Financial Markets and Economy

This bull market is just getting started (Yahoo Finance)

This bull market is just getting started (Yahoo Finance)

There is a popular definition in the financial media that a Bear Market is a -20% correction in the S&P 500. Don’t listen to it! It is wrong! This definition has hurt too many investors because they keep hearing this “7-year Bull Market is getting too long in the tooth” and it’s about to end. It has kept many people out of the market when we are potentially just starting a new Bull Market uptrend.

Think about how dumb this definition is?

Venezuela’s currency is so devalued it no longer fits in ordinary wallets (The Washington Post)

Venezuela’s currency is so devalued it no longer fits in ordinary wallets (The Washington Post)

It’s not so easy to find someone who still uses a wallet in Venezuela, where inflation is expected to reach 720 percent this year and the biggest bill — 100 bolivars — is worth about 5 U.S. cents on the black market.

China Has Quietly Hiked Borrowing Costs With PBOC Operations (Bloomberg)

Without a policy announcement, China’s central bank has effectively tightened monetary conditions in recent weeks, an analysis of its transactions shows.

China's property frenzy and surging debt raises red flag for economy (The Guardian)

China's property frenzy and surging debt raises red flag for economy (The Guardian)

Chinese household debt has risen at an “alarming” pace as property values have soared, analysts have said, raising the risk that a real estate downturn could wreak havoc on the world’s second largest economy.

PBOC’s Yi Says China Reserves ‘Very Adequate,’ Yuan Stable (Bloomberg)

People’s Bank of China Deputy Governor Yi Gang said the country has "very adequate" foreign reserves and the yuan remains strong compared with the currencies the central bank uses to set the exchange rate.

The British Service Sector Is Losing Confidence (Bloomberg)

Businesses in the U.K. service sector are increasingly pessimistic about the future as sales slow and costs rise, according to the Confederation of British Industry.

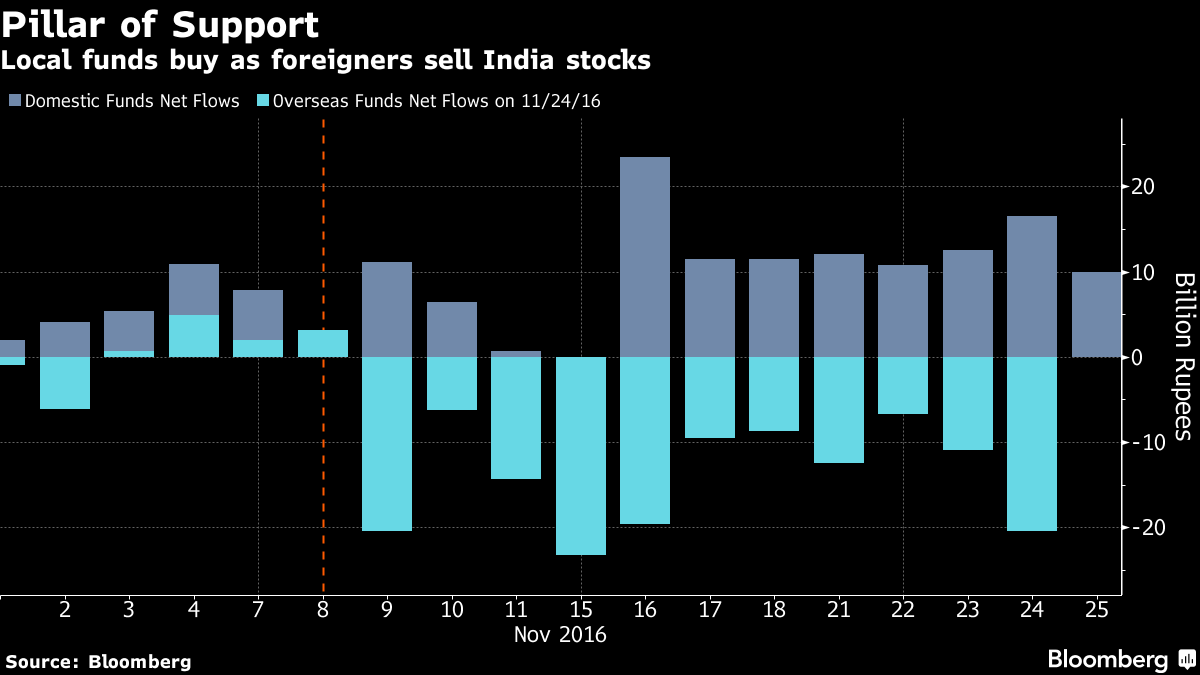

MidCaps Advance for Second Day as Indian Funds Extend Purchases (Bloomberg)

India’s small- and mid-cap stocks climbed to a two-week high and the benchmark indexes rose for a second day as local institutional investors boosted purchases amid gains in Asian equities.

China May Waste $490 Billion on Unneeded Coal Plants: Study (Bloomberg)

China risks wasting $490 billion by building more coal power plants than it needs as slower power demand growth and less polluting energy sources squeeze coal generation out of the power mix, according to a study from an environmental think tank.

China Cites ‘The Art of War’ as Trump Signals Trade Battle (Bloomberg)

There’s a Chinese saying that stems from the philosophy in Sun Tzu’s ancient text “The Art of War”: You can kill 1,000 enemies, but you would also lose 800 soldiers.

Warning Ahead: The Pitfalls of Dow Milestones (The Wall Street Journal)

Warning Ahead: The Pitfalls of Dow Milestones (The Wall Street Journal)

Dow 19000 was nice, but Dow 20000 is the real milestone to watch and maybe even fret about.

The Dow Jones Industrial Average is roughly 5% away from reaching the next millennium marker. If history is a guide, it probably won’t be a straight shot getting there. But when the Dow hits 20000, holding that major milestone might prove to be problematic.

OPEC Tries to Salvage Deal as Saudis Say Cut Isn’t Essential (Bloomberg)

OPEC ministers flew to Moscow and officials in Vienna started another round of talks in an effort to salvage an agreement on production cuts, just as Saudi Arabia said a deal might not be necessary.

China's Bad Banks Serve Zombies, Not Investors (Bloomberg)

China's zombie companies can rest easy. It's a shame the same can't be said for investors in the nation's banks.

Copper's Capacity Problem (Bloomberg)

Copper's Capacity Problem (Bloomberg)

Normally, when commodity prices jump — and LME copper is up 21 percent this month — it's because either demand is looking strong, or supplies are looking short.

Wall Street Legend Predicts “Dow 50,000”! (The Sovereign Investor)

A massive stock market rally is on our doorstep according to several noted economists and distinguished investors.

Ron Baron, CEO of Baron Capital, is calling for Dow 30,000.

Dollar Reverses Some Post-Election Gains on Oil Jitters (The Wall Street Journal)

The dollar weakened sharply against the yen and other currencies in Asia trade Monday as renewed uncertainty over the direction of oil production amplified a selloff after a post-U.S. election surge.

Gold Options Traders Most Bearish Since July 2015 (Zero Hedge)

After a year of almost uninterrupted bullish bias in precious metals options markets, gold skews (the 'price' of put protection over calls) has exploded to its highest (most bearish) leves since July 2015.

OPEC Deal Disintegrates After Iran Press Accuses Saudi Arabia Of "Reneging" On Agreement (Zero Hedge)

On Friday, after reading the latest shift in the ever-changing, always fluid OPEC narrative, according to which Saudi Arabia now demands Iranian oil production cuts contrary to the agreement reached at the end of September in Algiers, in which Iran was granted an exemption from the upcoming supply cut negotiation in Vienna on November 30, we were confused.

Marc Hanson: "Houses Have Never Been More Expensive To Buyers Who Need A Mortgage" (M Hanson Advisors, Zero Hedge)

Houses have NEVER BEEN MORE EXPENSIVE to end-user, mortgage-needing shelter buyers. The recent rate surge crushed what little affordability remained in US housing. It now it requires 45% more income to buy the average-priced house than just four years ago, as incomes have not kept pace it goes without saying.

Black Friday and Thanksgiving online shopping surpasses $5 billion for the first time (Market Watch)

Black Friday and Thanksgiving online shopping surpasses $5 billion for the first time (Market Watch)

Online sales on Black Friday will hit $3.34 billion, up 22% on last year, and surpassing the $3 billion mark for the first time, according to estimates from software company Adobe Digital Index.

Nomura Sees Trump Extending Japan’s Stock Rally Next Year (Bloomberg)

Policy pledges by U.S. President-elect Donald Trump are bullish for Japanese share prices, which will build on their recent gains in 2017, according to Norikazu Akedo, a senior managing director at Nomura Holdings Inc.’s brokerage unit.

60% Of New Yorkers Are One Paycheck Away From Homelessness (Zero Hedge)

More than half of all New Yorkers don't have enough money saved to cover them in the event of a lost job, medical emergency, or other disaster, according to a new report by the Association for Neighborhood & Housing Development.

The Engine of Inequality: Privilege (OfTwoMinds)

We all know wealth/income inequality is soaring. I've published many entries on this topic (please see the three charts below as a refresher), and it's clear there are multiple sources of rising inequality: globalization and technology, which concentrate gains in relatively few hands, and inflation, which reduces the purchasing power of stagnating real wages.

Companies

Shell CEO expects no valuation hit from climate accord (Reuters)

Royal Dutch Shell expects to pump out all the fossil fuel reserves listed on its balance sheet, its chief executive said, dismissing concerns that production limits in the wake of the Paris climate accord could hit the energy giant's valuation.

Is It Time to Throw In the Towel on CVS Health Stock? (Fool.com)

Warren Buffett once said, "Our favorite holding period is forever."Many CVS Health (NYSE: CVS) shareholders probably bought the healthcare giant's stock thinking that they might be able to buy and never sell. But even Buffett has sold his fair share of stocks well before forever arrived. Is it time now to throw in the towel on CVS Health stock?

Technology

Amazon Broadens Cloud Services as Big Companies Sign On (Bloomberg)

Amazon.com Inc.’s first cloud-computing conference in 2011 was a curiosity. Many of its 6,000 attendees worked for startups that had chosen to buy access to processing power and data storage via the web from Amazon Web Services rather than own and maintain their own data centers.

South Korea's Samsung Electronics Co Ltd will consider splitting itself into two as proposed by U.S. activist hedge fund Elliott Management, Seoul Economic Daily reported on Monday citing an unnamed source.

Hackers are holding San Francisco’s light-rail system for ransom (The Verge)

San Francisco Municipal Railway riders got an unexpected surprise this weekend after the system’s computerized fare systems were apparently hacked. According to the San Francisco Examiner, the MUNI system had been attacked on Friday afternoon.

Are Big Data, Predictive Analytics, and Social Media Getting in the Way Of Basic Marketing? (Forbes)

Are Big Data, Predictive Analytics, and Social Media Getting in the Way Of Basic Marketing? (Forbes)

I recently purchased an accessory for a phone that required assembly instructions. Unfortunately, the English instructions were unintelligible—incorrect grammar, missing words, sentence fragments, etc.

Daimler announces $11 billion investment in electric vehicles (Electrek)

Daimler has been fleshing out its electric vehicle strategy over the last year and a big part of it came to life in Paris earlier this year with the unveiling of Mercedes’s new ‘EQ’ brand and the first vehicle under that electric brand: ‘Generation EQ’.

Politics

Why the US government wants to bring cryptocurrency out of the shadows (The Guardian)

Why the US government wants to bring cryptocurrency out of the shadows (The Guardian)

A US government request to trawl through the personal data of millions of users of the cryptocurrency exchange Coinbase signals the start of an effort to pull digital currencies like bitcoin into the mainstream, experts have said.

Trump, without evidence, says illegal voting cost him U.S. popular vote (Reuters)

U.S. President-elect Donald Trump said in a tweet on Sunday that he won the popular vote in the Nov. 8 election "if you deduct the millions of people who voted illegally", though he provided no evidence of widespread voter fraud.

Why journalistic 'balance' is failing the public (The Conversation)

Renowned reporter Christiane Amanpour recently told a conference of the Committee to Protect Journalists that they should aim for truth over neutrality.

Here's what could happen if Trump pulls the US out of the Paris climate agreement (The GroundTruth Project)

Here's what could happen if Trump pulls the US out of the Paris climate agreement (The GroundTruth Project)

Diplomats who gathered earlier this month in Marrakech, Morocco for COP22, the United Nations climate change summit, already faced a difficult proposition: how to fine-tune and implement the international agreement on climate change drafted last year in Paris.

CNN/ORC poll: A nation divided, and is it ever (CNN News)

After a bruising presidential election featuring the two least liked major-party candidates in recent history, more than 8-in-10 Americans say the country is more deeply divided on major issues this year than in the past several years, according to a new CNN/ORC poll. And more than half say they are dissatisfied with the way democracy is working in the US.

Life on the Home Planet

28 changes to make in your 20s to set yourself up for lifelong success (Business Insider)

28 changes to make in your 20s to set yourself up for lifelong success (Business Insider)

Your 20s are, at least according to one psychologist, the "defining decade," because they play a huge role in who you'll become personally and professionally.

16 paradoxes that will make your head explode (Business Insider)

This statement is a paradox in itself, demonstrating the complexities of self-referential statements, but it also suggests a crucial insight from one of the founders of Western philosophy: You should question everything you think you know. Indeed, the closer you look, the more you'll start to recognize paradoxes all around you.

Declaring Addiction a Health Crisis Could Change Criminal Justice (The Atlantic)

For the first time ever, a sitting U.S. surgeon general has declared substance abuse a public-health crisis. “It’s time to change how we view addiction,” Vivek Murthy said in a statement last week, which was accompanied by a lengthy report on the issue.

‘Moana’ Has the Second Best Thanksgiving Weekend Opening of All Time (NY Times)

‘Moana’ Has the Second Best Thanksgiving Weekend Opening of All Time (NY Times)

LOS ANGELES — With the mega-arrival of “Moana” over the holiday weekend, the reinvigorated Walt Disney Animation Studios cemented its status as cartoon-dom’s reigning powerhouse for non-sequel films.

The 30 Highest-Paid Celebrities Under 30 In 2016 (Forbes)

Taylor Alison Swift was born on Dec. 13, 1989 in Reading, Pennsylvania. Thanks to her album and tour named after the year of her birth, the 26-year-old pop superstar banked $170 million in a year, which makes her the top-earning celebrity in the world.