Financial Markets and Economy

Here's why Jim Chanos is shorting big oil (Business Insider)

Famous short seller Jim Chanos isshorting oil majors Royal Dutch Shell Plc and Chevron Corp, according to Bloomberg. He is operating under the belief that the negative cash flows and dividend payments using borrowed money by both the companies is an unsustainable move in the long-term.

Strong U.S. data bolsters second-quarter growth prospects (Reuters)

U.S. consumer prices recorded their biggest increase in more than three years in April as gasoline and rents rose, pointing to a steady inflation build-up that could give the Federal Reserve ammunition to raise interest rates later this year.

Other data on Tuesday showed housing starts and industrial production rebounded strongly last month, suggesting the economy was regaining steam early in the second quarter after almost stalling early in the year.

Strongest Inflation in 38 Months (Crossing Wall Street)

This morning, the government reported that the headline CPI rose by 0.4% in April. That’s the largest increase in 38 months. Wall Street had been expecting an increase of 0.3%. The big driver was gasoline prices which rose by 8.1%. Still, gas is down a lot in the last year.

The Most Important ETF Of 2016 (ETF)

There are more than 1,900 ETFs listed in the U.S., and each one of them has a story to tell. At some point, some entrepreneur or innovator decided that this ETF would at least partially define the future of investing, and would matter to investors around the world.

Apple is the new IBM (Quartz)

The company run by the world’s most famous value investor, Warren Buffett, built up a position in Apple worth roughly $1 billion in the first quarter of 2016. The investment is yet another sign that the iPhone maker’s days of explosive growth might be permanently fading into the past.

How Should Alternative Investments Be Benchmarked? (A Wealth of Common Sense)

I’ve heard from a number of investors and advisors over the past few years who have come to the same conclusion — they know they need to take risk but they don’t want to go all the way into stocks and they’re worried bonds aren’t going to pull their weight in a portfolio.

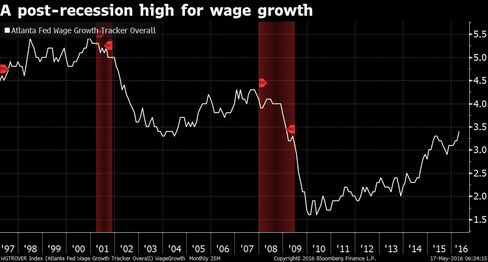

One Measure of U.S. Wage Growth Just Hit a New Post-Recession High (Bloomberg)

The median U.S. worker is enjoying their highest wage growth since 2009, according to the Federal Reserve Bank of Atlanta's wage growth tracker.

Is Productivity Really That Bad? (Value Plays)

“U.S. Worker Productivity Hasn’t Been This Bad Since 1993”

Is the Market Cheap? Three things you need to know about valuation, but don’t (Dash of Insight)

There is a general consensus that valuation indicators are not very useful for market timing. Despite this, the financial media and the blogosphere feature an avalanche of articles warning that the market is seriously overvalued. Your retirement account might drop 50% at any moment. There are countless worries in the world.

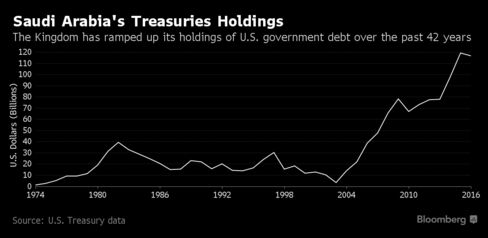

U.S. Discloses Saudi Holdings of Treasuries for First Time (Bloomberg)

The Treasury Department released a breakdown of Saudi Arabia’s holdings of U.S. debt, after keeping the figures secret for more than four decades.

The Pain Gap (Motley Fool)

The biggest story in investing is understanding why so many people have been hurt by, and are skeptical of, a market that has increased 18,500-fold in the last century.

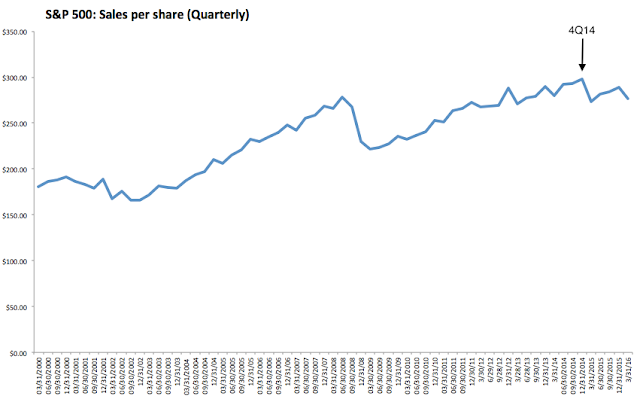

Are Poor Sales and Profit Growth Signaling an Imminent Recession? (Fat Pitch)

Over the past year, earnings for the S&P have declined 12%. Earnings have declined 5 quarters in a row. Even excluding the troubled energy sector, valuations now are as high (or higher) than in 2007. It's no wonder that there has been little net gain in the S&P since late 2014.

Soros Increases Bet Against the S&P 500 (Wall Street Journal)

Billionaire investor George Soros, who made a fortune betting against the British pound in 1992, on Monday disclosed a big bet on gold during the first quarter and doubled the wager against the S&P 500, according to a regulatory filing.

Beyond Apple, Here's What Warren Buffett's Berkshire Hathaway Is Buying and Selling (Fox Business)

In a recent SEC filing, it was revealed that Warren Buffett's Berkshire Hathaway has built a new stake in Apple worth approximately $1 billion. And while that was the headline news of the filing, this was actually a pretty active quarter for Buffett & Co. Here are the details of Berkshire Hathaway's recent portfolio activity, and what investors should keep in mind.

Brexit fears drive funds' UK equity holdings to 7-1/2-year low (Reuters)

Investors have slashed holdings of UK equities to the lowest level since November 2008 on fear Britons will vote next month to leave the European Union, a monthly survey by Bank of America Merrill Lynch (BAML) showed on Tuesday.

Politics

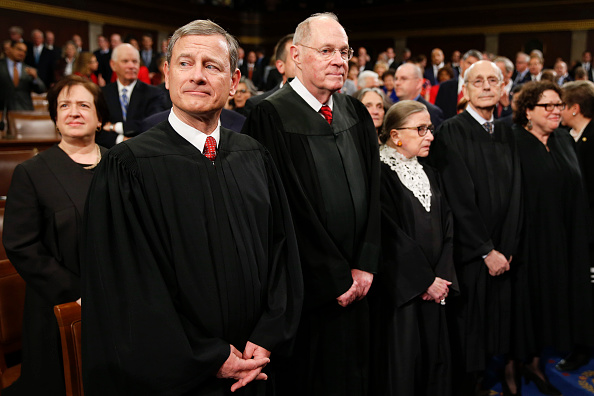

The Government Just Got More Powerful. (And That's a Good Thing.) (Bloomberg View)

The Government Just Got More Powerful. (And That's a Good Thing.) (Bloomberg View)

Here’s the most important legal principle that you’ve probably never heard of: If a regulation issued by a government agency turns out to be ambiguous, the agency, not the court, gets to resolve the ambiguity. It’s called the Auer principle, after the 1997 Supreme Courtdecision that established it. (This is different from Chevron deference, which gives agencies deference in interpreting statutes.)

How the Clinton team will go after Donald Trump (Washington Post)

How the Clinton team will go after Donald Trump (Washington Post)

Can Hillary Clinton beat Donald Trump in part by laying out a programmatic economic agenda that is designed to make a concrete difference in Americans’ lives? Or does that risk being too conventional an approach that fails to reckon with the unpredictable nature of Trump’s appeal?

In an interview with me, Clinton’s chief strategist, Joel Benenson, previewed some of the Clinton team’s lines of attack on Trump.

Bernie Sanders defends supporters after rowdy Nevada convention (Market Watch)

Bernie Sanders defends supporters after rowdy Nevada convention (Market Watch)

Presidential candidate Bernie Sanders rejected accusations that his supporters were prone to violence, moving to tamp down fallout from a contentious state Democratic convention in Nevada while also insisting that the Democratic Party must accommodate people fighting for “real” change.

Technology

:no_upscale():format(webp)/cdn0.vox-cdn.com/uploads/chorus_image/image/49570835/14C1450_059.0.0.jpg) The complete timeline to self-driving cars (Recode)

The complete timeline to self-driving cars (Recode)

Self-driving cars are coming — sooner than you think. But when will we get there, and how will we get there?

Two terms for the transition have become standard in the auto industry. There's the "evolutionary" path to autonomous vehicles, where today's cars get self-driving features bit by bit — Tesla's autopilot feature, for example. And then there's the "revolutionary" path. That's where totally self-driving cars, like the ones Google is working on, start as test vehicles and become more mainstream as they can drive in more places.

Apple staffing up on wireless charging experts, including former uBeam engineers (The Verge)

Apple staffing up on wireless charging experts, including former uBeam engineers (The Verge)

Last week a former engineer from the much hyped wireless charging startup uBeam left some scathing criticism of the company on his blog. He compared uBeam to the now disgraced startup Theranos, saying that uBeam has avoided any full-fledged public demonstrations because its technology doesn't work as advertised. While it can do some very limited charging over a short distance, he allowed, the basic laws of physics prevent the product from being practical at any commercial level.

Health and Life Sciences

Allurion offers gastric bypass surgery in a pill (Tech Crunch)

Allurion offers gastric bypass surgery in a pill (Tech Crunch)

Just swallow a pill and it expands into a balloon in your stomach so you don’t feel hungry. No gastric bypass, no surgery required. Sounds magical, but Boston-based Allurion has created the only non-invasive gastric balloon for obesity.

Life on the Home Planet

There's Another Climate Fight. (We're Losing That One, Too.) (Bloomberg View)

There's Another Climate Fight. (We're Losing That One, Too.) (Bloomberg View)

The proposal boiled down to just three paragraphs in the Federal Register: Would it be a good idea, the Federal Emergency Management Agency wondered, if Washington gave states a financial incentive to pass building codes, better protecting their residents against the effects of climate change?

Much of World Suffers Not From Abuse of Painkillers, but Absence of Them (NY Times)

While Americans are confronting an epidemic of prescription drug abuse, particularly for addictive painkillers, the reverse problem prevails in much of the world.