Financial Markets and Economy

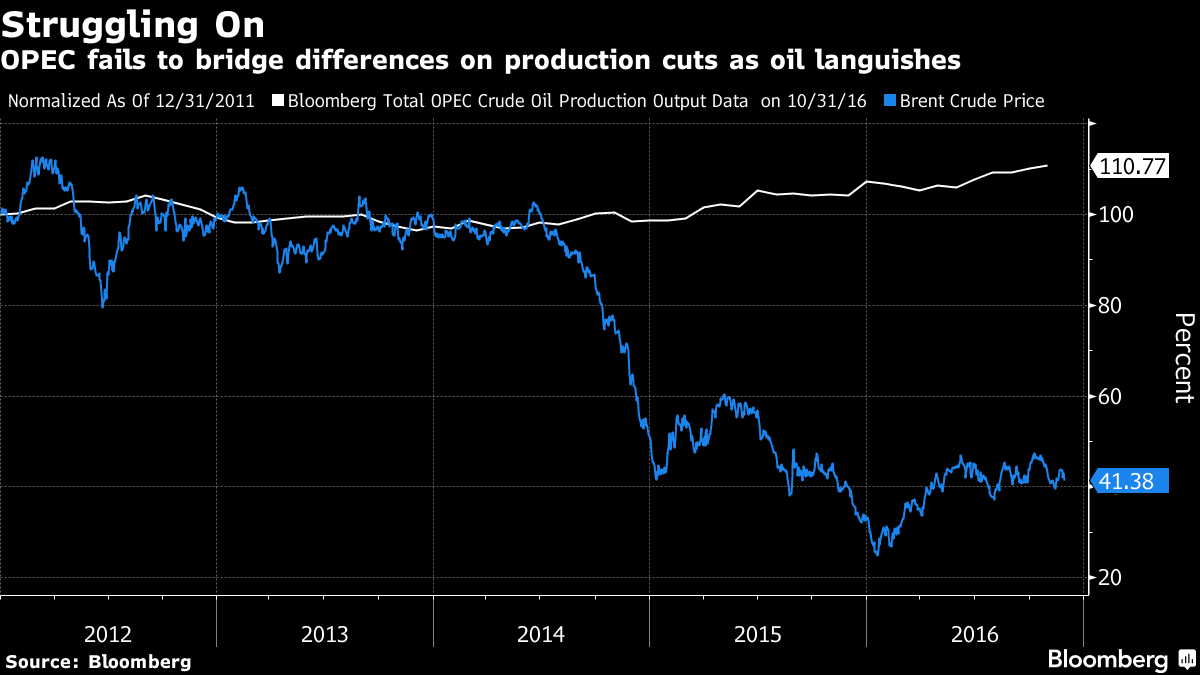

OPEC Deadlocked as Iran, Saudis Harden Positions on Oil Deal (Bloomberg)

An OPEC deal to curtail oil production appeared in jeopardy as Iran said it won’t make cuts while Saudi Arabia insisted Tehran must be willing to play a meaningful role in any agreement.

Can Stocks, Bonds, Metals, Currencies All Be Wrong About Trump? Yes (The Wall Street Journal)

Markets may not be the perfectly efficient trading venues of economic theory, but they do tend to be internally consistent. And so it is with Donald Trump. Three weeks after he won the U.S. election, pretty much every investment is telling the same story: renewed growth and inflation in the U.S., no retaliation by emerging markets for any tariffs he might impose and no foreign-policy mistakes.

Europe Warned It’s on Edge of Abyss Unless Brexit Lessons Heeded (Bloomberg)

The European Union is at risk of collapse unless it shares out economic wealth more widely and does more to protect workers from the fallout of globalization, according to Social Democrat leaders in Germany, Austria and Sweden.

Tiffany Says Trump Tower Problems Are Keeping Customers Away (Fortune)

Tiffany Says Trump Tower Problems Are Keeping Customers Away (Fortune)

Tiffany & Co TIF 3.15% said Tuesday that the recent protests and road closures at Trump Tower near its Manhattan flagship store hurt third-quarter sales, and the jeweler hinted that the problem could last a long time.

Investors Right to Be Nervous About Italy, Says Stadlmann (Bloomberg)

Politics have loomed large on investors’ radars this year, with the U.K.’s decision to leave the European Union and Donald Trump’s unexpected U.S. election win whipsawing markets.

Brazil Economists Cut 2017 Growth Estimate Below 1 Percent (Bloomberg)

Brazil will grow 0.98 percent in 2017, according to a weekly central bank survey of economists. That is the sixth straight week in which analysts have lowered their gross domestic product estimates for next year.

Traders Bet on Big Stimulus Spending. Congress May Not Go Along. (NY Times)

Traders Bet on Big Stimulus Spending. Congress May Not Go Along. (NY Times)

WASHINGTON — Stock traders celebrating Donald J. Trump’s election have been bidding up equity prices on a risky bet: that the new president will steer congressional Republicans in a U-turn away from their tightfisted fiscal policies — and bring Democrats along for the ride.

US Home Proces Surpass Pre-Recession Peak Amid Healthy Sales (Associated Press)

WASHINGTON (AP) — U.S. home prices have fully recovered from their steep plunge during the housing bust and Great Recession, according to a private measure.

2 Red-Hot Biotechs to Buy Ahead of FDA Decisions (Fool.com)

Investing in biotech is always a risky business. The chances of a drug making it from phase 1 to FDA approval can be as low as 10%. However, once a drug passes phase 3, investors can breathe more easily as drugs with positive phase 3 trials have a more than 80% chance of being approved by the FDA for commercial use.

Home Prices in 20 U.S. Cities Climbed 5.1% in September (Bloomberg)

Home Prices in 20 U.S. Cities Climbed 5.1% in September (Bloomberg)

Home prices in 20 U.S. cities continued to climb in September, while a gauge of values nationwide exceeded the pre-recession peak, according to S&P CoreLogic Case-Shiller data released Tuesday.

Getting Chinese to Buy Your House Isn't Easy Anymore. Just Ask Cate Blanchett. (Bloomberg)

Getting the money out of China proved impossible. The A$20 million ($14.9 million) price tag was far in excess of the $50,000 limit on what Chinese are allowed to convert each year due to capital controls.

Dropping fertility rates are a threat to the global economy (Visual Capitalist)

Total fertility rates, which can be defined as the average number of children born to a woman who survives her reproductive years (aged 15-49), have decreased globally by about half since 1960.

Three ways to play the Trump stock market (Market Watch)

Three ways to play the Trump stock market (Market Watch)

Since the surprise win of Donald J. Trump in the U.S. presidential race, many pockets of the financial markets have enjoyed a “Trump Bump”—while others have fallen fast and hard.

Monte dei Paschi’s Future Hangs on Sunday Vote (The Wall Street Journal)

MILAN—The day of reckoning for Banca Monte dei Paschi di Siena SpA, Italy’s No. 3 lender by assets and one of Europe’s most troubled, is drawing near.

U.S. Economic Confidence Highest in Nine Years (Gallup)

U.S. Economic Confidence Highest in Nine Years (Gallup)

WASHINGTON, D.C. — Americans expressed more positivity about the U.S. economy last week than they have at any other time during the nine years that Gallup has been tracking the U.S. Economic Confidence Index.

How Far Can Bond Yields Rise Before Hurting Equities? Goldman Answers (Zero Hedge)

Ever since "Trumpflation" emerged as a driver of risk-assets, a tension has emerged in capital markets: how much higher can rates rise (and by implication the US Dollar) before financial conditions become so tight that the equity rally reverses under the weight of the very reflation it is pricing in.

Mugabe's "Last Gamble" – Zimbabwe Unleashes Newly-Printed 'Bond Notes' Pegged To The Dollar (Zero Hedge)

One might think that after 92 years, some wisdom may have leaked into the brain of Zimbabwean president Robert Mugabe. But no. As the world's oldest head of state, he has overseen the demise from a post-colonial success to a pariah state wrecked by hyperinflation.

Richard Branson Explains Why Most Entrepreneurs Lack the Right Mindset (Entrepreneur)

Richard Branson Explains Why Most Entrepreneurs Lack the Right Mindset (Entrepreneur)

To excel as an entrepreneur, having a “growth mindset” is vital, explains Virgin Group founder Richard Branson in a recent blog post. That means being willing to learn, make mistakes and experiment.

Will Italy provoke a systemic financial crisis afterDecember 4? (The Huffington Post)

The Italian economy has been in a virtual recession while its public debt increased to 2,273 billion euros representing 132.7% of its Gross Domestic Product, despite a monetary policy that pushed interest rates at a record low. The effect of this situation on Italian banks has been to accelerate the deterioration of their loan portfolio.

What Happened To The Earnings Recession? (The Fat Pitch)

A year ago, profits for companies in the S&P had declined 15% year over year (yoy). Sales were 3% lower. Margins had fallen more than 100 basis points. The consensus believed all of this signaled the start of a recession in the US.

Robin Hood Conference 2016 Notes: Ainslie Tepper, Druckenmiller, Einhorn, Griffin etc. (Value Walk)

Robin Hood Conference 2016 Notes: Ainslie Tepper, Druckenmiller, Einhorn, Griffin etc. (Value Walk)

The Robin Hood Conference is one of the top investment conferences of the year. While the gathering is closed to media (besides CNBC and/or Bloomberg) ValueWalk has some reliable sources who will enable us to provide coverage of the event.

Mortgage REITs Look Better as Yield Curve Steepens: 5 Picks (Barron's)

Mortgage real estate investment trusts (REITs) are more profitable when the yield curve is steeper, improving their net interest margins. And steepen it has.

Companies

Does Facebook Generate Over Half of Its Ad Revenue From Fake News? (Forbes)

Does Facebook Generate Over Half of Its Ad Revenue From Fake News? (Forbes)

Fake news has been in the news. But one important question about fake news has not yet been answered: How much revenue would Facebook sacrifice if it purged fake news from its site?

Lululemon Founder Chip Wilson On The Future Of Athletic Wear (Forbes)

Billionaire Chip Wilson is a visionary not prone to political correctness. He created Lululemon Athletica and by dint of his personality turned the retailer a billion dollar trend setter.

Technology

Amazon Developing Echo Speaker With 7-Inch Touchscreen to 'Fend Off Competition' From Apple and Google (Mac Rumors)

Amazon Developing Echo Speaker With 7-Inch Touchscreen to 'Fend Off Competition' From Apple and Google (Mac Rumors)

Amazon's next iteration of the Echo speaker will be a "premium" model that includes a touchscreen measuring around seven inches, marking "a major departure" from the tall, cylindrical design of the Echo currently on sale.

Washer And Dryer Sharing? Electrolux Suggests An 'Uber For Laundry' Service (Digital Trends)

Shortly after Thanksgiving, Swedish company Electrolux announced they were toying with the idea of an “Uber for laundry” type service. The premise would be for people without a washer and dryer to pay for laundry time from someone who owns the appliances.

Apple is ramping for its biggest iPhone sales success ever next year, according to KGI. Its estimates suggest that the new iPhones in 2017, expected to comprise three new models, will empower Apple growth with ‘unprecedented’ demand. KGI expects the new phones may sell between 120-150 million units in the second half of next year, eclipsing the previous sales record set by iPhone 6 and iPhone 6 Plus.

Nanoengineers Produce A Battery Alternative That Charges A Cell Phone In Seconds (Forbes)

The list of things with lithium-ion batteries just keeps growing. Smartphones, tablets, laptops, game controllers, cordless power tools, grooming products, digital cameras, camcorders, e-cigarettes, cars and more all rely on lithium-ion batteries.

Hungry Poop-Eating Bacteria Munches On Sewage, Converts It Into Energy (Digital Trends)

Extracting energy from sewage may not be the most glamorous job in scientific research, but it could turn out to be a potentially transformative one.

Don’t believe us? Just ask the team of microbiologists and biochemists working at Ghent University in Belgium, in collaboration with DC Water in Washington DC.

Customers of Valartis, a Chinese-owned Liechenstein bank, are being told by unknown blackmailers they must pay 10% of their life savings or face having account details sent to finance authorities and the media, German-language newspaper Bild reports.

Politics

Trump Excuses the White Working Class From the Politics of Personal Responsibility (The Atlantic)

Last week, Donald Trump advisor Stephen Moore, who has built his career advocating tax cuts for the rich and the privatization of America’s welfare state, said something startling to congressional Republicans.

Trump Chooses Rep. Tom Price, An Obamacare Foe, To Run HHS (NPR)

Trump Chooses Rep. Tom Price, An Obamacare Foe, To Run HHS (NPR)

Rep. Tom Price, a Georgia Republican, is President-elect Donald Trump's pick for Secretary of Health and Human Services. He is currently chairman of the powerful House Budget Committee.

Cramer's 4 signs the Trump rally is morphing into something else (CNBC)

Jim Cramer and Wall Street agree on one thing — the Trump rally for the stock market must come to an end. The question is what will cause it to end, and when.

Trump Slams CNN Over Baseless Voter Fruad Claim (Associated Press)

President-elect Donald Trump is lashing out on Twitter as he faces questions about his unsubstantiated claims of voter fraud.

On Monday night, Trump retweeted a series of messages that were critical of a CNN reporter who called the accusations "blatant and baseless."

'Snooper's charter' bill becomes law, extending UK state surveillance (The Guardian)

'Snooper's charter' bill becomes law, extending UK state surveillance (The Guardian)

The “snooper’s charter” bill extending the reach of state surveillance in Britain was given royal assent and became law on Tuesday as signatures on a petition calling for it to be repealed passed the 130,000 mark.

Trump proposes stripping citizenship from political protesters (Think Progress)

It a scene that is likely to prove quite familiar during a Trump presidency, Americans woke up Tuesday to discover that the incoming president took to Twitter to expose his ignorance of or disregard for the Constitution.

Trump abandons campaign promise to penalize outsourcing, offers tax breaks instead (Think Progress)

Trump abandons campaign promise to penalize outsourcing, offers tax breaks instead (Think Progress)

Earlier this year, the air conditioner and furnace giant, along with its parent company United Technologies, announced that it planned to relocate operations currently headquartered in Indiana to Mexico over the next three years, potentially moving more than 2,000 American jobs in the process.

U.S. Companies Hope Trump Won't Block Their Million-Dollar Cuba Deals (Reuters)

U.S. companies are looking for ways to persuade President-elect Donald Trump to soften his threats to cancel the Obama administration's opening to Cuba, a reversal they fear could cost them hundreds of millions of dollars.

Life on the Home Planet

Why Smart People Diversify (Fool.com)

Why Smart People Diversify (Fool.com)

If you've spent any time reading or listening to financial fare, you've surely heard references to diversification. Here's a look at why diversification matters to you and your portfolio.

Inmates are dying in jails that prioritize cutting health care costs (Think Progress)

Tanyatta Woods knows very little about the agonizing last days of her son’s life. She didn’t get to comfort 19-year-old Deundrez when his hallucinations reached a fever pitch, or to see him one last time before his mind shut down.

Private moon mission plans to revisit Apollo 17 landing site (New Scientist)

A planned private mission to the moon could revisit the spot where astronauts last roamed its surface.

German-based PTScientists says it will land a pair of rovers, designed with the help of car firm Audi, near the Apollo 17 landing site and check out the lunar buggy left behind by NASA during its final mission to the moon in 1972.

The millennial generation is now reaching the age of 30. Many of these 80’s and 90’s kids are having children of their own, and recent surveys show that one in five millennial parents is living in poverty. Primarily, this is a result of rising costs for raising children, declining wages, high levels of unemployment, and high debt-mostly college related.

Inside The 2016 Forbes 400: Facts And Figures About America's Richest People (Forbes)

Soaring stock prices at the hottest tech firms shook up the top of The FORBES 400 this year. Amazon.com CEO Jeff Bezos gained $20 billion, more than anyone else in America.

KGI: iPhone 8 to eclipse sales record set by iPhone 6, wireless charging on high-end and low-end models

KGI: iPhone 8 to eclipse sales record set by iPhone 6, wireless charging on high-end and low-end models The Actual Reason Millenials Are The Poorest Generation Ever Is Because Their Parents Proved Money (And Constantly Working) Couldn't Buy Happiness

The Actual Reason Millenials Are The Poorest Generation Ever Is Because Their Parents Proved Money (And Constantly Working) Couldn't Buy Happiness