.jpg) Our Tesla (TSLA) short is looking good!

Our Tesla (TSLA) short is looking good!

Despite releasing an earnings report that looks more like a sales brochure (and the CFO promptly quit, so he won't have to justify these numbers) it's pretty clear to investors that all is not well under the hood of the auto hobby shop. You have to make much more than 8,000 vehicles a month to be considered an actual "manufacturer" – in 1914, with 13,000 employees, Ford (F) produced 300,000 Model Ts while TSLA's 13,058 employees have only managed to produce 75,000 cars (mostly the Model S) in their "amazingly automated" plant.

You would think, 103 years after Ford invented the assembly line, that Tesla could do a little better but hey, give them a couple of more years and they might give the 1914 Model T a run for its money! Given the shortfall in production (90,000 cars were promised for 2016) and the rapidly bleeding cash position, the departure of the CFO and the massive dilution of the shareholders (SCTY was given stock), we're very confident the $2,163 short we gave you yesterday will return the full $7,500 on March 17th (up 246% in less than 30 days) so you're welcome for that and happy St. Patrick's Day!

Other than warning you not to buy the dip in TSLA, I've lost interest and am moving on. Paulo Santos wrote a great article analyzing their earnings if you are interested, but we have bigger fish to fry now that we're done with Tesla – no sense beating a dead horse, even an electric one. Just be aware that there are only 790 Super Charger sites in the US and that's 36% growth from last year – how do they get to 300,000 sales with that slow growth (and there are 114,533 gas stations)?

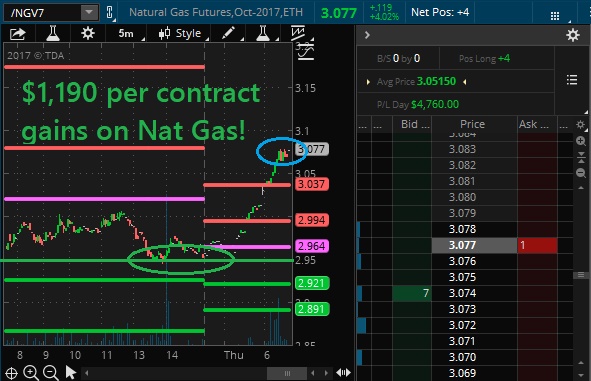

So, what else is going on in the World? Well, we scored a nice win on Natural Gas Futures (/NGV7) from yesterday's live Trading Webinar with a nice $1,190 per contract gain for our Members – not bad for a half day's work, right?

So, what else is going on in the World? Well, we scored a nice win on Natural Gas Futures (/NGV7) from yesterday's live Trading Webinar with a nice $1,190 per contract gain for our Members – not bad for a half day's work, right?

The weak Dollar is boosting all commodities this morning as it slumps back to 101, down 0.5% from yesterday so no surprise at all to see Gold (/YG), Silver (/SI) and even Oil (/CL) popping as well. Silver Wheaton (SLW), as you know, is our 2017 Trade of the Year and we also have Barrick Gold (ABX) on the gold side and the Agriculture ETF (DBA) on the food side and the Energy ETF (XLE) on the oil and gas side.

We also like Coffee (JO) and, as we expected, Kraft (KHC) just raised the price of coffee by 6% as they now agree with us that higher coffee prices are here to stay. We took the money and ran on the Coffee Futures (/KC) yesterday but JO is more of a long-term play we're hanging on to while /KC Futures are what we play on the dips in our Live Member Chat Room.

Today, we'll be watching for the EIA Petroleum Status report and we're itching to short oil (/CL) at $54.50 but maybe we'll test $55 first. API reported a small 884,000 barrel draw in oil last night and, after a month of massive builds, that's a huge relief for oil bulls. Gasoline was down 893,000 barrels and Distillates were down 4.3Mb so all good news but that makes expectations high so, at $55, I think the risk/reward favors taking a stab at the short side into the 11 am EIA announcement.

Also, clearly the DOE has not yet dropped their 10Mb on the market (a mandated sale from the SPR) and they said late February and we're running out of month so next week's inventories are almost certainly going to show a big build again – such fun! Remember, at PSW, we can only tell you what is going to happen and how to make money trading it – the rest is up to you!

The Dollar is weak because Treasury is talking it down this morning, nothing Fundamental and Secretary Mnuchin says he wants to have tax reform in time for Congress' August recess but it's late February and they have no details other than it will be "yuge". Of course, Trump supporters have already forgotten the President promised to unveil a "phenomenal" tax plan by the end of February but we can forgive the President, as it's so uncharacteristic of him to promise something and fail to deliver, right.

Of course the markets already rallied off that promise and today they will rally off Mnuchin's promise, even though it's the same promise delayed by 6 months because the markets are completely unhinged from reality at this point. This is, of course, fantastic for our longs but it makes us feel silly for hedging when it never, ever, ever goes down.

Today, in fact, will be the 10th consecutive record high for the Dow, breaking the 1987 record of records we tied yesterday at 9. We're going to ignore the 0.05 drop in the Chicago Fed Index because it's a fact and facts are only someone's opinion, apparently but so are equity prices – do keep that in mind.

Of course we have the March 15th Fed meeting to look forward to and I made the case in yesterday's Webinar that we can expect the Fed to raise rates at that meeting, which would be strong for the Dollar and SHOULD pull the markets in a bit but , as you can see from this chart, the market has been trained to expect MORE FREE MONEY at every meeting and, usually, they get it – so it will take more than just promises of higher rates to stop the bulls from BUYBUYBUYing on any dip.

Well, oil is up to $54.90 as I write this so time to start shorting (we might not make $55) and time to go to work in the Chat Room – it's going to be an exciting day!