Financial Markets and Economy

China's Communist Party goes way of Qing Dynasty as debt hits limit (Ambrose Evans-Pritchard, Telegraph)

Nobody rings a bell at the top of the credit supercycle, to misuse an old adage. Except that this time somebody very powerful in China has done exactly that.

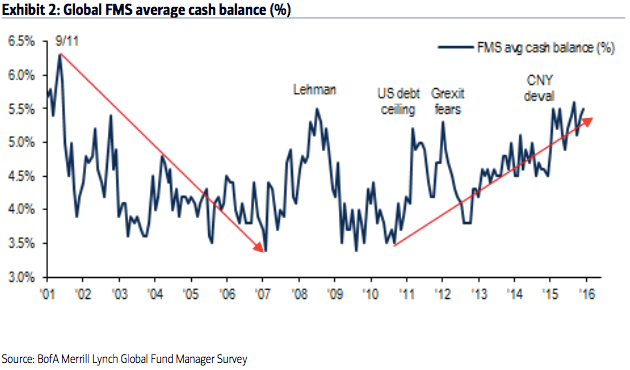

Global funds fear 'summer of shocks' despite boom in money growth (Ambrose Evans-Pritchard, Telegraph)

Global fund managers have almost no faith in the latest stock market rallies around the world and have begun to fear the worst from Brexit, putting aside near record sums of money in cash as they brace for a ‘summer of shocks’

The bond market could be recreating the massacre of 1994 (Business Insider)

Investors could be setting up a repeat of 1994's bond-market chaos, according to Deutsche Bank's Torsten Sløk.

With big outages in oil supply, buyers tap plentiful storage (Reuters)

Oil traders from Houston to the North Sea are tapping into plentiful storage onshore and offshore, evincing little sign of concern yet about mammoth supply losses from Canada to Nigeria that has knocked out about 2 million barrels a day of output.

Sovereign Wealth Funds Investing In Infrastructure? (Value Walk)

Using extracts from the 2016 Preqin Sovereign Wealth Fund Review and data from Preqin’s Infrastructure Online, Joe McGee and Selina Sy examine these investors’ plans and preferences concerning infrastructure investments.

Five banks sued in U.S. for rigging $9 trillion agency bond market (Reuters)

Five major banks and four traders were sued on Wednesday in a private U.S. lawsuit claiming they conspired to rig prices worldwide in a more than $9 trillion market for bonds issued by government-linked organizations and agencies.

Most Americans Don’t Know About Ride-Sharing and the ‘Gig Economy’ (Wall Street Journal)

Most Americans Don’t Know About Ride-Sharing and the ‘Gig Economy’ (Wall Street Journal)

If you think ride-sharing and the gig economy are taking over the world, you might be living in a bubble.

New research from the Pew Research Center shows that ride-hailing and home-sharing and grocery delivery and shared office spaces remain unfamiliar phenomena to the majority of people in the U.S. despite substantial inroads among young urbanites.

IMF Greek Debt Relief Terms Signal Tough Bailout Talks Ahead (Wall Street Journal)

A senior International Monetary Fund official on Thursday cooled European hopes to secure IMF backing for a Greek bailout plan soon and opened the door for emergency financing without new loans from the fund.

Fund Managers' Current Asset Allocation – May (Fat Pitch)

At the panic low in equities in February, fund managers' cash was at the highest level since 2001, higher than at any time during the 2008-09 bear market. Since 2009, allocations had only been lower in mid-2011 and mid-2012, periods which were notable lows for equity prices during this bull market.

The S&P 500 is the World’s Largest Momentum Strategy (A Wealth of Common Sense)

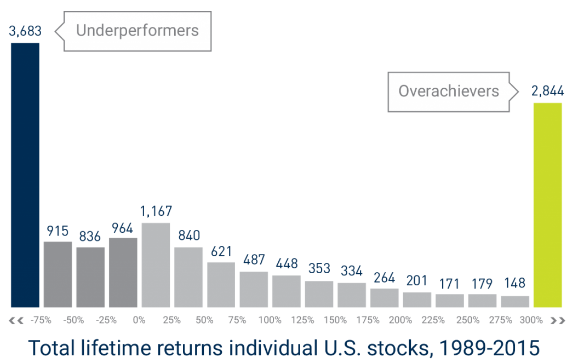

In many ways the stock market makes no sense. You would assume that half of all stocks would outperform a market index while the other half would underperform. Then all you would have to do is pick from the top half and avoid the bottom half, make massive amounts of money and go buy an island somewhere.

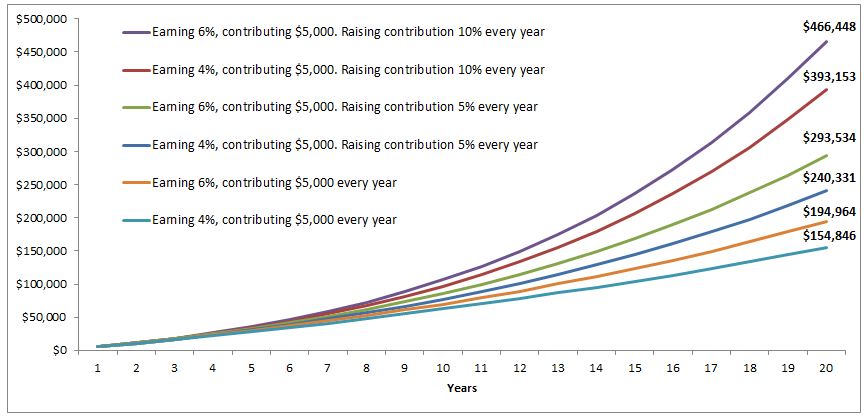

How To Stack The Odds In Your Favor (The Irrelevant Investor)

The best investment advice- boring as it may be- is to save more money. Delaying current consumption to benefit your future self is one of the simplest ways an investor can stack the odds in their favor.

Hikes Data Dependent Says NY Fed: So, Let’s Look at the Data (Mish Talk)

Yesterday, Fed minutes show that Fed Chair Janet Yellen is on a mission to convince the market that a rate hike is on the table for June.

Are Dividends Too High and Investment Too Low? (Wall Street Journal)

U.S. companies are paying out dividends at near-record levels, leaving some investors asking: Why won’t they invest?

Wal-Mart profit, revenue beat expectations; US sales up more than expected (CNBC)

Wal-Mart Stores on Thursday reported a higher-than-expected quarterly profit and revenue, as sales in the U.S. market rose and the retailing giant kept a lid on costs.

Hartford Funds Acquires ‘Smart Beta’ ETF Specialist Lattice Strategies (Barron's)

Deals are heating up in the industry for exchange-traded funds.

Economic Data Surprise Index Shows Continued Weakness (Vix and More)

Today we get another glimpse into the behind-the-scenes machinations of the “data dependent” Federal Open Market Committee (FOMC) with the release of the minutes from the April 26-27 meeting.

Politics

It turns out that Puerto Rico's plan to default on its debt and beg congress for help is working out as planned.

After a slight delay, House Republicans have reached an agreement with the Obama administration to provide a path to restructure Puerto Rico's $70 billion debt load. The bill would offer the island a legal out similar to bankruptcy and wouldn't commit any federal money according to the WSJ.

Never underestimate the Democrats' ability to blow a presidential race (The Week)

Never underestimate the Democrats' ability to blow a presidential race (The Week)

Democrats should be nervous about Donald Trump. Well, more specifically, they should be worried about Democrats.

Yes, demographics favor the Democrats in modern presidential elections, and yes, Trump is a spectacularly flawed candidate. But you'd almost never lose money betting on the Democrats blowing a good thing.

Technology

This Tiny Robot 'Perches' Like An Insect (Popular Science)

This Tiny Robot 'Perches' Like An Insect (Popular Science)

A Harvard-turned-MIT researcher and his colleagues just dropped some pretty cool Spider-Man tech in the latest issue of Science magazine: surface clinging via "electrostatic adhesion." It's a widely applicable breakthrough that will, for instance, keep future robots perched while they wait for instructions.

Health and Life Sciences

Where science meets supplements (Science-Based Medicine)

Where science meets supplements (Science-Based Medicine)

The supplement industry is big business, and the popularity of these products seems to keep growing. I once worked at a small independent pharmacy that specialized in supplements, homeopathy and “alternative medicine” as way to differentiate itself from the big chain pharmacies. A lot has changed in a decade. Today, even national chain pharmacies have aisles and aisles of herbal remedies, dietary supplements, and even homeopathy. Yet despite the preponderance of products on store shelves, there is little evidence to suggest that supplements are necessary or even improve health (and may evencause harm). The right for consumers to buy products for themselves, and make their own self-care decisions, is an important one that respects individual autonomy.

How To Prevent Millions of Deaths from Failing Antibiotics (National Geographic)

How To Prevent Millions of Deaths from Failing Antibiotics (National Geographic)

One death every three seconds, all around the world.

That will be the toll of antibiotic resistance by the year 2050 if nations don’t take sharp, immediate action together to prevent it. But prevention is possible, areport issued last night argues—and it makes a slew of specific (and possibly controversial) prescriptions.

Life on the Home Planet

Inside The Looming Disaster Of The Salton Sea (Think Progress)

Inside The Looming Disaster Of The Salton Sea (Think Progress)

The lake is drying up, uncounted dead fish line the shore, and the desert town is losing people.

It could be the plot of a post-apocalyptic movie set in the future, but this is actually happening here and it has been going on for years. It wasn’t always like this, of course. There was a time when this town was booming. There was a time when the Salton Sea, California’s largest lake, was the “French Riviera” of the state, and the pride and joy of Imperial County. But that was decades ago, during the Sea’s heydays of the 1950s and 1960s. Back when this area had luxury resorts, piers, yachts, and thousands of visitors, including stars like Frank Sinatra — who owned a house in nearby Palm Springs and would come down to see Guy Lombardo sail his speedboat.