Wheeeeee – what fun!

Wheeeeee – what fun!

Over and over again they take us back to 18,500 on the Dow Futures (/YM) and 2,180 on the S&P Futures (/ES) and over and over again we short them and pick up $250-500 per contract. It's a suckers game and we're the guys with the cups challenging the bulls to find the red ball and the bulls are certain it's under one of those cups – just never the one they pick.

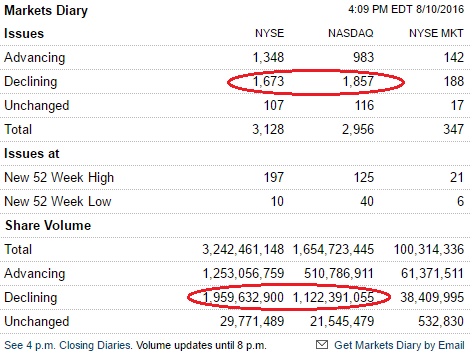

It should be like shooting fish in a barrel, making money in this market yet the average hedge fund is up 2% for the year, well behind the 6.5% gain in the S&P. Yesterday, as we predicted in our Morning Alert to our Members (and tweeted to the general public – as we do from time to time) the market took a nice dive and though it "recovered" to 2,175 on the S&P, the huge declining volume told a very different story.

I simply run out of ways to tell you what a horribly rigged market this is and that the "rally" is nothing more than a prop job to keep you buying at the top while the "smart money" runs for the hills. What I said to our Members at 6am was:

Dollar is still diving, testing 95.50 and the indexes are up a lot less than the Dollar is down so huge grain of salt to be taken on the Futures, which are at 18,500 (short on /YM there), 2,180 (good on /ES too), 4,800 (good short for /NQ), 1,232.50 on/TF (also a good short) and 16,800 on /NKD (yet another good short). Well – I guess I still like the shorts here!

The Dow bottomed out at 18,420 for a $400 per contract gain.

The S&P bottomed out at 2,168 for a $600 per contract gain.

The Nasdaq bottomed out at 4,770 for a $600 per contract gain.

The Russell bottomed out at 1,220 for a $1,250 per contract gain.

The Nikkei botomed out at 16,650 for a $750 per contract gain.

Where else can you get a stock market newsletter that specifically gives you 5 trade ideas that make $3,600 the same day? As I told you in yesterday's post – we have a lot of experience calling these things and we make calls like this every single day in our Live Member Chat room but I'm not telling you this to sell you a Membership – I'm telling you this so that perhaps you will believe me when I say I think these very predictable market signals are telling us a very different story than the cheer-leading MSM is and that it would be prudent to be extremely careful with your money for the moment.

Today we went long on Gasoline Futures (/RB) at $1.292 (as noted in yesterday's Live Trading Webinar). Why? Because 4 out of 5 weekends, despite any and all fundamentals, "THEY" tend to boost wholesale gas prices into the weekend so YOU will pay more at the pump to fill up your car, putting more money in THEIR pockets. It's a very simple theory based on the cynical corruption that pervades the US economy – we can't change it so we just make money off it!

We're also playing Natural Gas (/NG) long at $2.64 and that's not going well at $2.57 this morning but it's a long-term play, assuming things will pick up into January, but you need a strong stomach to ride it out. Futures trading is not for everyone and we only do it to pass the time while we wait for our long-term plays to mature. If natual gas does go significantly lower ($2.20), we'll be excited to get back into the Nat Gas ETF (UNG) but first, inventories are at 10:30 and we'll see if they tell us anything.

Meanwhile, there are plenty of stock bargains to be had. We'll be adding to Sunpower (SPWR) at $10 today, they took a viscious hit on earnings (down 30%). KATE is also looking exciting at $17 as their 13.7% revenue growth wasn't enough to satisfy traders who bailed on the stock because same-store sales were "only" up 4% in this dismal retail environment.

Meanwhile, with a net quarterly income of $26.8M in a slow quarter and a market cap of $2.2Bn, this is a reasonably-priced retail play at $17 but here's the difference at PSW – because we never pay retail for a stock! Step one for us in entering a new position is Buying A Stock for a 15-20% Discount – part of our video educational series. In the case of KATE, we can sell the 2018 $15 puts for $2.50, which nets us into the stock for $12.50, which is 26.7% below the current price.

Selling a put contract obligates us to buy the stock for (in this case) $15 in exchange for the contract buyer paying us $2.50 up front. They can never get that $2.50 back – all they can do is excercise the contract between now and January 2018, forcing us to buy 100 shares (per contract) of KATE for $15 ($1,500). That's our entire obligation, to buy KATE for $2.20 (12.7%) below the current price but we also have the $2.50 cash – giving us the net 26.7% discount.

If KATE never goes below $15, we simply keep the cash and don't end up owning the stock but we're more bullish than that and think the stock will go to $20 and, since we won't mind owning it for $15, we can treat the $2.50 we collected as free money and put it towards the following spread:

- Sell 10 KATE 2018 $15 puts for $2.50 ($2,500)

- Buy 10 KATE 2018 $15 calls for $5 ($5,000)

- Sell 10 KATE 2018 $20 calls for $2.95 ($2,950)

As the net of the spread is only $2,050 and we collected $2,500 for selling the puts, we still have a $450 credit so our net cost of Kate, if assigned, would be $14.55/share – and now we're back over our 15% discount target (15.4%). Our worst case is we own 1,000 shares of KATE for net $14,550 and our best case is KATE is over $20 and we make $5,000 plus the $450 we start with for a $5,450 gain on a -$450 cash outlay (1,211%?). The ordinary margin requirement on the short puts is only $1,500 – so no burden there either!

There are dozens of stocks like this we will be looking at now that we're mostly through earnings season. We're already well-hedged for a downturn that hasn't come – yet, so we may as well fill in the bullish side of our portfolio while we wait. As long as we have 15-20% cushions in our purchases – I'm comfortable adding smallish positions like this one.