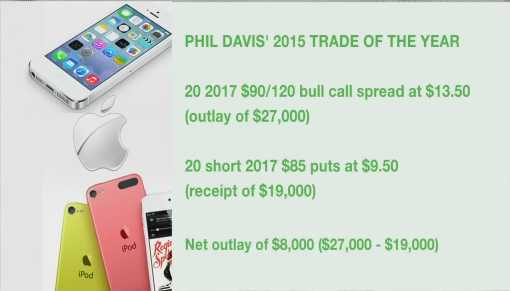

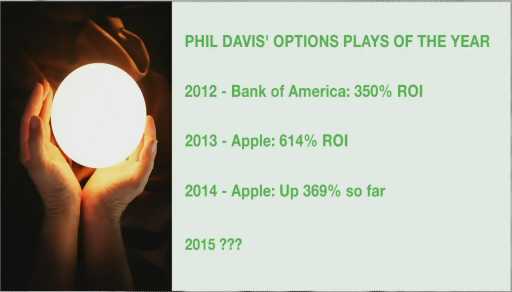

I may have mentioned AAPL a couple of times, after all, it was our 2013, 2014 and 2015 Stock of the Year but not this year, as we were at $120 last Thanksgiving, when I make my picks for the following year, and we saw a rough year ahead so our Trade of the Year for 2016 was the Natural Gas ETF (UNG), which is right on track. Anyway, I laid out my logic for the AAPL trade on TV (as I always do with our trades of the year) and this graphic they used lays out the idea we had to take advantage of AAPL.

The target price was $120 and the target time was Jan of 2017 and we've been in and out of AAPL along the way, buying whenever it's below $100 and selling when it went over $120 because, as I noted yesterday, we are FUNDAMENTAL investors and we KNOW what our stocks are worth so we buy them when they are cheap and we sell them when they are expensive. I know that's a strange concept to most investors but trust me – it's a profitable one!

Notice we don't NEED a stock to go up for our Trade of the Year to make money – that's not how we play the market. At Philstockworld, we use the simple options strategies we teach our Members to construct plays that give us tremendous upside leverage. Using the above bull call spread and put combination, we netted into the AAPL trade for just $8,000 in cash and, if AAPL manages to hold $120 into January, the bull call spread will be worth $60,000 for a $52,000 profit (650%). This is good money for two years' "work", right?

Every year, in an attempt not to be boring, I struggle to find a Top Trade Idea that's better than Apple but that doesn't mean we aren't afraid to go back to the well, over and over and over again – when the opportunity presents itself. As recently as August, when Apple dipped back to $108.36, we made AAPL our Top Trade Idea for the Week on 8/22 and I said:

Meanwhile, AAPL is at $108.36 and is dropping $8.50 to the bottom line in 2016 and they have $35 per share in CASH!!!, so saying they have a p/e of 12.7 is an overstatement. If we are in a bubble rally, AAPL will catch up eventually and, if we do turn down and AAPL drops 20% to $85 – the p/e will be under 10 and more like 5 if you take the cash into account and it would be the best stock you could buy in the crash.

So, as usual, AAPL is my favorite stock in the World. 1/3 of all Americans own IPhones – what other brand of any kind has that kind of penetration? Coke is one that comes to mind. Only 350M Rubik's cubes have been sold since the 80s – not even close to 1Bn IPhones. Only 500M Harry Potter books. 350M PlayStations is very good too but you get the idea. IPhones are pretty much the most successful consumer product of all time and those things don't tend to just disappear – people are pretty brand-loyal unless you really mess up (new Coke).

Anyway, AAPL's dividend is a sad $2.08 (2%) but one day they might make a special dividend to return some cash and you could suddenly get $10 or so dropped in your pocket. The stock would drop too but MSFT did it once and it was great for shareholders long-term.

You can sell AAPL 2018 $95 puts for $7.50 to net in at $87.50 and that's a very fair price and, if you want to be more aggressive, you can buy the $100 ($16.35)/$125 ($5.50) bull call spread for $10.85 and that would net you into the $25 spread that's $8.20 in the money for $3.35 with an upside profit potential of $21.65 (646%) in 515 days.

See, we can construct these sorts of options trades any time – we simply seek to take advantage of dips to sell high-yielding puts (due to volatility) and pick up inexpensive spreads providing, of course, that the Fundamentals haven't changed and our targets and time-frames are intact.

See, we can construct these sorts of options trades any time – we simply seek to take advantage of dips to sell high-yielding puts (due to volatility) and pick up inexpensive spreads providing, of course, that the Fundamentals haven't changed and our targets and time-frames are intact.

Another cool thing about these fairly conservative, long-term spreads is that you don't actually need to wait 2 years to make great money. Just on this recent pop the $95 puts have fallen to $5.10 and the $100/125 spread is up to $11.25 for net $6.15 per contract, which is already up $2.80 or a +83.5% gain on cash in less than two months but you know what? That's only "on track" for our trade. You can still play it from here at $6.15 per contract and it pays $25 at $125 for an additional gain of $18.85, which is still a 306% ADDITIONAL gain. See, even our Members' leftovers make nice trades!

AAPL was also a Top Trade Idea on July 12th ($97.50), May 13th ($90), April 28th ($95), March 9th ($100) and Jan 28th ($93) AND we even used AAPL short puts to pay for our disaster hedges on Jan 8th. Why? Because there is no stock we were more certain of that would NOT be lower than AAPL so selling puts is essentially FREE MONEY – especially when we catch the dips. Oh sorry, it was also a Top Trade Idea on Jan 6th ($105), when we added the first set of the year to our Long-Term Portfolio.

Sadly, we will be saying goodbye to AAPL because Samsung is now recalling and likely discontinuing their Galaxy Note 7 phone, because they keep exploding and that is not a good feature for things you carry in your pocket when they are not in your hands or being held against your ear. Samsung's phones blow up because they tried to make a phone that was as cheap and as fast as an IPhone but all it takes is a very tiny mistake in engineering and, like a fine race car – disaster is going to be right around the next sharp turn.

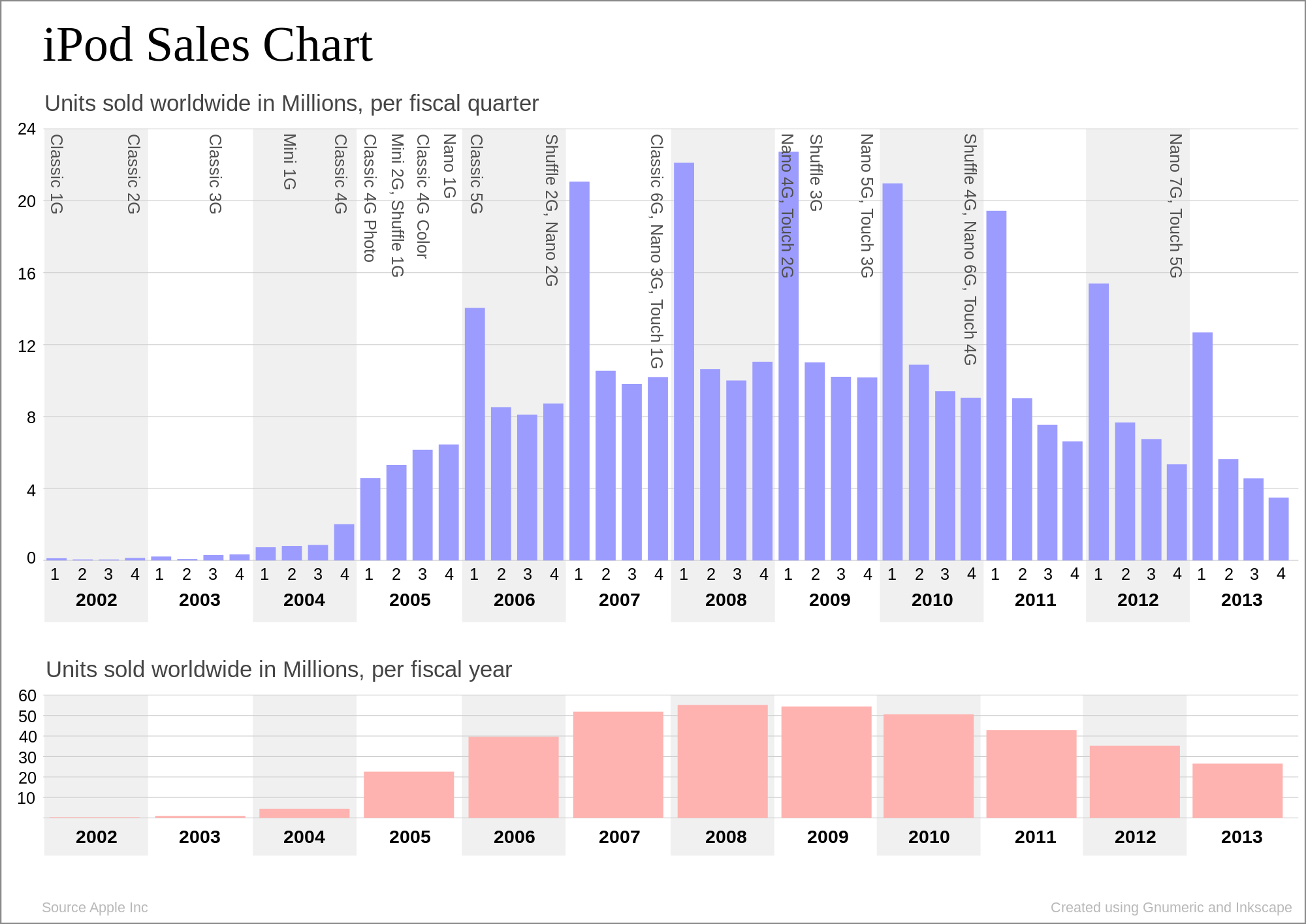

As with the IPod, one by one Apple's phone competitors are falling and Apple keeps coming out with better, faster, cheaper models with more features – keeping constant, relentless pressure on their competitors to keep cutting costs (and margins) while upping their R&D spending just to keep up and, eventually, they drop out of the race. It's kind of mean, actually – but it's just business, nothing personal…

As with the IPod, one by one Apple's phone competitors are falling and Apple keeps coming out with better, faster, cheaper models with more features – keeping constant, relentless pressure on their competitors to keep cutting costs (and margins) while upping their R&D spending just to keep up and, eventually, they drop out of the race. It's kind of mean, actually – but it's just business, nothing personal…

Keep in mind that almost all of the competition relies on Google to supply a free operating system or they'd have no chance at all of competing with iOS if they had to also write software while having to compete with Apple on the hardware side. What happens to the remaining competition if Google decides Android is not giving them enough bang for the buck because Google is also forced to constantly spend to keep up with Apple – for a product they give away (and yes, they do get search revenues and App revenues).

So RIP Samsung, you had a good run and maybe you will come back but that depends on how the board decides to take this $17Bn hit to their bottom line. Although they sold more phones by volume, Samsung wasn't making that much money on the phones in the first place (tight margins) and now the other divisions have to chip in their profits to cover the recall of the entire 7 line. And, if that wasn't enough damage, Apple and Samsung are headed to the Supreme Court, who will decide on the appropriate damages for Samsung's patent infringements.

Whatever the outcome of that case, the key takeaway here is we are heading into Q4 and Apple's main competitor has no top-line phone to sell. How can Apple not benefit. Feel free to use the scraps from our old trades – we're done with them and moving on to more profitable trade ideas, which we will be happy to share with you here.