Go Dollar, go!

As you can see on the chart, we had a blow-off spike down to 96 on Election Eve but, since then – it's been a rocket to 100 for the Dollar which is now up 5% since early October and really 3% of it came in November, after our first pullback from 99.

None of this is a surprise to our Members, of course, as we told you back on 9/14, right in the Morning Report (subscribe here if you like to know what the market will do in advance):

Goldman Sachs has finally caught up to our long Dollar (/DX) premise and we're still sitting on 4 longs at 95 on the Dec 31st contracts (DXX6) with a goal of hitting 100 (but we'll take 99.50 for $4,500 per contact gains for the holidays). We're expecting a bit of a repeat of last October's action and, until then, we'll just need to be patient. As I was saying to our Members yesterday, we don't know WHEN enough people will realize we're right to move the Dollar higher but we do know it won't take much of a catalyst to get it going – a Fed hike next week would be a good start.

If you are futures challenged, the Dollar ETF (UUP) is a nice way to play, now $24.64 and you can buy the Jan $24 calls for 0.85 and sell the $25 calls for 0.35 for net 0.50 on the $1 spread which is already 0.64 in the money so, if UUP stays flat through January expirations, you make 28% but the potential is 100% gain if up moves up just 2% to $25 – that's nice leverage!

So that's goaaaaaaalllllllllll at 99.50 for gains of $4,500 per contact in less than two months and those UUP Jan $24 calls are already $1.60 at yesterday's close while the $25s are 0.90 with UUP at 25.99 so that's already net 0.90 for a 0.40 (80%) gain already!

100 was our goal and we expected a pullback here and, thanks to the brilliant editorial decisions at certain places, I can't get into what might have changed since then and how that might affect the Dollar because we have to pretend politics have nothing to do with the stock market – even when they are causing obvious, MASSIVE upheavals that affect everyone's portfolio. I will, of course, be getting into our reasoning with our Members as to how to play this going forward – but it can't be published here.

What I can tell you is that, generally, a strong Dollar puts negative pressure on commodities, as well as the indexes so, if the Dollar were to pull back off the 100 line (and a weak retrace takes it to 99 which a strong one will test 98 without breaking the still-bullish uptrend), then that will boost Gold (GLD), Silver (SLV), Oil (USO), Gasoline (UGA) and Natural Gas (UNG) – all of which look like good long-term pokes here at $116.50, $16.35, $9.75, $24.50 and $7.05 respectively. Of course we have really cool options plays to leverage them but, again, we have to save some things for our Members or it's no fun!

I will tell you that we always like Barrick Gold (ABX) at $14 and we're getting there. Selling the Jan $15 puts for 0.90 was an offsetting hedge to our long Dollar plays and our net entry is $14.10. We could roll the Jan $15 puts, now $1.40, to the 2018 $12 puts (now $1.55) but we REALLY do want to own ABX at net $14.10 and we'll probably bounce back anyway so, at $1.40 – I still like selling the Jan $15 puts to raise some cash for a net $13.60 entry.

One thing people tend to forget about ABX, as well as other gold miners (again, we'll discuss in Chat) is that they also mine copper. ABX has 6.5 BILLION pounds of copper and a pound of copper has flown up in value from $2.10 to $2.55 in the past month and that then adds $3Bn in value to ABX's copper reserves but the market only trades them on their gold – hence the drastic sell-off.

Generally, as a more pure copper play, we like to play Freeport McMoRan (FCX) and the funny thing about them is they are 30% gold but, like ABX, no one pays attention to that and they focus on the copper. We sent out a Top Trade Alert to our Members for FCX on Nov 7th, saying:

I'm thinking FCX makes a good add. We do have 25 short 2018 $8 puts in the LTP and we sold them for $1.85 back in July, now $1.05 so let's just use those and add a bull call spread. We can buy 25 2019 $7 calls at $5.30 and sell 25 2019 $12 calls at $3.20 is net $2.10 on the $5 spread so nice $2.90 upside is not a very exciting play but nothing wrong with $7,250 in pretty easy upside. Also makes a nice inflation hedge and, as a new trade, your net is a credit if you sell the 2019 $10 puts for $2.65.

As you can see, our timing was very, very good (you're welcome) and already the 2019 $7/12 bull call spread is net $2.92 ($7,300) while the $10 puts have dropped to $2.07 ($5,175) for net $2,125, which is up $3,500 (254%) from the original $1,375 credit on the new spread in one week. That's why we call them Top Trades!

Anyway, even if you are too cheap to subscribe and just read this delayed version of our free morning report (free of political commentary, of course) and this is the first you are hearing about it, we still have a trade where the stock is already $2 over the goal that will pay $12,500 if FCX is over $12 in January, 2019 and it's "only" $3,500 now (and $2,500 of ordinary margin is required to sell the short puts). Sure it sucks compared to our original $1,375 credit, which will pay us $13,875 in profits (1,009%) but $9,000 in profit is still 254% in 2 years and you saved $3 per day by not subscribing to our newsletter – clever!

Anyway, even if you are too cheap to subscribe and just read this delayed version of our free morning report (free of political commentary, of course) and this is the first you are hearing about it, we still have a trade where the stock is already $2 over the goal that will pay $12,500 if FCX is over $12 in January, 2019 and it's "only" $3,500 now (and $2,500 of ordinary margin is required to sell the short puts). Sure it sucks compared to our original $1,375 credit, which will pay us $13,875 in profits (1,009%) but $9,000 in profit is still 254% in 2 years and you saved $3 per day by not subscribing to our newsletter – clever!

Meanwhile, despite the Dollar topping out here at 100, we think a pullback in the Dollar is more likely to mask the exit of the "smart money" from the top of this rally (that would be here, in case you are a voter on the winning side and don't get nuance) so we like shorting the Dow Futures (/YM) at 18,900, S&P (/ES) at 2,170, Nasdaq (/NQ) at 4,760, Russell (/TF) at 1,290 and especially the Nikkei (/NKD) at 17,700 because the Nikkei hates a weak Dollar and Japan's GDP report, though up a "surprising" 2.2% is based on a Yen that fell 8% since the early July top – making the GDP gains meaningless. Traders that understand nuance get this and they are heading for the doors while fools rush in.

The Japan ETF (EWJ) was reverse split 1:4 and is now trading at $50 and makes a lovely short bet along with the Futures. I don't think it will take even this long for things to fall apart for reasons I couldn't possibly go into here – where it might upset sensitive readers who then whine to even more sensitive editors who would rather censor free speech than anger an eyeball.

As an options play, the March $48 puts are oddly cheap at $1.35 considering they are 4 months away and EWJ has gone up $5 in the last 4 months so $5 back down would put them $3 in the money but this is a trade you can take a quick 50% ($2) and run on – there's plenty of other things we can trade in a Trumpocalypse (and that's not a dig on the President-elect, that's what it's called in the bible!).

We already have plenty of hedges in place, guarding our Member Portfolios so I'm not worried about the inevitable pullback now that the hangover from last week's party is about to kick in. I'll be at the Nasdaq this morning, on their Facebook Live Broadcast at 10 am with Jill Malandrino, where we'll discuss these and other trade ideas and, of course, we have our usual Live Weekly Trading Webinar on Wednesday for our PSW and Seeking Alpha Subscribers.

Our Sept 6th Nasdaq Live pick to go long on Coffee (/KC) Futures on Sept 6th at $1.51 topped out at $1.72 on Friday for a $7,500 per contract gain for our viewers while Natural Gas (/NG) went from $2.75 to $3.75 for $10,000 gains at $100 per penny per contract – you are very welcome! Now it's back to $2.65 and we like it again!

Remember, I can only tell you what is going to happen and how to make money playing it – the rest is up to you!

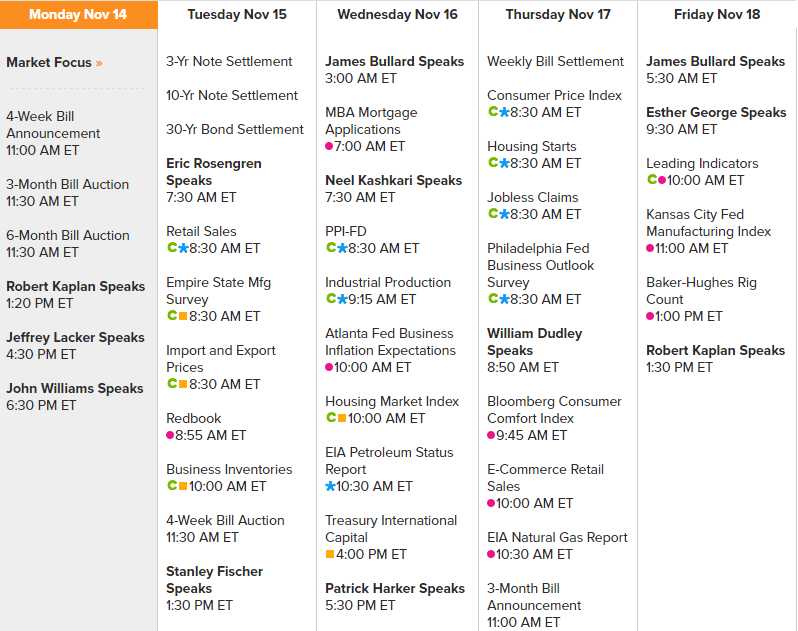

It's going to be a crazy week (13 Fed speakers with Evans at 2:45 on Thurs) – be prepared!