Financial Markets and Economy

The bond market could be recreating the massacre of 1994 (Business Insider)

Investors could be setting up a repeat of 1994's bond-market chaos, according to Deutsche Bank's Torsten Sløk.

The Fed Has Something to Prove to Wall Street (Bloomberg)

It’s hard to fault investors for being complacent when the Federal Reserve says it’s on the brink of raising interest rates again.

Nasdaq Raises Lawsuit Threat Over SEC’s IEX Speed-Bump Plan (Wall Street Journal)

The owner of the largest U.S. stock exchange issued a stern warning to the Securities and Exchange Commission, saying the agency could be sued if it approves a competitor’s bid to become a full-fledged stock exchange.

Futures are higher ahead of a quiet day for data (Business Insider)

Stock futures were a hair higher on Friday ahead of a quiet day for economic data.

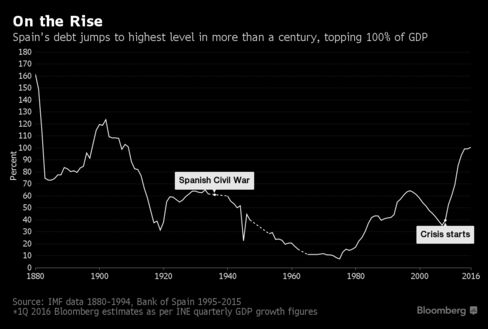

Spain’s Debt Jumps Most in Century, Topping 100% of GDP (Bloomberg)

Spain’s debt pile topped 100 percent of gross domestic product in the January-March period, according to Bloomberg calculations, marking the first time in more than a century that debt has outweighed total output.

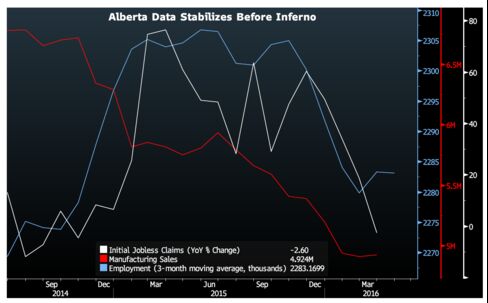

Alberta's Wildfires Couldn't Have Come at a Worse Time for the Local Economy (Bloomberg)

The wildfires raging in Alberta are destined to go down as the most expensive natural disaster in Canada's history, doing monumental damage to property and the environment in the process. These blazes may have also caused harm to the province's nascent economic green shoots.

Credit-Card Debt Nears $1 Trillion as Banks Push Plastic (Wall Street Journal)

U.S. credit-card balances are on track to hit $1 trillion this year, as banks aggressively push their plastic and consumers grow more comfortable carrying debt.

America’s central bank picks a poor time to get hawkish (Economist)

America’s central bank picks a poor time to get hawkish (Economist)

The members of the Federal Reserve's monetary-policy making committee have been desperate to hike rates, often, for most of the past year. They were keen to begin hiking in September, but were put off when market volatility threatened to undermine the American recovery. In December they managed to get the first increase on the books, and committee members were feeling cocky as 2016 began; Stanley Fischer, the vice-chairman, proclaimed that it would be a four-hike year. Instead, markets spent the first two months of the year in a near panic, and here we are in mid-May with just the one, December rise behind us.

The World's Most Valuable Brands 2016? (Forbes)

Apple AAPL -0.39%’s 13-year run of quarterly revenue growth came to a crashing halt last month when the tech giant reported revenue of $50.6 billion, off 13% thanks to soft iPhone sales and a slowdown in China. The gloom-and-doom sentiment around the company has reached a zenith with the stock off 30% from its all-time peak 12 months ago.

Often what upends the stock market is when potential bad stuff that investors know about — but underestimate and don’t sufficiently guard against — happens.

Wall Street doesn’t like surprises. Case in point: the stock market’s negative reaction to Wednesday’s surprise announcement by the Federal Reserve that a June interest rate hike is still on the table if the economy perks up in the current quarter. The Dow Jones industrial average tumbled 91 points Thursday.

Saudi Arabia is borrowing more money as its reserve cash pile burns (Business Insider)

Saudi Arabia is borrowing more money as its reserve cash pile burns (Business Insider)

Saudi Arabia is set to launch its first international bond to help shore up the country's finances in the wake of persistently low oil prices, says the Financial Times. Oil prices have dropped from highs in the triple digits in June 2014 to about $40 to $50 per barrel.

The FT, citing unnamed sources, said that Saudi Arabia is talking to international banks to start arranging a sovereign debt issue.

Conflicted Trades and Collapsing Bids (Bloomberg View)

One theory that you sometimes hear is that bank employees should eat their own cooking.

The Magic of Compound Interest? (Value Walk)

So you want financial independence? You want your money to work for you? But how? Well, investing is certainly a great place to start. More specifically, value investing. But how do we really grow wealth into a sum substantial enough to claim financial independence? The answer… by utilizing compound interest.

There has never been a country that should have been so rich but ended up this poor (Washington Post)

According to the International Monetary Fund's latest projections, it has the world's worst economic growth, worst inflation and ninth-worst unemployment rate right now. It also has the second-worst murder rate, and an infant mortality rate that's gotten 100 times worse itself the past four years. And in case all that wasn't bad enough, its currency, going by black market rates, has lost 99 percent of its value since the start of 2012. It's what you call a complete social and economic collapse. And it has happened despite the fact that Venezuela has the world's largest oil reserves.

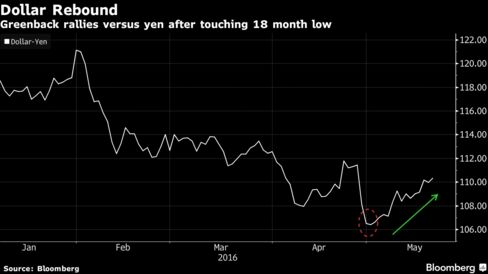

Dollar Divergence Trade Spurs Best Run Versus Yen Since August (Bloomberg)

The dollar extended its longest winning streak against the yen since August as traders weighed the possibility of tighter monetary policy in the U.S. against stimulus in Japan and other major economies.

ECB's room for rate cuts almost exhausted (Reuters)

The European Central Bank should not consider any further easing for now and if further stimulus becomes necessary, it should focus more on unconventional measures rather than rate cuts, Governing Council member Jozef Makuch said on Friday.

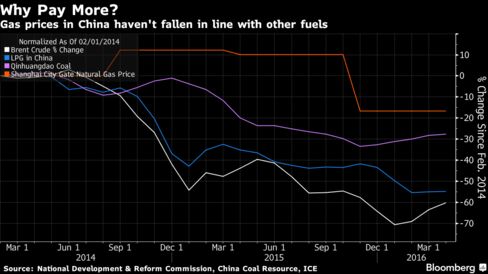

China’s Cheaper Coal Seen Slowing Switch to Cleaner Natural Gas (Bloomberg)

China’s effort to promote natural gas over coal to cut pollution is facing resistance from buyers who prefer cheaper to cleaner.

G-7 Gathering Kicks Off With Competing Views on Boosting Growth (Bloomberg)

Finance chiefs from the Group of Seven advanced economies arriving for meetings in Japan on Thursday, sent mixed signals on how best to boost flagging global growth.

Japan April core CPI seen falling for second month on energy prices (Reuters)

Japan's consumer prices were expected to fall for a second straight month in April as energy prices dipped, and exports were seen to drop for a seven consecutive month on weak overseas demand and a strong yen, a Reuters poll found.

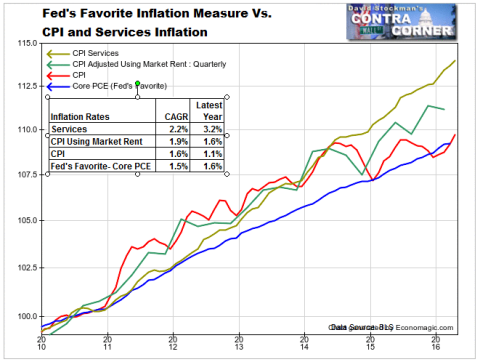

The Inflation Targeting Scam And Why It Guarantees The Mother Of Financial Meltdowns (Wall Street Examiner)

The estimable Martin Feldstein put the wood to the Fed in a recent op-ed and in so doing hit the nail directly on the head. He essentially called foul ball on the whole inflation targeting regime and the magic 2.00% goalpost in part due to the measuring stick challenge.

Markets in the UK are convinced there's not going to be a Brexit (Business Insider)

Britain's financial market players are becoming less and less worried about the prospect of Britain leaving the European Union — dubbed a Brexit — as they are increasingly pricing out Brexit risks.

According to a new report on the British economy from Deutsche Bank strategist Jack Di-Lizia, market volatility has stabilised after recent polls showed that the remain camp is pulling away.

Defaults Throw Wrench in China’s $3 Trillion Company Bond Engine (Bloomberg)

Defaults and pulled sales are starting to gum up China’s bond refinancing machine.

China Stocks in Hong Kong Post Biggest Weekly Advance in a Month (Bloomberg)

Chinese stocks traded in Hong Kong headed for a weekly advance, the first in a month, as investors took advantage of recent declines to add to their holdings.

Gap is closing a bunch of stores and says layoffs might be coming (Business Insider)

Gap Inc. is closing a bunch of stores and could lay off workers soon amid declining sales.

Has consumerism milked democracy dry? (ABC)

Despite dairy producers being battered by market forces, a 'milk tax' has reportedly been deemed unpalatable in the lead-up to the election. Waleed Aly, Scott Stephens andYanis Varoufakis discuss whether the solidarity required for democracy can survive the forces of capitalism.

What’s Killing the American Middle Class? (Bill Moyers)

A new study by the Pew Research Center spurred a rash of headlines last week about “the dying middle class.” But the word “dying” might be more appropriate if we were watching the regrettable-but-inevitable effects of natural forces at work. We’re not. We’re seeing the fruits of deliberate action – and sometimes of deliberate inaction – at the highest levels of power.

Negative indicators suggest investors take a breath (Market Watch)

The S&P 500 Index has bounced strongly off of support at 2040 three times in the last month or so, but each time it returned to the 2040 level. This has become an inflection point. Either the market will fall through and close well below 2040, thereby setting off a bearish leg in the market of some magnitude. Or the bears will fail once again, and the bulls will finally be able to mount another challenge of the 2110 April highs.

Fed Up with the Fed (Wall Street Examiner)

Destroying our ability to discover the real cost of assets, credit and risk has not just crippled the markets–it’s crippled the entire economy.

Yahoo bids are coming in way lower than expected (Business Insider)

Yahoo might be worth a whole lot less than anyone thought.

Warning: Don’t Trust Goldman (Especially on Oil Prices) (Wall Street Examiner)

An open public market requires an even playing field. Some participants may have bigger computers, or a millisecond head start on data.

Money and Banking Part 15: Monetary Systems (New Economic Perspective)

Throughout this series, posts have used balance sheets extensively to get an understanding of the monetary operations of developed economies, but nothing has been said about what a monetary instrument is. It is time to spend some time on the nature of monetary instruments and the inner workings of monetary systems.

Politics

Elizabeth Warren To Donald Trump: I’m Right, You’re Wrong (Huffington Post)

Elizabeth Warren To Donald Trump: I’m Right, You’re Wrong (Huffington Post)

Sen. Elizabeth Warren (D-Mass.) on Thursday night resumed her stream of disdainful tweets directed at presumptive GOP presidential nominee Donald Trump.

Warren, a fierce defender of the middle class, sent several tweets attacking Trump’s meandering statements surrounding the federal minimum wage, and linked to a new PolitiFact article that calls a Trump claim “mostly false.” The article examines Trump’s back-and-forth opinions on the minimum wage and his assertion that Warren lied when she said he wanted to abolish it.

Taiwan inaugurates its first woman president and now China is worried (Business Insider)

Taiwan inaugurates its first woman president and now China is worried (Business Insider)

Tsai Ing-wen was sworn in as Taiwan's first woman president on Friday, with the export-driven economy on the ropes and wary Communist Party rulers in China watching for any move towards independence by an island it considers its own.

Tsai's Democratic Progressive Party (DPP) won parliamentary and presidential elections by a landslide in January on voter backlash against creeping dependence on China.

Here's Why Trump's Presidential Run Has Been a Bonanza for his Bank Account (Fortune)

Here's Why Trump's Presidential Run Has Been a Bonanza for his Bank Account (Fortune)

Marketing mavens were sure that Donald Trump’s flame-throwing presidential campaign would hobble his knack for making money. But the presumptive GOP nominee’s new financial results show that the experts have been just as wrong predicting Trump business demise as they were at forecasting the collapse of his maverick run for the White House.

Technology

This Google Patent Is Like Human Flypaper For Cars (Popular Science)

This Google Patent Is Like Human Flypaper For Cars (Popular Science)

If you are ever struck by a self-driven car in the future, then you might finally understand how a bug feels on your windshield–except you'll have a better chance of surviving.

Google has put through a patent for a new strategy to limit injuries when pedestrians are struck with vehicles. It operates roughly through the same method as flypaper.

Mini-robot perches like an insect (BBC)

Mini-robot perches like an insect (BBC)

Scientists have designed flying, insect-sized robots that can perch and launch from ceilings.

The robots use something called electrostatic adhesion, the same process by which statically-charged balloons stick to walls.

Next-gen microwave ovens are small enough to sling on your back (New Scientist)

Next-gen microwave ovens are small enough to sling on your back (New Scientist)

Get ready to nuke your packed lunch: a new era in microwave cookery is around the corner. As well as portable ovens you can stick in a backpack, electronics will enable appliances that detect when their contents are thawed or risk boiling over, and smart ovens which will cook multiple items at different rates simultaneously.

Health and Life Sciences

Clumsy teenage boys 'can blame brain' (BBC)

Clumsy teenage boys 'can blame brain' (BBC)

Scientists have come up with an explanation for why some teenage boys go through a clumsy phase.

Research suggests the brain struggles to cope with the body's change in height during a sudden growth spurt.

Can Nightmares Cause a Heart Attack? (NY Times)

There are case reports of people with no previously known risks having a heart attack after a nightmare, though they appear to be quite rare.

Life on the Home Planet

Indian Heat Wave Breaks Record for Highest Temperature (Wall Street Journal)

Indian Heat Wave Breaks Record for Highest Temperature (Wall Street Journal)

A small town in the desert state of Rajasthan saw the mercury rise to a searing 123.8 degrees Fahrenheit (51 degrees Celsius), the hottest moment ever recorded in the South Asian nation.

The heat on Thursday in Phalodi – a town of about 45,000 people – bested the previous national record set way back in 1956 when it reached 123.1 degrees Fahrenheit in another Rajasthani town, Alwar.

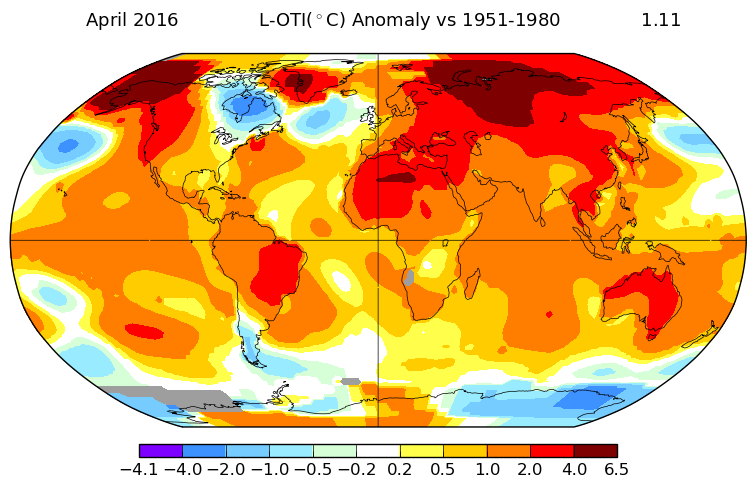

Could La Niña Break Our Global Hot Streak? (Gizmodo)

Could La Niña Break Our Global Hot Streak? (Gizmodo)

This is the hottest month on record. No, this is the hottest month on record. No, THIS is the hottest month on record!

We got so tired of repeating those words that a few months back, we decided to consolidate our coverage of the planet-wide hot flash into a single post. This week, that post saw a disturbing milestone: the one year mark. We just lived through twelve record-smashingly hot months, April to April. On top of that, 2016 is now all but assured to become the hottest year on record—stealing the title from 2015 which just became the hottest year on record.