Financial Markets and Economy

Global stocks are selling off (Business Insider)

It's a risk-off kind of day in markets.

Global stocks slip as Brexit jitters feed Bund bonanza (Reuters)

Europe's benchmark government bond, the 10-year German Bund, had a zero yield firmly in its sights on Friday as worries about a potential British exit from the EU and weakened U.S. rate hike expectations extended the week's global bond rally.

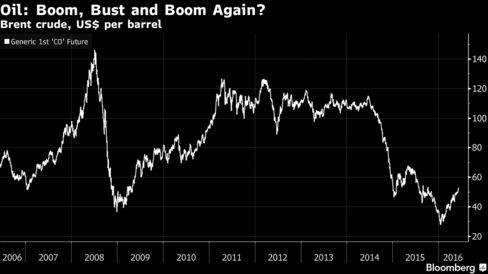

How Far Can Oil Rally? Options Investors Bet on Surge Above $100 (Bloomberg)

Oil investors are buying contracts that will only pay out if crude rises well above $100 a barrel over the next four years — a clear sign some believe today’s bust is sowing the seeds of the next boom.

Investors Shed Assets as Government Bond Yields Hit Fresh Lows (Wall Street Journal)

Global stocks dropped and government bond yields in Germany, Japan and the U.K. hit all-time lows as a range of political and economic uncertainties continued to take a toll.

The Fed Must Attack Low Inflation (Bloomberg View)

The U.S. economy remains weak, with inflation expected to remain below the Federal Reserve's target for years to come. When the central bank holds its policy-making meeting next week, it should take decisive action to end the malaise.

European stocks are getting pounded (Business Insider)

European stocks are taking a pounding on Friday as investors flood into safer, less risky bonds amid worries about the global economy.

Economics Struggles to Cope With Reality (Bloomberg)

Economics Struggles to Cope With Reality (Bloomberg)

There are basically four different activities that all go by the name of macroeconomics. But they actually have relatively little to do with each other. Understanding the differences between them is helpful for understanding why debates about the business cycle tend to be so confused.

Stocks Retreat With Oil as Record-Low Bond Yields Point to Angst (Bloomberg)

Caution prevails as the week draws to a close, with global stocks headed for their biggest two-day decline in a month and bond yields at record lows as investors gird themselves for potentially seismic events this month.

Asian bond yields plumb fresh lows as investors rush in (Market Watch)

Investors’ global scramble for safe-haven government debt offering some kind of return spread to Asia on Friday, as yields from Japan to Australia to Korea plumbed fresh lows.

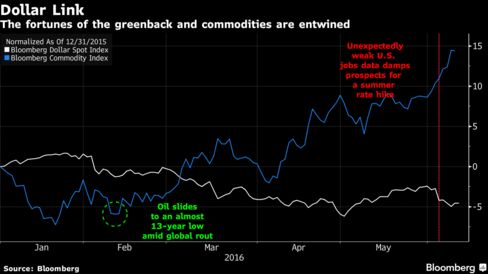

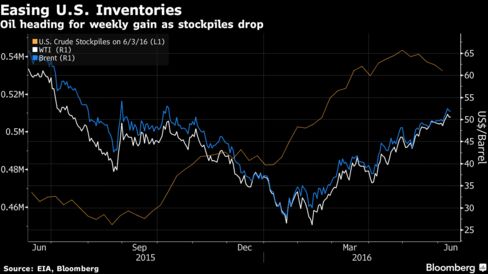

Oil Trims Weekly Gain as U.S. Dollar Counters Supply Declines (Bloomberg)

Oil trimmed its weekly advance as a rising U.S. dollar countered declining crude stockpiles and disruptions from Canada to Nigeria.

Here's why the collapse in global bond yields could cause a $1 trillion financial nightmare (Business Insider)

Worries about a massive crisis in the global bond market are starting to grow. Last week a note from Goldman Sachs warned that even a relatively small upwards movement in US Treasury yields could spark as much as $1 trillion in losses, while on Thursday, Bill Gross, called the huge pile of sovereign debt trading in negative territory a "supernova that will explode one day" on Twitter.

Government Bond Yields Hit New Lows Amid Stock Selloff (Wall Street Journal)

Global stocks dropped and government bond yields in Germany, Japan and the U.K. hit all-time lows as a range of political and economic uncertainties continued to take a toll.

Emerging Markets Pare Weekly Gain as Traders Brace for Fed, MSCI (Bloomberg)

Emerging-market assets trimmed their weekly gains, pausing a rally driven by bets the U.S. will delay interest-rate hikes, as investors grew cautious before next week’s Federal Reserve meeting and MSCI Inc.’s annual market-classification review.

Oil traders who know China, with good heads for liquor (Business Insider)

Chinese independent oil companies are luring traders, marketers and risk managers away from dominant state behemoths, offering better pay and perks in a hiring spree triggered by the freeing up of China's crude import trade.

Puerto Rico Debt Crisis Bill Passes U.S. House (Wall Street Journal)

The House approved legislation Thursday to stem Puerto Rico’s escalating debt crisis, capping an unusually bipartisan course on a fraught and technically complex compromise measure.

Rand Slumps Most Among Emerging Markets as Investors Avoid Risk (Bloomberg)

South Africa’s rand fell 1.6 percent to lead emerging-market currency losses against the dollar as investors took some profits after a rally prompted by bets the U.S. will delay raising borrowing costs.

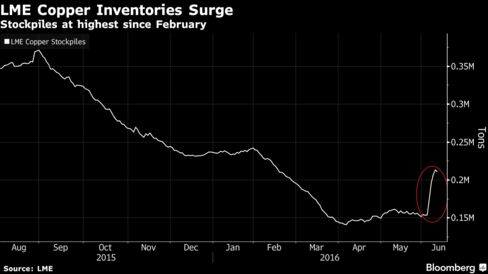

Copper Market Goes Bearish as Tons of Metal Flood LME Warehouses (Bloomberg)

Dr. Copper’s health has taken a turn for the worse.

Latest threat to online lenders: 'stacking' of multiple loans (Reuters)

Many online lenders have failed to detect the “stacking” of multiple loans by borrowers who slip through their automated underwriting systems, lending company executives and investors told Reuters.

Politics

Clinton’s attacks on Trump’s temperament may backfire (Market Watch)

Clinton’s attacks on Trump’s temperament may backfire (Market Watch)

The day after she claimed the Democratic nomination, Hillary Clinton told an interviewer that she was not going to trade insults with Donald Trump but just keep telling people how “he’s unqualified to be president” and “temperamentally unfit to be commander-in-chief.”

Will Bernie Sanders Give Away His Supporters’ Data? (The Atlantic)

Will Bernie Sanders Give Away His Supporters’ Data? (The Atlantic)

Bernie Sanders has built more than just a following. He’s amassed the mother of all email lists. Some estimate it contains more than 5 million contacts, which is big, even by presidential standards. That database has allowed Sanders to raise thousands of dollars at the click of a button. But as his candidacy coasts to a close (?), some of his supporters say they want off before the Vermont senator shares their names with the Clinton campaign—or worse yet, the Democratic National Committee.

Technology

This is What Eric Schmidt Thinks About AI Fears (Gizmodo)

This is What Eric Schmidt Thinks About AI Fears (Gizmodo)

Never mind that Google is working on a kill switch to control robots, executive chairman Eric Schmidt thinks there’s nothing to worry about because “the state of the earth” does not support these killer AI scenarios. In other words, let’s come back to reality here.

Speaking at Stockholm’s Brilliant Minds conference, Schmidt acknowledged the fears over superintelligent AI that people like Stephen Hawking and Elon Musk have raised.

Health and Life Sciences

New treatment can 'halt' multiple sclerosis, says study (BBC)

New treatment can 'halt' multiple sclerosis, says study (BBC)

Aggressive chemotherapy followed by a stem cell transplant can halt the progression of multiple sclerosis (MS), a small study has suggested.

The research, published in The Lancet, looked at 24 patients aged between 18 and 50 from three hospitals in Canada.

Life on the Home Planet

Scientists turn carbon dioxide into stone to combat global warming (The Verge)

Scientists turn carbon dioxide into stone to combat global warming (The Verge)

Researchers have developed a way to capture and store carbon dioxide by turning it into stone. Their technique, described in a paper published this week in the journal Science, could provide a safer, faster way to sequester CO2 and limit global warming.

Scientists have long seen carbon capture and sequester, or CCS, as a potentially significant way to combat climate change.

‘Monkey archaeology’ reveals macaque’s own Stone Age culture (New Scientist)

‘Monkey archaeology’ reveals macaque’s own Stone Age culture (New Scientist)

The world’s first archaeology dig of an old world monkey culture has uncovered the tools used by previous generations of wild macaques – a group of primates separated from humans by some 25 million years of evolution.

The discovery means humans aren’t unique in leaving a record of our past culture that can be pried open through archaeology.