Financial Markets and Economy

World oil reserves stable despite drop in investment (Reuters)

The world's oil reserves were unchanged in 2015 despite a sharp drop in investment and exploration after the collapse in crude prices, BP said in its benchmark industry report.

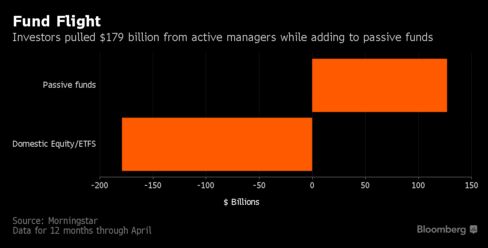

Active Firms May Need to Shrink Assets by Up to $10 Trillion (Bloomberg)

Active investment managers may need to shrink assets by as much as a third if they want to beat industry benchmarks, Peter Kraus, chief executive officer of AllianceBernstein Holding LP, said.

Maybe Yahoo is worth $8 billion after all (Quartz)

It’s round two for Yahoo.

Dollar Pullback Continues in Asia; Oil Gains Boost Energy Stocks (Bloomberg)

Asian commodity-linked and emerging-market currencies dominated the dollar amid mounting speculation the Federal Reserve will hold off on raising interest rates until later in the year. A rally in oil boosted energy stocks, while Japanese shares retreated following gains in the yen.

The dumbest math mistake investors make in the stock market (Yahoo! Finance)

The most popular way to measure value in the stock market (^GSPC) is to take the price of the stock or a pool of stocks, and then divide that by earnings. This is the price/earnings (PE) ratio. When the PE ratio is above some longer-term average, the stock is considered expensive. When it's below average, it's considered cheap. Importantly, PEs have been shown to revert to those averages.

Rock-Bottom Bond Yields in Europe Hit All-Time Lows (Wall Street Journal)

Yields on the 10-year government debt of Germany and the U.K. fell to all-time lows, a stark demonstration of the modern era of scant inflation, weak growth and outsize monetary policy.

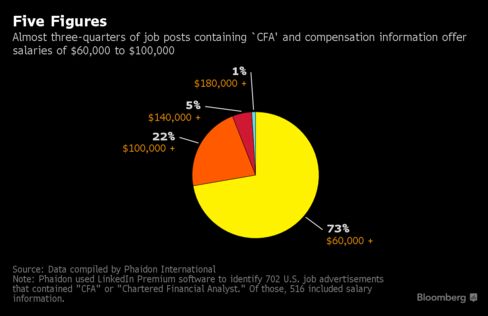

The CFA Exam's Toughest Question: What's the Payoff? (Bloomberg)

As financial workers from New Jersey to New Delhi sat this month for one of three grueling stages of the Chartered Financial Analyst exam, one question wasn’t on the test: Is it worth it?

Mutual-Fund Directors Are Staying On Boards for Decades. Is That a Bad Thing? (Wall Street Journal)

Mutual-fund board members are getting older and staying longer, raising questions about whether extended tenures improve or harm the oversight of trillions in savings.

BlackRock Calls For a Muni Market Strike in Budgetless Illinois (Bloomberg)

For years, Illinois has found the municipal-bond market open whenever it needs to raise money, despite budget deficits, worst-in-the-nation pension shortfalls and a political paralysis so severe it’s headed for a second year without even a blueprint for what it should be spending.

Apple is making a major change to the way it splits money with app creators (Business Insider)

Apple will now take a smaller cut of money from app developers if customers stick with their subscription for longer than a year, Phil Schiller told The Verge in a pre-WWDC interview.

IEX CEO Brad Katsuyama on lies, 'Flash Boys,' and egregious pricing (Business Insider)

It's been a wild ride for Brad Katsuyama, the CEO of IEX Group. The mild-mannered Canadian went from relative obscurity to a Wall Street celebrity in 2014 after Michael Lewis published "Flash Boys," a book focused on the ills of high-speed trading and Katsuyama's efforts to build a market that protected investors.

The smugger Germany gets about its powerful economy, the less competitive it becomes (Quartz)

Europe’s economic engine, political hegemon, and home to the most powerful woman on the planet. Generally, just the best country out there. Germany tops many rankings, but this dominance isn’t absolute, and what’s more it isn’t always a good thing.

2016's Biggest ETF Launches To Date (ETF)

The first five months of 2016 are really an example of extremes when it comes to ETF launches, with two funds in particular attracting assets of more than $200 million. No other funds that have launched this year have even begun to approach those levels.

Fintech Is Ending Money Management as We Know It (Bloomberg View)

Financial Technology Partners is a San Francisco-based investment-banking firm focused, appropriately enough, on the financial-technology industry. I managed to get my hands on its new report of how fintech is altering the landscape for money management. The report looks at industry trends, interviews numerous fintech executives and sizes up all of the usual big picture Silicon Valley stuff.

To grow the economy, grow small businesses: Bloomberg & Buffett (USA Today)

The economy has experienced 75 straight months — more than six years — of private sector job growth. Yet some areas still have not recovered all the jobs lost during the recession, and nationally, under-employment exceeds pre-recession levels. How can we increase the speed of job creation?

Visualizing "The 5000 Year Long Run" In 18 Stunning Charts (Zero Hedge)

In the long run, as someone once said, we are all dead, but in the meantime, as BofAML's Michael Hartnett provides a stunning tour de force of the last 5000 years illustrates long-run trends in the return, volatility, valuation & ownership of financial assets, interest rates & bond yields, economic growth, inflation & debt…

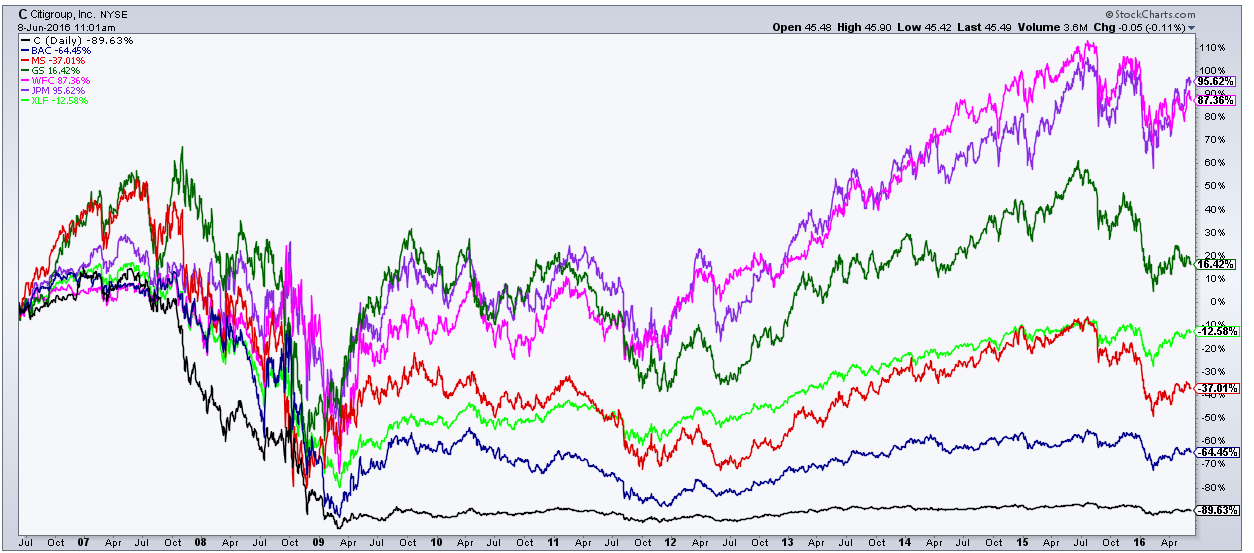

S&P Financials Down 30% Over the Last Decade (The Reformed Broker)

As investors hope for a new high in the S&P 500, consider the following fact: only one industry sector of the index is down over the last 10 years; care to guess which one? It’s not Energy; that group is actually up 23% on a price basis. Nor is it Materials, up 48%.

Richard Wolff on the Changing Tides of Capitalism and Socialism (Truth-Out)

Nearly 30 years ago, many capitalists were celebrating what political scientist Francis Fukuyama called the "ultimate victory of the VCR": where consumerism sank communism. However, they failed to calculate the effects of this consumerism on the environment. They also failed to predict how the public would start to tire of a situation in which a very small percentage of capitalists are reaping all the benefits while the rest of us are sinking deeper and deeper into debt, poverty and powerlessness.

Goldman Turns Downright Gloomy, Warns Market "Despair" Is Coming, Prepare For A Major Drawdown (Zero Hedge)

One month after Goldman strategists downgraded equities to neutral on growth and valuation concerns, the firm has turned up the heat on the bearish case with a report by Christian Mueller-Glissmann in which he says that equity drawdown risk “appears elevated” with S&P 500 trading near record high, valuations stretched, lackluster economic growth and yield investors being “forced up the risk curve to equities."

Global Stocks "Most Expensive" In 6 Years As Bond Yields Hit Record Lows (Zero Hedge)

As global growth expectations collapse, so do bond yields (now at new record lows for developed markets) but that doesn't stop equity 'investors' from piling into already richly-valued stocks on the hope that next year will be the year when global macro and micro hockey-stick projections will work out…

Politics

7 Answers About the Clinton Campaign (The Atlantic)

7 Answers About the Clinton Campaign (The Atlantic)

When Donald Trump locked up the Republican nomination in May, I put together a compendium of the GIFs I’d included in my 2016 presidential cheat sheet, tracking Trump’s progress from joke candidate to object of morbid fascination, then on through resignation to his apotheosis. In a similar spirit of self-flagellation, I thought it’d be worth marking the occasion of Hillary Clinton clinching the Democratic nomination by reviewing a piece I wrote back in April 2015, when she jumped into the race. That piece was “10 Questions About the Hillary Clinton Campaign.” Three were rather utilitarian. How’d I do on the other seven? Like the Clinton campaign so far, it’s up and down.

How the AP Screwed Sanders, and Other Tales From Tuesday Night (Truth-Out)

How the AP Screwed Sanders, and Other Tales From Tuesday Night (Truth-Out)

Thanks to The Associated Press, I was awake well past midnight on Wednesday morning watching a series of non-events come to a grateful conclusion. I wanted to see the speeches, especially Bernie's, which came after 1:00 am; they were the one thing the "news" media couldn't screw up. How did Tuesday's primaries become non-events? Because The Associated Press on Monday night, straight out of the blue, declared Secretary Clinton to be the presumptive Democratic nominee for president.

Technology

Robot Bartenders and Virtual Skydiving: Smart Ship Cruises Into Asia (Bloomberg)

Robot Bartenders and Virtual Skydiving: Smart Ship Cruises Into Asia (Bloomberg)

Robot bartenders mixing your cocktails, 360-degree views from an observational pod, and having the option of "skydiving" at sea. That's the experience promised by what Royal Caribbean Cruises Ltd. calls the world's smartest ship.

Chinese Clone Cars Raise the Ire of Western Automakers (NBC)

Chinese Clone Cars Raise the Ire of Western Automakers (NBC)

Alibaba, the Chinese answer to Amazon and eBay, touched off a firestorm last month when it was admitted to the Washington-based Anti-Counterfeiting Coalition. That spurred a wave of defection, notably including fashion house Gucci, which described Alibaba as a "dangerous and damaging adversary" for allegedly tolerating widespread sale of counterfeit designer goods.

The Web’s Creator Looks to Reinvent It (NY Times)

Twenty-seven years ago, Tim Berners-Lee created the World Wide Web as a way for scientists to easily find information. It has since become the world’s most powerful medium for knowledge, communications and commerce — but that doesn’t mean Mr. Berners-Lee is happy with all of the consequences.

Health and Life Sciences

Study says a major blood cancer is 11 distinct diseases (BBC)

Study says a major blood cancer is 11 distinct diseases (BBC)

One of the main types of blood cancer is not one but 11 distinct diseases, detailed genetic analysis suggests.

A study in the New England Journal of Medicine found genetic differences explain why some patients respond much better to treatment than others.

Life on the Home Planet

Are Shipping Containers the Future of Farming? (Wall Street Journal)

Are Shipping Containers the Future of Farming? (Wall Street Journal)

Inside the cavernous Interior of a former Boston-area taxi depot—walls covered in graffiti, pools of water on the concrete floors—three gleaming green-and-white containers sit side by side. The steel boxes are former “reefers”—refrigerated shipping containers used to transport cold goods. Bone-chilling rain is falling outside, but inside the 320-square-foot boxes, it’s a relatively balmy 63 degrees, and the humid air is heavy with the earthy smell of greens.

Palestinian Gunmen Open Fire in Tel Aviv, Leaving Four Dead (NY Times)

Palestinian Gunmen Open Fire in Tel Aviv, Leaving Four Dead (NY Times)

Two Palestinian gunmen posing as restaurant patrons opened fire on civilians in a popular Tel Aviv cafe on Wednesday night, killing four people and reigniting fears of terrorism in Israel just as a recent wave of Palestinian attacks had seemed to be waning.

NASA just gave $100K to a company that wants to steer asteroids toward Earth (Fox News)

Countries around the world are betting big on asteroid mining. Last year, President Obama approved measures to give companies permission to mine and own resources harvested from outer space. Back in May, Luxembourg announced the Prospector-X concept spacecraft, which it plans to launch into Earth's orbit to test resource extracting technologies.