Well, something is going to happen.

As you can see from Afraid to Trade's S&P 500 (SPY) chart, we're clearly forming a Triangle Squeezy +Thingy Patten on the index and that's bound to lead to something dramatic in the pretty near future. How's that for technical analysis?

As noted yesterday morning, when I was interviewed over at the Nasdaq, we're still a bit skeptical of these low-volume moves up and, Fundamentally, we just don't see a good reason to go long here. In fact, just this morning, I put out an Alert to our Members saying:

On the indexes, the strong Dollar should knock us down a bat at 18,200 (/YM), 2,160 (/ES), 2,875 (/NQ) and 1,250 (/TF) so watch those lines and short the 4th if 3 go below with very tight stops if ANY go back over. Can't use /NKD (16,800) because they love a strong Dollar.

We're also loading up on Coffee (/KC) at $1.475 and Natural Gas (/NG) at $2.875 this morning – those are two longs we also have long-term plays on in the ETFs (JO), (UNG) in our Member Portfolios. See last week's Live Trading Webinar for commentary on both of those trades.

I also tweeted it out (you can follow me here) along with news and market comments so I'm not not going to repeat that stuff and we can move on and discuss some other things that matter, like this year's 20% melt-down in the British Pound which is now causing the FTSE to lead European markets higher which is, of course, ridiculous because the FTSE stocks are priced in Pounds so they are really only going higher because the currency is worth less (worthless?) than it was before.

Don't forget another Goldman Sachs (GS) stooge, Mark Carney, is running the Bank of England into the ground, which is extra interesting as he's Canadian. So, if you are British and you saved all your life and last year you had 1,550,000 Million Pounds in the bank – you've gotten 0% interest and now your remaining money buy's 300,000 pounds less than it did last year – thanks Mark!

Obviously, Brexit hasn't helped either but the point of Brexit was to get away from the disastrous policies being set by the ECB yet the head of the Bank of England has made it clear that he will continue following the policies employed by yet another GS stooge – Mario Draghi.

You may wonder if there are any Central Banks in Europe not under the influence of Goldman Sachs? No, not really. Let's just accept that and move along.

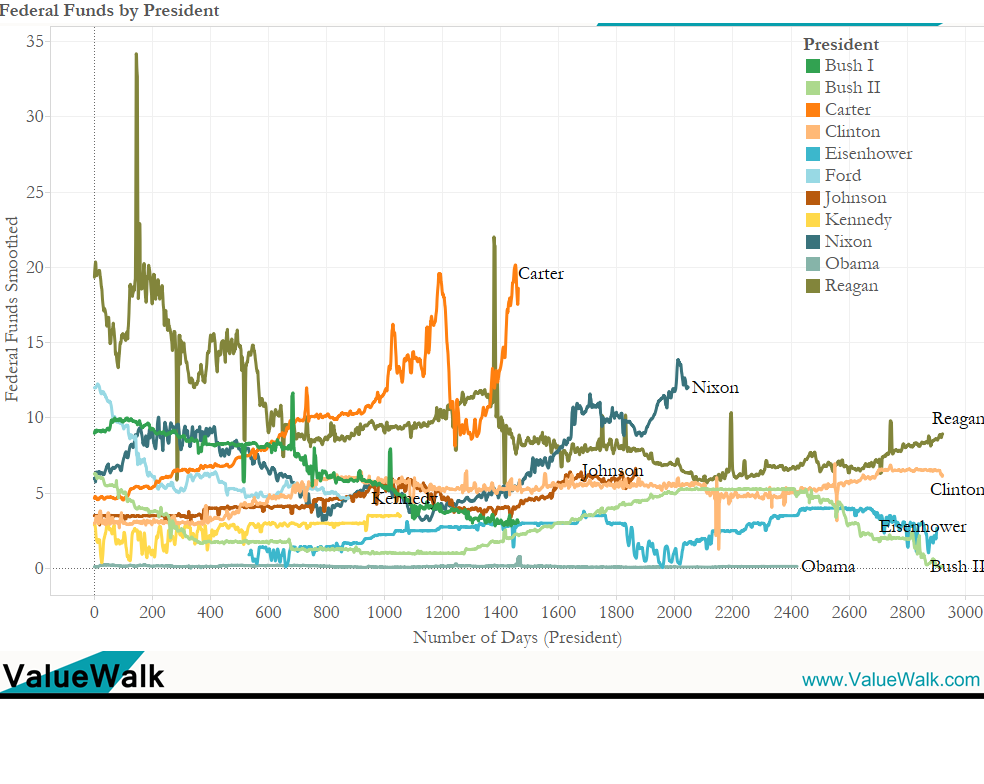

Accepting things we cannot change is something they teach addicts to do and we are all addicted to low interest rates and the Fed is our pusher. Recently, however, there have been some on the Fed who have become worried they are overdosing their addicts. Richmond Fed President, Jeffrey Lacker actually titled today's presentation: "Help or Harm: Central Bank Monetary Policies at the Outer Limits" and that sums it up nicely, doesn't it?

Lacker said there was a strong case for raising interest rates, arguing that borrowing costs might need to rise significantly to keep inflation under control. "Pre-emptive increases in the federal funds rate are likely to play a critical role in maintaining the stability of inflation," Lacker told a conference on the economic outlook. Lacker argued economic history suggests the fed funds rate might need to be higher than 1.5 percent at present. He warned that keeping rates too low could lead to a rise in inflation and aggressive rate hikes, potentially causing a recession.

So far (8:30), it's not moving the markets but let's see what happens as word spreads. Lacker is a known hawk and a non-voting Fed Governor, which mitigates the impact of his speech.

Speaking of things that are the opposite of the MSM narrative – Petromatix Analyst Oliver Jakob agrees with what I said yesterday, declaring the global oil market to still be oversupplied while other analysts question whether or not OPEC is even capable of cutting production to 32.5Mb/d and, even if they do pull it off, it's very likely that other production will come on-line to take its place.

Speaking of things that are the opposite of the MSM narrative – Petromatix Analyst Oliver Jakob agrees with what I said yesterday, declaring the global oil market to still be oversupplied while other analysts question whether or not OPEC is even capable of cutting production to 32.5Mb/d and, even if they do pull it off, it's very likely that other production will come on-line to take its place.

Countries outside of OPEC now account for 58% of the world’s total output, which in the second quarter ran at 95.9 million barrels a day, above estimated demand of 95.6 million barrels a day, according to the International Energy Agency. OPEC’s proposed cuts would reduce the excess supply only if they weren’t offset by gains in non-OPEC output. Even if the cuts were to bring global production back into line with consumption, inventory levels around the globe would remain high.

“At the end of the day, it just comes down to very, very basic fundamentals: how much oil do you have in the system?” said Joe Tanious, senior investment strategist at Bessemer Trust. “You want to see a drawdown of those inventories.”

Overall, non-OPEC production is expected to fall by more than 800,000 barrels a day this year, according to the IEA, but rise by nearly 400,000 barrels a day next year due to increased output from Canada, Russia and Brazil. Lower investment hasn’t translated into lower production as quickly as many expected. Projects that were started years ago are still coming on line. Bernstein Research released a list last week of 136 offshore projects still under construction, some of which aren’t expected to be complete until 2021.

On the demand side, consumption has recently disappointed. Oil demand was expected to grow by a robust 1.3Mb/d this year, according to the IEA, but demand growth plunged in the third quarter due to “a dramatic deceleration in China and India,” the agency said. What actually happened is China stopped filling up their new SPR, which has been creating false demand for years and now the glut will intensify until and unless there are actually production cuts.

We are short the Oil ETF (USO) with the Nov $12 puts, now $1.10 but there's an inverse ETF (DUG) that can be fun to play in a volatile market and they do have options so, with the ETF at $44.25, we can play it like this:

- Buy 10 DUG Nov $45 calls at $2 ($2,000)

- Sell 10 DUG Nov $50 calls at $1 ($1,000)

- Sell 2 BHI 2018 $40 puts for $3.50 ($700)

That nets you into the $5,000 spread for $300 in cash with an upside potential of $4,700 (1,566%) and the worth thing that can happen to you otherwise is you lose the $300 and you are "forced" to buy 200 shares of Baker Hughes (BHI) for $40 ($8,000), which is 20% below the current price. But, of course, if you lose the DUG bet because oil goes higher – that's GOOD for BHI anyway.

So that's a fun way to put some cash to work on a Tuesday. The closer oil gets to $50, the more we want to short it but we stopped out our last entry at $48.50 and now we'll either short back below that line (/CL) or we'll wait for $50 to be tested. The API inventory report is tonight and EIA is tomorrow at 10:30 so we'll discuss it further tomorrow.