Financial Markets and Economy

Oil prices rise on talk of possible exporter moves to prop up market (Reuters)

Oil prices edged up in early trading on Friday, extending gains from the previous session on expectations that exporters could at an upcoming meeting talk about ways to prop up a market that continues to be dogged by a supply overhang.

Oil ends near 3-week high as Saudi's hint at plan to stabilize crude market (Market Watch)

Oil ends near 3-week high as Saudi's hint at plan to stabilize crude market (Market Watch)

Oil futures rallied Thursday to their highest settlement in nearly three weeks as comments from Saudi Arabia’s energy minister raised the possibility that major producers will take action to stabilize the market at a meeting planned for next month.

Central banks are printing money as though the global economy is in freefall (Quartz)

Central banks around the world are now spending $200 billion a month on emergency economic stimulus measures, pumping this money into their economies by buying bonds. The current pace of purchases is higher than ever before, even during the depths of the financial crisis in 2009.

Bond Markets: Growing Ever More Bizarre (Wall Street Journal)

Central banks have always been able to make waves in markets. But never have they had such far-reaching effects, nor so quickly. The world of bonds is being turned upside down as a result.

Emerging Stocks Head for Fifth Weekly Gain as Yield Demand Rises (Bloomberg)

Emerging-market stocks headed for a fifth week of gains, the longest winning streak in more than two years, as optimism central banks will keep interest rates low and gains in oil prices spurred demand.

Surging OPEC crude production, talk of a freeze, and the meeting in Algiers (Platts)

As speculation swirls over whether OPEC will discuss a crude oil production freeze deal next month, the producer group's output has reached new heights, with the market share strategy still apparently in full swing. The likelihood of a deal emerging is doubtful, analysts say, and even OPEC president and Qatar energy minister Mohammaded bin Saleh Al-Sada insists that the oil market's fundamentals appear sound.

The Debt Markets Are Sending A Warning (Value Walk)

The Debt Markets Are Sending A Warning (Value Walk)

The fund returned 3% for the second quarter, net of fees and expenses, bringing year-to-date estimated net returns through June 30 2.81%. In the last quarter the fund made a number of changes to its portfolio significantly to reduce the risk profile of the fund. Many of Canyon’s recent investments have been in, “ballast” securities that, “are likely to anchor the portfolio and subdue its risk profile across a relatively broad spectrum of potential macro outcomes.”

Bad-Loan Deals Surge in Europe as Italian Banks Clean Up Assets (Bloomberg)

Bad-loan deals in Europe this year have already surpassed 2015’s total, driven by Italian banks’ efforts to clean up balance sheets, according to Deloitte LLP.

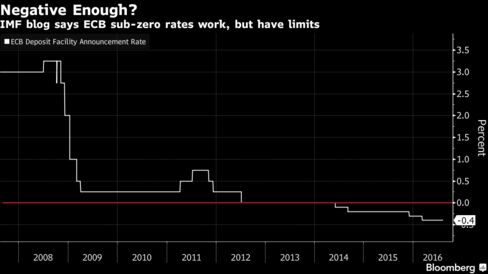

IMF Sees ECB Focus on More Asset Buying as Rate Cuts Near Limit (Bloomberg)

The European Central Bank may need to rely more on asset purchases for monetary stimulus as its negative interest rates approach the limit of their effectiveness, economists at the International Monetary Fund said.

A New York private-equity firm has raised what it believes is the largest amount of capital ever to invest in the legal marijuana industry (Business Insider)

A New York private-equity firm has raised what it believes is the largest amount of capital ever to invest in the legal marijuana industry (Business Insider)

Tuatara Capital has raised a $93 million fund to invest exclusively in the legal marijuana industry, The Wall Street Journal reported.

Abenomics Won't Work. And That's OK. (Bloomberg View)

Abenomics Won't Work. And That's OK. (Bloomberg View)

Japanese Prime Minister Shinzo Abe recently announced plans for yet another round of aggressive economic stimulus. But it's doubtful that this new initiative will make much difference.

Mexico President’s Approval Falls to 23% on Economy and Violence (Bloomberg)

Mexican President Enrique Pena Nieto’s approval has plunged in a poll by Reforma newspaper to 23 percent as most people surveyed said they saw the economy worsen and violence rise over the past year.

A Look at the Shocking Student Loan Debt Statistics for 2016 (Student Loan Hero)

It’s 2016 and Americans are more burdened by student loan debt than ever.

This is why China’s investors are crazy about bitcoin (True Wealth Publishing)

Bitcoin is on a tear.

Tesla rival LeEco building $1.8 billion EV factory in China (Engadget)

Tesla rival LeEco building $1.8 billion EV factory in China (Engadget)

China's EV industry hasn't produced many vehicles yet, but thanks to strong government incentives, it's on an explosive growth curve. One of the main players is electronics giant LeEco, which backs EV builder Faraday Future and recently showed off its own electric car, the LeSee. It unveiled plans for a $1.8 billion EV factory near the Chinese city of Huzhou that will pump out 400,000 EVs per year. The new plant "will be open to all LeEco's strategic partners including Faraday Future," says CEO Jia Yueting.

Macy's to close more stores in turnaround push, stock jumps (Reuters)

Macy's Inc said it plans to shutter 100 more stores, representing about 14 percent of its total, as it tries to turn around its business after six quarters of falling sales.

Negative Interest Rates: Have They Backfired Already? (Financial Sense)

Anyone with an ounce of common sense knows that negative interest rates cannot occur naturally, can only occur with government or central bank intervention, have nothing to do with free markets, and must fail eventually.

Why Oil Under $40 Will Bring It All Down Again: That's Where SWFs Resume Liquidating (Zero Hedge)

After several months of aggressive selling of stocks in late 2015 and early 2016, the culprit for the indiscriminate liquidation and concurrent market swoon was revealed when it emerged that the seller was not only China (which was forced to sell USD-denominated reserves to offset a surge in capital outflows following the Yuan devaluation), but also Sovereign Wealth Funds belonging to oil-exporting countries, who were dumping billions in risk assets to offset the collapse of the price of oil, which in turn exacerbated current account and budget deficits.

Gold Daily and Silver Weekly Charts – Late Day Selloff – Risk On But Stronger Dollar (Jesse's Cafe Americain)

Apparently the Street is looking for a good Retail Sales number tomorrow because it will include Amazon's 'Prime Day' promotion.

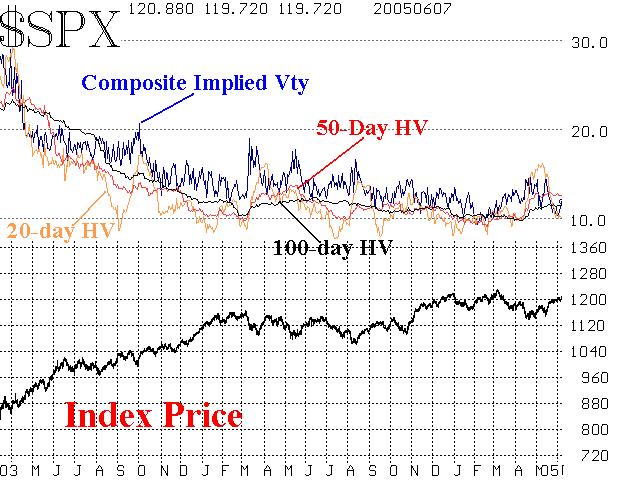

Preparing For A Volatility Increase (Option Strategist)

Before you declare me insane for even mentioning the words “volatility” and “increase” in the same sentence, let me point out that I am not saying that volatility will increase immediately. However, it will certainly increase sometime and that could happen as soon as the second half of this year.

Hyperinflation Defined, Explained, and Proven: Part III (Sprott Money)

Hyperinflation Defined, Explained, and Proven: Part III (Sprott Money)

In the first part of this series, the term “hyperinflation” was defined. “Inflation” is an increase in the supply of money. The prefix “hyper” denotes that something is excessive. Thus by necessary, logical extrapolation, hyperinflation can only be an excessive or exponential increase in the supply of money (currency).

Can Successful Trading Be Taught? (Trader Feed)

Can successful trading be taught? Consider this excellent post from Bella at SMB, describing what the folks at SMB have learned from the training and mentoring of successful traders. That post rings true for me, because I personally know (and have worked with) most of the traders Bella speaks about. I have observed their development and can vouch for the qualities that have made them winners.

Politics

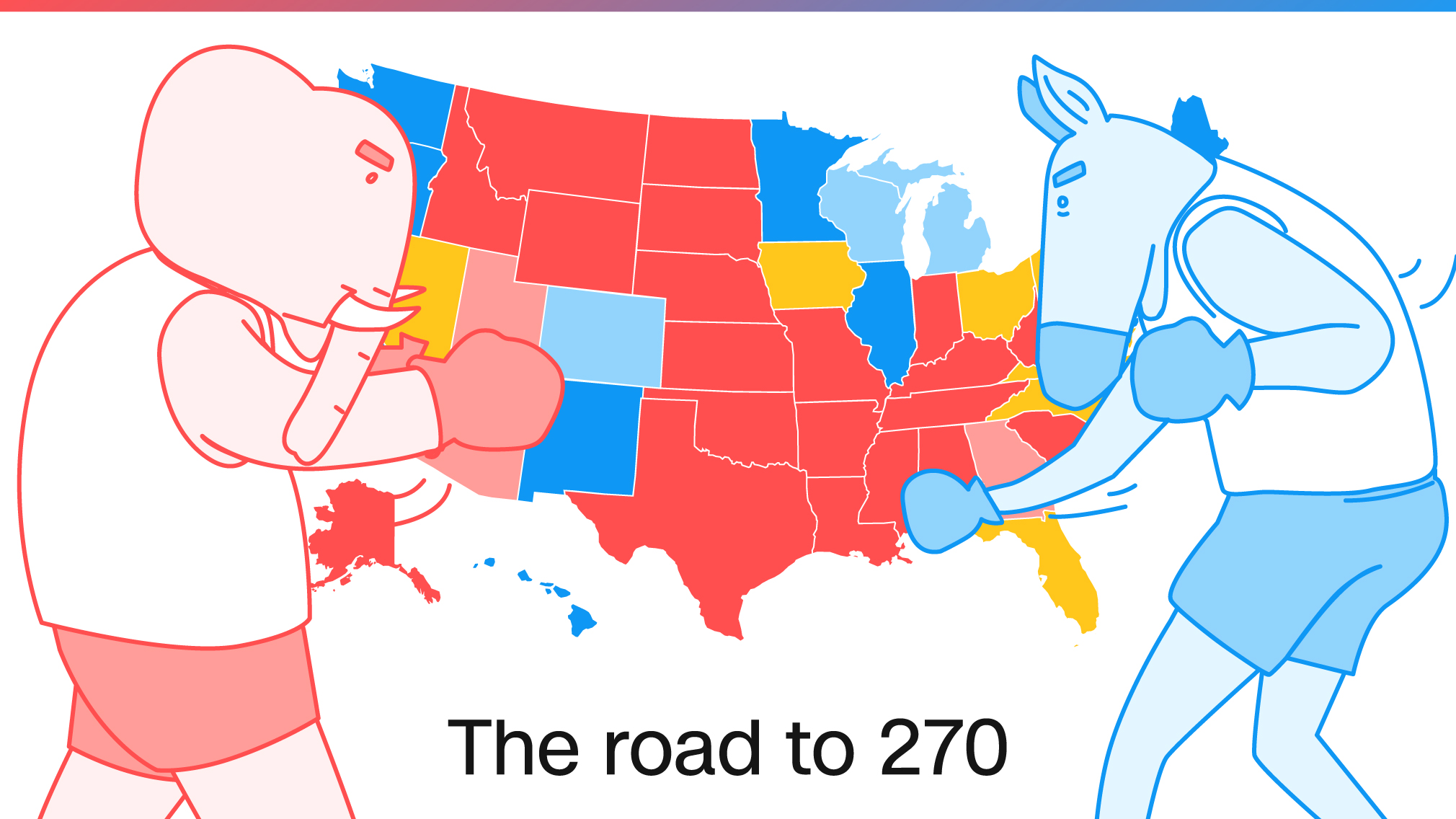

What Did Voters Learn from a Week of Economic Promises? (The Atlantic)

What Did Voters Learn from a Week of Economic Promises? (The Atlantic)

This week, the two major parties’ presidential candidates each made speeches that were meant to show all the good they could do for the country’s economy. But despite the hours Trump and Clinton spent speaking—and making clever criticisms of each other— in the end, there wasn’t all that much clarity on how, exactly, the myriad parts of each candidate’s economic plans would work together, and if they’d help, or hurt, the American economy in the long run.

Trump and Clinton battle over ISIS (CNN)

Trump and Clinton battle over ISIS (CNN)

Donald Trump on Wednesday and Thursday repeatedly called President Barack Obama the "founder" of ISIS and labeled Hillary Clinton the "co-founder" — after which Clinton used his comments to say they show he is not fit to be president.

Technology

Virtual reality helps eight paralysed people feel their legs (New Scientist)

Virtual reality helps eight paralysed people feel their legs (New Scientist)

Eight paralysed people have regained some feeling in their legs after training with brain-controlled robotic systems.

FCC filing reveals Google seeking to test wireless Fiber broadband in 24 U.S. locations (9 to 5 Google)

FCC filing reveals Google seeking to test wireless Fiber broadband in 24 U.S. locations (9 to 5 Google)

We learned back in April that Google was planning to experiment with wireless Fiber service to extend the reach of its high-speed broadband service beyond cities, but the company wouldn’t be drawn on where it had in mind. An FCC filing spotted by Business Insider now appears to provide the answer.

Health and Life Sciences

Researchers find brain's 'physics engine' (Science Daily)

Researchers find brain's 'physics engine' (Science Daily)

Whether or not they aced the subject in high school, human beings are physics masters when it comes to understanding and predicting how objects in the world will behave. A Johns Hopkins University cognitive scientist has found the source of that intuition, the brain's "physics engine."

After age 40, volunteering linked to enhanced mental health (Reuters)

Volunteer work may be good for your mental wellbeing, but only after age 40, according to a new study.

Life on the Home Planet

Aphrodisiac virus makes plants super-attractive to bumblebees (New Scientist)

Aphrodisiac virus makes plants super-attractive to bumblebees (New Scientist)

Going viral is a good thing. Viral infections can help some plants attract more pollinators and produce more seeds, essentially boosting – rather than hurting – their evolutionary fitness, a new study has found.

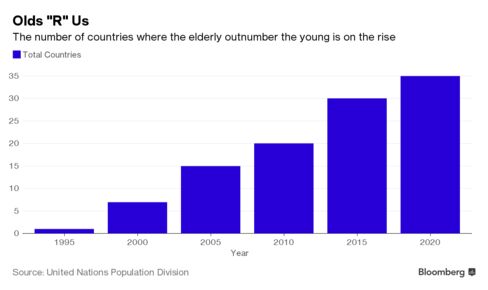

More Old Than Young: A Demographic Shock Sweeps the Globe (Bloomberg)

It’s known as the historic reversal, and it appears irreversible: Places where the old outnumber kids.