Financial Markets and Economy

Oil Declines as June Contract Expires, Paring Weekly Rally (Bloomberg)

Oil fell as the expiration of the June contract in New York spurred selling by traders who don’t intend to take delivery of barrels next month.

A big oil and gas company just withdrew its IPO (Business Insider)

A big oil and gas company just withdrew its IPO (Business Insider)

The mining company filed for the stock offering in June 2015.

"At this time the Company has determined not to proceed with the initial public offering contemplated by the Registration Statement," the company said in a filing on Friday.

A New Trading Floor in 2016? Options Market Turns to Old Tactic (Bloomberg)

In an age of light-speed electronic trading, an options exchange is going old school with a plan to let traders conduct business face to face.

One of the Biggest Bond Market Players Has No Employees (Bloomberg)

One of the most prolific issuers in the $3.7 trillion municipal market is a Wisconsin agency with no employees, coveted tax-exempt bond status and a nationwide client list.

Traditional finance firms are about to be slammed by a 'perfect storm' (Business Insider)

"A perfect storm of technology, regulation and demographic changes is dramatically changing the value proposition traditional financial firms provide," reports Karen Demasters, citing Michael Foy, the director of wealth management practice at J. D. Power.

Fed raises risks for REIT investors (The Globe and Mail)

The sharp sell-off in North American bond markets Wednesday doesn’t look bad in a longer term context and the risks of a Federal Reserve rate hike do not look like a threat to investor returns in dividend-paying equity sectors like REITs. At least not yet.

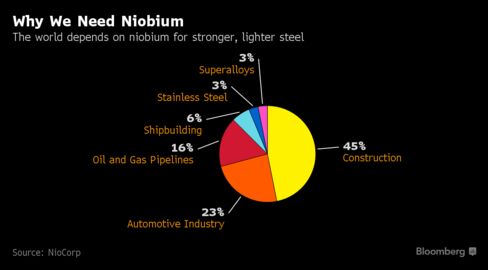

The Commodity That No One Knows About But Everybody Wants to Buy (Bloomberg)

The world’s mines and steel plants got so devalued during the commodity slump that some were just given away by owners struggling to cut losses or debt. But there’s at least one metal that’s been attracting a lot of attention.

ETF Investors Take the Kiddie Rides (Bloomberg Gadfly)

A look at the flows into exchange-traded funds this year shows that if the stock market were an amusement park, the crowds would be lining up for the tea-cup ride instead of the roller coasters.

This OPEC member is the next big wild card for oil (Business Insider)

Oil-production outages have been piling up.

Walmart Outperforms Estimates, but Online Retail Lags (NY Time)

One percent growth may not seem like a lot — unless you’re the world’s largest retailer.

Four Ways to Think About the Economy (Bloomberg View)

Four Ways to Think About the Economy (Bloomberg View)

I see four different schools of thought about how the economies of the U.S. and much of the developed world should be managed. The challenge for the Federal Reserve and other central bankers is that it's hard to know who's right.

Let's call the first group of economists the neutralists. They would say that as long as inflation is low and stable, central banks can have only a modest and short-lived effect on variables such as jobs and economic growth.

As hedge funds dumped Apple in first quarter, this stock was their biggest buy (Market Watch)

For hedge funds, Apple Inc.’s stock went from gadget-making darling to pariah in the first quarter.

ETF trading, pricing practices under SEC review after pricing disruptions (Market Watch)

U.S. market regulators are conducting a sweeping review of exchange-traded funds, weighing the possibility of new rules aimed at trying to contain trading and pricing disruptions that can harm investors.

Yahoo Suitors Expected to Bid $2 Billion to $3 Billion, Below Past Indications (Wall Street Journal)

Verizon Communications Inc. and others are expected to bid around $2 billion to $3 billion in the auction for Yahoo Inc.’s core business, less than what the troubled Internet pioneer was expected to fetch, according to people familiar with the matter.

Business Loan Delinquencies Spike to Lehman Moment Level (Wolf Street)

This could not have come at a more perfect time, with the Fed once again flip-flopping about raising rates.

Oil Supply Disruptions Quickly Fading As Canada, Libya, And Nigeria Resume Production (Zero Hedge)

Earlier this week, Goldman unleashed the latest oil rally when it admitted that while the oil market will take far longer to rebalance due to rising low-cost oil production, it said that material supply disruptions are providing a boost to near-term prices. Goldman provided the following visualization of unplanned ongoing outages …

Complexity, Chaos and Chance (RP Seawright)

As Clay Shirky has pointed out (based upon Dan Sperber’s Explaining Culture), culture is “the residue of the epidemic spread of ideas.” These ideas are, themselves, overlapping sets of interpersonal interactions and transactions.

Politics

I watched Hillary Clinton’s forces swipe Nevada: This is what the media’s not telling you? (Salon)

I watched Hillary Clinton’s forces swipe Nevada: This is what the media’s not telling you? (Salon)

It probably wasn’t the best time for me to go to Vegas. My beloved father had just died the week before, and I was feeling hazy and vulnerable, prone to weeping at the slightest provocation. Grief made me feel like I had no skin and no brain; grief had turned me into a cloud, and I was in that floaty state when I got on the plane with my husband—a state delegate headed to the Nevada Democratic Convention—and our 6-year-old son. I wasn’t sure what would happen once we got to Vegas, whether all the lights and bells would hammer me back into my body, or whether I would drift even further away from myself, hover like the cigarette smoke over the casino floor.

Donald Trump: ‘Who The Hell Cares About a Trade War?’ (Time)

Donald Trump: ‘Who The Hell Cares About a Trade War?’ (Time)

"We’re like a big, big sloppy bully who gets punched in the face and gets knocked down"

Presumptive Republican nominee Donald Trump escalated his rhetoric against China’s currency manipulation and the outsourcing of U.S. labor, defending his aggressive trade policies from conservative critics.

Technology

Say hello to Allo – and the AI assistants set to run your life (New Scientist)

Say hello to Allo – and the AI assistants set to run your life (New Scientist)

You may not know it yet, but you’re getting a new secretary. Someone to tackle the drudgery of everyday life like booking restaurants, checking the weather and responding to your messages. And the tech world is locked in a battle to build it for you.

Google is the latest company to throw its hat into the ring.

A tech company is developing temporary tattoos to serve as credit cards (Business Insider)?

A tech company is developing temporary tattoos to serve as credit cards (Business Insider)?

If you’ve ever been to a music festival, sports stadium or any other crowded event, you may have been concerned about carrying a purse or wallet, which can not only be cumbersome, but can make you the target of pickpockets.

And the alternative of carrying a solitary plastic credit card isn’t much better since they can easily slip out of your pocket.

Health and Life Sciences

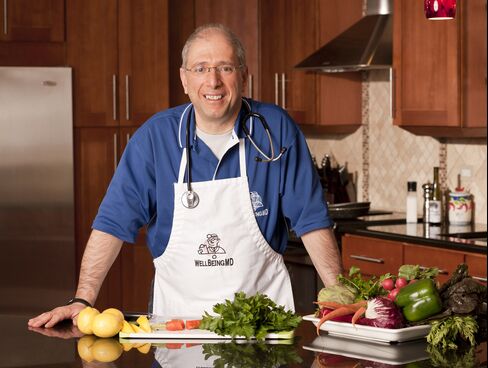

When Your Doctor Is Your Chef (Bloomberg)

When Your Doctor Is Your Chef (Bloomberg)

After more than 20 years in practice, Dr. John Principe was ready to quit.

“I was just tired of doling out pills and having people die of the same disease I was quote-unquote treating,” says the 58-year-old internist. While he was helping his patients manage their illnesses, he says, he wasn't changing their lives.

Life on the Home Planet

1,700 years ago, the mismanagement of a migrant crisis cost Rome its empire (Quartz)

1,700 years ago, the mismanagement of a migrant crisis cost Rome its empire (Quartz)

On Aug. 3, 378, a battle was fought in Adrianople, in what was then Thrace and is now the province of Edirne, in Turkey. It was a battle that Saint Ambrose referred to as “the end of all humanity, the end of the world.”

The Eastern Roman emperor Flavius Julius Valens Augustus—simply known as Valens, and nicknamed Ultimus Romanorum (the last true Roman)—led his troops against the Goths, a Germanic people that Romans considered “barbarians,” commanded by Fritigern. V

Man-eating crocodiles are turning up in Florida (Futurity)

Man-eating crocodiles are turning up in Florida (Futurity)

An invasive crocodile that can grow to 18 feet and weigh as much as a small car has been discovered in Florida.

Using DNA analysis, researchers confirmed the capture of multiple Nile crocodiles in the wild. The ancient icon eats everything from zebras to small hippos and even humans in sub-Saharan Africa.