Financial Markets and Economy

Weak U.S. retail sales, inflation data dim prospect of Fed rate hike (Reuters)

U.S. retail sales were unexpectedly flat in July as Americans cut back on discretionary spending, pointing to a moderation in consumption that could temper expectations of a sharp pickup in economic growth in the third quarter.

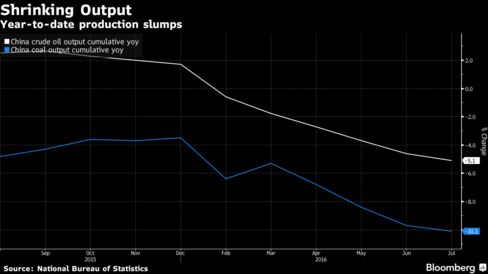

China’s Crude Oil, Coal Output Declines Deepen Amid Cutbacks (Bloomberg)

China’s crude oil and coal production declines deepened as the nation’s oil companies cut spending amid low prices and coal miners slashed output to meet government-set targets.

Mexico Said to Begin Quietly Hedging 2017 Oil Price in June (Bloomberg)

Mexico started quietly buying contracts to lock in 2017 oil prices when futures were near their peak in June, signaling the start of what has in prior years been the world’s largest sovereign petroleum hedge, according to people familiar with the deal.

Hong Kong's 'frothy' housing market could become a major problem (Business Insider)

Hong Kong's latest rebound could end up being just a blip.

11 of Wall Street's top analysts reveal their favorite stock picks (Business Insider)

Once in a while, it's good to step back and take stock of the state of things.

Home Equity Loans Come Back to Haunt Borrowers, Banks (Wall Street Journal)

The bill is coming due for many homeowners on a type of loan that was widely popular in the run-up to the housing bust, causing a rise in delinquencies at banks.

IMF says China's credit growth is unsustainable (Reuters)

The International Monetary Fund on Friday said China needed to slow its unsustainable credit growth and stop financing weak firms.

"China's corporate debt is still manageable, but at approximately 145 percent of GDP, it is high by any measure," said James Daniel, IMF Mission Chief for China, in the fund's annual review of the country.

Eurozone GDP growth rate halves in second quarter (Independent)

Eurozone GDP growth rate halves in second quarter (Independent)

Eurozone growth slipped back in the second quarter of the year and dried up entirely in Italy, the bloc’s most troubled large economy.

Eurostat reported that the single currency’s aggregate GDP expanded by 0.3 per cent in the three months to June, down from the 0.6 per cent rate in the first quarter.

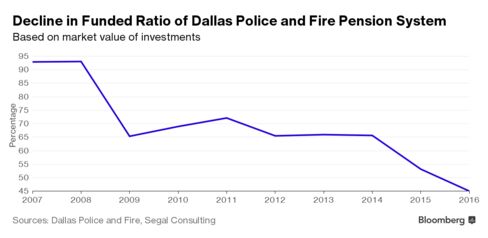

Once-Celebrated Dallas Pension Fund Runs Risk of Going Broke (Bloomberg)

The Dallas Police and Fire Pension System, once applauded for a diverse investment portfolio that included Hawaiian villas, Uruguayan timber and undeveloped land in Arizona, finds itself needing to dig out of a deep hole.

Solar Energy Is Powering New Careers And It Could Be Absorbing Coal Sector Job Losses (Forbes)

It’s an obvious symbolism — one where the sun is overhead and spreading power and light, compared to coal, which is underground where it is dark and dank. One is the future where the sky may be the limit and the other is the past, with many workers who will need to find new opportunities.

SunEdison shareholders denied official role in bankruptcy (Reuters)

A U.S. judge denied a request by shareholders of SunEdison Inc (SUNEQ.PK) for an official committee to represent them in the bankruptcy of the U.S. renewable power plant developer, which the judge described as "hopelessly insolvent."

It’s not just Trump: The GOP is not serious on the economy (The Washington Post)

In recent days, I have had a dream: that America has a real Republican Party, a party offering a serious right-of-center alternative to the Democrats. Such a contest of ideas would improve the public debate and offer Americans a real choice, not the cartoon campaign we have today.

Carney to Ignore Inflation Overshoot as Economists See Rate Cut (Bloomberg)

Bank of England Governor Mark Carney isn’t finished yet.

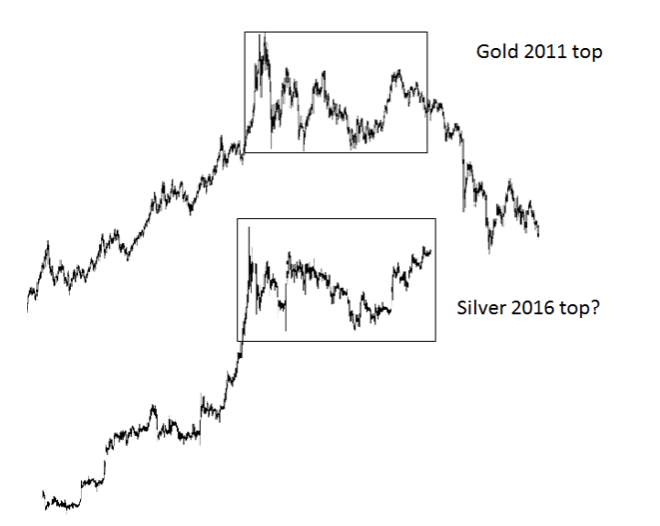

Silver: Spiking Higher, Or Topping Like 2011? (Seeking Alpha)

So far this month, we've had two contrasting outlooks for silver and the iShares Silver Trust ETF that tracks it.

Study Finds PayDay Lenders Charging 300% Interest (Forbes)

What is a fair amount of interest to charge for a short-term loan? It’s unlikely anyone would say 300%. Yet that’s one likely outcome if the move toward installment loans among payday lending continues unchecked, according to a review of the payday lending market by The Pew Charitable Trusts.

Nordstrom is officially a discount retailer (Business Insider)

Nordstrom is moving even further into the discount space.

"The Final Melt Up", "A Blow Off Top": Money Floods In As Investors Turn Euphoric At Triple Record High (Zero Hedge)

In a historic trifecta, yesterday for the first time this century, all three US indexes posted concurrent record highs. The last time this had happened was on December 31, 1999.

Politics

How Insane Are Republicans’ Tax Plans? Just Look at These Charts. (Slate)

The Republican primary campaign continues apace Tuesday night with another debate, this time on the Fox Business Network. Theoretically, the subject will once again be the economy, an issue the candidates have primarily dealt with by offering one titanic tax cut after another that would, of course, sink the federal budget unless they made equally massive spending reductions. If you've ever wondered what GOP policymaking might look like in a mathematically unconstrained conservative fantasia, these plans are it.

Bob Woodward So Tired Of How Both Sides Are Exactly As Bad As Donald Trump (Wonkette)

Bob Woodward So Tired Of How Both Sides Are Exactly As Bad As Donald Trump (Wonkette)

Bob Woodward is very upset with all the “hyperbolic, ungenerous rhetoric” in the presidential campaign, especially from Donald Trump, but you know, he worries that Both Sides Do It, don’t they? On MSNBC’s “Morning Joe” Thursday, Woodward grumped that while Trump has definitely said a lot of untrue things — like calling an American president “the founder of ISIS” — he also warned that people who oppose Trump are pretty terrible too, because Bob Woodward is A Idiot.

Technology

An Apple a Day: Apple Could Eye an All-New Device (Fortune)

An Apple a Day: Apple Could Eye an All-New Device (Fortune)

So far this summer, there have been countless rumors surrounding Apple’s 0.20% plans for the future. But Apple has largely remained quiet, leaving the rumor mill to talk about its plans.

How Nanotech Will Lead to a Better Future for Us All (Singularity Hub)

How Nanotech Will Lead to a Better Future for Us All (Singularity Hub)

How do we gain the immense benefits of advanced nanotechnology while avoiding its potential misuse?

This was Christine Peterson’s big question when she co-founded the Foresight Institute, a non-profit think tank focused on nanotechnology, three decades ago. And she says it’s still her guiding focus today.

Intel Reinvents Itself to Stay King in a Changing World (Wired)

Intel Reinvents Itself to Stay King in a Changing World (Wired)

Intel is bigger than all but 50 other U.S. companies, and that’s because of something called the CPU.

If you were around in the ’90s or the early aughts, you saw the TV ads. Intel Inside. For decades, Intel has supplied a majority of the chips that sit at the heart of our personal computers, including desktops as well as laptops.

Meet the Reactors Accelerating Us Toward Fusion Energy (Singularity Hub)

Meet the Reactors Accelerating Us Toward Fusion Energy (Singularity Hub)

The old joke about fusion is that it is 30 years from becoming a reality — and that’s been the case for the last 50 years or more. It’s a joke that may quickly be reaching its sell-by date.

Health and Life Sciences

4 Ways Successful People Learn More (Inc.)

4 Ways Successful People Learn More (Inc.)

Most people are inherently inquisitive. I spend a lot of time talking with our team about the value of curiosity. But over time, we can become set in our ways. Sometimes it seems easier to shrug off a new concept or task that appears difficult than to invest the time to master it.

Life on the Home Planet

We’re In A ‘Hurricane Drought’? Tell That To Victims Of Sandy, Irene And Ike. (Think Progress)

We’re In A ‘Hurricane Drought’? Tell That To Victims Of Sandy, Irene And Ike. (Think Progress)

You may have seen a headline in recent weeks that asserted “The U.S. coast is in an unprecedented hurricane drought” or “U.S. experiencing record hurricane drought”.

US Air Force wants to plasma bomb the sky using tiny satellites (New Scientist)

US Air Force wants to plasma bomb the sky using tiny satellites (New Scientist)

Can you hear me now? The US Air Force is working on plans to improve radio communication over long distances by detonating plasma bombs in the upper atmosphere using a fleet of micro satellites.

Since the early days of radio, we’ve known that reception is sometimes better at night.