Financial Markets and Economy

Investors are fleeing stock funds at the fastest pace in over 5 years (Business Insider)

Retail investors seem to have cooled on the stock market.

According to a note from Bespoke Investment Group, equity mutual funds have experienced their largest weekly outflows since August 2011.

Deutsche Bank's earnings call was the most brutally honest, angsty thing we've heard in a long time (Business Insider)

Deutsche Bank just reported third-quarter earnings, and the earnings call with analysts to discuss the numbers is really worth a listen.

U.S. Oil Companies Are Pumping … Stocks (Bloomberg)

The oil business has been cutting back on everything — except when it comes to selling stock. Average oil prices are at their lowest since 2004, but this is by far the biggest year for equity issuance by U.S. E&P companies as far back as Bloomberg tracks the data.

SEC Probes Whether Companies Are Misusing Adjusted Earnings Metrics (The Wall Street Journal)

The Securities and Exchange Commission’s enforcement division has informed some companies in recent weeks that it is examining their use of adjusted earnings measures.

How Bonds Were Looking For An Excuse to Sell Off—And Found It (The Wall Street Journal)

With markets expecting central banks to dial back hyperactive policies, global bonds seem to have been looking for an excuse to come off record-high levels. Upbeat post-Brexit data for the U.K. economy provided just that.

Spain Has No Government For 10 Months – Economy Grows, Unemployment Falls To 18.9% (Forbes)

We are continually told that every country must have an activist government. No economy nor society can be allowed to just bumble along by itself, the firm smack of political control is necessary for the world to continue to turn on its axis.

Everything in Bond Market Priced to Perfection (Bloomberg)

Seth Masters, chief investment officer at AB Bernstein, discusses bond markets that are priced to perfection and investment risks in longer-duration bonds. He speaks on "Bloomberg Surveillance."

Inflation Fear Fuels Bond Rout (The Wall Street Journal)

Investors worried for years about the prospect of deflation. Now another concern—inflation—is starting to rattle global markets.

Rich-country government-bond prices tumbled Thursday, sending yields on both sides of the Atlantic up to levels not seen since the U.K.’s vote to exit from the European Union in June.

Grocers Feel Chill From Millennials (The Wall Street Journal)

Grocers are struggling to lure e-commerce-loving millennials into their aisles amid what experts say is a permanent shift in shopping patterns among consumers.

Strong across-the-board wage growth in 2015 for both bottom 90 percent and top 1.0 percent (Economic Policy Institute)

Annual inflation-adjusted earnings of the top 1.0 percent of wage earners grew 2.9 percent in 2015, and the top 0.1 percent’s earnings grew 3.4 percent, according to our analysis of the latest Social Security Administration wage data.

The Fed Is More Hawkish Than You Think (Mauldin Economics)

This is not a good Fed. They aren’t making decisions on a predictive, forward-looking basis. They are very concerned about optics, appearances—how things look. And to them, right now the optics of having Fed funds at 0.375% with unemployment at 5% are very bad.

Major Shale Companies Look To Harvest Drilled Untapped Wells (Reuters, Kal Telage, Seeking Alpha)

U.S. oil and gas companies have drilled thousands of wells they have yet to tap creating a ready reserve of fuel that could surge onto the market when energy prices recover. Federal estimates identify a backlog of 5,069 completed standing wells, up from 3,768 in January 2014.

This infographic explains the British pound's October flash crash (Visual Capitalist)

We all know that software is eating the world.

For better or worse, that statement applies to the financial world as well. It is said today that 75% of all financial market volume is automated, though there are lower and higher estimates out there depending on the report.

GDP Now Forecast Inches Up from 2.0 Percent to 2.1 Percent (MishTalk)

As expected in this corner, the net effects of economic reports of the week balanced out to much ado about nothing.

The overall result of the week’s reports was a rise in the Atlanta Fed GDPNow model from 2.0% to 2.1%.

Clothing Keeps Getting Cheaper, and Factory Workers Are Paying the Price (Bloomberg)

In April 2013, when the Rana Plaza building in Bangladesh crumbled and killed more than a thousand garment workers, Western clothing executives were chastened. They were the ones, after all, who’d been pressuring Bangladesh’s apparel factories to cheaply reproduce runway trends for consumers in the U.S. and Europe who’d grown used to $10 dresses.

Moody’s: Deutsche Bank Is Dangerously Close To Falling Below Its “Default Point” (Value Walk)

Moody’s Capital Markets Research issued a damning verdict on Deutsche Bank earlier this week. In a research report put together by the credit agency’s ‘Analytics’ research division, Moody’s analysts write that Deutsche Bank AG (NYSE:DB) expected default frequency remains at one of the highest levels in the banking industry, despite the bank’s efforts to shore up its capital position.

Investors are holding a ton of cash right now (The BlackRock Blog)

Judging by recent headlines, cash is once again king. The Wall Street Journal recently reported that investor cash levels currently represent 5.8% of portfolios, the highest in 15 years.

Venezuela Throws In The Towel On Hyperinflation: Will Print 200x Higher-Denominated Bills (Zero Hedge)

While several years ago it was perhaps debatable in polite society that Venezuela's socialist economy would collapse ultimately unleashing hyperinflation, any doubt was put to rest early this year when the IMF's own inflationary forecast confirmed as much.

Companies

The Feds are starting to dig in at the biggest middle-man in the pharmaceutical game (Business Insider)

The Feds are gunning for the biggest middle man in the American pharmaceutical game, Express Scripts, according to government filings published on Tuesday along with the company's earnings.

Groupon Posts Another Quarterly Loss, Says It's Purchasing LivingSocial (Forbes)

Groupon’s stock was dropping on Wednesday after the deals site recorded another unprofitable quarter and announced it was purchasing rival company LivingSocial.

The company that's supposed to protect America's cops is being accused of some shady stuff (Business Insider)

The company is being sued over anticompetitive behavior and patent infringement in part of what has become one of the fiercest fights in American business — over who will outfit the hopefully more transparent and less lethal future of American policing.

Aetna's CEO laid out just how Obamacare could collapse (Business Insider)

Mark Bertolini, the CEO of health insurer Aetna, laid out just how Obamacare could fall apart during an interview with Bloomberg's David Gura on Tuesday.

Technology

Ford Fortunes Fade While Crosstown Rival GM Posts Record Profit (Bloomberg)

Ford Motor Co.’s profits are slumping while General Motors Co. is posting record earnings. To understand why, look no further than big sport utility vehicles that have come roaring back as U.S. gasoline prices plunged.

Tesla Motors: Not as Good as It Looks? (Barron's)

JPMorgan’s Ryan Brinkman and team contend that Tesla Motors’ (TSLA) earnings weren’t as good as they looked as they maintain their Underweight rating on the stock.

Twitter announces it’s shutting down Vine, after announcing big layoffs (Salon)

Twitter is ending vine, the company wrote Thursday in Medium post.

“Nothing is happening to the apps, website or your Vines today,” Twitter wrote. “We value you, your Vines, and are going to do this the right way. You’ll be able to access and download your Vines.

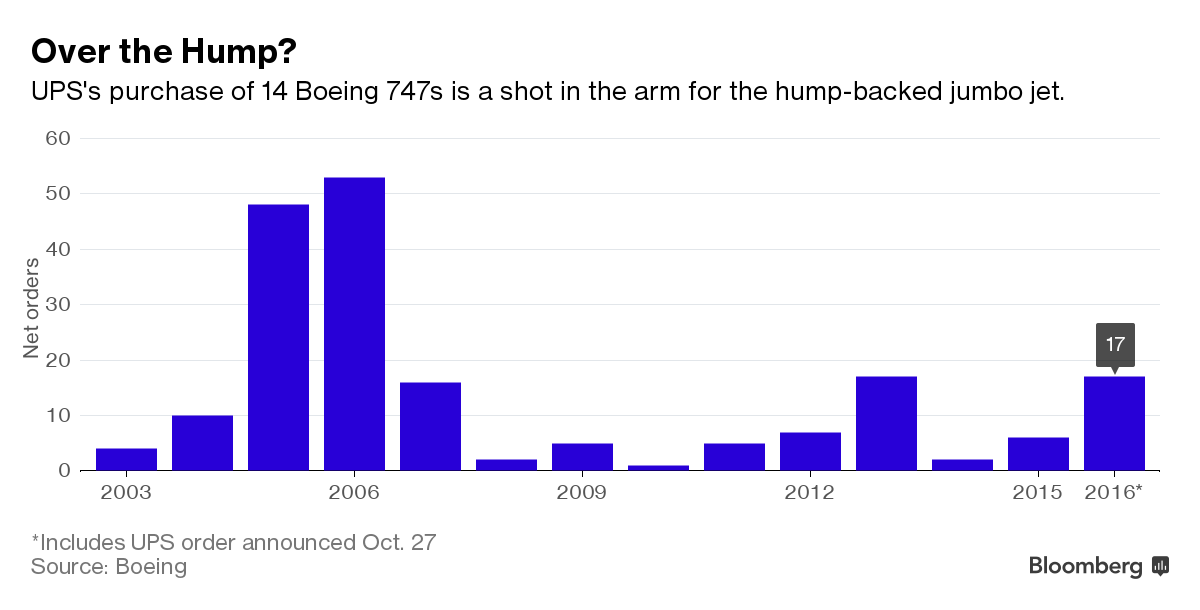

Boeing’s 747 Jumbo Snags a $5.3 Billion Lifeline From UPS (Bloomberg)

Boeing Co.’s 747 jumbo jet may have won a reprieve from an uncertain future as United Parcel Service Inc. agreed to buy at least 14 freighters — the biggest order in almost nine years.

Despite Business Mess, Twitter Is At Its Most Vital (BuzzFeed News)

Twitter is living a fascinating contrast. Its business, following a botched sale, is in a state of terrible mess. Its product, now at the heart of a number of major world events, is more influential than ever.

Ford (F) CEO Mark Fields Talks Q3 Results, Says Automation of Cars Will Be 'Story of the Decade' (The Street)

NEW YORK (TheStreet) — Ford (F) beat estimates on the top and bottom line for its 2016 third quarter, despite a $600 million expense related to a recall for faulty doors, CEO Mark Fields said on Fox Business' "Mornings with Maria Bartiromo" on Thursday.

Apple finally revealed its plan to conquer TV (Business Insider)

Apple has announced a new Apple TV app that it says will bring all your shows and videos into a central app.

As Uber Offers Bagels by Bike, New York City Couriers Seek More Pay (Bloomberg)

Uber Technologies Inc., which has battled New York cabbies, regulators and its own workers, now faces a fight with foot and bike couriers as it moves to grab a share of the business delivering anything from blueprints to bagels.

Apple's new MacBook Pro is slim, trim and has a stunning screen (Engadget)

We knew it was coming, and now it's here. Apple's newest MacBook Pro. It's thinner, it's lighter and it comes with a better screen than the Pros of yesteryear.

iPhone 8 will reportedly come in three different sizes – all with glass-backed bodies (The Next Web)

It’s only been a few weeks since Apple dropped the iPhone 7, but technophiles are already speculating about the company’s next generation of smartphones.

Uber's Flying Car Ambitions Are Lofty And Ridiculous (Popular Science)

Uber, the massively successful app based around the convenience of summoning a car to take you home from a bar at last call, is ready to embark on a new frontier: flight. In a white paper published today, Uber says the next stage of transport is a network of app-summoned vertical-takeoff (VTOL) aircraft for elite commuters.

Politics

Trump attacks Clinton on trade, says he should be handed victory (Reuters)

TOLEDO, Ohio; WINSTON SALEM, N.C. U.S. Republican presidential nominee Donald Trump criticized Democrat Hillary Clinton on Thursday over her trade policies, saying she would handle trade deals so badly that the country should "just cancel the election" and name him the victor.

At a Trump rally in North Carolina, signs of a shrinking campaign (The Economist)

IF HILLARY CLINTON has made any new friends in this surly election year, that group should start with the souvenir-sellers at Trump rallies. Like itinerant camp-followers trailing a medieval army, they line the approach roads to the Republican’s campaign events for hundreds of yards.

Inside the Trump Bunker, With 12 Days to Go (Bloomberg)

On Oct. 19, as the third and final presidential debate gets going in Las Vegas, Donald Trump’s Facebook and Twitter feeds are being manned by Brad Parscale, a San Antonio marketing entrepreneur, whose buzz cut and long narrow beard make him look like a mixed martial arts fighter.

Trump aggressively fought to starve the towns near his golf courses of tax revenue (Think Progress)

Republican presidential nominee Donald Trump has basically admitted to avoiding paying federal income taxes for a long period of time – potentially as long as 18 years.

How large is the “Secret Hillary Club”? Red-state women may be defying their Trump-loving husbands (Salon)

One of the emerging themes of the last weeks of the presidential campaign is the resurgence of the right’s “unskewed polls” theory, which holds that when Republicans are behind it’s because the pollsters are sampling the wrong people.

Hillary Clinton’s Super PAC Has Raised More Money Than Any Super PAC Ever (The Huffington Post)

Priorities USA Action, the main super PAC supporting Democrat Hillary Clinton’s presidential campaign, has raised and spent more money than any super PAC since the committees were sanctioned in 2010.

Health and Biotech

Male contraceptive pill works – but side effects halt trial (New Scientist)

Male contraceptive pill works – but side effects halt trial (New Scientist)

An injected male contraceptive has been shown to be almost 100 per cent effective in a trial involving 320 men.

The hormone-based jab is designed to lower sperm counts by acting on the brain’s pituitary gland.

You need to stop trying to treat your UTI with cranberry juice (Science Alert)

Up to 60 percent of women will experience at least one urinary tract infection (UTI) in their lifetime, and if you’ve ever had one, you’ll know how unbearable it can be.

Colorado’s Marijuana Industry Had a $2.39 Billion Impact Last Year: Report (TIME)

Pot funded more than 18,000 jobs in the state last year, a new report found.

Legal marijuana has become a big business for Colorado, with an impact of $2.39 billion in 2015 alone, according to a report released this week.

Life on the Home Planet

Dozens Dead In What UNICEF Calls One Of The Worst School Bombings In Syria's War (NPR The Two-Way)

Dozens Dead In What UNICEF Calls One Of The Worst School Bombings In Syria's War (NPR The Two-Way)

Warplanes repeatedly bombed a complex of three schools in northern Syria on Wednesday in what UNICEF is calling one of the deadliest attacks on schools since the conflict began more than five years ago.

You're About To See A Lot More Cuban Cigars In The U.S. (NPR)

Finally today, it's time for our segment called Words You'll Hear. That's where we take a word or a phrase that we think will be in the news and let you know what it's all about. And this week's word is Cohiba.

Scientists have found a lake under the sea – those who swim there won't come back alive (Science Alert)

Scientists have discovered a 'lake' in the Gulf of Mexico. Everyone, who enters this pool at the bottom of the sea will suffer horribly.

Erik Cordes, associate professor of biology at Temple University, has researched the pool and described his findings in the journal Oceanography.

How South Park changed the way we think about vulgarity (Holy Kaw)

How South Park changed the way we think about vulgarity (Holy Kaw)

When it first came out, South Park was so vulgar that people could barely believe it was on TV. Now, they still do insanely vulgar things, but no one bats an eye. Who changed, South Park or us?