Financial Markets and Economy

Fed Puts June Rate Increase on Table Provided Economy Says Go (Bloomberg)

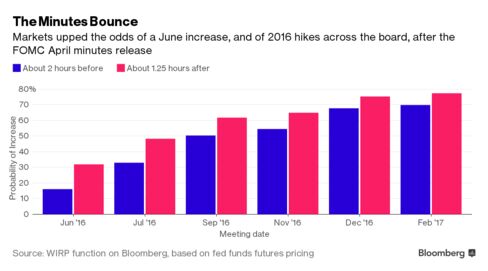

Federal Reserve officials want to raise interest rates in June. Now, it is up to the U.S. economy to confirm their view that slow growth in the first quarter was temporary.

The dollar keeps getting stronger — here's what's happening in FX (Business Insider)

The US dollar is stronger after the latest Fed minutes flabbergasted the markets.

Violent Struggle Over Oil and Money Rattles Global Energy Market (Bloomberg)

After years of relative peace, militants are again blowing up the pipelines that criss-cross the mangrove swamps of Nigeria’s Niger River delta, reducing oil output to the lowest in almost three decades and fueling a rally in global crude prices.

Oil drops below $48 on Fed hike speculation, fading support from outages (Reuters)

Oil fell below $48 a barrel on Thursday, pressured by a stronger dollar and as a surprise increase in U.S. crude inventories served as a reminder that supply remains ample despite output problems.

The real problem with negative interest rates? They are a stealth tax (Market Watch)

Central banks have slashed interest rates to nothing. They have printed money on a vast scale. Where that has not quite worked, and if we are being honest that is most places, they now have a new tool. Negative interest rates. Across a third of the global economy, money you put in the bank does not only generate nothing in the way of a return. You actually get charged for keeping it there.

How Wall Street Led LendingClub Into Crisis (Bloomberg)

John Mack, a crisp, red windbreaker over his business suit, climbed the dais at the New York Stock Exchange to hail the coming revolution.

Bayer Proposes to Acquire Monsanto (Wall Street Journal)

Bayer AG has approached Monsanto Co. about a takeover that would fuse two of the world’s largest suppliers of crop seeds and pesticides, the companies said.

Best Performing S&P 500 Stocks on Earnings (Be Spoke)

So far this earnings season, 43 stocks in the S&P 500 have gained more than 5% on their earnings reaction days (first trading day following earnings).

Why optimism for stocks on Wall Street is fading—fast (Market Watch)

A monthlong drift lower on the S&P 500 along with a gradual shift in expectations for interest rates has sapped Wall Street’s enthusiasm for stocks.

Gold is getting crushed by the US Federal Reserve (Business Insider)

Gold is getting crushed by the US Federal Reserve (Business Insider)

Gold's stunning rally, which saw it gain more than 15% in the first quarter of 2016, is going into reverse.

Fewer Shareholders Pay U.S. Taxes on Dividends (Wall Street Journal)

A new study showing that a shrinking fraction of shareholders of U.S. corporations pay taxes on dividends is bolstering a drive to revamp the corporate tax system.

BOJ to expand stimulus by July, yen too strong for economy (Reuters)

The Bank of Japan will ease monetary policy even further by July as a strong yen and still-sluggish economy threaten its ability to meet its ambitious inflation target, a Reuters poll showed.

Asked what steps it would take next, 80 percent of analysts surveyed May 11-17 picked a combination of cutting negative interest rates further and boosting its purchases of government bonds, exchange-traded funds and corporate bonds.

Canadian subprime debt accelerates as economy pinches consumers (Reuters)

The debt of Canadian subprime borrowers grew at a faster pace than other consumers in the first quarter, suggesting the weak economy forced some to turn to pricier credit at a time when policymakers are concerned about high household debt.

Macau casinos face growing bad debts as VIP punters step back (Reuters)

Casinos in Macau face a growing volume of bad debt provisions, further hitting earnings in the world's largest gambling hub at a time when high-roller VIP punters are backing off.

China's slowing economy and a pervasive campaign against graft has sapped demand from wealthy gamblers and prompted operators in the southern Chinese territory to shift their focus to lower spend mom and pop gamblers.

Fed Outlook Keeps Investors Cautious (Wall Street Journal)

Global stocks inched lower Thursday as investors grappled with falling commodity prices and the prospect of higher U.S. interest rates.

China steelmakers attack U.S tariff move; say need more time (Reuters)

Chinese steelmakers attacked new U.S. import duties on the country's steel products as "trade protectionism" on Thursday, saying the world's biggest producer needs time to address its excess capacity.

Here's Why What's In the Fed's Minutes Is Really Bad for Stocks (Fortune)

Labor is striking back, and that’s bad news for the stock market.

European shares drop as mining stocks weaken, airlines fall (Reuters)

May 19 European stocks retreated on Thursday as weaker oil and metals prices put pressure on commodities shares and concern mounted that U.S. interest rates would be raised soon.

Trading Floors ‘Quiet’ as Revenue Drops, JPMorgan Analysts Say (Bloomberg)

Quiet trading floors are set to depress global investment banks’ second-quarter revenue 24 percent, with the underwriting and equities businesses facing the biggest drops, according to analysts at JPMorgan Chase & Co.

Late-Day Buying Panic Keeps Stocks Green For 2016 After Fed Shock (Zero Hedge)

Today's melt-ups (pre-FOMC Minutes) were all thanks to broken markets

Politics

Netanyahu pulls off coalition surprise to upend Israeli politics (Reuters)

"He's a magician, he's a magician," the partisan crowd chanted as a beaming Benjamin Netanyahu strode into his party headquarters a little over a year ago to declare a come-from-behind victory in Israel's election.

Trump’s Dodd-Frank Plan Will Be Early Test of Republican Unity (Bloomberg)

Donald Trump says he’ll deliver a plan in the next two weeks to rewrite the Dodd-Frank law. Around the same time, House Financial Services Chairman Jeb Hensarling is promising to make his own proposal.

Technology

10 New Electric Cars From China (Forbes)

10 New Electric Cars From China (Forbes)

The market for electric cars in China is booming, supported by subsidies and other incentives like free license plates and free parking places and public charging stations are now popping up everywhere. In 2015 sales of new-energy vehicles (electric and plug-in hybrids) stood at 188,700 units, up a staggering 223% compared to 2015.

Android now runs on androids (Quartz)

Android now runs on androids (Quartz)

Google’s mobile operating system just got a little more mobile. Starting today, developers can build out apps on Android for Pepper, the humanoid robot made by Japanese telecom firm SoftBank, using the same tools and languages they’d use to code apps for smartphones and tablets.

Health and Life Sciences

The empty brain (Aeon)

The empty brain (Aeon)

No matter how hard they try, brain scientists and cognitive psychologists will never find a copy of Beethoven’s 5th Symphony in the brain – or copies of words, pictures, grammatical rules or any other kinds of environmental stimuli. The human brain isn’t really empty, of course. But it does not contain most of the things people think it does – not even simple things such as ‘memories’.

Life on the Home Planet

EgyptAir Flight MS804, en Route From Paris to Cairo, Goes Down in Mediterranean Sea (Wall Street Journal)

EgyptAir Flight MS804, en Route From Paris to Cairo, Goes Down in Mediterranean Sea (Wall Street Journal)

An EgyptAir plane carrying 66 passengers and crew from Paris to Cairo disappeared early Thursday over the Mediterranean Sea, the airline said.

French President François Hollande said that French and Egyptian authorities have determined the Airbus A320 “went down and is lost.”

Totten Glacier may face 'rapid retreat' (BBC)

Totten Glacier may face 'rapid retreat' (BBC)

Unchecked climate change could put Antarctica's huge Totten Glacier into an unstable configuration over the coming centuries, a study has warned.

If that happens, the ice loss could push up global oceans by 2m, or more.