Financial Markets and Economy

Wall Street ends higher as Britain seen staying in EU (Reuters)

Wall Street rose on Monday, though indexes ended far from the highs of the day, in a relief advance after indications that British voters later this week will choose to remain in the European Union.

A New, Slower Stock Exchange (The Atlantic)

Last Friday, the Securities and Exchange Commission was scheduled to rule on whether it would certify Investor’s Exchange—better known as IEX—as a national securities exchange. The backstory and aspirations of IEX were captured by Michael Lewis in his 2014 book Flash Boys.

$52 Billion Worth of Oil Producers Gone from the Oil Market (EconMatters)

Imagine if Kellogg, the iconic cereal maker, just disappeared. That’s $25 billion suddenly gone… poof.

Saudi Crude Exports Fall to 6-Month Low as Refineries Cut Back (Bloomberg)

Saudi Arabia, the world’s biggest crude exporter, cut shipments in April to the lowest level in six months as overseas refineries bought less due to seasonal maintenance and the kingdom burned more oil at home to power air conditioners.

The Three Stages of the Post-War Economy (Crossing Wall Street)

Here’s a look at the growth of the U.S. GDP in real terms since 1947, but I’ve made one major changed, I’ve divided the data series by a trend line growing at 3.2% per year.

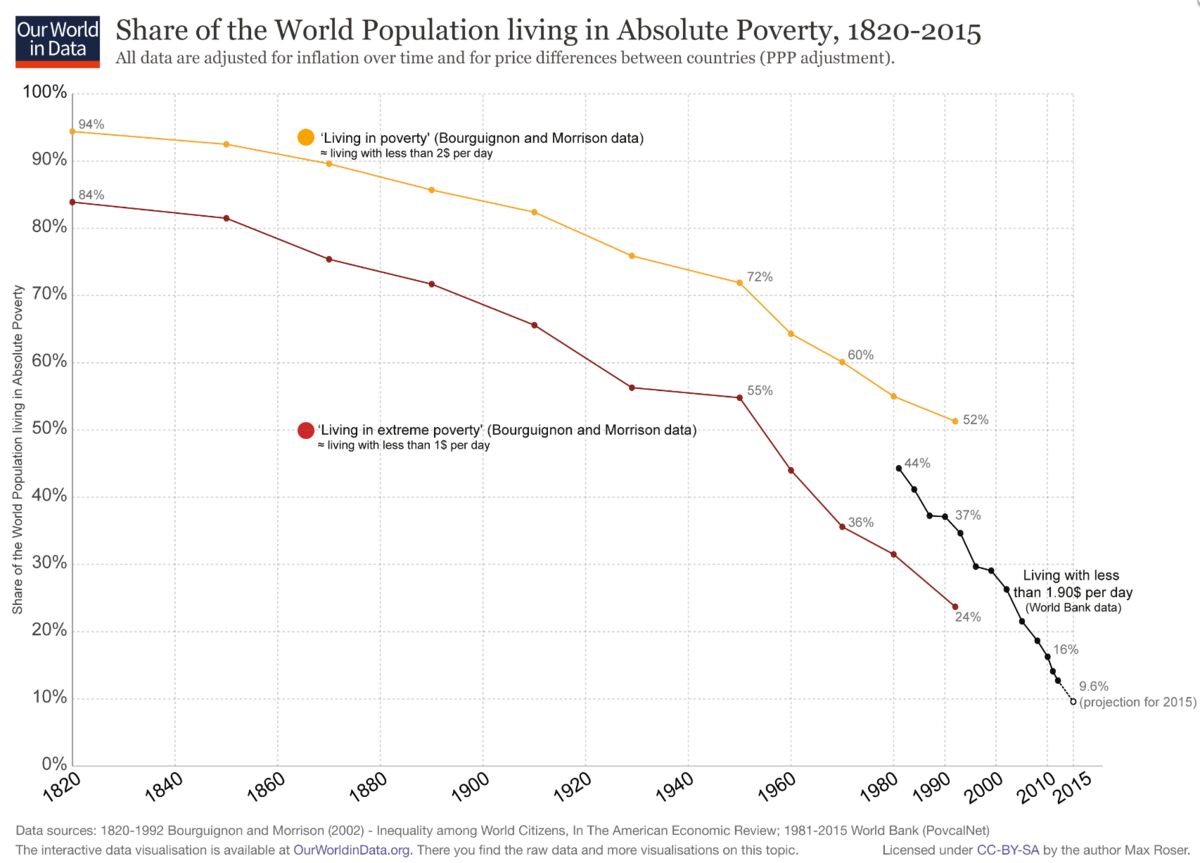

There's Great News on Inequality and Poverty (Bloomberg View)

Many people on the left seem to believe that the global economy has the same problems as the economies of the U.S and Europe. For example, presidential candidate Bernie Sanders recently tweeted: “The global economy has simply failed when so many have so little and so few have so much.”

Yield Opportunities Abound In Muni Bond ETFs (ETF)

Depending on your specific asset allocation or income goals, many of the other muni-bond ETFs may be appropriate. (Read How To Pick The Right Muni Bond ETF for additional guidance.)

IRobot, Your Trusted Adviser (Bloomberg Gadfly)

A private banker used to be the trusted person who'd ensure your wealth would grow and be passed on to future generations. Relationships were nurtured with more than just advice to buy stocks low and sell high. They could go as far as helping secure a vacancy for a child at a Swiss boarding school, or obtaining tickets for the NBA finals. Clients were so close that bankers would take them along when they moved employers. That was before robots could do the job.

Gold is going to explode once China has enough (Business Insider)

China wants to do what the U.S. has done, which is to remain on a paper currency standard but make that currency important enough in world finance and trade to give China leverage over the behavior of other countries.

Kellogg's to Invest $100 Million in Food Startups (Eater)

Kellogg's to Invest $100 Million in Food Startups (Eater)

Venture capital investment in food startups has been on the rise in recent years, with companies sinking millions into meal kits, food delivery services, and other new products. Kellogg's latest project is proof that the trend shows no sign of slowing.

No One Knows What Will Happen (A Wealth of Common Sense)

This memo was sent to President Bush in April of 2001, a mere six months before 9/11.

Why Transocean Will Soar Higher (Seeking Alpha)

Just over a month ago, I had recommended that investors should be buying offshore driller Transocean (NYSE:RIG). I had said so because the company has been able to keep its efficiency levels at strong levels by aggressively fighting for new contracts, while a low cost base has allowed it to keep its margins and cash flow in good shape.

CRE & REITs – U.S. Real Estate: A Storm Is Brewing – PIMCO (Value Walk)

Storms form when moisture, unstable air and updrafts interact. Similarly, a confluence of factors – volatility in public markets, tightened regulations, maturing loans and uncertain foreign capital flows – is creating a blast of volatility for U.S. commercial real estate (CRE) that we anticipate could lower overall private U.S CRE prices by as much as 5% over the next 12 months. For nimble investment platforms, however, these swirling winds should create attractive opportunities over the secular horizon.

Are negative rates a “calamitous misadventure"? ECB economists say no (Brookings)

In June 2014, the European Central Bank (ECB) brought its deposit facility rate (the one that banks face when they put their excess reserves at the ECB) below zero for the first time in its history, to -0.10%. By March 2016, the rate was -0.40%. As of mid-June, European banks now had about €870 billion in excess reserves at the ECB on which they are not earning interest, but instead are paying about €3.5 billion per year. This isn’t unique to the ECB—Sweden, Denmark, Switzerland, and Japan have also gone negative.

Politics

Those 'Dump-Trump' Republicans Are Getting Kind of Weird (Bloomberg View)

Those 'Dump-Trump' Republicans Are Getting Kind of Weird (Bloomberg View)

How desperate is the Republican Party? This desperate: Political strategists are concocting schemes to preserve their congressional majorities that they know would concede the presidential contest to Hillary Clinton.

Every political generation has its low moment; this is ours (The Spectator)

Every political generation has its low moment; this is ours (The Spectator)

No, there was never a Golden Age of genteel and elevated discourse. Never a time when the fate of the country didn’t seem to hang in the balance or when politics was ever played for anything less than all the marbles. Check old election-day copies of the Daily Mirror if you doubt this.

Clinton's Wall Street Donors Revolt After Warren Emerges as VP Contender (Common Dreams)

Clinton's Wall Street Donors Revolt After Warren Emerges as VP Contender (Common Dreams)

Top Democratic donors in the financial industry are threatening revolt after news broke that top Wall Street critic and progressive darling Sen. Elizabeth Warren (D-Mass.) is one of the leading candidates for vice president under Hillary Clinton.

Technology

This Is The Future Of Artificial Intelligence (Forbes)

This Is The Future Of Artificial Intelligence (Forbes)

It’s widely known by now that the U.S. and global economy are being profoundly re-shaped by software technology. Human jobs are being eaten by software, specifically Artificial Intelligence (AI) algorithms able to ingest and analyze massive volumes of data to inform and remotely control better process management decisions, more efficient outcomes.

Health and Life Sciences

Can electric fields speed wound healing for diabetics? (Futurity)

Can electric fields speed wound healing for diabetics? (Futurity)

People with diabetes often suffer from wounds that are slow to heal. New research finds that slow healing is associated with weaker electrical currents in wounds.

“This is the first demonstration, in diabetic wounds or any chronic wounds, that the naturally occurring electrical signal is impaired and correlated with delayed healing,” says Min Zhao, professor of ophthalmology and of dermatology at the University of California, Davis.

Second baby for womb transplant mum (BBC)

Second baby for womb transplant mum (BBC)

One of the first women to receive a womb transplant is expecting a second child, a medical conference has heard.

Prof Mats Brannstrom, who pioneered the fertility surgery in 2014, made the announcement at the Royal College of Obstetricians and Gynaecologists' annual meeting in Birmingham.

Life on the Home Planet

Microbial mass extinctions were kicked off by human evolution (New Scientist)

Microbial mass extinctions were kicked off by human evolution (New Scientist)

It’s not just elephants and tigers we’re driving extinct – we’ve been drastically wiping out far tinier organisms too. This extinction of microbes brought about by the human era – known as the Anthropocene – could be behind some of our physical and mental health problems, as well as the current antimicrobial resistance crisis.

Why Rare Events Happen All the Time (Bloomberg View)

Why Rare Events Happen All the Time (Bloomberg View)

Something weird seems to be happening in the heavens. This week marks a coincidence of the full moon and the summer solstice. Some astronomers are calling this combination of maximum moonlight and the Northern Hemisphere’s longest day a rare event.