Good morning!

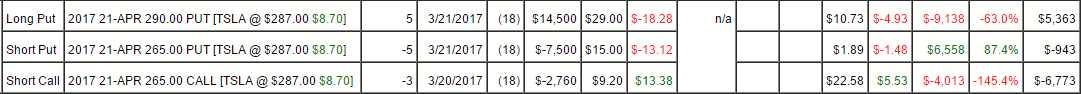

Looks like TSLA wants to hit $300. Now you know why we can't play that one in the OOP! Meanwhile, in the STP, we have:

We're going to roll our 3 short April $265 calls ($25.50 = $7,650) to 6 short June $300 calls ($15 = $7,500) for about even and our April $290 puts ($9) can be rolled to the June $300 ($26)/$270 ($12) bear put spread at $14 so $5 out of pocket there means we're spending net $2,500 on the adjustment and we still have a $15,000 potential spread for net $6,740.

I vote for first selling the new short calls and waiting to see if things calm down before buying back the originals. We risk losing $3,000 more if $300 breaks - we can live with that!

Obviously good as a new trade!