Financial Markets and Economy

Global stocks fall, UK PMIs flash Brexit recession warning (Reuters)

Shares fell on Friday after soft U.S. corporate results pulled Wall Street back from record highs, and sterling slumped as the first snapshot of the UK economy since the vote last month to leave the European Union painted a bleak picture.

U.S. stocks poised for a return to winning ways (Market Watch)

U.S. stocks poised for a return to winning ways (Market Watch)

U.S. stock futures pointed to a higher open Friday, with investors set for another heavy round of corporate earnings reports, which could help the Dow return to setting fresh highs.

Investors will get quarterly results from General Electric Co. and American Airlines Group Inc., as they also assess a stack of late Thursday reports from Starbucks Corp., Visa Inc. and others.

Is Inflation Too Low? Depends How You Look at It (Bloomberg View)

Is Inflation Too Low? Depends How You Look at It (Bloomberg View)

Those who argue that the U.S. Federal Reserve should keep interest rates low typically point to the same piece of evidence: The central bank's preferred measure of inflation remains below its 2 percent target, suggesting that the economy still needs stimulus.

This is the absolute worst reason to be bullish on stocks right now (Market Watch)

The argument that stock prices will go up because the market’s earnings yield is so much higher than the 10-year Treasury yield.

Investors Are Getting Ripped Off on Index Fund Fees, Lawsuits Say (Bloomberg)

Investors Are Getting Ripped Off on Index Fund Fees, Lawsuits Say (Bloomberg)

Index funds often benefit from a low-cost halo. They don't all deserve to bask in that glow.

Allegations of excessive index fund fees in retirement plans are at the heart of a new proposed class action lawsuit brought by New York Life Insurance Co. employees against the company. The case, filed in U.S. District Court for the Southern District of New York, alleges breach of fiduciary duty under the Employee Retirement Income Security Act.

Why it still makes sense to buy stocks and bonds at record prices (Market Watch)

Why it still makes sense to buy stocks and bonds at record prices (Market Watch)

Are you tired of stories speculating about when the Federal Reserve will raise interest rates? Maybe it’s time to stop reacting to them, because they can damage your investment portfolio.

World Bank Urges China Health-Care Reform to Save 3% of GDP (Bloomberg)

A series of structural changes to China’s current health-care system could save Asia’s largest economy up to 3 percent of GDP, according to a study released Friday.

For Post-Brexit Stock Pickers, Skill Is Bunk (Wall Street Journal)

Stock-picking skills have a time and a place, but post-Brexit Britain isn’t it. Almost half of U.K. shares rose or fell more than 10% in the past month, and just two macro factors explained three-quarters of the movement.

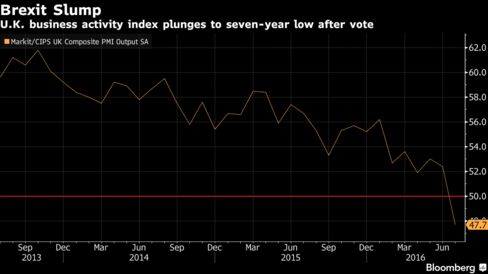

Brexit Vote Wreaks Havoc on U.K. Economy, Flash Estimates Show (Bloomberg)

The U.K.’s decision to leave the European Union inflicted an immediate blow on the economy as business activity shrank at its fastest pace since the last recession seven years ago.

High-yield bonds are now too high-risk for your money (Market Watch)

If you think the stock market has bounced nicely, the junk bond rebound has displayed just as much vigor.

Euro Traders Tell Draghi That ECB’s Policy Is Going Nowhere Fast (Bloomberg)

Euro traders are sending Mario Draghi a clear message: Monetary policy is reaching a dead end.

S&P 500 companies start facing up to the potential Brexit costs (Reuters)

U.S. companies, facing investors in their first earnings reporting season since Great Britain voted to leave the European Union, are broadly conceding that the so-called "Brexit" could weigh on profits.

Philippines' oil still in troubled waters after South China Sea ruling (Reuters)

The Philippines, eager to resume development of vital oil and gas reserves off its coast, will likely need to reach an accord with a Chinese government infuriated by last week's ruling that granted Manila a big victory in the South China Sea.

US Futures Rebound Despite Global Stock Weakness As USDJPY Ramps HIgher (Zero Hedge)

After breaking a multi-year stretch of 9 daily record highs in the Dow Jones, overnight global markets saw some early weakness with Asian stocks retreating after BOJ chief Kuroda dashed hopes for so-called helicopter money, triggering yen’s steepest rally in a month and pulling the Nikkei lower by 1.1%. This however did not last long, and around the European open the traditional ramp in the USDJPY helped European equities shrug off early downside, while US equity futures have already recovered half of yesterday's losses.

Politics

Hillary Clinton Prepares for Vice Presidential Pick (Time)

Hillary Clinton Prepares for Vice Presidential Pick (Time)

The 125,000 red, white and blue balloons have dropped and are deflating in unceremonious heaps on the ground as the Republicans wrapped up their convention in Cleveland, and Hillary Clinton is set at any moment to announce her pick for vice president.

The Economy Will Probably Be Pretty Good On Election Day (Five Thirty Eight)

The Economy Will Probably Be Pretty Good On Election Day (Five Thirty Eight)

This week’s Republican convention will probably be remembered for Melania Trump’s plagiarism, Ted Cruz’s pointed non-endorsement of Donald Trump, and Trump’s own record-long acceptance speech. But the convention was also notable for another reason: the near-total lack of discussion of jobs and the economy. Even Tuesday night (advertised theme: “Make America Work Again”) seemed to feature more discussion of Benghazi than unemployment. (Trump’s marathon speech did feature several sections on the economy, but focused more on crime and security.)

Trump's Still Wooing His Own Party Faithful (Bloomberg View)

Trump's Still Wooing His Own Party Faithful (Bloomberg View)

Donald Trump accepted the Republican presidential nomination on Thursday night and then proceeded to deliver a shouted, scare-mongering speech about a nation beset by constant lawlessness and violence. It was not a portrait that jibed with the facts and statistics, but perhaps it will resonate with the American voters out there who are still on the fence.

Technology

China wants to be a top 10 country for automation by putting more robots in its factories (Venture Beat)

China wants to be a top 10 country for automation by putting more robots in its factories (Venture Beat)

China is aiming for a top-10 ranking in automation for its industries by 2020 by putting more robots in its factories, the International Federation of Robotics (IFR) said.

Health and Life Sciences

Double hand transplant: UK's first operation 'tremendous' success (BBC)

The UK's first double hand transplant operation has taken place at Leeds General Infirmary and the patient says his new hands look "tremendous".

Who should we believe when it comes to fertility? (New Scientist)

How old is too old to have a baby? For many women in their 30s and 40s, that question nags away at them as they try to strike a balance between their career, their finances and their desire to start a family.

Hormone Therapy May Not Prevent Postmenopausal Brain Fog (Scientific American)

Hormone Therapy May Not Prevent Postmenopausal Brain Fog (Scientific American)

Although millions of women use hormone therapy, those who try it in hopes of maintaining sharp memory and preventing the fuzzy thinking sometimes associated with menopause may be disappointed. A new study indicates that taking estrogen does not significantly affect verbal memory and other mental skills.

Life on the Home Planet

Utah Lake’s Poop-Driven Algal Bloom Is a Crappy Situation (Wired)

Utah Lake’s Poop-Driven Algal Bloom Is a Crappy Situation (Wired)

Algae swamped Utah Lake last week, stretching over 134 square miles. The bright green bloom is mesmerizing — and possibly toxic. And, turns out, poop is partly to blame.

Drought 'shuts down Amazon carbon sink' (BBC)

Drought 'shuts down Amazon carbon sink' (BBC)

A recent drought shut down the Amazon Basin's carbon sink by killing trees and slowing trees' growth rates, a study has shown.

The term carbon sink refers to the ability of a natural zone to absorb CO2 from the atmosphere.