Financial Markets and Economy

U.S. bank stocks rally on hawkish Fed (Business Insider)

U.S. bank stocks rally on hawkish Fed (Business Insider)

Bank stocks were the standout winners on Wednesday from the Federal Reserve's unexpectedly firm signal that its next rate hike could be just weeks away, a prospect that could boost banks' bottom lines as they charge more for loans.

Mortgage REIT ETFs Explode To The Upside (Nasdaq)

The allure of high yields is something that income investors are always tempted to chase. When you couple an outsized dividend payout with an explosion of momentum, the attraction can become even further exacerbated.

Bond Buyers Can’t Stop Themselves as Risks Hit a 15-Year High (Wall Street Journal)

Global investors are struggling to reconcile low U.S. government-bond yields with signs of economic strength, underscoring the sense that Treasury markets are increasingly vulnerable to a reversal following this year’s gains.

Investors’ Flight From Negative Rates Flattens Yield Curve (Wall Street Journal)

A combination of strengthening economic data at home and plummeting interest rates overseas is causing distortions in the U.S. bond market as investors grapple with the question of when the Federal Reserve will next raise interest rates.

Inflation-Fearing Investors Pile Into TIP (ETF)

Investors have been piling into the iShares TIPS Bond ETF (TIP | A-99) this year, pouring more than $3.2 billion into the fund year-to-date, making it one of the most popular fixed-income ETFs of 2016, according to FactSet data.

The Perils of Extrapolating From Factor ETFs (Fortune Financial)

Charlie Bilello of Pension Partners has an interesting piece titled "The Volatility Cycle" in which he lays out the history of the S&P High Beta and S&P Low Vol indices going back to their common inception in November of 1990.

The inventor of the 401(k) says he created a ‘monster’ (Market Watch)

Most religious men find the answers to their prayers in scripture. Ted Benna found them in the U.S. tax code.

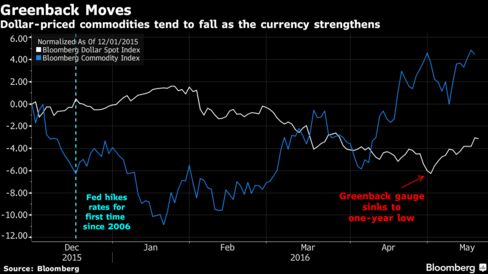

Dollar Gains Weigh on Commodities While Japanese Stocks Advance (Bloomberg)

The dollar solidified its surge, spurring losses in crude oil to industrial metals after minutes of the Federal Reserve’s last meeting put the prospect of a June interest-rate hike on the table. Japanese shares climbed with the yen near a three-week low.

Giant Hedge Fund’s Radical Idea: Performance Guaranteed or Your Money Back (Wall Street Journal)

Hedge-fund managers have long clung to a doctrine of high fees in good years and bad, minting billionaires and riling investors along the way.

Hedge Fund Bosses Make Too Much? Get Used to It (Bloomberg View)

Hedge funds are back in the headlines, thanks mainly to the release of Institutional Investor’s Alpha magazine annual report on the earnings of top hedge fund owners and managers. The Hedge Fund Rich List includes such well-known luminaries as Citadel’s Ken Griffin, Bridgewater’s Ray Dalio and Renaissance Technologies’ Jim Simons. Together, the top 25 are reported to have taken home about $13 billion last year.

As New ETF Strategies Get Campier, Tickers Get Tamer (Bloomberg)

Exchange-traded fund issuer Global X did something highly unusual when it recently launched a spate of colorfully thematic ETFs. It picked boring tickers for them.

There’s a strange consumer paradox playing out in India right now (Quartz)

Indians are more confident about their jobs prospects, personal finances and ability to spend, but they still aren’t opening up their wallets properly.

An overlooked investment risk: wishful thinking (Market Watch)

Here’s one way to calculate your ability to reach your financial goals: Take the return that qualifies as “wishful thinking” and subtract from it the return that makes up your “reasonable expectation” for how much an investment actually can return. The difference is the likely amount of your savings shortfall.

Acknowledging the Value of Lending Club, Even as It Stumbles (NY Times)

Lending Club’s implosion is a tale of two Silicon Valleys. The first story is about yet another Internet unicorn — valued at more than $8 billion at its initial public offering in 2014 — grasping for growth and cutting corners. But the second is about the good that an online lender can do, by disrupting technology and opening new avenues of credit for consumers. As the herd lashes the now-fallen Lending Club, let us not forget this second story.

Politics

Trump Names Names (The Atlantic)

Trump Names Names (The Atlantic)

Donald Trump released the names of 11 people he’d consider appointing to the U.S. Supreme Court if he’s elected president. An estimated 4.2 million Americans will be eligible for overtime pay under a new rule finalized by the U.S. Department of Labor. Fighting between Bernie Sanders’s campaign and the head of the Democratic National Committee has intensified. And the first missing Chibok girl was found after two years as a Boko haram prisoner.

The Bernie Sanders Trainwreck (Bloomberg View)

The Bernie Sanders Trainwreck (Bloomberg View)

At this point, the best thing Bernie Sanders’s supporters can probably do for his reputation is to vote against him in the remaining primaries and caucuses.

Hillary Clinton long ago wrapped up the nomination. Tuesday’s results — her narrow victory in Kentucky and his win by about 10 percentage points in Oregon — doesn't change anything: It's over.

Technology

Watch This Glove Levitate Objects With Sound (Popular Science)

Watch This Glove Levitate Objects With Sound (Popular Science)

Magnets move over: You may have a new challenger to the "levitation" throne.

GauntLev is a new tool from a group of UK-based researchers that uses sound to make small objects levitate.

Health and Life Sciences

How Does a Mathematician's Brain Differ from That of a Mere Mortal? (Scientific American)

How Does a Mathematician's Brain Differ from That of a Mere Mortal? (Scientific American)

Alan Turing, Albert Einstein, Stephen Hawking, John Nash—these “beautiful” minds never fail to enchant the public, but they also remain somewhat elusive. How do some people progress from being able to perform basic arithmetic to grasping advanced mathematical concepts and thinking at levels of abstraction that baffle the rest of the population? Neuroscience has now begun to pin down whether the brain of a math wiz somehow takes conceptual thinking to another level.

Science That Makes Us Squirm (Bloomberg View)

Science has a way of making people uncomfortable. Sometimes that’s because it seems likely to produce agents of harm; think of nuclear weapons research. Sometimes, though, for reasons less obvious, it just feels weird.

Superbugs will 'kill every three seconds' (BBC)

Superbugs will 'kill every three seconds' (BBC)

Superbugs will kill someone every three seconds by 2050 unless the world acts now, a hugely influential report says.

The global review sets out a plan for preventing medicine "being cast back into the dark ages" that requires billions of dollars of investment.

Life on the Home Planet

India’s drought foretells of greater struggles as climate warms (New Scientist)

India’s drought foretells of greater struggles as climate warms (New Scientist)

India is in the grip of a severe drought as a result of two successive weak monsoons and a searing heatwave. Its reservoirs dipped to less than a fifth of their total capacity in May, and a quarter of the country’s 1.1 billion people are estimated to be affected in some way.

We Just Completed A Full Year Of Record-Hot Months (Huffington Post)

For the 12th month in a row, the National Oceanic and Atmospheric Administration has announced record-high global temperatures — marking a yearlong heat streak that scientists say is grim sign of climate change in action.