Financial Markets and Economy

Fed Concern Makes Rand Most Turbulent in Emerging Markets (Bloomberg)

South Africa is now home to the most volatile currency in developing nations for the first time since Argentina free-floated its exchange rate in December.

Global Stocks Tumble as Yen Soars (Wall Street Journal)

Uncertainty over next week’s U.K. referendum on European Union membership sent stocks in Europe and Asia tumbling Monday, while the yen and government bond prices touched multiyear highs as investors continued to reach for assets perceived as safe.

Oil is back below $50 (Business Insider)

The price of oil is slipping in early trade on Monday, with both major benchmarks substantially lower thanks to ongoing concerns about the state of the markets supply and demand issue.

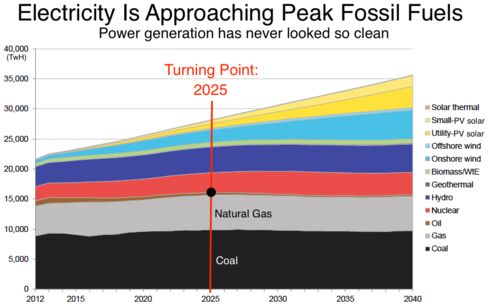

Weve Almost Reached Peak Fossil Fuels for Electricity (Bloomberg)

The way we get electricity is about to change dramatically, as the era of ever-expanding demand for fossil fuels comes to an end—in less than a decade. That's according to a new forecast by Bloomberg New Energy Finance that plots out global power markets for the next 25 years.

The FTSE 100 has new competition (Business Insider)

The FTSE100 has new competition.

A group from Silicon Valley has a serious plan for creating a totally new US stock exchange (Quartz)

A group from Silicon Valley has a serious plan for creating a totally new US stock exchange (Quartz)

A startup backed by prominent Silicon Valley names is moving toward creating a new US stock exchange, one with additional rules for companies and investors designed to reward long-term shareholding and business strategies to generate long-term results.

OPEC Sees Global Oil Market Balancing Toward the End of 2016 (Bloomberg)

OPEC predicted that the global oil market will be more balanced in the second half of this year as demand rises and rival supplies falter, echoing views expressed by ministers at the group’s meeting this month.

There's a Seismic Change Coming to Money Markets (Bloomberg)

But we don't quite yet know what it will be.

A Numbers Game: Which Labor Market Data Should You Believe? (NY Times)

Two important measures of how the job market is doing seem to point in opposite directions.

This seasonal ‘sweet spot’ might be just what the stock market needs (Market Watch)

Dark clouds hang over the country this morning after this weekend’s mass shooting. The mood, for now, is reflected in the stock market, where blue chips are setting up for a tough start. But, if history is any indication, don’t expect a lingering overreaction to the downside from traders.

Gold Advances to Four-Week High on Brexit Risk, Fed Rate Outlook (Bloomberg)

Gold climbed to the highest in four weeks as uncertainty mounts over the potential risks if Britain decides to leave the European Union, and as traders price in zero chance of the Federal Reserve raising interest rates at a meeting this week.

Asian shares and sterling skid, yen firms (Business Insider)

Asian shares and sterling skidded in early Asian trade on Monday and the perceived safe-haven yen rose, as investors fretted ahead of this week's central bank meetings as well as Britain's June 23 referendum on whether to remain in the European Union.

A Brexit might not be terrible news for British stocks after all (Business Insider)

British stocks would be the best-performing equities in Europe should Britain vote for Brexit in 10 days time, according to a note sent to Deutsche Bank clients on Monday morning.

Gold hits multi-week high as investors back away from stocks, dollar (Market Watch)

Gold prices on Monday hit levels not seen in weeks, as investors sought safety in the precious metal, prompted by nervousness around the Brexit referendum and a pair of high-profile central bank meetings.

Becoming a Peak Performing Trader (Trader Feed)

Trading is a performance field, no less than athletics or the performing arts. What you see in any performance field is a dedication to practice among successful professionals. Indeed, from chess to Olympic wrestling to Broadway acting, there is no performance field I'm aware of where there is not a high ratio of time spent practicing to time spent performing among elite performers.

Inflation Expectations Lowest Since 70s Before Fed Meets (Business Insider)

U.S. consumers’ long-term inflation expectations have notched down to 2.3 percent, the lowest in records back to 1979. And while pretty much no one expects a Fed rate increase this week, that fact may strengthen the resolve of some policy makers who argue that higher borrowing costs can wait a while longer.

The Most Pessimistic Bull Market in History (Wall Street Journal)

Could this be the most pessimistic bull market in history? The S&P 500 is just one good day’s trading away from a new record high, yet the usual rush into go-go stocks is nowhere to be seen.

Iran Plans Oil-Refinery Expansion to Cut Gasoline Imports (Bloomberg)

Iran plans to increase its refining capacity for crude and condensate by more than 70 percent within the next four years as it works to improve the quality of fuel sold on the domestic market and wean itself off imported gasoline.

6 Events That Could Make Soros a Winner (Bloomberg View)

6 Events That Could Make Soros a Winner (Bloomberg View)

The Wall Street Journal reported last week that yet another respected longtime investor was trying to call time on financial markets that are getting stranger by the day. George Soros started trading again, positioning himself for what he expects to be a significant decline in risk markets that he views as highly overvalued.

Verizon, AT&T set to make final round of bids for Yahoo web assets – sources (Business Insider)

U.S. telecommunications rivals Verizon Communications Inc and AT&T Inc are set to go through to the third and final round of bidding in the auction for Yahoo Inc's core internet assets, according to people familiar with the matter.

Volatility Flares in World Markets as Amundi Says Sell on Brexit (Bloomberg)

A resurgence in volatility across global markets left investors from Japan to Hong Kong scrambling to sell their riskiest holdings.

Wal-Mart names Sean Clarke as Asda head (Business Insider)

Wal-Mart Stores Inc said on Monday that Asda chief executive Andy Clarke has decided to leave the company and will be replaced by Sean Clarke.

Analysts’ Disappearing Edge (ETF)

A long-standing anomaly for efficient markets has been what’s called “post-revision return drift” (PRD). Research into stock returns has found that changes in sell-side analyst recommendations for buying and selling stocks predict future long-term returns in the same direction as the change. Upgrades are followed by positive returns, and downgrades are followed by negative returns.

Politics

Trump calls for increased military response after Orlando shooting (Reuters)

Donald Trump on Monday said the United States needs to increase its military response against Islamic State in the wake of the Orlando nightclub shooting over the weekend, including additional bombings.

Technology

Chemists invent new supercapacitor materials (Phys)

Chemists invent new supercapacitor materials (Phys)

Dr David Eisenberg and Prof. Gadi Rothenberg of the University of Amsterdam's Van 't Hoff Institute for Molecular Sciences have invented a new type of supercapacitor material with a host of potential applications in electronics, transportation and energy storage devices. The UvA has filed a patent application on this invention.

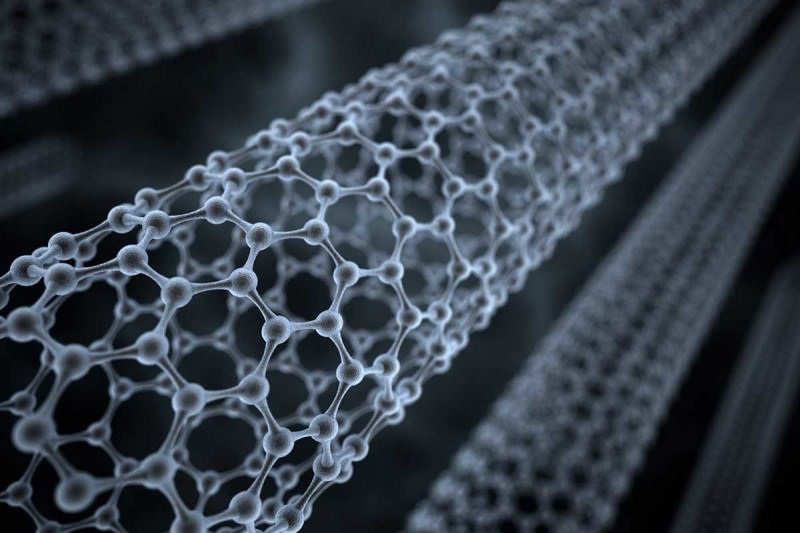

Carbon nanotubes too weak to get a space elevator off the ground (New Scientist)

Carbon nanotubes too weak to get a space elevator off the ground (New Scientist)

Carbon nanotubes (CNTs) are famed for being a future wonder material that will enable a swathe of super-strong but light applications from racing bikes to computer components.

But now it seems a single out-of-place atom is enough to cut their strength by more than half. That means one of the more outlandish applications for CNT fibres – a sci-fi space elevator – might never happen.

Health and Life Sciences

The Memory Illusion (Scientific American)

The Memory Illusion (Scientific American)

Picture this. You are in a room full of strangers and you are going around introducing yourself. You say your name to about a dozen people, and they say their names to you. How many of these names are you going to remember? More importantly, how many of these names are you going to misremember? Perhaps you call a person you just met John instead of Jack. This kind of thing it happens all the time.

Spread of human disease from animals mapped (BBC)

Spread of human disease from animals mapped (BBC)

Scientists say they have developed a better way to predict how animal diseases can spill over into humans.

Their model for Lassa fever, which is spread by rats, predicts that there will be twice as many human cases of the disease in Africa by 2070.

Should Pediatricians Refuse to Treat Patients Who Don’t Vaccinate? (NY Times)

Some say they should, but other say doctors have an obligation to educate parents “to do the right thing for their children, not to give up on them.”

Life on the Home Planet

50-year-old observation leads to the most successful seagrass restoration in the world (Phys)

50-year-old observation leads to the most successful seagrass restoration in the world (Phys)

When Geoff Bastyan noticed seagrass disappearing from harbours in Albany nearly 50 years ago, he would never have predicted his observation would lead to the most successful seagrass restoration in the world.

How Americans Came Together After the Orlando Massacre (The Atlantic)

How Americans Came Together After the Orlando Massacre (The Atlantic)

The most deadly mass shooting in U.S. history began in the early hours Sunday morning when a lone gunman opened fire at a nightclub in Orlando, Florida. Throughout the day, millions of Americans followed the story through their social media feeds, where many angrily rehashed debates about gun control, radical Islamist terrorism, homophobia, President Obama’s public response to the mass killing, and Donald Trump’s proclivity for making everything about Donald Trump.