Financial Markets and Economy

That 5.2% Jump In Household Income? Nope, People Aren't Suddenly Getting Big-Fat Paychecks (Wolf Street, Seeking Alpha)

We'll be hearing and reading about this for a long time, in all kinds of iterations: "Americans last year reaped the largest economic gains in nearly a generation," the New York Times gushed.

Asia's $1 Trillion Spoiler (Bloomberg)

Corporate earnings in Asia are bumping up against the law of diminishing returns. Loading up on debt is becoming both increasingly useless and progressively risky, giving CEOs an incentive to put prudence ahead of profit.

Global Markets Drift in the Run-Up to Key US Data (Associated Press)

LONDON (AP) — Global markets traded in narrow ranges Thursday ahead of a raft of U.S. economic data that could impact on market expectations over when the Federal Reserve will raise interest rates again.

Spooked Gold Bull Cohen Trims Holdings as Yields Rise (Bloomberg)

The Federal Reserve is giving some gold investors a case of the jitters.

Why A JPM Trader Just Said "This Is The Most Uncomfortable I’ve Felt Investing In 35 Years" (Zero Hedge)

In a repeat of what we said in our market wrap this morning, namely that the market's attention is transfixed on two things: long bond-yields (specifically if curve steepening will continue), and what the BOJ may or may not do, the WSJ writes that "speculation continued around the Bank of Japan, following a Nikkei report that the Japanese central bank will consider cutting interest rates further into negative territory."

Banks and Colleges Are Wasting Our Money (Bloomberg)

Let’s say you’re willing to do some job — say, regrouting a bathroom — for $15 an hour.

The Bank Of Japan Unleashes Chaos (Zero Hedge)

Last week we wrote an article in which we explained "How The Bank Of Japan May Be About To Unleash A Global Selloff."

The $18 Trillion Central Bank Experiment In Five Charts (Forbes)

Today let’s take a look at the total assets that have been hoovered up by the world’s biggest central banks, an activity that the central banks thought would lead to growth and the goldbugs thought would lead to hyperinflation. They’ve both been underwhelmed.

8 Reasons Why One Hedge Fund Is Keeping A Long VIX Position On (Zero Hedge)

With stocks soaring, now that the "Brainard" risk factor has been fully unwound after the Fed governor's surprisingly dovish speech which has essentially killed any probability of a September rate hike and unleashing today's ""Violent Rally In Risk" Today" as predicted earlier, one would expect that there is only smooth sailing not only until the September 21 FOMC meeting, leaving only the post-election December 13-14 Fed meeting potentially in play.

Harvard economist never thought his new study would take him where it did (Yahoo Finance)

This was a key finding in Harvard Business School’s study on competitiveness. Professors, led by Michael Porter, found the political system was actually a key cause in hindering the economic development of the US.

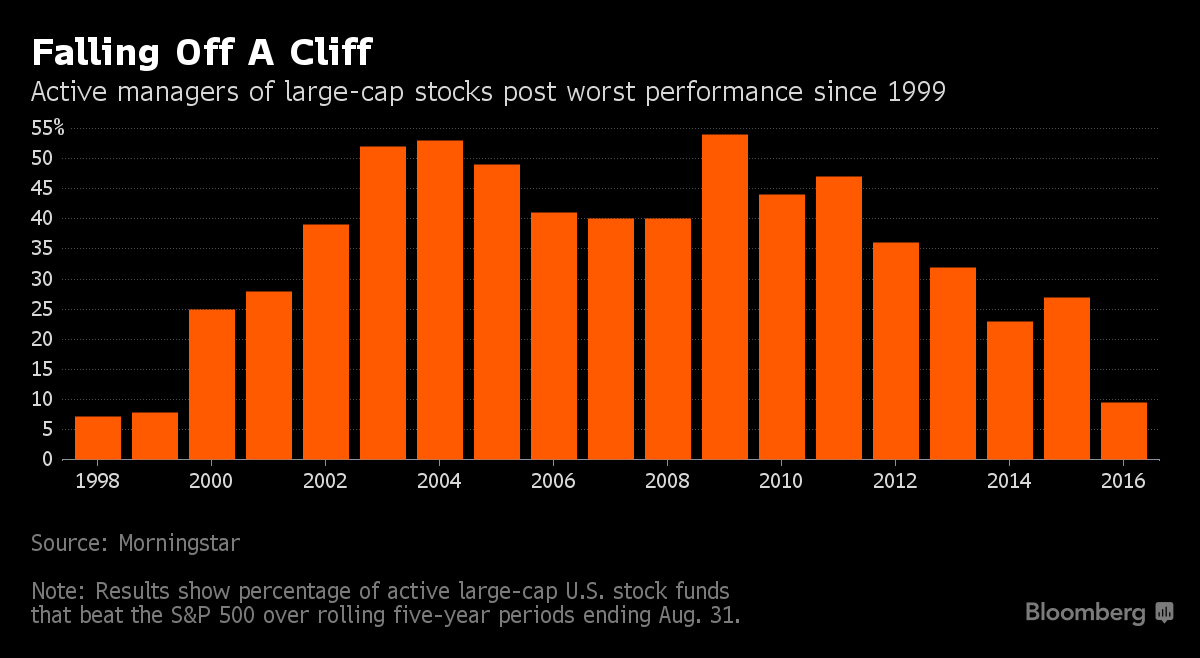

Failing to Measure Up Is $422 Billion Stock Pickers' Crisis (Bloomberg)

You don’t have to look far to explain why investors are yanking money from mutual funds run by stock pickers.

Japan's Central Bank May Up Easing Commitment, Analysts Say (Bloomberg)

A strengthened commitment by the Bank of Japan to maintain unprecedented monetary easing for a prolonged period would be a logical conclusion of its comprehensive review, analysts say.

Former Treasury Secretary says banks may be riskier now than in the 2008 crisis (Sovereign Man)

“Sir. SIR! This your bag,” the TSA agent barked at me last week, more as a statement than a question.

Japanese Employees Rarely Switch Jobs, Ask for Pay Raises (Benchmark, Bloomberg)

Japanese Employees Rarely Switch Jobs, Ask for Pay Raises (Benchmark, Bloomberg)

In contrast to job-hopping Americans, Japanese workers rarely jump to different companies, likely frustrating policy makers’ efforts to drive wages up.

DoJ Asks Deutsche Bank to Pay $14 Billion in Mortgage Settlement (Naked Capitalism)

The Wall Street Journal reported that the Department of Justice is seeking $14 billion from Deutsche Bank to settle its claims in a series of mortgage abuses. According to the Journal, Deutsche’s position is that $2 to $3 billion as a reasonable figure. Analysts anticipated that the maximum settlement amount would be in the $4.5 to $5 billion range.

Oil Set for Weekly Drop as Resilient Supply Seen Sustaining Glut (Bloomberg)

Oil headed for a weekly loss on speculation a global crude glut will persist as disrupted supply returns and demand growth slows.

Oil Glut Bomb: New Data Suggests Global Economy Too Weak To Hold Up Oil Prices (Forbes)

IEA and EIA dropped an oil-glut bomb this month. Their September monthly reports indicate that the world continues to have a glut of oil with little hope of a balanced market in the near future.

This Bond Market Sell-off Looks a Lot Like ‘Taper Tantrum,’ the Sequel (Bloomberg)

JPMorgan Chase & Co. analysts led by Jay Barry point out that the latest sell-offs in government bonds and the rising yields they've produced resemble the 'taper tantrum' that engulfed markets back in 2013 as investors fretted about the potential for the Federal Reserve to reduce the pace of its asset purchases.

A Rebounding Economy Remains Fragile for Many (NY Times)

A Rebounding Economy Remains Fragile for Many (NY Times)

WASHINGTON — The eye-popping improvement in economic fortunes last year raises the question: If incomes are up and poverty is down, why is Donald J. Trump’s message of economic decay resonating so broadly?

Optimism Fades for Economic Boost By Year-End (The Wall Street Journal)

Cautious consumers, retrenching manufacturers and scant signs of inflation are diminishing optimism about a breakout in economic growth in the final stretch of the year.

Companies

Apple’s 21% Rally Is Tough Pill for 295 Funds That Bailed (Bloomberg)

Apple Inc.’s third-quarter rally is unwelcome news to the unusually large swath of investors who have been giving up on the stock.

Apple is a sexist, toxic work environment (Engadget)

Apple is a sexist, toxic work environment (Engadget)

Apple made improving its employee diversity a focal point in recent years — but the company is still dominated by men. Women only make up 32 percent of its total workforce, and that imbalance has reportedly manifested itself in some very ugly ways.

Bayer's $66bn takeover bid of Monsanto called a 'marriage made in hell' (The Guardian)

Bayer's $66bn takeover bid of Monsanto called a 'marriage made in hell' (The Guardian)

German chemical giant Bayer’s $66bn (£50bn) deal to buy controversial US agrochemical giant Monsanto and create the world’s largest seeds and pesticides company is “a threat to all Americans” and should be blocked, Bernie Sanders said on Wednesday.

Thousands Work Daily at Japan Nuclear Plant Selling No Power (Bloomberg)

More than 6,000 workers cycle through the world’s biggest nuclear plant every day to operate and maintain a facility that hasn’t sold a kilowatt of electricity in more than four years.

Lyft Sued For Millions For Allegedly Overcharging New Yorkers (The Huffington Post)

A potential class-action lawsuit filed earlier this week in New York City claims Lyft has regularly overcharged riders for tolls there and seeks nearly $60 million in damages.

Politics

Voters’ View of a Donald Trump Presidency: Big Risks and Rewards (NY Times)

Voters’ View of a Donald Trump Presidency: Big Risks and Rewards (NY Times)

With less than eight weeks before Election Day, Donald J. Trump and Hillary Clinton are locked in a tight contest, with both candidates still struggling to win the confidence of their respective bases, the latest New York Times/CBS News poll finds.

Donald Trump’s new economic policy plan would be devastating to the climate (Think Progress)

If you’re a voter who cares about stopping climate change, you really need to read Donald Trump’s newest economic policy plan.

Why Trump isn't actually that close to winning (The Fiscal Times)

Despite all the breathlessheadlines to the contrary, the presidential race between Hillary Clinton and Donald Trump isn’t really that close right now.

Trump's Environmental Policy: You're Fired, Earth (Gizmodo)

Trump's Environmental Policy: You're Fired, Earth (Gizmodo)

Trump never was much for the environment. The man who calls global warming a Chinese hoax and questions the existence of California’s drought has made it clear he has better things to do than worry about his Florida properties going underwater.

One Beneficiary of Clinton’s Complex Tax Plan: Tax Lawyers (NY Times)

It’s hard to imagine a tax code more complicated than the one we already have. Hillary Clinton has come up with one.

Trump’s potential SCOTUS appointee thinks America took a wrong turn when women got the vote (Think Progress)

Peter Thiel, a libertarian billionaire known for funding a lawsuit seeking to destroy the media company behind the website Gawker, is a leading candidate for the Supreme Court in a Trump administration, according to reporting by the Huffington Post’s Ben Walsh and Ryan Grim.

Technology

The 92 features that make iOS 10 a fine, free upgrade (Yahoo Finance)

Hey, guess what? You can upgrade your iPhone to iOS 10 today! 92 new features, yours free!

Driverless cars are going to wipe out 4 million jobs (Wolf Street)

Tesla made headlines the other day with the first traffic fatality caused by its “Autopilot” system, which had failed to “see” a big tractor-trailer rig that had pulled right in front of the car.

Buying Your iPhone 7 And Plan: Buyers Could Overspend By As Much As $1,074 (Forbes)

Buying Your iPhone 7 And Plan: Buyers Could Overspend By As Much As $1,074 (Forbes)

The new iPhone 7 is set to launch on Friday amid rumors of sold-out pre-orders and intrigue regarding Apple AAPL +9.62%’s decision not to disclose launch weekend sales.

U.S. Consumer Safety Agency Recalls Samsung Galaxy Note 7 (The Wall Street Journal)

The Consumer Product Safety Commission on Thursday announced a formal recall of the Galaxy Note 7 phone, which has sparked fires and a global crisis for Samsung Electronics Co.

The Bot Economy Is Growing Even Faster Than the App Economy Did (Bloomberg)

Move over apps, it's time for the bots to shine.

This wall-climbing robot will be the death of us all! (Holy Kaw)

Ok, maybe it is just a little bit alarmist to say that this wall-climbing robot is going to usher in the robot apocalypse––but it’s still a little freaky. Or maybe this will just make building inspections a thousand times more efficient.

Health and Biotech

CRISPR Targets Cancer in First Human Trial — What You Need to Know (Singularity Hub)

CRISPR Targets Cancer in First Human Trial — What You Need to Know (Singularity Hub)

On Tuesday June 21, an advisory panel from the National Institute of Health (NIH) green lighted a proposal to use the game changing technique to tackle three different kinds of cancer. Scientists at the University of Pennsylvania (UPenn), who are spearheading the small trial, hope to use the technique to edit genes in a patient’s own immune cells, reprogramming them to recognize and attack cancer at the first signs of growth.

A 93-year-old drug that some children can't live without tells us everything that's wrong with American healthcare (Business Insider)

Insulin has been around since 1923, so it came as a surprise in July 2015 when Cole LePere's doctor told his mother, Janine, to prepare to pay a lot at the pharmacy for it.

Life on the Home Planet

How much is Saudi Arabia to blame for Islamist terrorism? Iran says entirely. (The Washington Post)

How much is Saudi Arabia to blame for Islamist terrorism? Iran says entirely. (The Washington Post)

In what's becoming almost a recurring theme, Iran's Foreign Minister Mohammad Javad Zarif wrote an op-ed in the New York Times attacking Saudi Arabia, a long-standing geopolitical foe of the Islamic Republic.

As Colin Kaepernick’s Gesture Spreads, a Spirit Long Dormant Is Revived (NY Times)

Colin Kaepernick, the San Francisco 49ers quarterback who touched off a national debate when he chose not to stand during the playing of the national anthem before games, has emboldened a handful of other players to follow suit.

More Americans Have Been Shot to Death in the Last 25 Years Than Have Died in Every War (Mother Jones)

On Monday, yet another deadly shooting—this time at Mississippi's Delta State University—made national news. At least one person was killed, and as of Monday night, the suspect had not been apprehended.

In a hungry Venezuela, buying too much food can get you arrested (The Washington Post)

In a hungry Venezuela, buying too much food can get you arrested (The Washington Post)

BARQUISIMETO, Venezuela — The hunt for food started at 4 a.m., when Alexis Camascaro woke up to get in line outside the supermarket. By the time he arrived, there were already 100 people ahead of him.

Four Studies Find ‘No Observable Sea-Level Effect’ From Man-Made Global Warming (CNS News)

Ten years after former Vice President Al Gore warned in his 2006 Oscar-winning film, An Inconvenient Truth, that if nothing was done to stop man-made global warming, melting Antarctic and Greenland ice sheets could raise sea levels by up to 20 feet, four peer-reviewed scientific studies found “no observable sea-level effect of anthropogenic global warming.”