.

Tallying the Economic Toll of Political Upheaval (Wall Street Journal)

Donald Trump and Hillary Clinton promise to rejuvenate the nation’s economy. Meanwhile, the process of electing one of them to the presidency will likely bruise it.

Technology

Google plans to start blocking Flash in Chrome this year (The Verge)

Google plans to start blocking Flash in Chrome this year (The Verge)

Flash's death has been slow and painful, and now Google is planning to deal it another blow. Google has detailed plans to start blocking most Flash content with Chrome, with the change targeted toward the end of this year.

Under its current vision, nearly every website would have Flash content blocked by default.

Health and Life Sciences

Cancer samples from dead patients sought for new study (BBC)

Cancer samples from dead patients sought for new study (BBC)

Terminally ill UK cancer patients are being asked to donate blood and tissue samples to a study when they die.

The aim is to find out how tumours develop and spread and what happens during the final stages of the disease.

Do You Suffer from Memory Blindness? (Scientific American)

Do You Suffer from Memory Blindness? (Scientific American)

You see a crime take place. You are interviewed about it. You give a statement about what you saw.

Do you think that at a later date you would be able to detect whether someone had tampered with your statement? Or re-written parts of it?

Life on the Home Planet

Ethiopia is experiencing one of the worst droughts in 50 years — but farmers found an astonishing way to make the desert bloom again (Business Insider)

Ethiopia is experiencing one of the worst droughts in 50 years — but farmers found an astonishing way to make the desert bloom again (Business Insider)

Ethiopia is in the middle of the worst drought in 50 years. It’s the sort of shock to the system we are likely to see more of with climate change. But Ethiopia is also home to a successful experiment to make the land more resilient to drought.

If we are going to adapt to our changing world, it’s experiments like these that will show us the way.

Global flooding 'will threaten billion' (BBC)

Global flooding 'will threaten billion' (BBC)

A British aid charity is warning that by 2060 more than a billion people worldwide will live in cities at risk of catastrophic flooding as a result of climate change.

A study by Christian Aid says the US, China and India are among the countries most threatened.

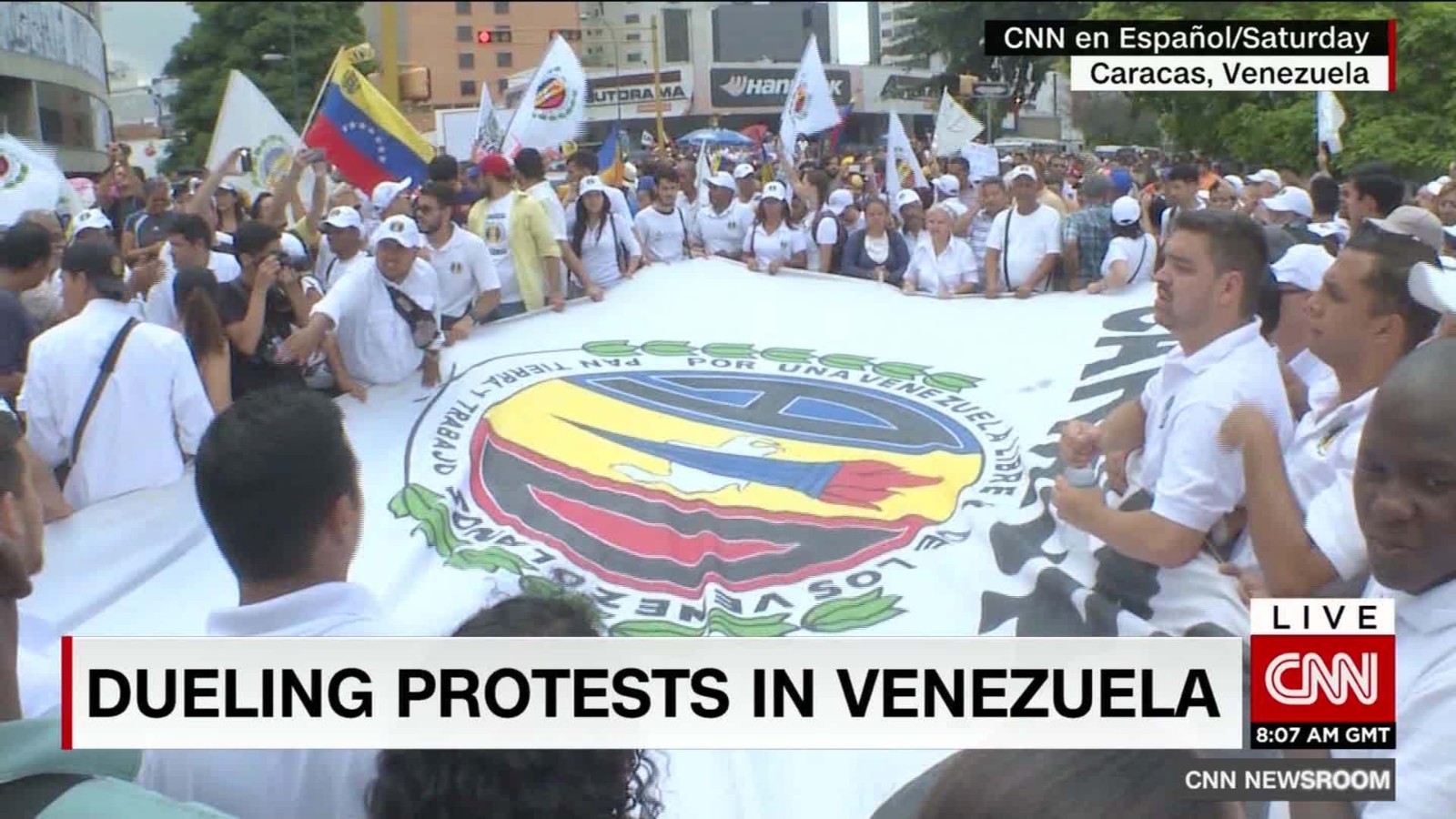

Venezuela's 'state of emergency': How the country slid into crisis (CNN)

Venezuela's 'state of emergency': How the country slid into crisis (CNN)

Protests rocked the Venezuelan capital of Caracas Saturday, as rival factions of pro- and anti-government activists took to the street to add their voices to President Nicolas Maduro's latest attempt to exert some control and hold onto power.