Financial Markets and Economy

The Fed Might Make a Big Mistake This Week (Money)

The Fed Might Make a Big Mistake This Week (Money)

It’s virtually certain that at the end of their two-day meeting on Wednesday, Fed officials will leave interest rates exactly where they are—at near-record-low levels.

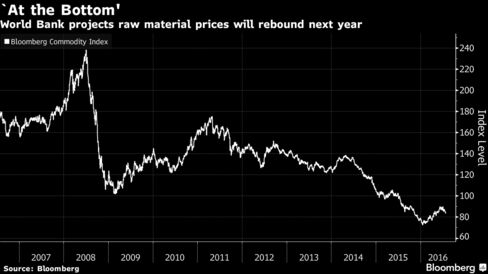

Commodities ‘At Bottom,’ Says World Bank as Rebound Seen (Bloomberg)

Commodities will probably rebound next year as demand strengthens, according to the World Bank, adding its voice to those including Citigroup Inc. who’ve forecast that 2017 may be a better year for raw-material prices.

Bull market in U.S. stocks ‘has a long way to go’ (Market Watch)

In the midst of winter’s gloom, when U.S. stocks looked like they had nowhere to go but down, even some bullish market gurus began to doubt that the nearly seven-year-old bull market could continue.

Oil Majors Lost One Engine; Now the Second One Is Sputtering (Bloomberg)

If Big Oil was a two-engine airplane, you could say it’s been flying on a single engine since energy prices crashed in 2014. Now, the second motor is sputtering.

A startup backed by the hero of 'The Big Short' is attempting to bring Wall Street to Main Street (Business Insider)

Eight years after the subprime crisis, news of a startup bringing institutional real-estate exposure to individual investors may be met with some skepticism.

Appetite for U.S. Debt Is Weakest Since 2009 in Lead-Up to Fed (Bloomberg)

For the second day in a row, an auction of U.S. Treasury notes drew the feeblest demand in years, before central-bank decisions this week that may spark volatility in financial markets.

How U.S. stock investors ‘buy American’ too much, in one chart (Market Watch)

Investors ought to think about whether they have too much riding on their domestic stock market, says a report out this month from fund giant Vanguard.

Here's what Jack Dorsey said about selling Twitter (Business Insider)

Twitter's business is struggling, and its stock price has been pummeled, erasing billions of dollars in market value.

S&P 500 Earnings Forecast For Q3 Goes Negative As Industrial Output Growth Stalls (Confounded Interest)

As the 2016 Presidential election season goes into warp drive with the recently completed Republican convention and the Democrat convention convening this week in Philadelphia, all eyes will be focused on the US economy and financial markets.

Abe’s Unusual Stimulus Unveiling May Be Directed at the BOJ (Bloomberg)

It wasn’t your typical Japanese stimulus announcement.

A New Normal for the U.S. Economy: Slow and Steady (Bloomberg View)

For the first time since 2009, all sectors of the economy are chugging along at normal rates: The housing industry pulled out of its nosedive, the government sector ended its downturn, and as of this quarter, the industrial recession is over. Policy makers face a new challenge, building on an economy in which no major sector is in contraction. But first, the U.S. deserves some recognition for the feat it just accomplished.

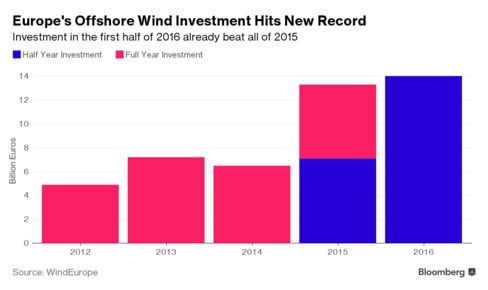

Offshore Wind Investments So Far This Year Already Beating 2015 (Bloomberg)

Europe’s offshore wind-power industry attracted more investment in the first half of 2016 than it did during the whole of last year, according to figures from trade association Wind Europe.

Headwinds To US Earnings Growth Abate (Value Walk)

The US stock market has gone nowhere for the past 15 months, with plenty of volatility along the way, as the Display below shows. To a large extent, the flat market reflects flat earnings, which peaked at the end of 2014 and have declined modestly since then. But we think the headwinds to US earnings growth are abating.

Apple Announces Q3 FY 2016 Results: App Store Up, Hardware Down (Anand Tech)

Today Apple announced their third quarter results for their fiscal year 2016. Much like last quarter, Apple has struggled to maintain the sales pace of the iPhone 6s, compared to the iPhone 6.

Nissan Profit Falls 11% on Yen, Mitsubishi Motors Reports Loss (Bloomberg)

Nissan Motor Co. reported a 11 percent drop in quarterly profit after a stronger yen eroded overseas earnings, while a slump in domestic sales pushed minicar partner Mitsubishi Motors Corp. into a loss after its mileage scandal.

Ignore the Cliches: A Simple Tip That Will Change the Way You Invest (Spark Fin)

One of the commonly repeated maxims in trading is to “cut short your losses, and let your profits run on.” Attributed to David Ricardo, a political economist who rose to prominence in the early 19th century, it’s one dear to the heart of momentum traders and trend followers, for it forms the very basis of what makes their methodology profitable.

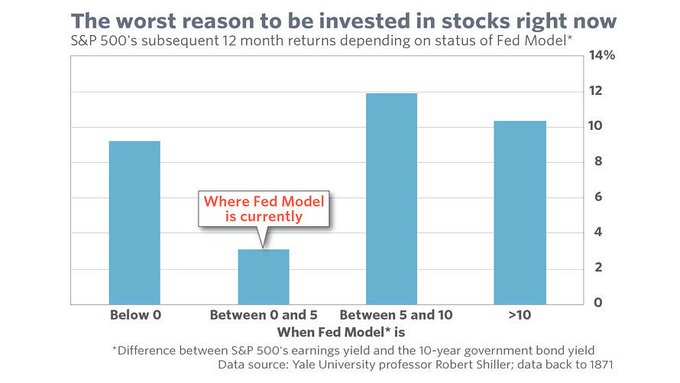

Investors Are Relying On ‘Dangerous Rationalizations That Have Never Held True In The Past’ (The Felder Report)

I’m always fascinated to witness how investor sentiment shifts in reaction to price. Stocks have recently risen to new highs and, in reaction, investors are grasping at straws in trying to justify extreme valuations amid an ongoing earnings recession.

What The Sudden Spike In The TED-Spread Really Means (Business Insider)

Historically, blowing out short-term funding rates, whether measured by the TED Spread (the difference between LIBOR and 3 month TSYs), or the 3 month FRA-OIS spread, have been an indicator of funding stress and heightened systemic risk.

Politics

Democratic Convention Tops RNC on First Night With 26 Million Viewers (Wall Street Journal)

Democratic Convention Tops RNC on First Night With 26 Million Viewers (Wall Street Journal)

About 26 million viewers tuned in to watch the headline speakers during night one of the Democratic National Convention, besting the figures from the first evening of the Republican event a week ago, according to Nielsen.

Trump Doubles Down on Taxing Companies That Manufacture Overseas (The Fiscal Times)

Trump Doubles Down on Taxing Companies That Manufacture Overseas (The Fiscal Times)

Listening to Donald Trump explain how he’ll solve major global problems is like watching a man prepare to fix a malfunctioning computer with a pipe wrench. While you may not know exactly how it’s going to play out, you do know there is zero chance that the problem will be fixed.

Technology

LG wants to make foldable OLED displays commonplace with massive $1.75 billion investment (Singularity Hub)

LG wants to make foldable OLED displays commonplace with massive $1.75 billion investment (Singularity Hub)

LG is looking to invest massive amounts of money into developing and perfecting its foldable OLED screen business. This comes at a time when rumors of Samsung launching devices with foldable screens get louder and louder. It also comes recently after LG Display announced a massive 91% drop in profits.

The World Depends on Technology No One Understands (Singularity Hub)

The World Depends on Technology No One Understands (Singularity Hub)

As a teenage nobody, George Hotz earned notoriety for being the first hacker to unlock Apple’s iPhone — much to the annoyance of AT&T, who had exclusive-ish networking rights at the time. Several years later, he became the focus of a Sony lawsuit for releasing hacked Playstation 3 software to the world. And last December, he discussed his latest project with Bloomberg’s Ashlee Vance — a patched together home-made driverless car.

A one-armed Australian robot can build a house four times quicker than a human (Business Insider)

A one-armed Australian robot can build a house four times quicker than a human (Business Insider)

Fastbrick Robotics, an ASX-listed company based in Perth, has created a robot brick layer, a form of 3D printing which can create the shell of a house without being touched by human hands.

Health and Life Sciences

Should doctors routinely screen for melanoma? (Futurity)

The United States Preventive Services Task Force has released a report saying there isn’t enough evidence to recommend that clinicians perform visual screening for melanomas for patients with no known risk for the skin cancer.

Life on the Home Planet

MH370: Missing jet 'could be further north' (BBC)

MH370: Missing jet 'could be further north' (BBC)

The crashed remains from the Malaysia Airlines Flight MH370 could be as much as 500km further north than the current search area, say scientists in Italy.

Patchy oxygen in ocean may have stalled evolution (BBC)

Patchy oxygen in ocean may have stalled evolution (BBC)

Evolution has slowed to a crawl a few times in four billion years. And an eon or so has passed before more complex life forms, such as simple animals, could arise.