Financial Markets and Economy

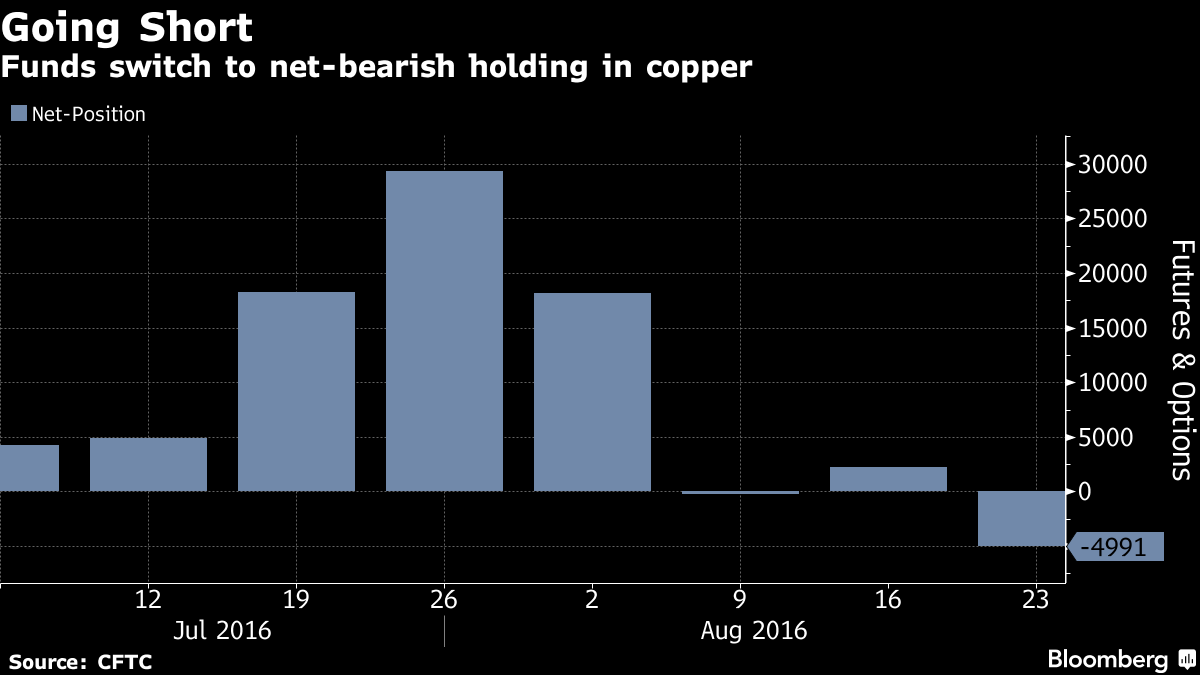

Hedge Funds Bail on Copper as Goldman Sees ‘Supply Storm’ (Bloomberg)

Copper is stuck in a rut.

While other metals have shined in 2016, copper has struggled to gain traction and last week erased its gains for the year. Demand in China, the world’s biggest user, is slowing just as Goldman Sachs Group Inc. predicts a “supply storm” will hit the market and drag prices even lower.

Jump in Job Loss Among Men in Japan Clouds Employment Picture (Bloomberg)

A growing number of men in their prime working years are joining the ranks of Japan’s long-term unemployed — unable or unwilling to adapt to a shifting labor market as opportunities continue to shrink in areas like manufacturing.

Yuan Trades Near Five-Week Low as Fed Signals Renew Pressure (Bloomberg)

China’s yuan traded near a five-week low, with the Federal Reserve’s signals of a potential interest-rate increase putting renewed pressure on Asian currencies.

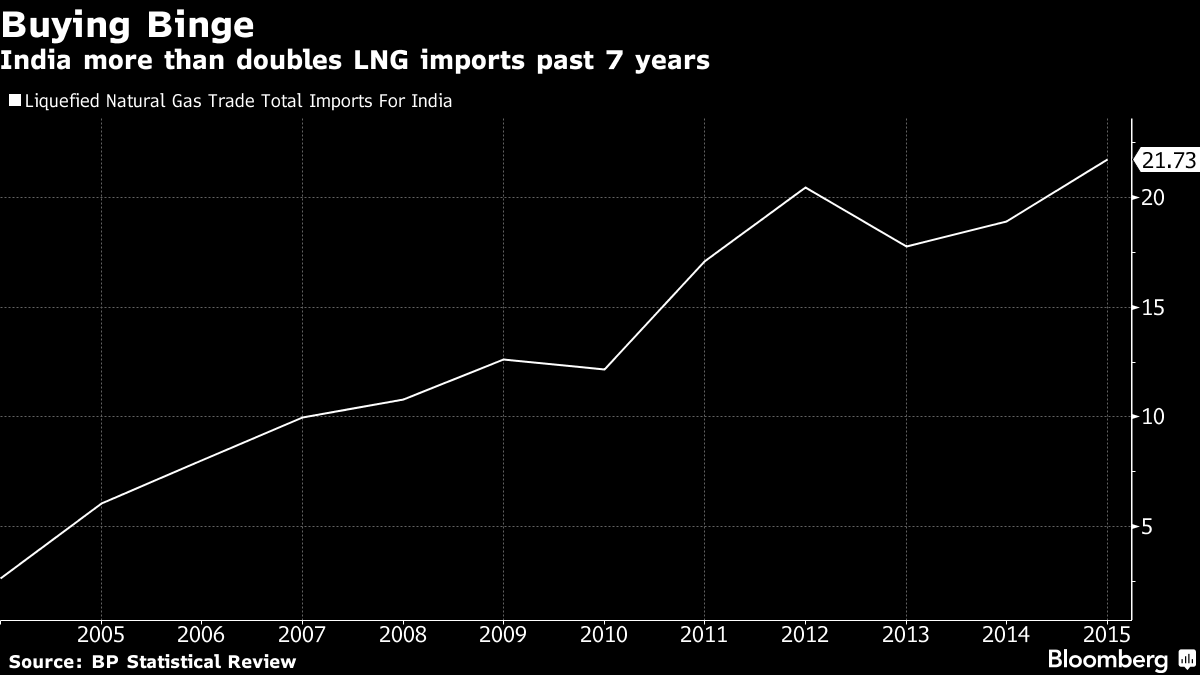

LNG Price Slump Sends Biggest Indian Refiner on Buying Binge (Bloomberg)

Indian Oil Corp., the nation’s biggest refiner that’s also boosting its liquefied natural gas business, is lifting purchases of the fuel to take advantage of a price plunge amid a glut.

Are Central Bankers Coming to a Bitter End? (Armstrong Economics)

Central bankers these days are seriously trapped. They cannot now reverse their policies for that means they have to admit that they have failed. This is why the Yellen is not so eager to move to negative rates and has continued to take the view that rates must be normalized (raised).

Digging Into China’s Growing Mountain of Debt (Bloomberg)

Some prominent investors are worried about China’s debt. George Soros sees an “eerie resemblance” between conditions in China now and those in the U.S. leading up to the financial crisis in 2008.

Singapore Central Bank Proposes New Rules for Bitcoin Startups (Coin Desk)

Singapore Central Bank Proposes New Rules for Bitcoin Startups (Coin Desk)

The central bank of Singapore has proposed a new regulatory framework for payments providers in the city-state, a move that would bring digital currency exchanges under its oversight.

QE, End of the Private Sector? Japanese Government Now Largest Shareholder of 474 Big Companies (Wolf Street)

The Bank of Japan and the Government Pension Investment Fund (GPIF) have been buying stocks to inflate the market, create some kind of “wealth effect,” and bamboozle regular Japanese into pouring once again into stocks, after many of them lost a big chunk of their savings when the prior bubble imploded without ever recovering.

Wrapping Up Jackson Hole: What Did We Learn? (Mish Talk)

Jackson hole did little more than make Fed Chair Janet Yellen look like a blithering fool.

Her chart of confidence levels on interest rates was just one of many silly things.

The Fed isn't the only game in town (A Wealth of Common Sense)

“Averages and relationships and trends and graphs are not always what they seem. There may be more in them than meets the eye, and there may be a good deal less.” – Darrell Huff

European Banks Prepare For "Economic Nuclear Winter" (Zero Hedge)

While some European bank stocks have scrambled back some of their plunge losses post-Brexit, the current uncertainty over when the U.K. will start the process of quitting the EU has banks on tenterhooks, with a source telling CNBC that banks are "preparing for an economic nuclear winter situation."

US Corporations Are Engaged in a Massive Debt-Binge – Here’s Why (Norman Mogil, Financial Sense)

Just as governments are cutting back on issuing new debt, the corporate sector has taken up the role of being the largest source of new debt in the United States

The U.S. Trade Deficit Is Not A Debt To Repay (Forbes)

It’s a presidential election year so the quadrennially-maligned U.S. trade deficit is taking its lumps. Donald Trump says the trade deficit means the United States is losing at trade, and it’s losing because U.S. trade negotiators aren’t smart enough.

Amazon Tests Out 30-Hour Work Week (David Z. Morris, Fortune, TIME)

Amazon Tests Out 30-Hour Work Week (David Z. Morris, Fortune, TIME)

The Washington Post reports that Amazon is launching technical teams whose workers will only clock in for 30 hours a week. While plenty of employees at Amazon are part-time, the novelty here is that the teams are entirely made up of workers on a reduced schedule, including managers.

Al Gore: The Clean Energy Revolution Is ‘A Dramatic New Reality (Think Progress)

Al Gore believes we are in a turning point in the fight against climate change. The latest version of his “Inconvenient Truth” slideshow, which helped win him a Nobel Peace Prize and an Academy award, is chock-full of charts, factoids, and quotes on the unprecedented revolution in clean energy technologies.

U.S. moves toward anti-dumping duties on truck and bus tires from China (Reuters)

The U.S. Commerce Department said on Monday truck and bus tires from China were being dumped in the United States at below-market prices, a potential step toward the imposition of duties.

Mission Creep – How the Fed will justify maintaining its excessive balance sheet (Bawerk.net)

FOMC have changed their normalizing strategy several times and we now see the contours of yet another shift.

Politics

Trump campaign manager: Clinton's immigration plans 'scary as heck' (Politico)

Relative to Donald Trump’s plan to deal with illegal immigration, the GOP nominee’s campaign manager said Hillary Clinton’s proposals are “scary as heck.”

This list includes current and former members of Congress, governors and high-level officials from Republican administrations. People shaded in blue have said they will vote for Hillary Clinton.

'This is unprecedented': Poll reinforces stunning fact about the presidential candidates (Business Insider)

A poll from Monmouth University released on Monday reinforced just how unpopular both presidential candidates are this election cycle.

Technology

FAA Expects 600,000 Commercial Drones In The Air Within A Year (National Public Radio)

FAA Expects 600,000 Commercial Drones In The Air Within A Year (National Public Radio)

We are in "one of the most dramatic periods of change in the history of transportation," says Transportation Secretary Anthony Foxx.

Amazon Angers Mom-and-Pop Sellers With ‘Arbitrary’ Suspensions (Bloomberg)

Andy Ayers was walking to his car in a Big Lots parking lot — shopping cart brimming with cereal, dog treats and Always brand feminine hygiene products he planned to resell for a markup on Amazon.com Inc. — when he got a phone alert that his account had been suspended.

Health and Life Sciences

Fossil Sleuthing Hints at What Killed “Lucy,” Our Iconic Ancestor (Scientific American)

Some 3.2 million years after she died and 42 years after scientists discovered her fossilized bones, the autopsy results of the famous human ancestor known as Lucy are in.

Life on the Home Planet

Coca-Cola: We're replenishing all of the water we use (CNN Money)

Coca-Cola says it has replenished all the water it used to make its drinks — a first for the company.

Typhoon Lionrock to Hit Japan’s Tohoku, Site of 2011 Tsunami (Bloomberg)

Typhoon Lionrock is projected to make landfall in Japan Tuesday and is likely to strike the northern Tohoku region, the area devastated by the March 2011 earthquake and tsunami.

The death of the middleman; and how it changes maritime transport (Shipping Today)

The death of the middleman; and how it changes maritime transport (Shipping Today)

Information technologies are killing the middleman. We have more information than ever before; as a result we see the decline of intermediaries in many areas.

You can now buy airline tickets with monthly payments (CNN Money)

CheapAir.com has teamed up with financial services company Affirm to allow fliers to take out three, six and 12-month purchase plans to cover their airfare.

Only in Palm Beach: The $95 Million Tear-Down (NY Times)

In 2008, Donald Trump sold a Palm Beach, Fla., estate for $95 million, making it the most expensive single residential property ever sold in town. Now the property is about to set another record — as Palm Beach’s most expensive tear-down.

New Solar Forecasting System Could Save Industry Hundreds Of Millions (Forbes)

New Solar Forecasting System Could Save Industry Hundreds Of Millions (Forbes)

A new solar forecasting system could save the solar power industry hundreds of millions of dollars and make it easier for grid operators and utilities to integrate high penetration levels of variable resources like solar into the electric grid.