"When I get to the bottom I go back to the top of the slide

Where I stop and I turn and I go for a ride

Till I get to the bottom and I see you again" – Beatles

No, it's not a song about killing people (Manson), it's a song about a carnival slide in England.

As it says at the entrance: "Don't forget your mat" – just as we always remind our Members not to forget their hedges because, when we get to the top of the slide, we often go for a ride to the bottom, where we see bargains again and it's a damned shame if we're not ready to buy them, right?

Just as the path of the Helter Skelter is predictable, so is the eventual unwinding of a market rally and, no matter how much QE you pump into it, things do come down eventually. Only when you build on the base are you able to raise the bottom of the slide. Otherwise, no matter how high you climb – you will see that bottom again.

We had a little scare yesterday but not too much damage done, so far and, hopefully, you are well-hedged, like our Member Craigs, who said last night:

Phil I must say that it was really nice to have a portfolio that was looking very stable in the face of a rough day for the markets. I ended the day up 0.3% which includes another successful day of futures trading. So with a portfolio of mostly cash, a few of our faves like Apple and LL, JO, TOL, DIS, etc., along with a couple of hedges that paid off nicely today, and my futures trades, I never had to break a sweat during that madhouse today. Yes, by George (or Phil), I may be learning this system.

Trading isn't just about making money – it's about protecting the money you've already made. If I haven't mentioned it lately, I like CASH!!! at the moment and our 4 Member Portfolios are 80% or more in CASH!!! and I still have to stop myself from cashing in the rest – despite them being well-hedged. If not for constant meddling by the Central Banksters – we'd be gung-ho short on this market now.

But meddling by Central Banksters IS a factor we have to take into account and it's tricky to call a top when these guys can create money almost at will. It's that "almost" part that we have to focus on because the constant creation of money leads to other problems that, eventually, do put the brakes on the money printing – eventually.

Meanwhile, we're getting really good at mapping out the meddling, as we did on Monday morning, when we charted the Fed speakers for the weak ahead and I said: "Hopefully, we'll see 18,350, 2,165, 4,900, 1,255 and 17,000 before they cross back under – that would be exciting!"

Meanwhile, we're getting really good at mapping out the meddling, as we did on Monday morning, when we charted the Fed speakers for the weak ahead and I said: "Hopefully, we'll see 18,350, 2,165, 4,900, 1,255 and 17,000 before they cross back under – that would be exciting!"

As you can see from the Nasdaq Futures Chars (/NQ), we nailed the exact move on the Nasdaq and the others had similar gains led by the Russell adding over $3,000 per contract on their fall back to 1,220. We took the money and ran in the afternoon because we know Fed dove Dudley is speaking at 8am but we also know, thanks to our fabulous 5% Rule™, that the Nasdaq needs to hit 4,840 to make a strong bounce and anything less than that will be a good bearish sign (and it already failed the strong bounce overnight).

3 Fed hawks in a row have the floor between now and Friday and the Fed Minutes will be out a 2pm, during our Live Trading Webinar and I'll be commenting on that live this afternoon and then I'll be on TV (Money Talk, 7pm) later this evening to elaborate on our outlook for Q4 which, I can tell you now, is not good.

Today, however, we are looking for strong bounces at most before resuming the downtrend at least into the Fed minutes (2pm) but probably we'll be going for a full 5% correction off of last week's highs, at least. We went over our hedges Friday afternoon so we're not worried about the drop, of course, we're just observing it with a detached curiousity for the moment and maybe making a little extra cash with some short bets as our lines are crossed. We're keeping a very close eye on that 3,000 line on EuroStoxx – the flood gates will certainly open if that fails.

Bounce lines to watch for our other indexes (Futures, we don't care about the headline index) are:

- Dow (/YM) 18,075 (weak) and 18,150 (strong)

- S&P (/ES) 2,134 (weak) and 2,140 (strong)

- Nasdaq (/NQ) 4,820 (weak) and 4,840 (strong)

- Russell (/TF) 1,226 (weak) and 1,232 (strong)

- Nikkei (/NKD) 16,900 (weak) and 16,950 (strong)

Dudley is speaking right now and, as expected, turning down the markets and next up is Esther George at 9:40, also a hawk so it's a good morning to short those strong bounce lines or, if 3 of 5 weak bounces fail, you can short the laggard and if we fail 3 of 5 of yesterday's lows – you can short the laggard there too. See, very simple to play the Futures. Combine that with a good stopping discipline (if 3 of 5 go back over – get out!) and you are on your way to making money!

Day to day, markets go up half as often as they go down so imaging how much easier your life will be if you learn how to make money in both directions. Think about it. Why only make money when the market goes up – that makes no sense, does it?

Day to day, markets go up half as often as they go down so imaging how much easier your life will be if you learn how to make money in both directions. Think about it. Why only make money when the market goes up – that makes no sense, does it?

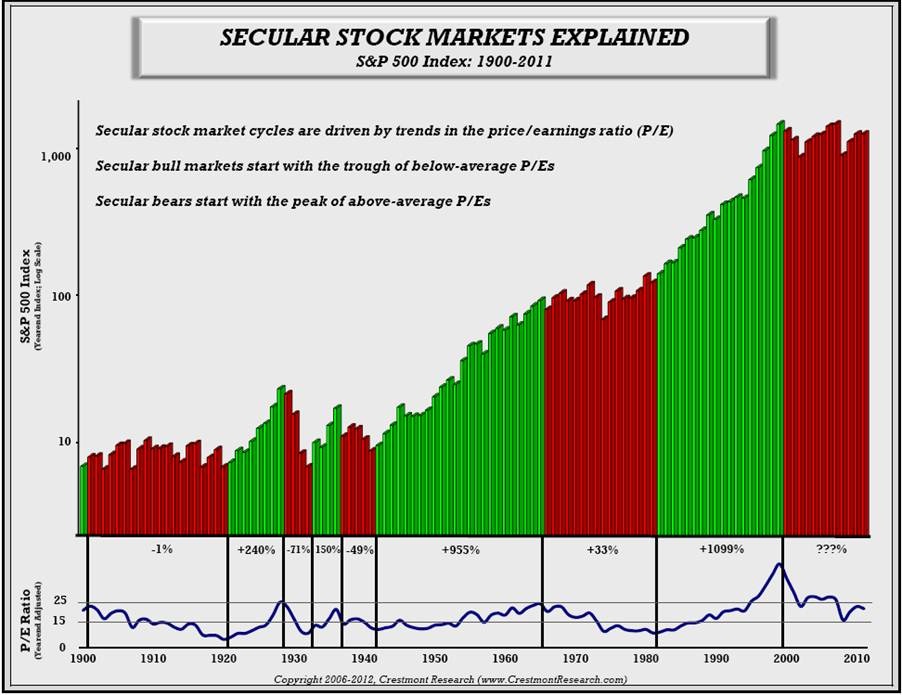

Yes, over time the market tends to go higher and that's what long-term bets are for but, in the short run – you have to be able to be flexible and go with the flow as markets can go many years at a time without giving you a satisfactory return. Even just mitigating your losses on down days can drastically improve your overall portfolio performance.

CASH!!! is a strategy. It is not "giving up" it is a position we take and, frankly, our cash has gained almost 4% since September (Dollar 94.5 to 98) – not bad for sidelined money! Having cash on the sidelines is like having a loaded gun when you go hunting – it's very useful once the game presents itself. We're hunting for bargains and, at the moment, they are hiding in the thicket but we'll flush them out and we'd better be ready before they run off and we miss them, right?

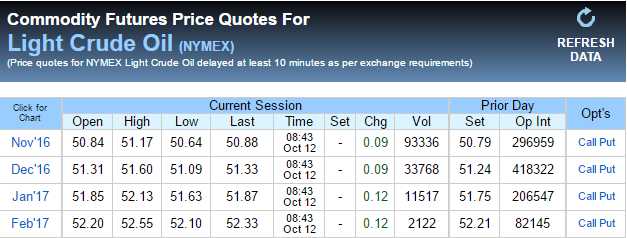

Oil (also mentioned in Monday's morning post, which you would never miss by subscribing) has also been a fun ride if you short it at the 0.50 or 0.00 lines). The idea is to keep a relatively tight stop over the line (0.10) and look to take profits on 0.25 or 0.50 moves back down. There are so many rabid oil bulls out there, you get to take their money over and over and over again as they keep trying to push the price higher while the reality of the massive glut of actual barrel inventories and FAKE NYMEX orders (see Friday's post) bears down on their positions.

It's $51 at the moment and we shorted it here in our Live Member Chat Room – hoping for $50.50 or less and a $500+ per contract gain.

On Friday, we pointed out that there were 484,095 open contract at the NYMEX and I told you that 460,000 of them were fake, Fake, FAKE!!! and would be cancelled by October 20th (expiration day). Already, just 3 sessions later, we can see that they've already moved 187,136 contracts out of November. Where did they go? Well, December has gained 73,499 contracts and January has gained 28,443, so there's 102,000 and the rest are spread over longer month, faking demand in perpetuity. Isn't blatant market manipulation fun?

Still, 269M barrels of oil is 245M more barrels than will actually be used in November for Cushing, OK delivery (which is what these 1,000-barrel contracts are for) and there are now just 7 trading days left so still 35M barrels a day (35,000 contracts) need to be shuffled around to longer contracts. This is a very expensive process so we're still likely to see a very good dump ($1-$2) between now and next Thursday, whish is why the short play is still very attractive, along with our USO puts (see Friday's post).

OPEC is still doing their best to talk up the price, as are the paid media pundits and the sheeple are running headlong into the trade so it will be kind of catastrophic if it unwinds and, if that happens, Chevron (CVX) at $103 may run into a spot of trouble and they are a big Dow (DIA) component, so we like that short too (and AA already turned in poor earnings – which does not bode well for the Dow).

The 2X Dow ultra-short (DXD) is a fun play at $17 and a 10% drop in the Dow would kick it up 20% over $20 so the January $16 ($1.40)/20 (0.30) bull call spread at net $1.10 offers you nice protection ($4 back at $20 for a 263% profit) into the holidays and the only way you can lose is if the Dow goes higher because it's currently in the money. So, if you expect to make $10,000 in a flat or up market with your bullish positions, you can take $3,300 and buy 30 of these hedges and that will pay you up to $12,000 back if the market turns sour. If not – then a percentage of your gains goes towards the insurance.

Of course we offset that potential loss by selling puts on something we REALLY want to own if it goes on sale. For instance, this morning I pointed out to our Members that our old favorite, Lumber Liquidators (LL) is still paying $1.40 for the Jan $17 puts, which nets you into the stock ($18.83) for $15.60 – a 24% discount. If you pair the sale of those puts (15) with the spread, you drop your net to $1,100 on the spread and you have an obligation to own 1,500 shares of LL at $17 ($25,500) if it heads lower – so just make sure it's a stock you REALLY want to own.

A key point to remember with this trade is that, if the Dow does well and your hedges do poorly, it's unlikely LL will do poorly, so you are off the hook on your short puts and your insurance costs you net $1,100. If, on the other hand, the Dow does poorly and you end up owning LL, you do so along with a $10,900 profit on the spread with which to buy your LL shares – a real win if you REALLY wanted to own them.

Trading is likely to be slow today so anything can happen – we are keeping tight stops and not trading with much conviction (other than oil – those bulls can suck it!) – especially into the Fed minutes but the pressure is down and up will be a surprise.