Financial Markets and Economy

World stocks hit one-year high as U.S. data saps dollar, bond yields (Reuters)

World stocks hit a new one-year high on Wednesday, while the dollar and benchmark government bond yields sank and precious metals rose after weak U.S. productivity data again pushed back expectations of a Federal Reserve rate hike.

The chart that’s proving crash-happy bears wrong (Market Watch)

Market catalysts can be hard to find, or they can come around the corner and smack you in the face.

Soaring Debt Has U.S. Companies as Vulnerable to Default as 2008 (Bloomberg)

U.S. companies have taken on so much debt that they’re at least as vulnerable to defaults and downgrades as they were leading up to the 2008 financial crisis, according to a report by S&P Global Ratings Tuesday.

For Oil Companies $110 Billion Debt Wall Looms Over Next 5 Years (Bloomberg)

The worst may be yet to come for some strained oil services companies as $110 billion in debt, most of it junk rated, creeps closer to maturity.

Wall Street waits for a catalyst as stock futures hold near record levels (Market Watch)

Wall Street waits for a catalyst as stock futures hold near record levels (Market Watch)

U.S. stock futures on Wednesday pointed to a roughly flat open, putting the market on track for another day of muted action around record territory.

China’s Central Bank Plans Push to Increase Yuan’s Global Usage (Bloomberg)

China’s central bank said it plans to push the yuan’s global use by seeking more cooperation with other countries and improving the infrastructure needed to support wider use of the currency.

In recovering housing market, the starter home remains elusive (Reuters)

In recovering housing market, the starter home remains elusive (Reuters)

Seeking a yard for her two dogs and proximity to her new government job, Alison Owen set out to buy a home this spring in the hot market of Austin, Texas.

Copper Rises From 4-Week Low as Metals Rally on Fed Speculation (Bloomberg)

Copper advanced from its lowest close in about a month as metals gained after speculation that the Federal Reserve will be slow to raise interest rates weakened the U.S. dollar, boosting demand for commodities as an alternative investment.

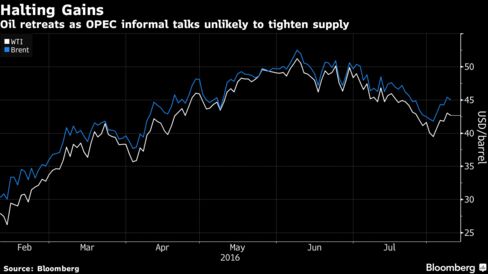

Oil Falls as Supply Glut Seen Shrinking Slower Than Expected (Bloomberg)

Oil fell as U.S. production was seen stronger than expected through 2017.

Asian shares near one-year high, dollar slips after soft U.S. data (Reuters)

June 4 Asian shares stepped back from their recent highs on Wednesday, while the dollar benefited from rising U.S. Treasury yields and pressure stayed on the euro ahead of expected easing steps from the European Central Bank.

Whistleblowers Are Poised to Collect $100 Million (Wall Street Journal)

After his warnings about Bernard Madoff’s Ponzi scheme went ignored for years, Harry Markopolos urged U.S. regulators to encourage tipsters. Now, the forensic accountant and a team he put together are in position to benefit from those new incentives.

Dollar under selling pressure ahead of Japan holiday (Market Watch)

The dollar declined Wednesday, primarily against the yen as Japan’s upcoming summer holiday season exaggerated the magnitude of the decline.

The Bank of England has a big problem (Business Insider)

The Bank of England has a problem.

Oil prices fall as uptick in U.S. production seen (Market Watch)

Oil prices fall as uptick in U.S. production seen (Market Watch)

Crude prices traded lower Wednesday, as traders and investors were discouraged by the upward revision in the outlook for U.S. crude production.

Nomura ‘Lost Control’ in Firing Salesman Over $40 Million Loss (Bloomberg)

Giovanni Lombardo, a bond salesman for Nomura Holdings Inc. in London, was starting to worry about Alberto Statti.

Palladium at Year High, Driving Precious Metals on Chinese Cars (Bloomberg)

Palladium touched a one-year high, leading gains in precious metals, as stronger Chinese car sales added to concerns over insufficient supply of the commodity used to reduce pollution from vehicles.

The pound has bounced back above $1.30 (Business Insider)

The pound has jumped by around 0.25% against the dollar on Wednesday morning, passing back above the psychologically significant $1.30 mark.

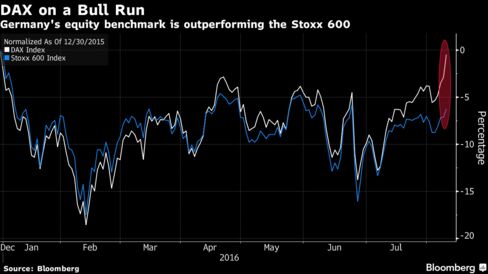

Investors Turn Backs on German DAX Just in Time for Bull Run (Bloomberg)

Volume has cratered, earnings estimates are down and forecasters are bearish on German stocks. And yet the benchmark DAX Index just rallied into a bull market.

One huge German market is about to be hit by a perfect storm of zero-interest rates and low inflation (Business Insider)

There is a perfect storm brewing in Europe's economy which is set to inflate Germany's housing market, according to Jefferies.

The Greatest Tech Businesses Aren't Really Tech (Bloomberg View)

The Greatest Tech Businesses Aren't Really Tech (Bloomberg View)

Technology companies are a lot like contemporary art: Their valuations reflect narratives more than anything else, and it's just as important to devise the right framework to describe a phenomenon as it is to build a beautiful product. Two New York consultants, Alex Moazed and Nicholas Johnson, have suggested an interesting way of looking at most of Silicon Valley's biggest tech-company successes: They are all platforms.

G4S Stock Jumps as Investors See Revival After Contract Scandals (Bloomberg)

G4S Plc, the world’s biggest security-services provider, rose the most since the merger that created it 12 years ago as investors saw signals of a recovery from scandals that included its handling of a contract for the 2012 Olympic Games in London.

The worst drought in decades is crushing Vietnam, but there's still hope things will get better later this year (Business Insider)

The worst drought in decades is crushing Vietnam, but there's still hope things will get better later this year (Business Insider)

It’s been understood for a while that Vietnam will probably not reach the ambitious growth target it set for itself in 2016. Its growth in the second quarter was a pretty lackluster 5.6%, bringing first half growth to a total of 5.5% — well below its 6.7% target.

Apple Said to Plan First Pro Laptop Overhaul in Four Years (Bloomberg)

Apple Inc. is preparing the first significant overhaul of its MacBook Pro laptop line in over four years, according to people familiar with the matter, using one of its older products to help reverse two quarters of sliding sales.

Apple iPhone lost Q2 market share in China, but iPhone SE offers hopeful signs (Venture Beat)

Apple iPhone lost Q2 market share in China, but iPhone SE offers hopeful signs (Venture Beat)

A new smartphone report confirms Apple’s struggles in China, but also points to some developments that may help the tech giant turn things around in this critical market.

In late July, Apple reported that in its third quarter (the three months ending June 30) sales in China dipped 33 percent compared to the same period a year ago.

Israel Eyes Second Import Terminal (Natural Gas Europe)

Israel Eyes Second Import Terminal (Natural Gas Europe)

The Israeli gas authority, an energy ministry department, supports more LNG imports, according to The Marker, a business daily. In order to accomplish that the authority will recommend building a second terminal. The first is offshore north of Tel Aviv and is operated by Israel Natural Gas Lines, a state-owned company. The only LNG importer is Israel Electric Corp. which is the biggest gas consumer in the country and most of the gas imports are for its own use.

US Futures Flat; Bonds Rise, Dollar And Oil Slide Over US Productivity Collapse Fears (Zero Hedge)

Following yesterday's muted action which saw the S&P500 close unchanged, it has been more of the same listless trading overnight, with US equity index futures little changed as the Nikkei fell on the back of a stronger Yen, while government bonds rose and European stocks reversed early gains following the BOE's expalantion in the aftermath of yesterday's failed bond monetization operation that the bank will "incorporate the shortfall into the second half of its 6 month program."

Politics

Maybe Trumpism Doesn't Work Without Trump (The Atlantic)

Maybe Trumpism Doesn't Work Without Trump (The Atlantic)

That House Speaker Paul Ryan easily won his congressional primary on Tuesday, by a nearly 70-point margin, should not have surprised anyone. Yet the political world was watching the result on tenterhooks, waiting for a surprise that never came. The fact that there was no upset was, in this season of political surprises, news of its own sort: a signal that perhaps the Trumpist ideology that has disrupted the Republican Party this year doesn’t work for anyone not named Donald Trump, and may not outlast him as a force in the GOP.

Newly Released Emails Highlight Clinton Foundation’s Ties to State Department (Wall Street Journal)

A conservative watchdog group on Tuesday released 296 pages of emails from former Secretary of State Hillary Clinton’s personal server, including many exchanges that weren’t handed over to the government as part of the Democratic nominee’s archive.

Clinton-Trump debate sites plan for a third podium (Politico)

Clinton-Trump debate sites plan for a third podium (Politico)

The venues that will host the presidential debates are drawing up plans for a three-person forum that would provide a lectern for a third-party candidate to stand on stage next to Hillary Clinton and Donald Trump.

Technology

Seagate’s new 60TB SSD is the largest the world has ever seen (The Next Web)

Seagate’s new 60TB SSD is the largest the world has ever seen (The Next Web)

Seagate just showed up Samsung with its latest product: its new 60TB SSD is the largest capacity drive of its kind in the world, and holds four times as much as Samsung’s recent offering.

Drop the Jackhammer and Fix Your Bridge With This Giant Waterpik (Wired)

Drop the Jackhammer and Fix Your Bridge With This Giant Waterpik (Wired)

Ah, water. Healer, destroyer, carver of rivers and shorelines, future of electricity. And now, bridge repairman.

This summer, Utah is running its first hydro demolition project. The name’s misleading, because the state’s department of transportation is using H2O to give two bridges a much-needed facelift. It’s an easier, faster, cheaper, and maybe more sustainable way to expand the span’s useful life by 15 years.

Health and Life Sciences

Diet Supplement May Help Prevent Kidney Stones (Medicine Net Daily)

Diet Supplement May Help Prevent Kidney Stones (Medicine Net Daily)

A dietary supplement may hold the power to dissolve a key component of kidney stones, potentially offering a new prevention tool against this painful condition, researchers say.

It's too early to be sure if the compound hydroxycitrate will become a preventive treatment for kidney stones, since extensive research in people hasn't begun.

The Beginning Of The End Of Candy Bars As We Know Them? (Forbes)

The Beginning Of The End Of Candy Bars As We Know Them? (Forbes)

The beginning of a candy bar is usually the end of a candy bar. But that’s not what I am talking about here. Current traditional candy bars certainly have had their heyday…and their Payday, but similar to soda, now face two major forces that are synergistic (like chocolate and peanut butter in a peanut butter cup). One force is the increasing attention to the global obesity epidemic and the health effects of sugar, which led the U.S. Food and Drug Administration (FDA) to recently require food manufacturers to begin listing “added sugars” on the Nutritional Facts labels by July 26, 2018. (Read here for the story.)

Life on the Home Planet

Rio 2016: It’s the Michael Phelps and Katie Ledecky Show (Wall Street Journal)

Rio 2016: It’s the Michael Phelps and Katie Ledecky Show (Wall Street Journal)

Just when it looked like the Rio Games would devolve solely into a finger-wagging meditation on anti-doping enforcement, the Michael and Katie Show takes over.

Vietnam moves new rocket launchers into disputed South China Sea (Reuters)

Vietnam has discreetly fortified several of its islands in the disputed South China Sea with new mobile rocket launchers capable of striking China's runways and military installations across the vital trade route, according to Western officials.