AAPL still holding back at $97.50 - usually AAPL punches up to make the rally tops.

Poor AAPL makes $50Bn a year and can't get arrested!

I guess if there are any new people who don't have AAPL, consider this a good time to put on the virtual reality gear so I can reach through the monitor and smack you around!

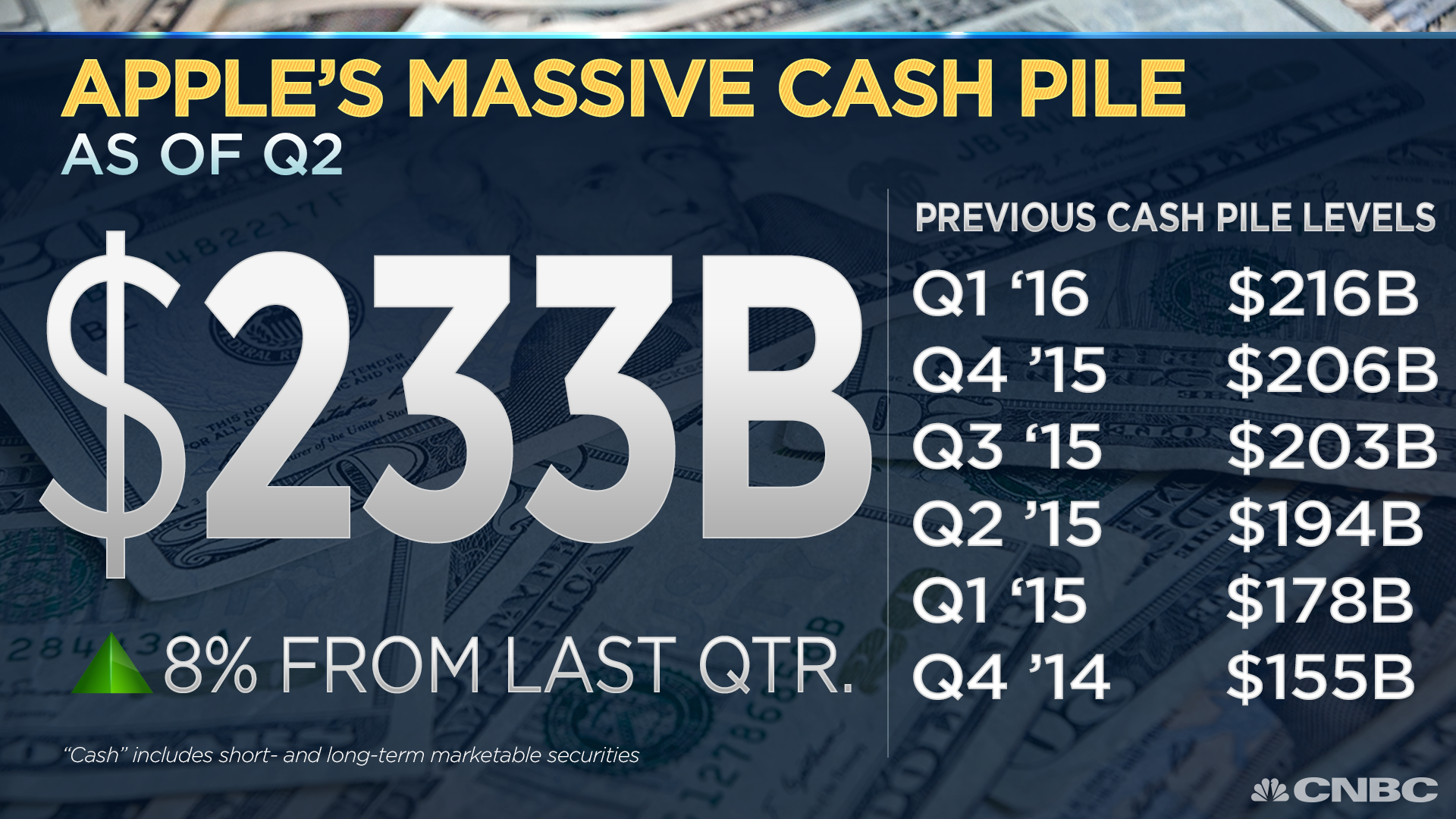

AAPL has a $533Bn valuation at $97.50 and makes $50Bn a year and has $200Bn in cash. EVEN IF you thought they were as boring as Berkshire Hathaway - Berkshire is valued at $356Bn dropping $25Bn (half) to the bottom line with $71Bn (1/3) in cash. AAPL is the most ridiculously undervalued company in the World.

In our LTP, we only have 10 2018 $85/110 bull call spreads and they are up because we bought them cheaper but $11.55 on a $25 spread that's $12 in the money on a fantastic stock is still a good trade so let's add 10 more of those and sell 5 more short 2018 $95 puts ($11.95).

In the OOP, we have 10 naked 2018 $85 calls and 5 short $90 puts. It's a smaller portfolio so we won't sell more puts but we can sell 2 (20) of the 2018 $110 calls for $6.65 ($13,300) and use that money to buy 10 more long 2018 $85 calls for $18.20 ($18,200) so for just $4,900 we get to participate in another $25,000 of upside if AAPL is at $110 or higher!

Obviously, as a new play, that's the spread I like too.