Fund Managers' Current Asset Allocation – December

Courtesy of Urban Carmel, The Fat Pitch

Summary: Global equities are more than 20% higher than in February. A tailwind for this rally has been the bearish positioning of investors, with fund managers persistently shunning equities in exchange for holding cash. This was in stark contrast to 2013, 2014 and early 2015, during which fund managers were heavily overweight equities and underweight cash and bonds.

Fund managers have finally become bullish again. Optimism towards the economy has surged to a 19-month high. Cash remains in favor (although levels dropped significantly in the past two months) but global equity allocations are now back to neutral for the first time in a year.

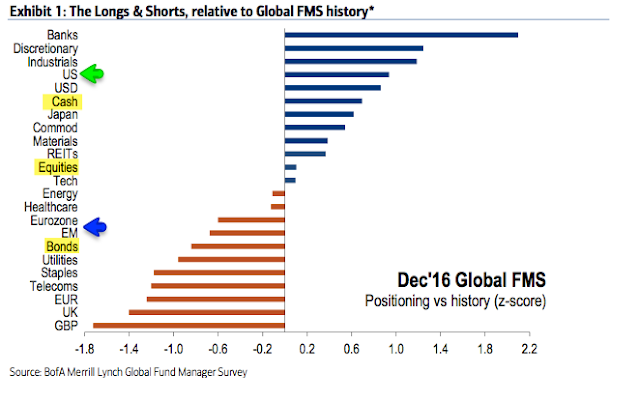

Bearish sentiment had been a persistent tailwind for US equities in the past year and a half. That's no longer the case. Another push higher and excessive bullish sentiment will become a headwind. Global equity allocations would already be excessively bullish if not for Europe, where sentiment has dropped. Emerging markets became the consensus long in October and the region has since been pummeled. Those markets are now in the process of resetting.

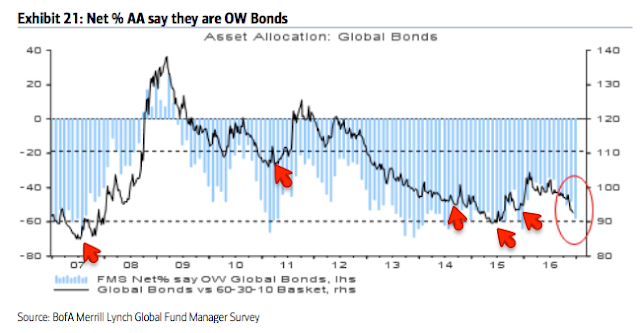

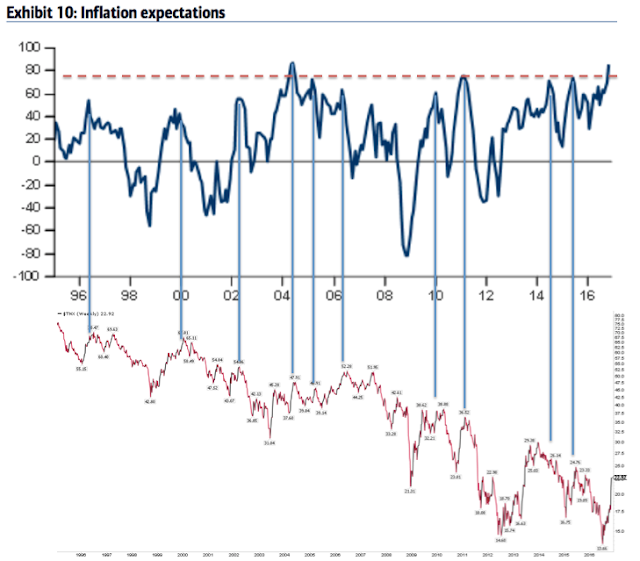

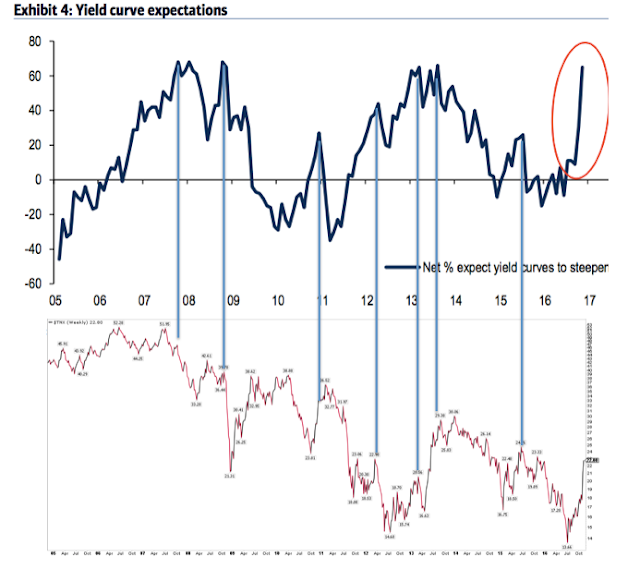

Findings in the bond market are of greatest interest. Fund managers' allocations to bonds are near prior capitulation lows. Moreover, inflation expectations have jumped to the highest level in 12-1/2 years and expectations that the yield curve will steepen are the highest in 3-1/4 years. When this has happened in the past, yields have been near a point of reversal lower, at least short-term.

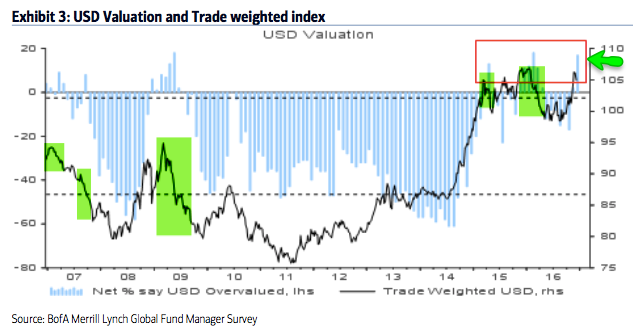

The dollar is now considered the third most overvalued in the past 10 years. Under similar conditions, the dollar has fallen in value in the month(s) ahead.

* * *

Among the various ways of measuring investor sentiment, the BAML survey of global fund managers is one of the better as the results reflect how managers are allocated in various asset classes. These managers oversee a combined $500b in assets.

The data should be viewed mostly from a contrarian perspective; that is, when equities fall in price, allocations to cash go higher and allocations to equities go lower as investors become bearish, setting up a buy signal. When prices rise, the opposite occurs, setting up a sell signal. We did a recap of this pattern in December 2014 (post).

Let's review the highlights from the past month.

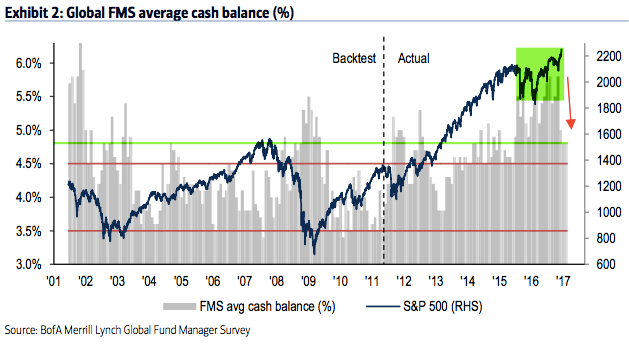

Cash: Fund managers' cash levels dropped from 5.8% in October to 4.8% in December. That is a big drop for two months, but recall that 5.8% was the highest cash level since November 2001. Cash has remained above 5% for all of 2016, the longest stretch of elevated cash in the survey's history. A good amount of the tailwind behind the rally is now gone but cash is still supportive of further gains in equities. A significant further drop in cash in the month ahead, however, would be bearish. Enlarge any image by clicking on it.

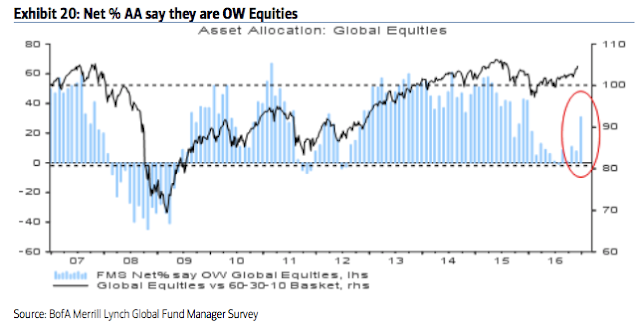

Global equities: Fund managers were just +5% overweight equities at their low in February; since 2009, allocations had only been lower in mid-2011 and mid-2012, periods which were notable bottoms for equity prices during this bull market. Allocations in December have jumped to +31% overweight, a 12-month high. This is now neutral (0.1 standard deviation above the long term mean). Over +50% overweight has historically been bearish (dashed line).

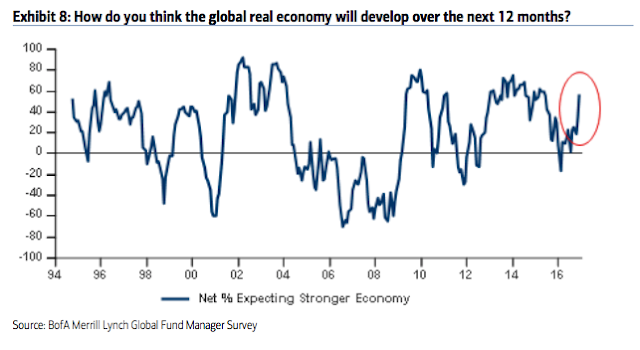

In February, 16% of fund managers expected a weaker economy in the next 12 months, the lowest since December 2011. They are now optimistic: 57% expect a stronger economy in the next year, a 19-month high. Pessimism explained their prior low allocation to equities and high allocation to cash; that has now flipped.

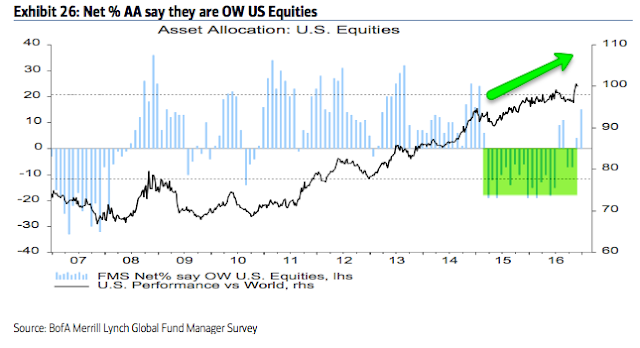

US equities: US exposure had been near an 8 year low during the past year and a half, during which US equities outperformed. US equities have been under-owned. That's changed. In December, fund managers were +15% overweight. This is 0.9 standard deviations above its long term mean. Bearish sentiment is no longer a tailwind for US equities. Above +20% overweight and sentiment would become a headwind (dashed line). Close, but not yet.

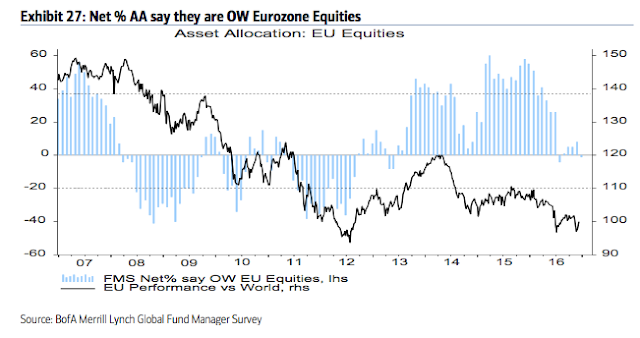

European equities: Fund managers had been excessively overweight European equities for more than a year in 2015-16, during which time EZ equities underperformed. That changed in July, with the region becoming underweighted for the first time in 3 years. That improved to +8% overweight in November before falling back to -1% underweight in December. This is 0.6 standard deviations below its long term mean, a slight contrarian long opportunity.

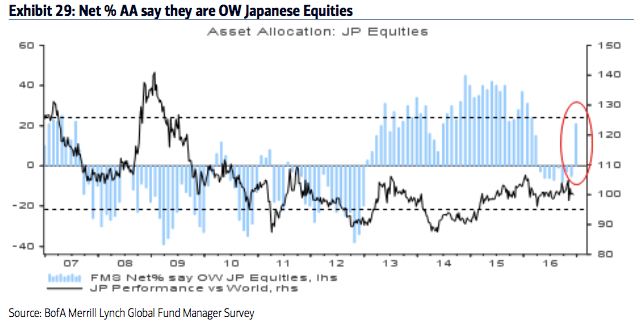

Japanese equities: Allocations to Japan had been falling in 2016 after excessive bullishness in 2015. Allocations fell to -8% underweight in September, the lowest since December 2012. Now, allocations have jumped back to +21% overweight. This is 0.6 standard deviations above its long term mean. Bullish sentiment is close to becoming a headwind (dashed line).

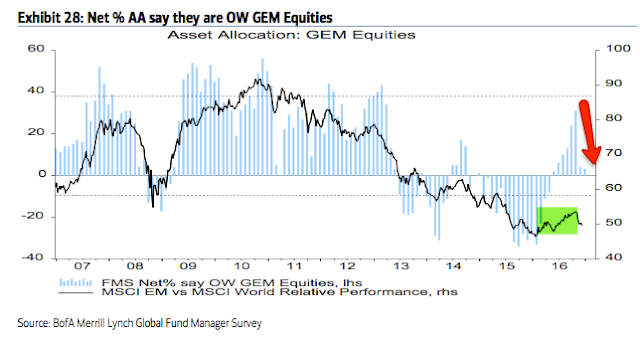

Emerging markets equities: We said in October, "the contrarian long in emerging markets is over." A brief recap: in January 2016, allocations to emerging markets fell to their second lowest in the survey's history (-33% underweight). As the region outperformed in 2016, allocations rose to +31% overweight in October, the highest in 3-1/2 years. That made the region the consensus long. Emerging equities have dropped sharply in the past two months. Allocations are now +3% overweight. This is 0.7 standard deviations below its long term mean. The region is no longer the consensus long and probably in the process of resetting for the next push higher.

Global bonds: Fund managers are -58% underweight bonds, a fall from -35% in July (which was near a 3-1/2 year high allocation). This is 0.8 standard deviations below its long term mean. A capitulation low in the past has often occurred when bonds were -60% underweight (red arrows and dashed line).

Of note, fund managers' inflation expectations have jumped to the highest level in 12-1/2 years. This explains some of the sell off in bonds in the past several months. It's notable that current levels have marked at least a short-term reversal point in yields in the past.

Similarly, in the past two months, there has been a massive increase in the percentage of fund managers who believe the yield curve will steepen in the next year. This is now at the highest level in 3-1/4 years. Similar cases, at either a high level or following a steep increase, have led to at least a short-term reversion lower in yields.

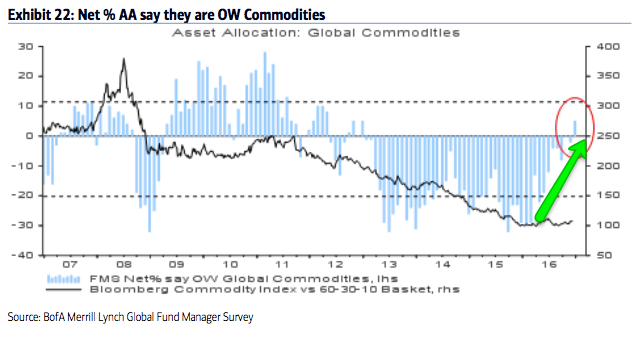

Commodities: Allocations to commodities are now at a 4-year high (+5% overweight). This 0.5 standard deviations above its long term mean. In comparison, in February, allocations were near one of the lowest levels in the survey's history (-29% underweight). The improvement in commodity allocations goes together with increased macro optimism.

Sectors: Relative to history, managers remain overweight cash, but much less so than in the past year and a half. For the first time in many months, managers are more weight equities than bonds. The allocation to equities would be higher if it were not for underweighted positions in emerging markets and Europe. US equities are overweighted relative to history.

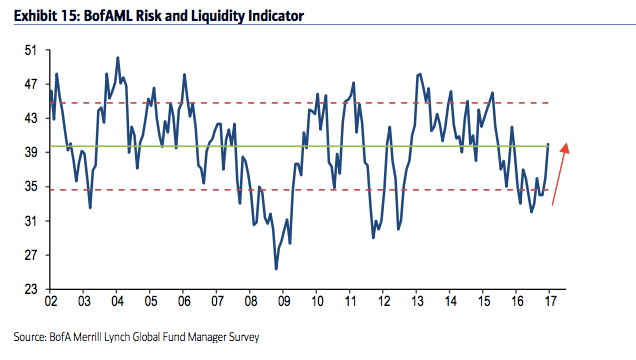

Fund managers' risk appetite had been well below the mean during 2016; during the current bull market, risk appetite had only been materially lower in mid-2011 and 2012, relative lows from which equities rose strongly in the following months. That has now changed, with risk appetite at 13-month highs and neutral relative to the long term mean. Risk appetite is the average of fund managers cash, investment horizon and investment risk (e.g., equity allocation and sector weighting).

Dollar: Since 2006, fund managers surveyed by BAML have been very good at determining when the dollar is overvalued. In March 2015, they viewed it as overvalued for the first time since 2009; the dollar index fell from 100 to 93 in the next two months. In late 2015, they again viewed the dollar as overvalued and the index lost 7%. In November and December, fund managers view the dollar as overvalued for the first time since April 2016 (and by the the third highest amount in 10 years), during which time the index has gained more than 7%. Under similar conditions (highlighted in green), the dollar has fallen in value in the month(s) ahead.

Survey parameters are below.

-

Cash: The typical range is 3.5-5.0%. BAML has a 4.5% contrarian buy level but we consider over 5% to be a better signal. More on this indicator here.

-

Equities: Over +50% overweight is bearish. A washout low (bullish) is under +15% overweight. More on this indicator here.

-

Bonds: Global bonds started to underperform in mid-2010, 2011 and 2012 when they reached -20% underweight. -60% underweight is often a bearish extreme.

-

Commodities: Higher commodity exposure goes in hand with improved sentiment towards global macro and especially EM equities.