Financial Markets and Economy

A $400 Billion Influx Squeezes U.S. Bond Market’s Safest Asset (Bloomberg)

The U.S. government’s attempt to alleviate the short supply of T-bills is about to get a little harder.

Globalization isn't killing factory jobs. Trade is actually why manufacturing is up 40%. (LA Times)

Foreign trade took a beating at both major party conventions, with speakers blaming free-trade agreements for all but wiping out U.S. manufacturing and eliminating millions of middle-class jobs. Both Donald Trump and Hillary Clinton have promised to renegotiate or abandon trade agreements with key U.S. trading partners such as Mexico and Canada.

Venezuela’s Inflation Is Set to Top 1,600% Next Year (Wall Street Journal)

Venezuela’s Inflation Is Set to Top 1,600% Next Year (Wall Street Journal)

While most advanced economies struggle to lift inflation, none would want Venezuela‘s situation: Consumer-price inflation is forecast to hit 480% this year and top 1,640% in 2017, according to the International Monetary Fund.

Hedge funds turn ultra-bearish on crude and gasoline (Reuters)

Aug 1 Hedge funds have turned very bearish towards both crude and refined products over the last two months amid signs of an oversupply of gasoline.

Construction spending falls to one-year low in June (Reuters)

U.S. construction spending fell for a third straight month in June as outlays dropped across the board, suggesting a downward revision to the second-quarter economic growth estimate published last week.

End of an Era as China’s Love Affair With U.S. Real Estate Fades (Bloomberg)

For David Wong, the business of selling homes isn’t as good this year as it was in 2015, and he’s blaming that on a decline in customers from China.

Here's where Americans are spending all the money they've saved on cheap gas (Business Insider)

Here's where Americans are spending all the money they've saved on cheap gas (Business Insider)

Americans are savings a lot of money on gas, and it looks like they are getting out there and spending that cash.

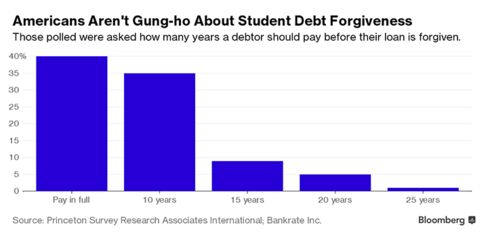

Majority of Americans Want College to Be Free (Bloomberg)

Few things are as universally beloved as getting something for nothing. Everyone supports free samples at the grocery store, soda refills, and, perhaps one day soon, college tuition.

This could be the last straw for Venezuela's oil sector (Oil Price)

I discussed in Prime Meridians this past weekend a $1.4 billion lawsuit brought against Venezuela state energy firm PDVSA. With the major this week filing a motion to quash the suit, which claims it illegally transferred billions out of the U.S. in order to duck a settlement.

Britain braced for ‘Super Thursday’ interest rate cut (The Spectator)

Britain’s financial status could be downgraded this week amid reports the Bank of England will cut interest rates on Thursday. The Guardian says that the Bank’s Monetary Policy Committee will examine the latest growth forecasts and inflation report, and then make a decision on whether to cut interest. If they do, it will be the first time the rate has changed since it was set at 0.5 per cent in March 2009.

Europe's stress tests fail to ease investors' bank sector worries (Reuters)

The latest health check of leading European Union banks failed to end worries about profitability in the sector and the omission of risks such as the effect of negative interest rates and Brexit blunted its impact.

UK manufacturing decline adds pressure on Bank to cut interest rates (The Guardian)

Fresh signs of falling demand and job cuts in Britain’s manufacturing sector have raised pressure on the Bank of England to soothe post-referendum jitters with an interest rate cut this week.

Time For Bold Economic Moves And Tough Security In Nigeria (Value Walk)

As Nigeria’s economy is contracting, domestic and global headwinds ensure that downside risks will escalate. Without aggressive economic moves and harsh security measures, the economy could face a disastrous free fall.

Economists Turn a Blind Eye to Historical Data (Bloomberg View)

Economists can’t seem to help themselves.

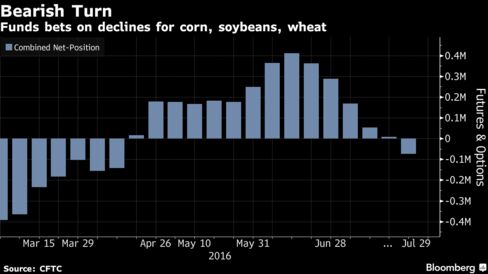

It’s Not Easy Being Grains When Investors Bet on Price Demise (Bloomberg)

Investors have turned against three of the largest U.S. crops, betting that timely rainfall will further swell grain supplies and exacerbate price drops.

Apple is now an investor in the world’s biggest ride-sharing companies (Quartz)

Just over two months ago, Apple made a $1 billion bet on Didi, the dominant ride-sharing company in China. Today (Aug. 1), that move has made Apple a part-owner of Uber, thanks to a $1 billion investment by Didi into Uber. All of a sudden, Apple has found itself with stakes in two of the world’s biggest ride-sharing firms.

Facebook and Twitter Will Dangle Ad Revenue to Lure YouTube Stars (Bloomberg)

Facebook and Twitter Will Dangle Ad Revenue to Lure YouTube Stars (Bloomberg)

Ricky Dillon is 24, but his spiked bleach-blond hair and multicolored metallic nail polish that shines on his right fingers make him look younger. He has about 3 million followers on YouTube, where his specialty is “reacting funny to things,” as he puts it. His light-hearted, lo-fi videos are labeled with such bright, bubble-lettered titles as “3 BOYS, 26 POSITIONS”—which is not what it sounds like. It’s Dillon and two friends contorting themselves into the shape of alphabet letters, and it has 1.2 million views.

Amazon passes Exxon to become 4th most valuable company in the U.S. (Market Watch)

Amazon.com Inc. muscled past Exxon Mobil Corp. Monday to become the fourth-largest U.S. company by market capitalization. Exxon Mobil also fell behind Facebook Inc. into sixth place, to make it an all-technology top five.

Uber Had No Way Out of China Except Through a Merger With Didi (Fortune)

It may never frame its time in China in such stark terms, but there’s no other way to interpret Uber’s merger of its China division with market leader Didi Chuxing in a tie-up worth $35 billion just a year after founder Travis Kalanick called the country Uber’s “number one priority.”

Saudi's Slash Oil Prices For Asian Markets; So Much For Solving That Banking Liquidity Crisis (Zero Hedge)

Shortly after we spoke yesterday about the banking liquidity crisis in Saudi Arabia caused by the "Saudi circ ref" (low oil prices -> budget deficits -> more oil pumping -> even lower oil prices), almost on cue, the state-owned Saudi Aramco, the worlds largest oil exporter, announced the largest price cut for Arab light sweet crude sold into Asian markets in 10 months.

Gold Daily and Silver Weekly Charts – Deliveries on Paper (Jesse's Cafe Americain)

Gold and silver held to an upward drift today, with a little more strength in Uncle Buck. One gets the sense that the 'risk on' boys were taking a little out of equities and putting the proceeds into safer harbors.

Big Data is Transforming Commercial Construction (Dataconomy)

Big Data is Transforming Commercial Construction (Dataconomy)

Construction is a costly and time-consuming process. There are several layers to every project, and average profit margins are relatively narrow. That’s why any and every money-saving measure counts. It’s nearly impossible to flawlessly budget, manage, and organize a construction project. From employees to suppliers and logistics, there’s one tool that can help the multifaceted building process: big data.

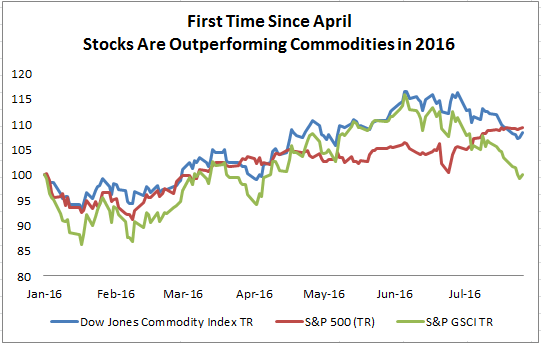

Commodities Post 3rd Worst July Ever (Indexology)

July was a bloodbath for commodities in the Dow Jones Commodity Index (DJCI) losing 6.0% and in the S&P GSCI losing 9.6% in total return. Although the equally weighted DJCI is still up 7.4% YTD through July 29, 2016, the S&P GSCI that is world-production weighted gave up all its gains from Q2 and is now negative 65 basis points for the year, allowing stock performance in 2016 to overtake commodities for the first time since April.

Brexit UK Heads Toward Recession, Europe and US Next? (Ticker District)

The UK economy was not strong before the Brexit vote and the July PMI report released today suggests Brexit was a material hit to economic activity. The Markit UK Manufacturing PMI printed 48.2, well into contractionary territory. A reading of 48.2 implies that the next UK GDP report should be negative – likely to be around -0.5%.

Politics

It’s About 100 Days Till Election Day (Five Thirty Eight)

It’s About 100 Days Till Election Day (Five Thirty Eight)

After two weeks on the road covering the conventions, the podcast crew is back in the New York studio. And with the primaries officially in our rear-view mirror, we thought this would be a good opportunity to look at how the FiveThirtyEight forecast models have moved since we launched them and answer listener questions about recent ups and downs.

How Low Will Republican Leaders Let Trump Go? (Bloomberg View)

How Low Will Republican Leaders Let Trump Go? (Bloomberg View)

Silence is not enough.

Republicans who refused to attend the convention last month got a lot of praise for not falling in line behind a dangerous demagogue. But after Donald Trump's attacks on the Muslim-American parents of a fallen soldier, merely passing on attending this coronation is insufficient. As are the statements criticizing the nominee flowing out of Washington.

Technology

Robots Are Getting A Sense Of Self-Doubt (Popular Science)

Robots Are Getting A Sense Of Self-Doubt (Popular Science)

You know that little voice in your head, the one that says,"Maybe jumping off this cliff isn't a good idea," or, "You can't drink a whole gallon of milk?"

US police use machine learning to curb their own violence (New Scientist)

US police use machine learning to curb their own violence (New Scientist)

None of their colleagues may have noticed, but a computer has. By churning through the police’s own staff records, it has caught signs that an officer is at high risk of initiating an “adverse event” – racial profiling or, worse, an unwarranted shooting.

Health and Life Sciences

Rare cardiac disease linked to higher seizure risk (Futurity)

Rare cardiac disease linked to higher seizure risk (Futurity)

Researchers have discovered a genetic link between Long QT Syndrome (LQTS), a rare cardiac rhythm disease, and an increased risk for seizures. The findings also show that people with LQTS who experience seizures are at greater risk of sudden cardiac death.

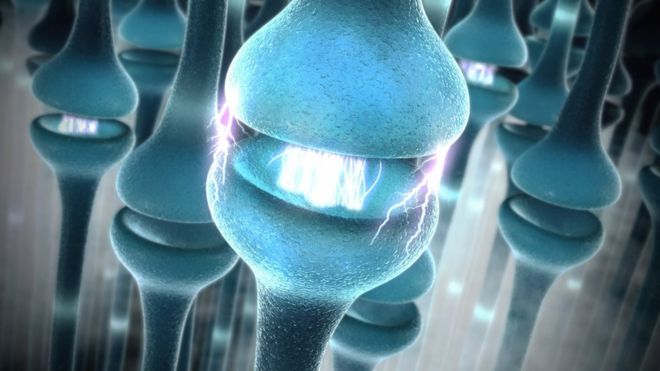

'Hacking nerves can control disease' (BBC)

'Hacking nerves can control disease' (BBC)

Controlling human nerve cells with electricity could treat a range of diseases including arthritis, asthma and diabetes, a new company says.

Galvani Bioelectronics hopes to bring a new treatment based on the technique before regulators within seven years.

Life on the Home Planet

Indonesian fires sent huge smoke plume halfway around the globe (New Scientist)

Indonesian fires sent huge smoke plume halfway around the globe (New Scientist)

The fires that raged through Indonesia last year were the world’s worst since 1997. They generated a smoke plume so large that it wrapped itself halfway around the equator – fallout on a scale usually associated only with volcanic eruptions.

How this Japanese town produces 'zero waste' (City Lab)

How this Japanese town produces 'zero waste' (City Lab)

At the waste collection center in Kamikatsu, Japan, there are separate bins for different types of paper products: Newspapers, magazines, cartons, flyers. Then there are separate ones for cans: Aluminum, spray, steel. There are even individual bins for plastic bottles and caps.