That's right, nothing gets the market going better than promising a chicken for every pot and yesterday we had the President promising a "phenomenal" tax cut package in 2-3 weeks, as well as reiterating his pledge to "roll back burdensome regulations." Meanwhile, the St. Louis Fed President Jim Bullard said rates can remain low through all of 2017, saying the Fed may only raise rates once this year – two less than expected!

This is nothing more than the classic 1920s Republican Playbook with Trade Tariffs, Deregulation of Industry, Lack of Financial Controls, etc. aimed at creating a false sense of prosperity while money is "hoovered" up by the rich until the economy collapses only this time they have to dismantle that pesky social safety net that was put in place after the last time they destroyed the lives of tens of Millions of families. Go GOP, go!

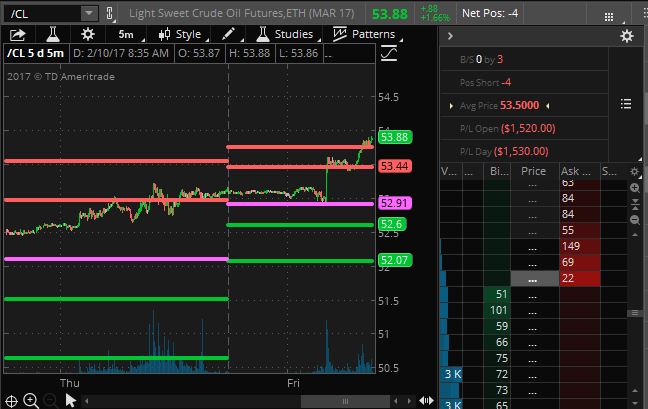

Meanwhile, as we expected, oil is being talked up into the weekend and we are very close to that $54 line again, boosted by the IEA report which says OPEC's cuts are 90% effective with production down 1Mb/d in January at 32.06Mb/d. PLEASE forget the fact that production was 31.5Mb/d before OPEC ramped up production ahead of the "cuts". Yes, I know, you already forgot, didn't you?

Remember, their original plan was to ramp up production and drive US shale producers out of business. That plan failed so their new plan is to stop producing all that oil nobody wanted anyway and call it a "production cut" and spin it as a reason to drive oil prices higher, which is working great so far as last February oil was $30/barrel and now $54 is up 80%, even though the US just had a 13.8Mb build and we are swimming in oil.

It's all done in the name of screwing over the consumers. Gasoline has jumped 10% from $1.46 on Tuesday to $1.60+ this morning (and a great short into the weekend at that price on /RB), which will cost US drivers about 0.20/gallon at the pump so about $3 per tank/per driver is a nice $150M bonus for "THEM" over the weekend (see this week's posts for more on the oil scam).

You would think other members of the retail sector would realize that this rampant consumer theft is hurting their business by taking cash out of the pockets of their customers and form some sort of lobby to counteract this insanity but noooooooooo – they instead contribute to the Chamber of Commerce who contribute to the GOP who make the CEO of Exxon the Secretary of State – quite the swamp!

Our short premise remains intact. The March contracts settle on the 21st but the 20th is a holiday so, when we come back on Monday (13th), there's really on 5 good trading days left in March and they still have 328 MILLION barrels worth of fake, Fake, FAKE!!! orders (1,000 barrels per contract) to get rid of between now and then.

|

Click for

Chart |

Current Session | Prior Day | Opt's | ||||||||

| Open | High | Low | Last | Time | Set | Chg | Vol | Set | Op Int | ||

| Mar'17 | 53.15 | 53.89 | 52.90 | 53.86 |

08:31 Feb 10 |

– |

0.86 | 134039 | 53.00 | 328293 | Call Put |

| Apr'17 | 53.55 | 54.35 | 53.37 | 54.32 |

08:31 Feb 10 |

– |

0.86 | 36791 | 53.46 | 310924 | Call Put |

| May'17 | 54.00 | 54.79 | 53.80 | 54.74 |

08:31 Feb 10 |

– |

0.86 | 11326 | 53.88 | 204546 | Call Put |

| Jun'17 | 54.32 | 55.17 | 54.19 | 55.11 |

08:31 Feb 10 |

– |

0.86 | 10755 | 54.25 | 259585 | Call Put |

| Jul'17 | 54.56 | 55.45 | 54.54 | 55.40 |

08:31 Feb 10 |

– |

0.85 | 3357 | 54.55 | 102768 | Call Put |

| Aug'17 | 54.78 | 55.63 | 54.78 | 55.63 |

08:31 Feb 10 |

– |

0.87 | 1486 | 54.76 | 73743 | Call Put |

Even including today, that's 50M barrels a day they have to hide in other months or find some sucker to take off their hands (not likely with the flood of oil we've been seeing in the weekly inventories) so the pressure will mount and the rolling cost is already a very painful 0.46 per barrel and look how stuffed April, May and June are already with 1.1 BILLION barrels of fake orders in the front 4 months.

Even worse for the oil bulls, they have new competition selling barrels from the United States Strategic Petroleum Reserve, which is scheduled to sell 10 Million barrels of oil on the open market in late February. That's going to show up as yet another build in commercial inventories and won't be much fun for the suckers who think April contracts will shield them from the pain. Overall, the US plans to sell at least 25Mb of oil from the reserves to raise money for their maintenance.

So the oil trade will be very exciting to watch next week and we'll be doing it LIVE in Las Vegas all day Monday at our seminar, where we'll get into the nuances of Futures trading along with a ton of other good stuff – see you there!

Have a great weekend,

– Phil