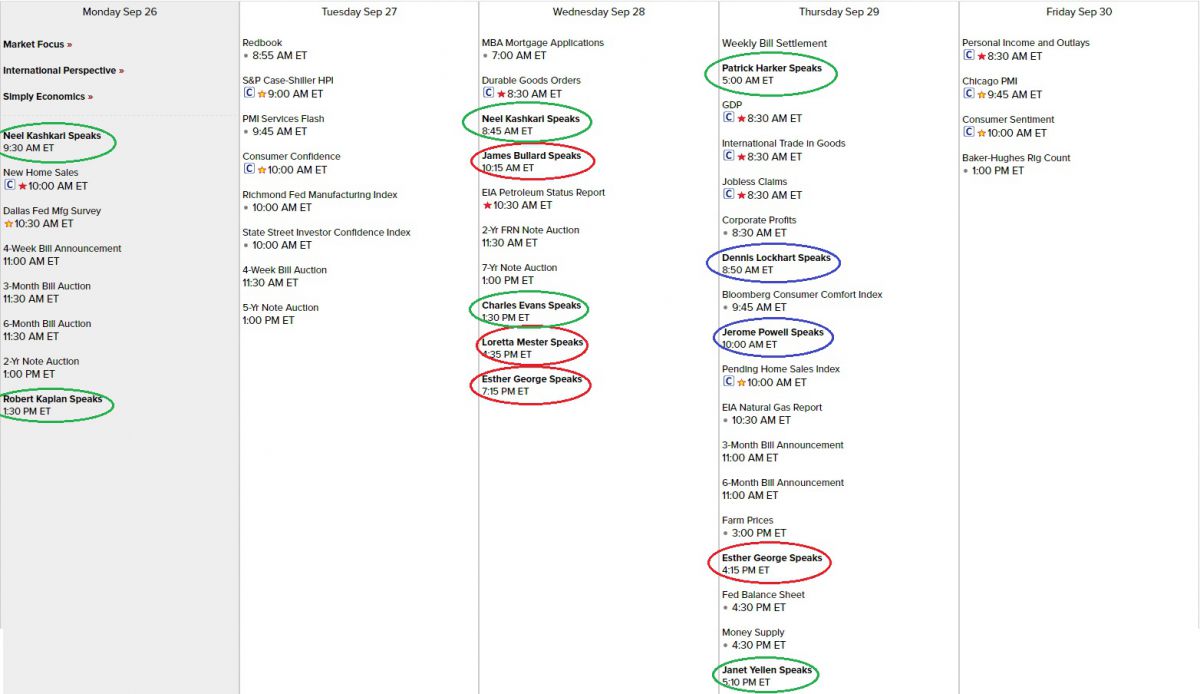

Last Wednesday, the Fed released the most divisive statement in many years with 3 Governors (Geoge, Mester and Rosengren), all of whom have expressed the opinion that the Fed needs to tighten now and stop dithering around. Sadly, other than Bullard, the hawks are vastly outnumbered this week and the last word goes to Grandma Dove, Yellen, who rides in at 5pm on Thursday to help dress those windows for the last day of the quarter.

If you think that makes it all seem like a gigantic, manipulated scam – you are catching on! Notice the only hawk allowed to speak during trading hours is Bullard and he speaks right ahead of a 7-year note auction – a time when the Fed WANTS to scare investors back to the bond market. There's a very strong correlation between days our Government needs to borrow money (bond auctions) and days when the market falls – making it look unattractive by comparison – even against 2% 10-year notes.

How else do you think a country can go over 100% of it's GDP into debt and still borrow money at rates that don't even keep up with inflation? There has to be FEAR somewhere, but you sure wouldn't know it from record-high stock indexes, would you? Keep in mind that being in debt 100% of your GDP is like you being 100% of your gross salary in debt, before taxes.

How else do you think a country can go over 100% of it's GDP into debt and still borrow money at rates that don't even keep up with inflation? There has to be FEAR somewhere, but you sure wouldn't know it from record-high stock indexes, would you? Keep in mind that being in debt 100% of your GDP is like you being 100% of your gross salary in debt, before taxes.

If you make $100,000 and lose $35,000 to taxes and have a $2,000 mortgage ($24,000) and $1,500 in monthly home expenses (taxes, insurance, utilities, groceries), that's $18,000 and maybe you have 2 cars for $1,000 month ($12,000) which leaves you with $11,000 in discretionary income and THAT is what you have to pay back your $110,000 of debt.

Then there's interest on the debt. If it's just 1%, like the US debt, then you are paying $1,100 in interest but that's still 10% of your disposable income. What happens if rates go up – what will you be sacrificing? Also, how's that saving for college and retirement going? No wonder 80% of American families have little or no retirement savings – this is the example for $100K earners – that's double the average US income!

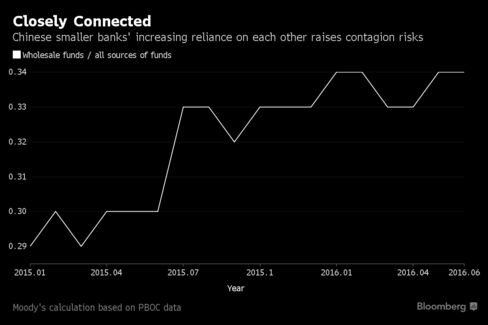

China, as I mentioned last week, is in a full-blown crisis but, then again, so is Japan. Both nations are approaching 3x their GDP in debt and both have been pouring Trillions into, so far, failed stimulus measures. China's banks are so desperate for cash that they are borrowing from each other and Moody's warns they are now in danger of a serious liquidity crisis.

China, as I mentioned last week, is in a full-blown crisis but, then again, so is Japan. Both nations are approaching 3x their GDP in debt and both have been pouring Trillions into, so far, failed stimulus measures. China's banks are so desperate for cash that they are borrowing from each other and Moody's warns they are now in danger of a serious liquidity crisis.

"Contagion risks are definitely rising," said Liao Qiang, Beijing-based senior director for financial institution ratings at S&P Global Ratings. "The pace of the development is concerning. If this isn’t stopped in time, the central bank will lose some control and flexibility of its monetary policy."

"The higher the reliance on wholesale funds and investment in illiquid assets, the greater the risk of a liquidity crunch," said Christine Kuo, a Hong Kong-based senior vice president at Moody’s. "When banks face fund withdrawals by other financial institutions, this will in turn prompt them to call back their own funds," she said. Tick, tick, tick, tick….

We jumped the gun on Wednesday when my morning post title was: "Wednesday Wipeout – BOJ and FOMC Fail to Please Investors – Market Falls." Apparently, it took a couple of days for the full weight of our disastrous economic situation to sink in for the other investors and this morning we're right back to good old 2,150 on the S&P and we'll see if it holds from the top this time.

We jumped the gun on Wednesday when my morning post title was: "Wednesday Wipeout – BOJ and FOMC Fail to Please Investors – Market Falls." Apparently, it took a couple of days for the full weight of our disastrous economic situation to sink in for the other investors and this morning we're right back to good old 2,150 on the S&P and we'll see if it holds from the top this time.

Actually, we were kind of right as our shorts made good money in the morning and, at 12:32, in our Live Member Chat Room, I called the bottom, saying:

Wow, we're red already. Obviously we'll cash in our shorts ahead of the Fed – not worth the risk after such nice gains.

18,050, 2,135, 4,800, 1,225 and 16,500 are now our stops.

We had a Live Trading Webinar (replay available here) that day and decided we wanted to short again, into the rally and, into the close, having our new Fed information, I said to our Members:

Futures – I don't know how Europe and Asia will react to this but I do like the short lines at 18,200 (/YM), 2,155 (/ES), 4,850 (/NQ) and 1,240 (/TF) and /NKD is back to 16,600 on a weak Dollar (95.50) so it's worth a toss but we've already taken losses twice today and I certainly don't have enough faith to stay short overnight until I have time to figure out how people are taking the news.

As you can see, we gapped up overnight and, in Thursday morning's post, I explained why I thought we should still stay short, despite the rally and, in our Live Chat Room, at 9:26, I called new shorting lines at 18,500, 2,170, 4875, 1,250 and we ignored the Nikkei due to dangerous Dollar fluctuations but later took a short at 16,850.

As you can see, we gapped up overnight and, in Thursday morning's post, I explained why I thought we should still stay short, despite the rally and, in our Live Chat Room, at 9:26, I called new shorting lines at 18,500, 2,170, 4875, 1,250 and we ignored the Nikkei due to dangerous Dollar fluctuations but later took a short at 16,850.

Now there's a nice gain and, keep in mind we were wrong twice on the way up but, if you follow the rules and stop out when the trade goes against us (losing $50-100 on wrong calls), then a single move in our favor more than makes up for it! Similar gains were had on the other indexes, led by /NKD, which hit 16,350 this morning and that's down 500 points x $5 per point is $2,500 per contract on that one.

Seems like a lot of work just to get back to where we wanted to short in the first place but call it a detour along the way to a proper correction, which is long overdue.

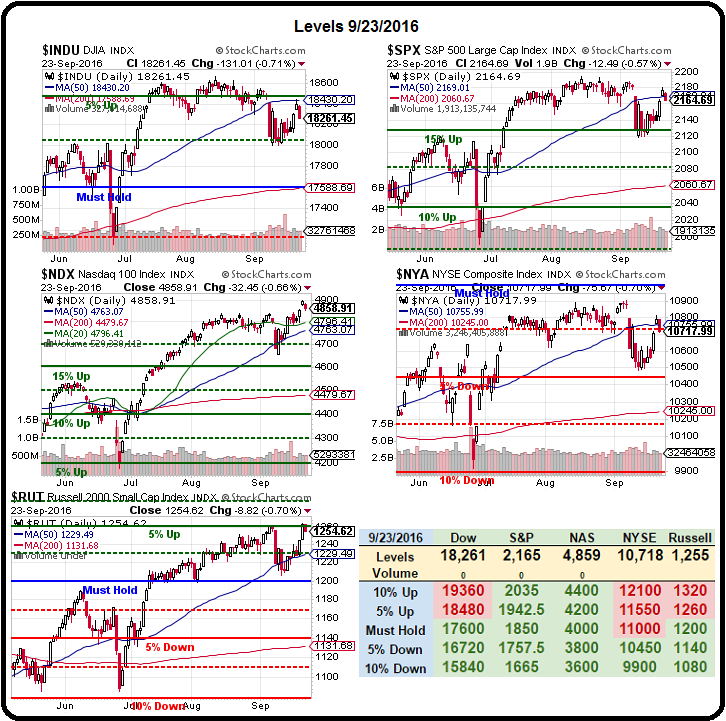

We're waiting for today's debates and there's a good amount of data around the Fed Speak but it's also the end of the quarter, so we'd be surprised to see a big correction this week. The markets are well into the top of their range with no index in clear danger of failing a bullish channel – yet – but let's keep an eye on the Big Chart in case those lines begin to fail.