.jpg) There's not much gas left in this tank.

There's not much gas left in this tank.

Try as we might, we still can't get bullish on this rally. As I noted in Monday's live interview, it's a ridiculously low-volume rally and that's just not the way you make record highs that stick. It's actually more like the way that Banksters manipulate the markets to reel in the suckers to offload the last of their shares right before they pull the rug out from under the markets but, what do I know – we're only up 377% in the Short-Term Portfolio (follow us here) where I've successfully predicted every market dip since November of 2013…

This isn't about bragging, this is about establishing some credibility so perhaps you listen to me when I say THIS MARKET DOES NOT FEEL RIGHT. I've written extensively about what I think is wrong with this rally and so far, so wrong as far as getting a summer drop and it's August 10th and I said I'd give up and put some of our cash ($470,376) back to work.

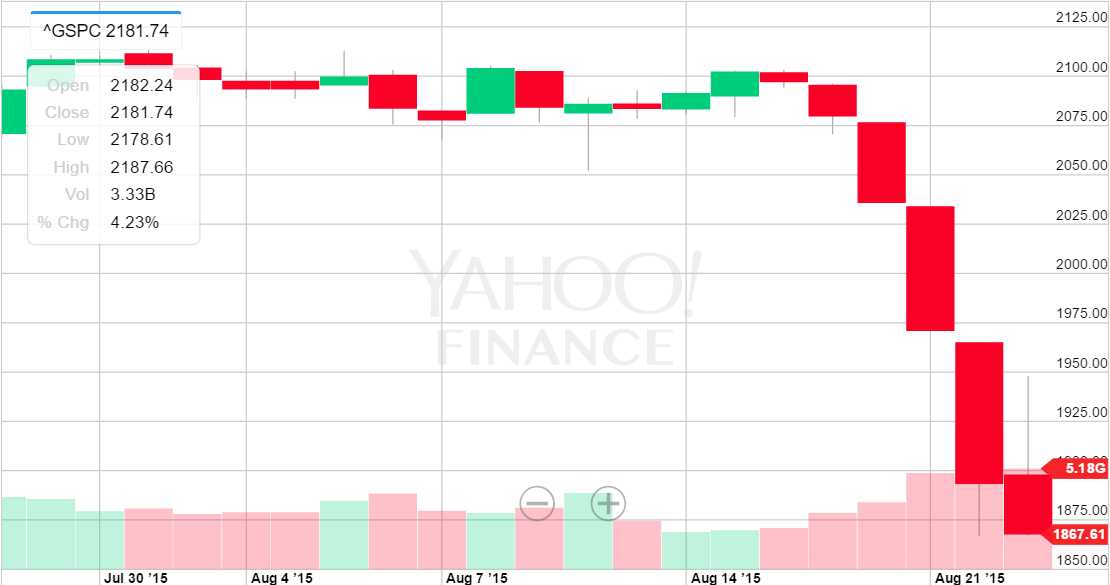

BUT, there are still 21 days left in August and last August 10th we looked pretty good too and all seemed very well until August 14th (Friday) when suddenly, on Monday the 17th, it wasn't. That led us to a horrific 250-point (12%) slide in the S&P in just over a week which tested the 1,850 line where we decided to BUYBUYBUY at the time – so it worked out great for us because our headlines were self-explanatory:

BUT, there are still 21 days left in August and last August 10th we looked pretty good too and all seemed very well until August 14th (Friday) when suddenly, on Monday the 17th, it wasn't. That led us to a horrific 250-point (12%) slide in the S&P in just over a week which tested the 1,850 line where we decided to BUYBUYBUY at the time – so it worked out great for us because our headlines were self-explanatory:

- July 8th: Which Way Wednesday – China is Down 5%, Why are you Looking at Greece???

- July 10th: Friday Market Fakery – Dollar Dip Does the TRICK!

- July 20th: Monday Market Manipulation – Everything is Awesome!

- July 21st: 2,130 Tuesdsay – 5th Time’s a Charm?

- July 22nd: Wednesday – Will AAPL $120 Cost Us Nasdaq 5,000?

- July 25th: Using Stock Futures to Hedge Against Market Corrections

- July 27th: China Meltdown Part II – NOW Are You Paying Attention?

- July 31st: Final Friday for Bull Run – Dow Death Cross Dead Ahead

- August 4th: Technically Troubling Tuesday – Collapsing Commodities Cause Concern

- Aug 11th: Technically F’d Tuesday – Death Crosses Hit Dow and NYSE Today!

- Aug 13th: Thoughtful Thursday – Contemplating the S&P 500

- Aug 17th: Monday Markdown – Morgan’s Fragile Five becomes the Troubled Ten

- Aug 18th: If China Drops 6% and no One Reports it, Does it Matter?

- Aug 20th: S&P Faces Critical Test at 2,060 – Will China Save Us?

- Aug 21st: China’s 11% Weekly Drop Finally Wakes the Sleeping Bears

- Aug 24th: Black Monday for the Markets – China Fails to Hold the Line

People are starting to FREAK OUT!

It's been so long since we've had a good old-fashioned market correction that many "investors" think the World is ending and are selling everything that isn't nailed down. Of course, in some cases they are right – especially if they are the kind of momentum chasers who piled into Netflix (NFLX) at over 250 times earnings or Tesla (TSLA) about the same or Amazon (AMZN) at 100 time earnings as they looked to carnival barkers like Cramer and Co. to hit the noisemakers and tell them how wise they were for following all the lemmings off a cliff.

- Aug 25th: Yesterday’s Trade Ideas Are Up $18,400 – Today it’s 3% Index Gains or Bust!

- Aug 27th: Shanghai Surprise Pops China 5% – Is Everything Awesome Again?

- Aug 28th: TGIF – Yesterday’s Fake GDP Number Allow Windows to Be Dressed

We nailed the bottom on Aug 24th and there was plenty of time to buy as we only bounced into Sept and then tested the lows again by the end of the month before racing back up in October, which we also called. Again, not bragging but how else to get you to listen when I say "I DON'T LIKE THIS MARKET AND I THINK YOU NEED TO BE WELL-HEDGED OR IN CASH!!!"?

Maybe I'm wrong – HOPEFULLY I'm wrong but it doesn't cost much to be wrong when you are cautious compared to what it costs to be wrong when you're not. It's not like we don't have any longs – we still have 39 long positions in our Long-Term Portfolio but they are well-hedged by our Short-Term Portfolio's decidedly bearish stance and they have kept us essentially even all summer and will hopefully do so in a correction as well.

We also have our Futures shorts and we'll be doing a Live Trading Webinar at 1pm, EST today where we'll go over Futures Trading Strategies and Techniques and this morning I sent out a note to our Members (and you can read it on Twitter or follow us on Facebook), laying out our shorting lines for the indexes today.

While the Nasdaq is at 5,225, the /NQ Futures are right on the 5,000 line and that's our favorite shorting line as it's an obvious stop above. Yesterday we ranged from 4,809 back to 4,783 and /NQ contracts pay $20 per point so $520 per contract up and down on that one. S&P (/ES) is another good short below the 1,280 line and, on the long side, we are playing Natural Gas (/NG) off the $2.60 line.

What we don't have that we had last year was an obvious downside catalyst like China leading us lower. Also, the indexes are technically in good shape, not showing exhaustion in their patterns quite yet and earnings have not been as bad as expected so maybe we won't need our hedges – but I'll sleep better knowing we have them for the next couple of weeks, anyway.