Featured Today

What's always amazed me is how Elizabeth Holmes erected her $9B house of cards in the first place…

How Elizabeth Holmes's House of Cards Came Tumbling Down (Nick Bilton, Vanity Fair)

How Elizabeth Holmes's House of Cards Came Tumbling Down (Nick Bilton, Vanity Fair)

In a searing investigation into the once lauded biotech start-up Theranos, Nick Bilton discovers that its precocious founder defied medical experts—even her own chief scientist—about the veracity of its now discredited blood-testing technology. She built a corporation based on secrecy in the hope that she could still pull it off. Then, it all fell apart.

Financial Markets and Economy

Labor Day 2016: Moderate Progress in Last Year (Truth-out)

The story for workers in the United States has improved somewhat over the last year. The economy has created almost 2.5 million jobs, bringing the unemployment rate down by 0.4 percentage points.

Dollar Falls as Hunt for High Yields Spurs Emerging-Market Gains (Bloomberg)

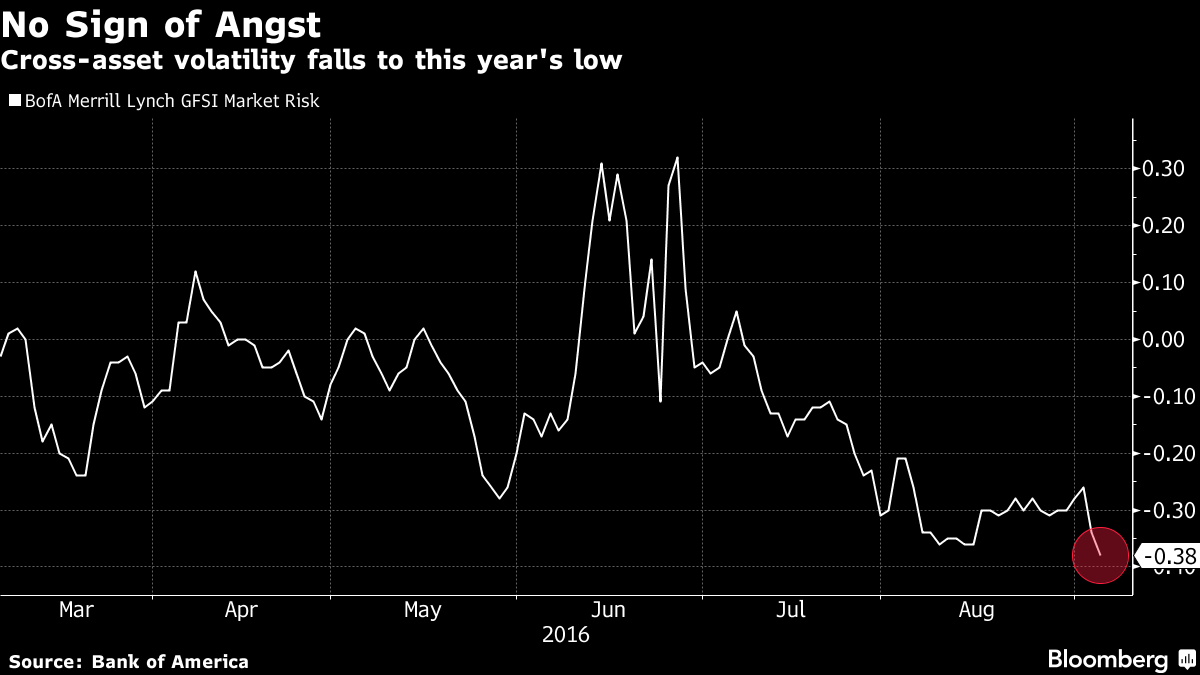

The dollar weakened against high-yielding currencies on confidence central banks around the world will go out of their way to avoid jolting financial markets.

A definitive breakdown of the sorry state of Wall Street (Business Insider)

Wall Street banks are having a terrible year.

Total revenue across the top 10 banks was down in the first six months of the year, according to the research firm Coalition. The total of $79.3 billion was 15% less than the $93.3 billion in the first half of 2015 and 23% less than the $102.4 billion in the first half of 2011.

Saudi Arabia and Russia Just Threw the Oil Market With a Big, Fat Head Fake (Fortune)

Crude spiked nearly $3 on a blast of hot air from top producers.

Crude oil prices rocketed, then fell back almost as precipitously, on Monday after big-sounding promises about restraining output by the world’s two largest producers—Saudi Arabia and Russia—turned out to be little more than big words.

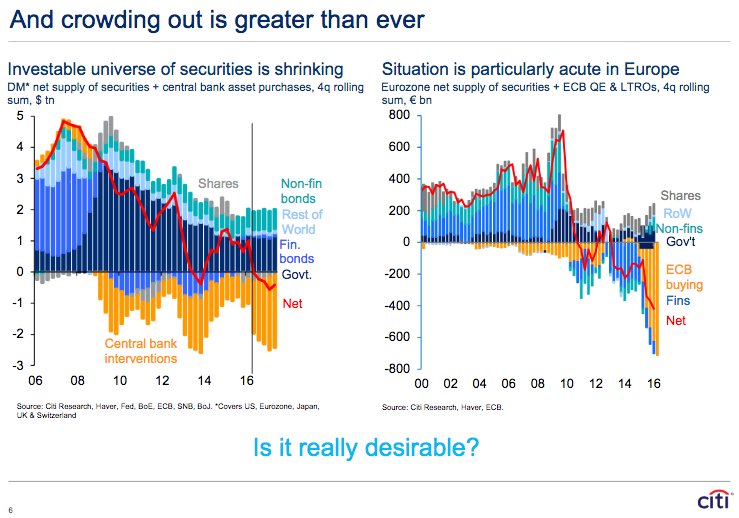

QE: quantitatively shrinking collateral reuse (Financial Times)

Adding to the QE scarcity concerns already highlighted by David earlier on Monday, here’s a couple of charts from Citi’s Hans Lorenzen …

Labor Day Summary: Wage Earners Have Taken A Beating (Of Two Minds)

Gordon T. Long and I discuss the decline of wages and employment and how this dooms the status quo.

Let's honor Labor Day by reviewing what's happened to wage-earners in the eight years since central banks "saved the financial system" with free money for financiers: wage-earners have taken a beating and been dumped in a ditch.

The economy may be growing but it sure doesn’t feel that way to most of us (The Guardian)

Figures released last week on capital and consumer spending in Australia suggest there remains a strong disconnect between the state of the economy for people and businesses. That is also likely to be found in the GDP figures to be released on Wednesday.

Saudi Arabia and Russia sign oil pact, could limit output in future (Reuters)

Saudi Arabia and Russia agreed on Monday to cooperate in oil markets, saying they will not act immediately but could limit output in future, sending oil prices higher on hopes the two top producers would work together to tackle a global glut.

UK services sector rebounds as companies shrug off Brexit vote shock (The Guardian)

UK services sector rebounds as companies shrug off Brexit vote shock (The Guardian)

Britain’s services sector enjoyed a record rise last month, as companies shrugged off the initial shock of the vote to leave the EU, according to a survey of business activity that adds to signs the economy has escaped recession in the immediate aftermath of the referendum.

G-20 Closes With Call for More Efforts to Boost Global Growth (The Wall Street Journal)

HANGZHOU, China—China rallied the Group of 20 around a call to use new levers to revive global growth, but the group’s nine-page statement was short on concrete steps and on signs that Beijing would lead by example.

Lower August Tax Collections Suggest US Near Recession, Fed To Delay Again (The Wall Street Examiner)

Real time withholding tax collections slumped badly in August after skyrocketing in July. The growth rate is now back to the lowest levels of the past year. As of September 1, the annual rate of change was +1% in actual, nominal terms versus the corresponding period a year ago.

How Central Banks Are LBOing The World In One Stunning Chart (Zero Hedge)

Last week we posted a chart from Deutsche Bank, showing that with a "global recovery" supposedly taking hold again, central banks are injecting a record amount of liquidity in the form of $2.5+ trillion in annual asset purchases by all central banks (more than $200 billion per month).

BlackRock Says Investors Need to Assess Climate Change When Investing (Reuters)

BlackRock, the world’s largest asset manager, said all investors should factor climate change into their decision-making and doing so would not mean having to accept lower returns.

FTSE weakens as Standard Chartered and Provident Financial fall (Reuters)

Britain's top shares index lost ground on Tuesday, as a drop in Asian-focused bank Standard Chartered (STAN.L) and Provident Financial (PFG.L) weighed on the market.

Ask Colorado Whether Infrastructure Spending Works (Bloomberg)

Ask Colorado Whether Infrastructure Spending Works (Bloomberg)

Here's something all of divided America should be able to agree on: Smart infrastructure investment works. For evidence, look at Colorado, where elected officials of both parties trace an economic boom to a decision 27 years ago to spend more than $2 billion on a new Denver airport.

Euro-Region Growth Bolstered by Exports as Investment Stalls (Bloomberg)

A surge in euro-area exports drove economic growth in the second quarter as domestic spending slowed, according to data published by the European Union’s statistics office in Luxembourg.

One Trillion Euros Spent & This Is What Draghi Has To Show For It (Zero Hedge)

It's been 16 months since the European Central Bank began its voyage into the unknowable in March 2015, and as The FT notes, this week marks a milestone – it has now purchased over EUR 1 trillion in government (and corporate) bonds since it began QE.

Investors Are Sticking With Pavlov's Dog Until Everything Breaks (Zero Hedge)

Remember when “bad news is good news” first leapt into common parlance? At first it was used as a way to describe the reaction function of Fed policy-makers.

Why Tesla's Cash Crunch May Be Worse Than You Think (Fortune)

Elon Musk has long been an enthusiastic advocate of controversial pro-forma accounting. Recently, Tesla’s founder and CEO introduced a creative new cash flow metric that’s supposed to present a truer picture of the electric automaker’s finances than do the official numbers.

ECB Board Member Lashes Out At Central Banking: Ignore "Mathematical Models", Focus On Reality (Zero Hedge)

At first (literally the day the Fed announced QE1) it was just "tinfoil fringe blogs" who predicted the failure of the central bank's attempt to boost the economy by printing money, instead warning that all the Fed would do is unleash an unprecedented income and wealth divide that may culminate in civil war and hyperinflation.

China's Productivity Growth is the Worst Since the Asia Crisis (Bloomberg)

Government employees playing badminton in a Tianjin office lobby in the middle of the afternoon. Hundreds of miles away in the northern city of Tieling, workers manually cut rubber truck parts in a tiny family workshop that makes about $600 a month.

Musk Confronts Wall Street Divided on Tesla in Plea to Workers (Bloomberg)

Elon Musk’s latest admonition to Tesla employees — produce more, spend less — is no simple belt-tightening before he asks investors for more cash. It also reflects Wall Street’s schism about the health of the electric-car maker.

Can Lululemon Stock Bounce Back After Last Week's 12% Slide? (Fool.com)

Can Lululemon Stock Bounce Back After Last Week's 12% Slide? (Fool.com)

Shares of lululemon athletica (NASDAQ: LULU) did their best downward-facing dog last week, plunging 12% after posting quarterly results. The fresh financials seemed decent at first glanceOpens a New Window., but at least one Wall Street pro didn't see it that way.

Lego Profit Slips as Toy Maker Ramps Up Investment (The Wall Street Journal)

Lego A/S, closing in recently on Mattel Inc. as the world’s biggest toy maker, hit an unexpected stumbling block Tuesday, reporting flat sales in the U.S. that cut first-half profits.

Barron’s Survey: Strategists Say Beware the Bear (Barron's Asia)

For the first time in years, there’s dissension in the ranks of the Barron’s strategists.

Why Harvard raising a record-breaking $7 billion is bad news for US education (Quartz)

Harvard University has raised $7 billion, since its fundraising campaign began in 2013. In the process, it has set a new record, beating Stanford University, which raised $6.2 billion in its last campaign that ended in 2011.

Low Taxes at Dozens of Firms in Spotlight After Apple Ruling (Associated Press)

Whether or not Apple used illegal breaks to pay virtually no taxes in Europe over 11 years, as regulators there contend and the company denies, the order last week that it pay billions in back taxes highlights a worrisome divide among the world's biggest corporations: Some pay relatively little taxes, others a lot.

Politics

Dan Rather Responds to Trump’s Immigration Speech (Moyers & Company)

Dan Rather Responds to Trump’s Immigration Speech (Moyers & Company)

Dan Rather first shared this post on his Facebook page. It is reprinted here with his permission.

Um. Wow. If anybody thought that Donald Trump would deliver a moderated speech on immigration, that ended pretty much in the first moments he walked onto the stage in Phoenix.

Trump’s history of corruption is mind-boggling. So why is Clinton supposedly the corrupt one? (The Washington Post)

In the heat of a presidential campaign, you’d think that a story about one party’s nominee giving a large contribution to a state attorney general who promptly shut down an inquiry into that nominee’s scam “university” would be enormous news. But we continue to hear almost nothing about what happened between Donald Trump and Florida attorney general Pam Bondi.

Missed the Interview With Putin? Here Are the Key Takeaways (Bloomberg)

Russian President Vladimir Putin on Thursday sat down for a rare interview with Bloomberg Editor-in-Chief John Micklethwait. The almost two-hour conversation in the Russian Pacific port city of Vladivostok delved into subjects ranging from the U.S. presidential election to the Syrian civil war, oil prices and state asset sales.

Obama Cancels Meeting After Philippine President Rodrigo Duterte’s Slur (NY Times)

Obama Cancels Meeting After Philippine President Rodrigo Duterte’s Slur (NY Times)

President Obama canceled a meeting with President Rodrigo Duterte of the Philippines scheduled for Tuesday in Laos, after the Philippine president directed an expletive at Mr. Obama on Monday.

Sonia Sotomayor and Elena Kagan Muse Over a Cookie-Cutter Supreme Court (NY Times)

COLORADO SPRINGS — As the Supreme Court prepares to return to the bench next month, its two newest members have been reflecting on the absence of Justice Antonin Scalia, who died in February, and on the striking lack of diversity among the remaining justices.

On Dec. 4, 2000, Salon ran a story by investigative journalist Greg Palast that added a whole new dimension to the controversy over the election in Florida — a premeditated, racially skewed effort to purge 173,000 likely Democratic voters from the rolls.

Hong Kong’s Election Results Have Been Slammed in Mainland Chinese Media (TIME)

Hong Kong’s Election Results Have Been Slammed in Mainland Chinese Media (TIME)

Beijing has emphasized its "resolute" opposition to Hong Kong legislators advocating self-determination

While mainland coverage of Hong Kong’s legislative elections has been thin on the ground, reactions from official media to polling results — which saw the election of young legislators favoring self-determination for the semiautonomous territory — has been vociferous.

Clinton Holds Steady Against Trump as Campaign Enters Final Weeks: Poll (NBC News)

Hillary Clinton's national lead over Donald Trump remains steady at 6 points, according to the latest NBC News SurveyMonkey Weekly Election Tracking Poll.

Stuck With Each Other, Xi and Abe Seek to Find Ways to Get Along (Bloomberg)

Japanese Prime Minister Shinzo Abe and Chinese President Xi Jinping agreed on the need to better manage ties when they met on Monday. They’ve got at least one shared reason to get along.

Technology

Billboards are far from dead in the digital age (Live Mint)

Billboards are far from dead in the digital age (Live Mint)

Big brands like McDonald’s and Comcast have long used billboards to promote their products, but now even tech companies like Foursquare and Snapchat use them.

Megaverse’s anti-gravity iPhone case is a modular solution to… everything (The Next Web)

If I’m being honest, I never really thought about the benefits of sticking my iPhone to walls.

The Industries Where Drones Could Really Take Off [Infographic] (Forbes)

In recent years, drone technology has attracted attention due to its use in countless conflicts around the world. Even though unmanned aerial vehicles (UAVs) have proven hugely successful in military service for decades, they also hold enormous commercial potential.

Health and Life Sciences

Memory Loss Associated With Alzheimer's May Be Preventable And Reversible (Forbes)

Memory Loss Associated With Alzheimer's May Be Preventable And Reversible (Forbes)

Alzheimer’s disease routinely appears at or near the top of diseases most feared by Americans. It’s terrifying to contemplate and devastating when it happens.

Magnetic particles from pollution have been found in human brains (Science Alert)

Toxic nanoparticles from air pollution have been found embedded in people’s brain tissue for the first time, and research has tentatively linked these particles to a higher risk of Alzheimer’s disease.

Life on the Home Planet

When You Change the World and No One Notices (Collaborative Fund)

Do you know what’s happening in this picture? Literally one of the most important events in human history.

British Airways computer glitch causes big delays at multiple airports (CNN Money)

British Airways says it has fixed a computer problem that caused delays and long lines at numerous airports.

The company's official Twitter account fielded a barrage of complaints from travelers at airports including Atlanta, Chicago and Boston late Monday. Others reported problems in the Bahamas and Mexico.

What Happens When 'The Walking Dead' Becomes 'The Working Dead'? (Forbes)

You know what regular zombies say: “Brains! More brains!” What do professional zombies, or zombie professionals say? Cartoon by Andy Singer.