You're welcome!

You're welcome!

In yesterday's Morning Report we called Oil Futures (/CL) short at $54 right in the 2nd paragraph (this one) and it was an easy call because oil was only up on a Trump tweet and nothing to do with fundamentals and we are, after all Fundamentalists. Oil made a nice $1,000 intra-day decline, weakly bounced (our 5% Rule™) 0.20 to $53.20 and then fell another $500 to net a $1,200 decline.

$1,200 pays for 6 months of a Trend Watcher Membership where you can view our Live Member Chat Room and learn how we make calls like this every day. If you don't like learning, our Top Trades Membership just sends out select Trade Ideas and a whole year of those is just $1,495 while only $995 buys you an entire year of the PSW Report – all paid for by a single trade in a single day!

We're done with oil and we took a poke long on Gasoline Futures (/RB) at the $1.50 line, but with tight stops below as it's just a technical bounce play. Natural Gas (/NG) Futures made another $500 per contract on the move from $3.05 to $3.10 this morning and we went long on Silver Futures (/SI) in my morning note to our Members at $17.60 at 6:36 am and already we're up 0.05, which pays a very quick $250 per contact – enough for a healthy breakfast.

Declining volume on the NYSE yesterday was 2M shares and advancing volume was 1M shares but this morning, on no volume, the Futures are blasting higher again and though they are a very tempting short, I warned our Members to be very careful attempting to use logic on these markets:

This is why we keep adding more longs to the LTP – the shorts simply don't work…

This is very much like 1999 where sure, it was ridiculous – but it just got more and more ridiculous the next day. You can't keep betting against ridiculous when ridiculous is the rule – you either go with the flow or wait patiently for sanity to return but I'll remind you that Donald Trump is President for the next 4 years so it's kind of like we just voted for the Red Queen anyway…

Speaking of Wonderland – Over the weekend, on Saturday Night Live, Melissa McCarthy did a brilliant sketch appearing as White House Press Secretary, Sean Spicer and the crazy part isn't the sketch but the White House's reaction to it. Turns out, Spicer is now in the dog house because he appeared weak and was too easy to make fun of and, even worse, by a woman in drag!

Meanwhile, those crazy Democrats have been holding an all-night protest against the nomination of Betsy DeVos that is scheduled to go through today over UNANIMOUS Democratic objection to the nominee. Is there really any point to holding nomination hearings if the other side has no say in the matter? I was reminded this morning of the exact day we lost our Democracy – as noted by President Obama in his 2010 State of the Union Address:

"With all due deference to separation of powers, last week the Supreme Court reversed a century of law that, I believe, will open the floodgates for special interests, including foreign corporations, to spend without limit in our elections."

"I don't think American elections should be bankrolled by America's most powerful interests or, worse, by foreign entities. They should be decided by the American people. And I urge Democrats and Republicans to pass a bill that helps correct some of these problems."

Of course, no bill was ever passed and here we are, with the Democratic party reduced to holding sit-ins while nominees are steam-rolled in over their objections. So, before I this article is declared "too political", let's talk about why this stuff matters to investors. Yesterday, as I noted, uncertainty is not good for the markets. Josh Brown reminds us that the US markets in many ways command a PREMIUM because we are viewed as a stable nation ruled by laws that apply equally to all, INCLUDING the politicians who happen to be in control at the moment.

If the president can, without consulting the courts or Congress, banish U.S. lawful permanent residents, then he can do anything. If there is no rule of law for some people, there is no rule of law for anyone. The reason the U.S. is a good place to do business is that, for the last 228 years, it has built a firm foundation on the rule of law. It almost undid that in a weekend. That’s bad for business.

The valuation of firms in any market also depends on the degree to which investors’ rights are protected. Because a firm’s share price reflects the cash flow per share that non-controlling shareholders expect to receive, this share price should fall if non-controlling shareholders expect expropriation by either corrupt officials or controlling shareholders. To the extent that official corruption and poor corporate governance distort the decision-making of the firm’s management, they also destroy shareholder value.

Because emerging markets in general have a more corrupt environment and weaker corporate governance institutions, financial markets tend to price assets in emerging markets at a discount with respect to comparable assets in developed markets.

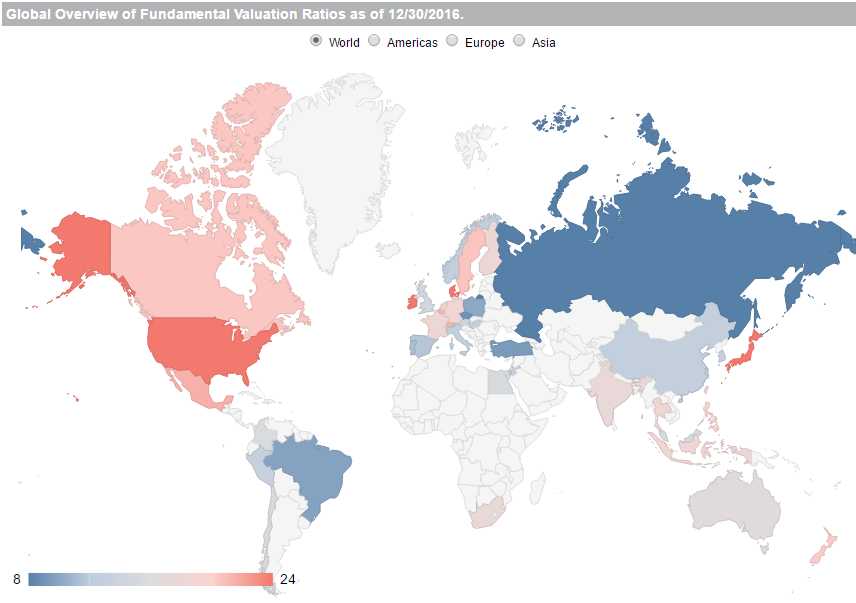

The United States stock market currently sells at a price-to-earnings (PE) multiple of 21.8 times (trailing 12 months) and a cyclically adjusted price-to-earnings (CAPE) multiple of 26.4 times. In comparison, the Russian stock market sells at a PE of 9.1 times and a CAPE of 5.9. It is the “cheapest” large stock market in the world.

The United States stock market currently sells at a price-to-earnings (PE) multiple of 21.8 times (trailing 12 months) and a cyclically adjusted price-to-earnings (CAPE) multiple of 26.4 times. In comparison, the Russian stock market sells at a PE of 9.1 times and a CAPE of 5.9. It is the “cheapest” large stock market in the world.

The reason for this discount is that these are shares of stock that trade in a dictatorship, wholly controlled by the whims of the Kremlin. CEOs can be jailed for operating or even speaking against those in power. Assets can be confiscated or reassigned at will. State control of corporate entities does not encourage investors to pay up for minority stakes in these businesses. Similarly, China’s PE is 7.2 times – one third the valuation of US companies – and its CAPE is 12.8 – less than half that of the United States stock market. In a similar fashion, we pay ultra-low interest rates on debt that is readily accepted BECAUSE of our stability.

Aside from the fact that these valuations are dangerously stretched in the first place, if the US begins to behave in a way that makes us look more like Russia, that alone can redefine the valuation investors are willing to place on our markets and 10%, even 20% of that value can vanish like a puff of smoke. What is it that makes you avoid investing in Egypt, for example? Troops in the streets, unrest, rioting – we're dangerously close to that already and it's only Day 15 of the Trump Dynasty!

They haven't even actually done anything yet, they are merely laying the path for the things they want to do. So far, only the policy wonks actually see what's happening and are upset about it but, once they start taking away people's rights and people's food stamps and people's health care and our children's education – a sit in at Congress will be the least of the problems.

Be careful out there!