Trump has been President all weekend and the World is still here so I suppose we're going to have to formulate a trading strategy going forward. We reviewed our 4 Member Porfolios over the weekend and we are 75-90% in CASH!!! and, if the World continues not to end this week – we will be looking for more opportunities to deploy some of it.

Of course we're already dealing with the first crisis of the Trump Administration – How big was the crowd at the inauguration? You might think, "who cares" if you are a rational person but crowd size experts told the New York Times they estimated Trump's audience at fewer than 200,000 people, and widely distributed side-by-side photographs showed the stark contrast between the comparatively sparse crowd for Trump's inauguration and the record-setting crowd for Obama's first.

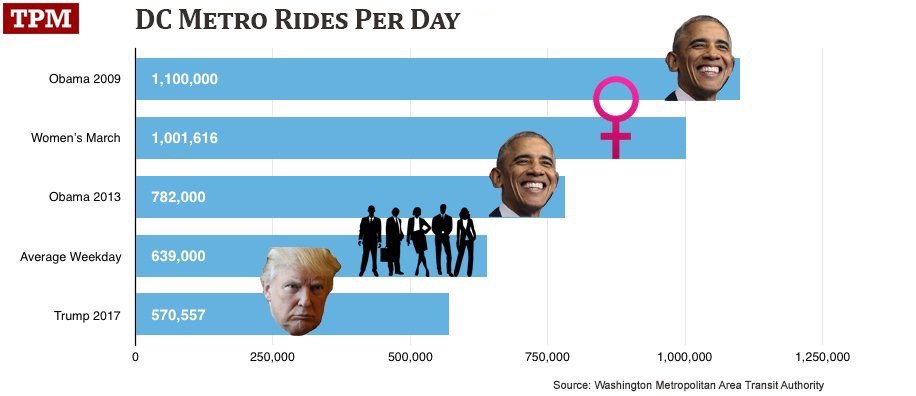

The President of the United States of America said the press was lying and under-reporting the crowd and White House Press Secretary Sean Spicer gathered the press to deliver a five-minute statement Saturday in which he issued multiple falsehoods, declaring erroneously the number of people who used the D.C. metro on Friday, that there was a change in security measures this year and that "this was the largest audience to ever witness an inauguration, period, both in person and around the globe." "These attempts to lessen the enthusiasm of the inauguration are shameful and wrong," Spicer said Saturday.

The President of the United States of America said the press was lying and under-reporting the crowd and White House Press Secretary Sean Spicer gathered the press to deliver a five-minute statement Saturday in which he issued multiple falsehoods, declaring erroneously the number of people who used the D.C. metro on Friday, that there was a change in security measures this year and that "this was the largest audience to ever witness an inauguration, period, both in person and around the globe." "These attempts to lessen the enthusiasm of the inauguration are shameful and wrong," Spicer said Saturday.

Then things get really freaky as Trump's counselor, Kellyanne Conway, went on Meet the press to confront the liberal media head on and ended up fighting with Chuck Todd and threatening NBC, saying "I think we're going to have to rethink our relationship here." You have to see it to believe it:

Nope, I still don't believe it! As noted by Todd, when the President's Press Secretary blatantly lies in his first Press Conference it undermines the credibility of the entire administration. Even more frightening is Conway's statement that: "You're saying it's a falsehood and Sean Spicer, our press secretary, gave alternative facts to that." #Alternativefact is already top-trending on Twitter and setting a theme for the Trump Error.

Anyway, though editors may disagree, this is VITALLY important to talk about because, if we can't trust something as simple as how many people turned up to watch Trump take his Oath of Office – how on Earth are we going to trust Unemployment reports or GDP data that comes from this administration?

You can't invest based on "alternative facts", you need real, verifiable facts to make accurate investing decisions and cutting throuh the BS is what PSW is all about but usually we're finding a path through the woods – this is turning into a jungle of BS we have to hack our way through to get to the truth of even the simplest things.

A loss of confidence in our data leads to a loss of confidence in our economy and that is already leading to a loss of confidence in our economy as the Dollar is plunging this morning, falling 1% below Friday's highs (straight downhill since the moment Trump was sworn in) and that is the only thing keeping stocks and commodities from plunging this morning – as those things are priced in Dollars so you need more weak Dollars to buy the same things but it is masking a lot of underlying weakness this morning.

The Nikkei doesn't like a weak Dollar (bad for exports) and that index has plunged 1% officially but down as much as 400 points (2%) since 11:59 on Friday. Trump is already talking about pulling out of the Trans Pacific Partnership (TPP) and renegotiating NAFTA and other trade agreements and that kind of uncertainty is not good for our major trading partners and the Global economy is not really strong enough to deal with disruptions in trade. It's hard to make America great if the rest of the World is crashing and burning…

We're short the market at the moment, as noted in our weekend Portfolio Review, we're shorting the Futures at Nasdaq (/NQ) 5,050 and S&P (/ES) 2,270 but with tight stops over the line as the Dollar weakness could still lift the markets and there's an OPEC meeting where, of course, they will try to boost oil (/CL) prices (now $52.50).

Our 2015 Trade of the Year came to a close on Friday. Way back on March 25th we did a live show in Canada for TD Bank's HNW investors and, at the time, our Trade of the Year selection was Apple (AAPL) for a net $8,000 cash outlay and a target of $120 on Jan 20th, 2017 (options expiration day).

Our 2015 Trade of the Year came to a close on Friday. Way back on March 25th we did a live show in Canada for TD Bank's HNW investors and, at the time, our Trade of the Year selection was Apple (AAPL) for a net $8,000 cash outlay and a target of $120 on Jan 20th, 2017 (options expiration day).

As it turned out, AAPL closed on Friday at $120.00 (not bad for a 2-year target) and our Trade of the Year paid back $60,000 for a $52,000 profit, which is a 650% return on CASH!!! Our Trade of the Year for 2016 was Natural Gas (UNG) and that is, of course, a huge winner already and our Trade of the Year for 2017 is on Silver Wheaton (SLW) and that one is already doing very well.

Our runner-ups have done well as well. In 2015 it was Baker Huges (BHI), in 2016 it was IBM (IBM) and this year it's the Agriculture ETF (DBA) so stay tuned and we'll see if we can hit our goals on those as well. Whatever the economy and whoever the President is, as long as we have the right FACTS, we can figure out ways to make good money in the markets, right?

"Trade of the Year 2015 – yes, it was a very good trade of the year. I decided to close out the long $90 calls way back in 2015 when AAPL started advancing on $130 (obviously a ton of additional premium to pick up by selling those long calls). I then spent the proceeds on layering over time more AAPL Bull Call Spreads – financed by various dated short $100 puts to reduce the cost.

Carrying those short AAPL $120 calls all this time turned out to be easy. I think Phil even mentioned on several occasions that he thought 'fair' value on AAPL was around $120. Another example of when AAPL gets 'cheap' you buy it and when it gets 'expensive' you sell it." – Winston. 1/21/17

It's not a big data week with PMI, Consumer Sentiment and a few regional Fed reports scattered through the week so focus will be on earnings and there we have a lot of biggies to look forward to.

We're going to be busy, busy this week and I'll be live at the Nasdaq this morning and then we'll see which way the winds are blowing this week as the World begins to digest the reality of Trumpmerica.